Insight Focus

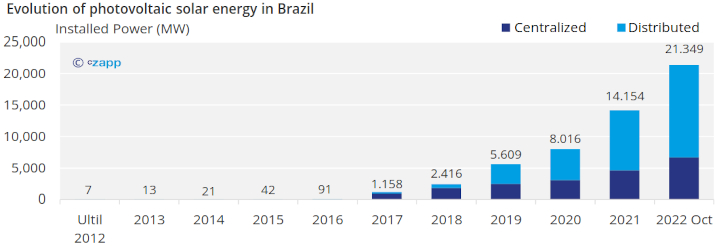

- Solar energy has grown by around 40% this year in Brazil.

- It’s only second behind hydropower for Brazilian electricity generation.

- Brazil is expected to become one of the top five global solar energy markets by 2026.

After becoming the third largest source in the Brazilian electricity matrix in July this year, with 16.4 gigawatts (GW) of installed power, solar energy hit a new record in November, when it reached 22 GW. In the coming months, the energy obtained by photovoltaic systems should exceed that of wind, becoming the second largest electricity matrix in Brazil, according to projections by the Brazilian Association of Photovoltaic Solar Energy (Absolar).

“The gain in competitiveness of photovoltaic equipment and the search for cleaner and cheaper energy are important factors for the sector’s expansion”, says Camila Ramos, Absolar’s vice president of finance.

Between January 1st and December 1st of this year, almost 600,000 new distributed generation (DG) projects, with an installed capacity of 5.7 GW, went into operation, which represents a result 42.5% higher compared to last year. Regarding centralized generation (CG), between January and November of this year, installed capacity reached 2.1 GW, an increase of 40% compared to 2021.

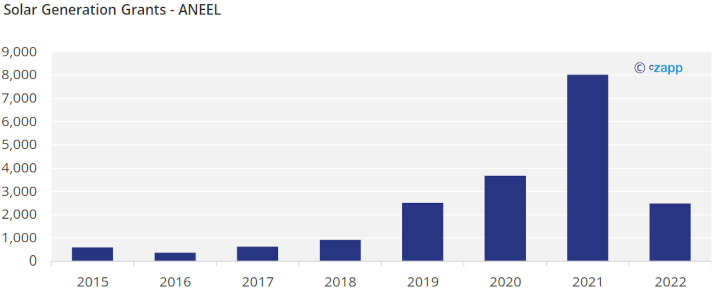

Distributed generation has experienced significant growth in recent years. The segment began to gain strength in 2012, when the National Electric Energy Agency (Aneel) Normative Resolution 482 came into effect, which allowed the generation of solar energy by the consumer. Centralized generation, referring to energy produced by power plants, also continues to expand.

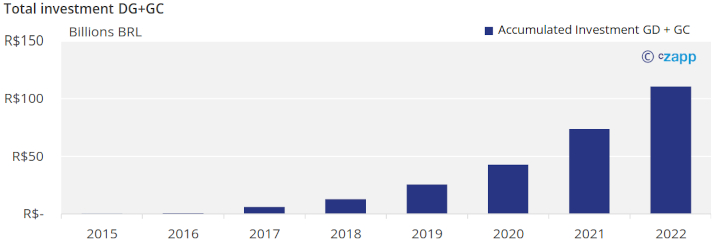

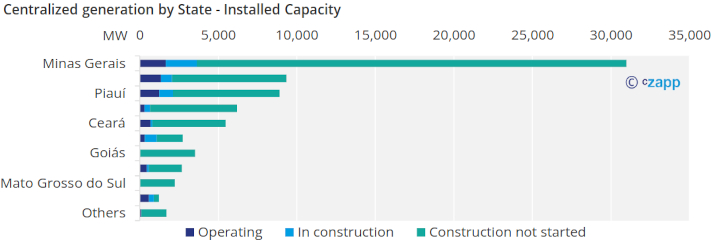

Investments have followed the pace of market growth. This year, the consolidated figure up to October points to investments of around R$ 110.8 billion (US$ 21.2 billion), which already exceeds by 50.3% the total invested in 2021, according to Absolar. In 2023, the inauguration of new solar energy plants is expected, with large groups entering the market. The North of Minas Gerais and the Northeast are among the priority regions for projects of photovoltaic systems, largely due to favourable conditions for the expressive capture of solar energy.

