This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

The sugar market was quiet over the holidays. Prices remained stable and most 2025 contracting was completed. Processing continued without interruption, and the cash market remained inactive in early January. Negotiations for 2025-26 contracts are set for late February, with mixed outlooks due to supply uncertainty and India’s production.

Quiet Sugar Market After Holidays

The sugar market was quiet during the week ending January 3, with many participants out of offices during the year-end holiday period. Prices were unchanged. With most corn sweetener contracting for 2025 completed prior to the start of the new year.

While buyers and sellers both pressed the pause button during the Christmas and New Year’s holiday weeks, sugar processing at beet factories and cane refineries continued at a steady clip without interruption.

Prior concerns about unseasonably warm winter temperatures posing threats to outside beet piles, where the harvested crop is stored prior to processing, have begun to wane as weather conditions in major growing areas are expected to turn sharply colder and reach levels sufficient to prevent spoilage.

The cash sugar market was still mostly inactive at the start of January. Most contracting for the current 2024-25 season was complete weeks, if not months ago, and there has been no rush to begin adding 2026 coverage as sugar buyers sought lower prices, while sellers were hesitant to lower offers this early in the season.

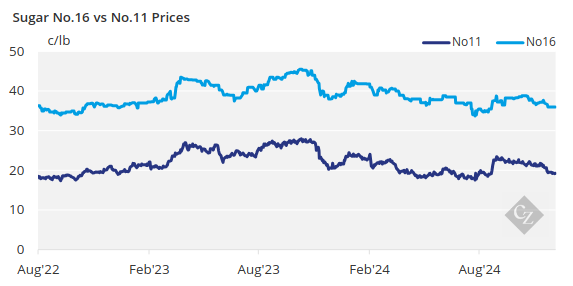

Some beet sugar was said to be offered flat, with 2024-25 prices in the mid- to upper-40¢/lb FOB range.

One beet processor remained out of the market for the current season, but others had sugar to offer. Prices were said to be mostly within the current quoted ranges, although some beet sugar sales below the ranges were noted in December from specific sellers in some regions.

Uncertainty Surrounds 2025-26 Sugar Contracts

Many buyers are waiting until the International Sweetener Colloquium in late February, where negotiations are expected to take place before finalising their 2025-26 contracts.

However, opinions are divided on the outcome of these negotiations as buyers have adjusted to a weakening cash sugar market, while sellers continue to cite supply uncertainty and anticipate a strengthening futures market due to lower production in India, the world’s second-largest sugar producer.

Deliveries at the end of December were weaker than expected, with last month’s pace for deliveries even slower than the year before when sugar deliveries also were below trade expectations. Some beet processors indicated demand was especially down for food manufacturers while retail demand was steady but is expected to adopt its typical post-holiday slowdown.

Corn sweetener prices were adjusted to reflect steady to mostly weaker prices for 2025 compared with 2024 contracted levels. Contracting was completed as 2024 came to a close, except for a few stragglers and the usual spot buyers.

The trade will be watching high-fructose corn syrup exports to Mexico as the USDA forecast a 12% drop in HFCS consumption in Mexico in 2025 because of ample supplies of lower-priced sugar prices in that country. Should exports slow as forecast, more spot supply could pressure HFCS prices in the US later in the year.