567 words / 2.5 minute reading time

- Drought has seriously reduced cane availability in China.

- However, high sugar yields have increased mill profitability enabling them to pay more for cane.

- Coronavirus and reducing consumption could affect mill sales and cause prices to drop once refineries import in H2’20 and begin competing with mills for sales.

Dry Weather Impacted Cane Growth

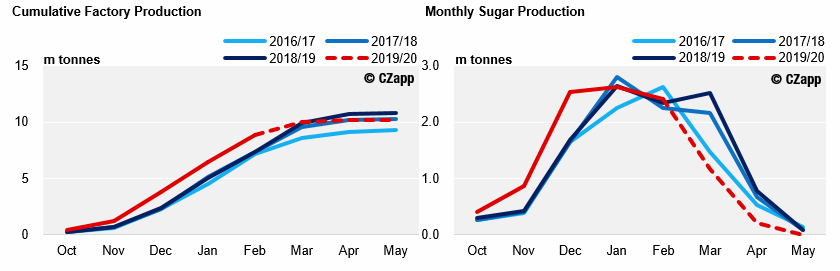

- By the end of February 2020, Chinese sugar production totalled 8.83m tonnes, up 1.45m tonnes year-on-year (YoY).

- This is because crushing started earlier in Guangxi – China’s largest sugar producing region – which accounts for 60% of production.

- We think production will sharply fall in March, however, and have completely stopped by May.

- Total sugar production this season is therefore estimated to be 500k tonnes lower YoY.

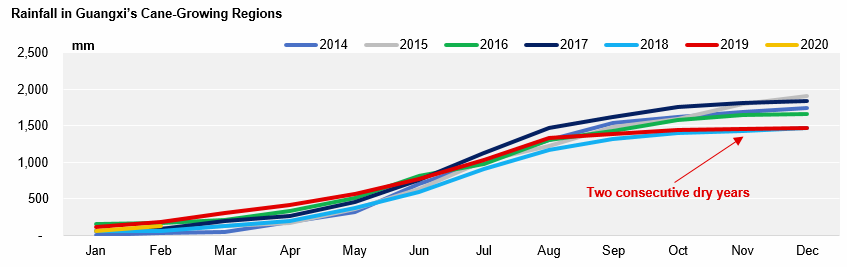

- Dry weather in southern parts of China is partly responsible for this poor production.

- There was very little rainfall in Guangxi between Apr’19 and Oct’19; plentiful water is crucial for cane growth during this period.

- Cumulative precipitation was 20% lower than the five-year average, resulting in a 14% reduction of total cane output.

Poor Production, Yet Record Sucrose Yields

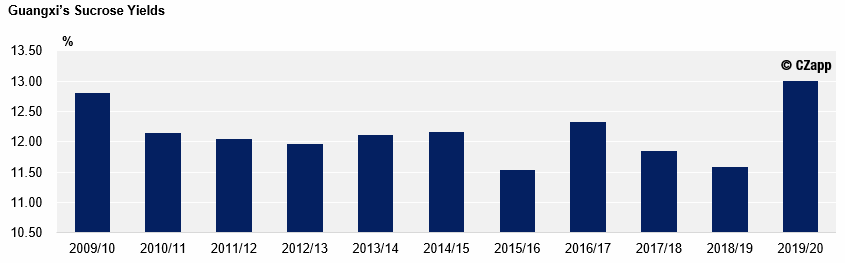

- On the bright side, the dry weather in Q4’19, paired with the high temperature differential, led to record sucrose yields in Guangxi.

- Guangxi’s cumulative sucrose yield by the end of Feb’20 was 13.01%; this is 1.42 percentage points higher (12.25%) than last season’s 11.59%.

- This partly offsets the impact of the low cane yield.

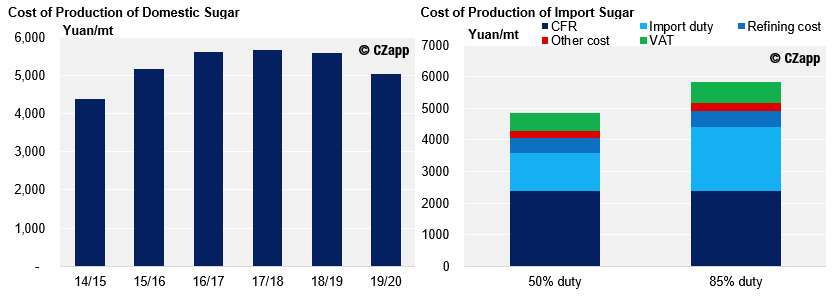

- The high sucrose yields have lowered the cost of production for sugar mills by 10% YoY to around 5000 yuan/mt.

- This is because it takes 7.7m tonnes of cane to produce one tonne of sugar this season, compared to 8.63m tonnes of cane in the 18/19 season.

- Mills, incentivized by the return of up to 700 yuan/mt, are willing to pay more for their cane to get farmers to break their contracts with other sugar mills.

- Guangxi mills have managed to get hold of approximately 600-700k tonnes of canes from the neighbouring province, Guangdong, so far.

Cost of Production at Four-Year Low

- At present, the mills have the say on domestic prices because they have no competitors.

- This is because refineries will mainly import sugar in 2H’20 to hit the possible 50% duty; they currently pay 85% duty.

- The cane price has been pushed up by almost 100 yuan per tonne, meaning an additional 680 yuan cost on top is incurred on top of production.

How Will Consumption Drop Affect Mills?

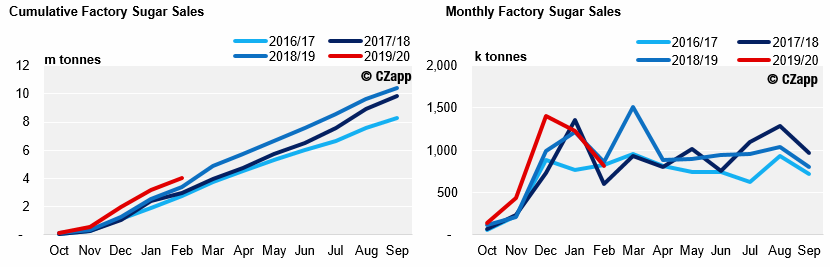

- Although the coronavirus has hindered sugar consumption since January, the factory sales in February appeared to be back to normal.

- Better still, cumulative factory sales as of Feb’20 were up 600k tonnes YoY, totalling 4m tonnes.

- However, this doesn’t mean that the impact of the coronavirus is over because much of this sugar is stuck in the hands of trading companies which are waiting for consumer demand to pick up.

- Mills are also carrying larger stocks at present, due to the impact of the coronavirus, meaning they may be forced to cut their prices to make sales.

- Stocks totalled 4.8m tonnes at the end of February, 811k tonnes higher YoY.

- If mills aren’t able to increase sales before the refineries start to import, we could see prices come under pressure.