Minas Gerais leads the ranking of states with the highest installed capacity of centralized generation, with 1,648.5 megawatts (MW) – adding the installed power of solar parks under construction and new projects, this total should reach 30,999.2 MW in the coming years, according to data from Aneel. In Bahia, which ranks second among states producing solar energy, installed capacity should reach 9,333.2 MW. Next, Piauí (8,906.4 MW), Rio Grande Norte (6,196.1 MW), Ceará (5,470.5 MW) and Pernambuco (2,730 MW) stand out.

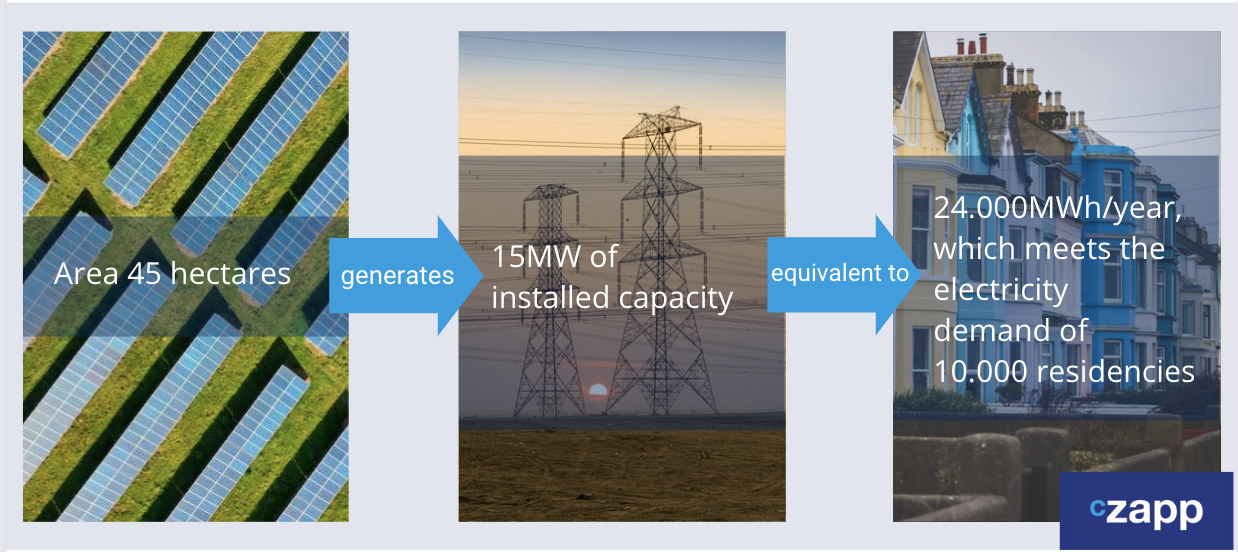

The equation of physical space available at attractive prices, combined with the incidence of sunlight practically all year round, make these states (and Brazil) ideal candidates for leadership in the production of solar energy. The plant located on a 45-hectare plot of land is able to deliver 15 MW to the consumer, after deducting the efficiency rate (around 30%), which feeds around 10,000 homes.

Opportunities

The advancement of new technologies, such as bifacial modules and photovoltaic systems developed from new materials that can replace silicon, such as pervoskite, should contribute to gains in efficiency and scale in the sector. “There are a series of raw materials under research to lower costs, increase the efficiency rate and provide for greater expansion in the sector”, says Ramos.

The decarbonization processes and the fulfilment of ESG goals by companies, organizations, and civil society, have also strongly contributed to the growth of the sector. In this regard, solar energy continues to rise because it is considered a clean and renewable source. The reduced impact of setting up solar parks and the generation of jobs provided, as well as the development of new production chains, also counts.

In the past decade, the sector generated more than BRL 35.7 billion in revenue for the public coffers and created 660,000 jobs. The production of solar energy also avoided the emission of 30.6 million tons of CO2 in electricity generation, according to Absolar.

