- Profitability of US soybean processors high on strong demand.

- Bunge, ADM see sustained high profitability for US processors.

- Gas shortages could boost soybean meal imports by Europe.

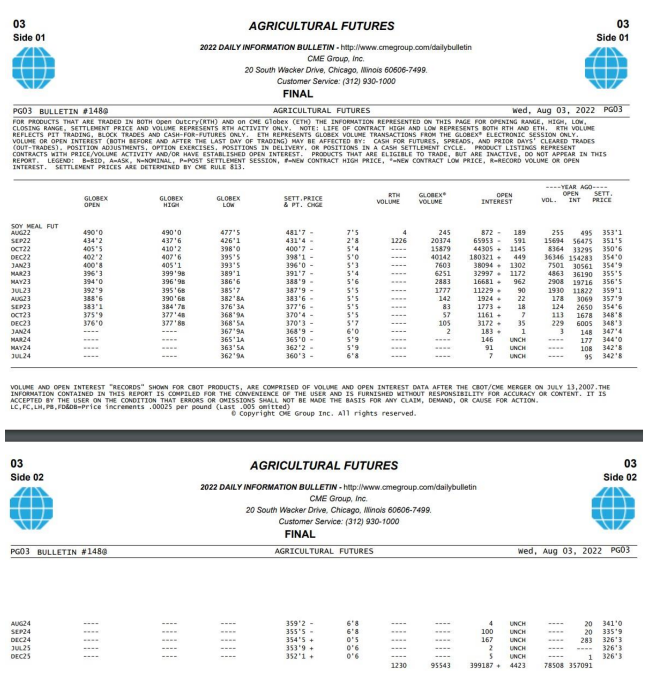

The Chicago Mercantile Exchange’s August soybean meal futures contract is now into its delivery period and during its last days of life behaves like a physical contract. The future contract’s price must necessarily reflect the true price of soybean meal which is the physical price, the real McCoy, the stuff chickens can eat.

A consumer can now buy August soybean meal futures, hold on to those futures through 12 August, the date the futures contract expires, and in short order receive physical soybean meal.

The August futures contract is rallying sharply to converge with the physical price of soybean meal. The chart below shows the convergence: during the middle of July just before August delivery at $420 a short ton, move forward into the delivery period and the contract settles at $513.90/st, a 22% increase in two weeks, reflecting the true physical price of soybean meal. A year earlier, the August price was $353/st.

Is the US soy processing industry running as hard as it can? Yes, it is. Is that enough to meet demand? No,

it isn’t. How do you know that? An entirely inverted (backwardated) futures curve and the above chart tell me all I need to know. The soybean meal market is dampening demand; prices in the future are cheaper than they are in the spot; the market’s message, delay your consumption because there is not enough today and you will receive a future benefit, a lower price.

The US soybean processing industry is outrageously profitable today and has a very positive looking future. Forward guidance from both ADM and Bunge during their recent second-quarter earnings calls painted a very positive picture for the sustainability of these profitable margins. Consumers of soybean meal and soybean oil find supplies uncomfortably tight. That tightness is here to stay, for quite some time. That tightness is greatly beneficial to the US soybean processor.

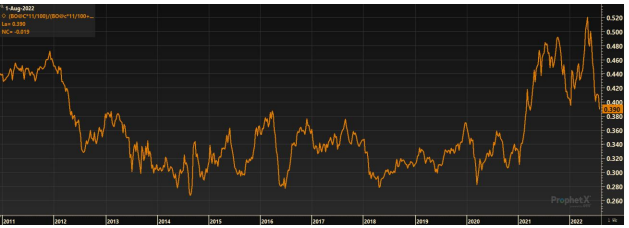

Soybean processing is a vegetable protein meal production business primarily and vegetable oil production business secondarily. Traditionally, except for brief periods of time, the soy processor earns 70% of the business’s revenue from soybean meal with soybean oil providing 30%. The chart below displays this long-term relationship. Soybean

processors refer to (and trade) this revenue ratio as oil share, or more appropriately, oil’s share of revenue contribution to the soybean processing margin.

As the chart displays, soybean oil’s revenue contribution to the crushing margin zoomed higher along with the price of soybean oil to nearly 50% during the winter of 2021 as the global vegetable oil markets felt the first effects of the enormous demand from the US’ renewable diesel industry. The market felt the second round of that demand again in the late spring/early summer of this year as more renewable diesel refining capacity came online. Many forecasted a new permanent, revised relationship between soybean meal and soybean oil: 50% from meal and 50% from oil.

But now the tide is turning, and soybean meal is taking back its traditional leadership role of providing most of the revenue for the soybean processor. Availability of global supplies of feed ingredients has tightened (spoiler alert, it will become tighter) and the global feed producer is starting to get very concerned about Argentina (world’s largest soybean meal exporter providing nearly 50% of the meal that enters global trade) and power curtailments in Europe that may impede protein meal production and force Europe to import higher-than-normal amounts of protein meal.

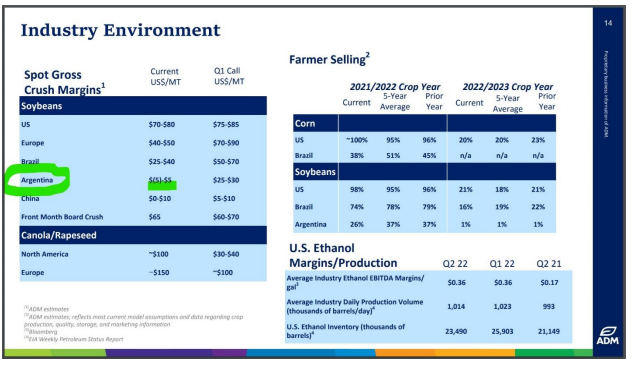

Will soybean oil’s contribution to share return to 50% any time soon? Maybe. When? When the world feels more confident about the ready supplies of vegetable protein meals to produce meat proteins. That will probably not happen any time soon, maybe in a couple of years. Finally, ADM posted this detail in its second quarter earnings release last week. Observe management’s Q1 estimate for Argentine soy processing margins and the actual current margin (expressed in dollars a tonne). Has the situation in Argentina turned sour quickly catching even the pros by surprise? Yes.

Other Insights that may be of interest

What the Energy Crisis Means for Inflation & Commodities

Interactive Data Reports that may be of interest …

Consecana Panel CS Brazil Weather Update