The agility for the installation of solar parks is considered another positive factor. On average, start-up takes 18 months, which makes solar energy one of the fastest sources of electricity generation in terms of implementation, especially regarding the design and engineering phases.

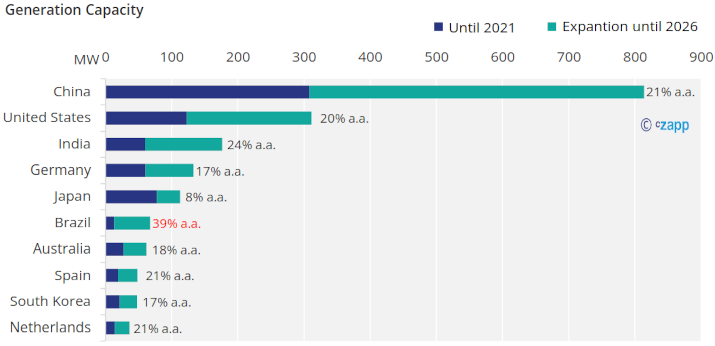

These advantages have been realized for some time by global markets. In the last three years, the installed power of solar energy has doubled in size in the world, according to the report “Global Market Outlook for Solar Power 2022-2026”, by SolarPower Europe, an entity that represents 280 global organizations and companies in the solar energy market. Last year, the installed capacity reached 167.8 GW, achieving the unprecedented mark of 1 Terawatt (TW). In 2025, the installed capacity should reach 2 TW.

Latin America leads the sector’s growth, with a 44% increase in installed power in 2021, reaching 9.6 GW. This expansion has been driven by Brazil. The country is expected to become one of the top five global markets by 2026, with an installed capacity of 54 GW.

Brazil should also emerge as one of the main world players in the production of green hydrogen obtained from solar energy and other renewable sources. The expectation is that a good part of the production of green hydrogen will be exported.

Recent advances in legislation have played an important role in market development. A good example is the regulation for the operation of hybrid power plants, which combine solar and wind generation, approved by Aneel in 2021. The norm defined the rules for contracting transmission systems, in addition to plant tariffs and other regulatory issues.

Challenges

The market, however, faces some challenges. With the accelerated expansion of solar energy projects, the country is currently dealing with flow bottlenecks. One of the answers to this question has been the holding of auctions for the expansion of transmission and energy disposal systems, promoted by the government. The expectation is that by 2028 this obstacle will be solved.

Another point highlighted by the sector is the supply of a volume of projects that must exceed future demand. Until the beginning of November, 2,487 solar energy projects started the granting process with Aneel, totalling an installed capacity of 99 GW, and current demand is around 63 GW. Only 10% of the projects, however, should go into operation in the coming years, due to factors ranging from the rising cost of rural properties to the need to expand transmission systems.

The race for the protocol of new generators took place in the context of decree 10,893, regulated at the end of 2021. Based on Law 14,120, from March of last year, the norm established a period of 12 months for new grant requests to be able to count on discounts between 50% and 100% on the Tariff for Use of the Transmission System (TUST) and on the Tariff for Use of the Distribution System (TUSD).

The bottlenecks in the infrastructure of the transmission and distribution systems weigh against the entry into operation of the avalanche of registration requests, as well as the projections of demand for electricity in the coming years. The per capita increase in energy consumption should be 1.5% per year until 2030, on average, according to the Ten Year Plan for Energy Expansion, of the Ministry of Mines and Energy, in line with the estimates of economic growth – the GDP expansion for the coming years fluctuates between 0.75% in 2023, 1.71% in 2024 and 2% in 2025, according to estimates from the latest Focus Bulletin, from the Central Bank, released on the 5th of this month.

The reduction of margins for the plants, in view of the greater competition between generators, is another issue discussed. Currency volatility also poses as a question mark. As most of the equipment is imported, variations in the dollar exchange rate directly impact production costs. In this sense, developments in the Brazilian macroeconomic scenario have been monitored with increased attention, with a special focus on fiscal risk and other indicators.