Insight Focus

Funds maintained net short positions for 67 weeks ending November 15. EUA prices are being driven by gas price fluctuations ahead of winter, with higher gas prices increasing coal demand and subsequently boosting EUA demand.

Spec Shifts Signal Potential EUA Recovery

European carbon allowance prices are heading into the final two weeks of trading before the December 2024 contract expires and the December 2025 future takes over as the benchmark for the coming 12 months.

The market has already seen a significant volume of December 2024 positions rolled into the December 2025 contract. According to ICE Endex data, since open interest in the 2024 contract peaked at 414 million tonnes in early October, over 82 million EUAs’ worth of positions have been liquidated.

At the same time, approximately 33 million tonnes of new open interest have been added to the December 2025 contract. This is typical end-of-year trading activity and is expected to continue through to the expiry on December 16.

This seasonal housekeeping has however been accompanied by a significant change in the positioning of speculative traders, which may suggest that prices are in for a recovery in the short to medium term.

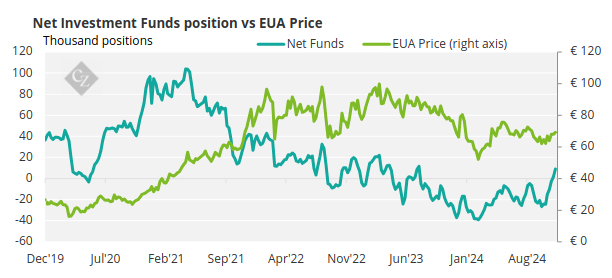

Data from the ICE and EEX exchanges showed that in the week ending November 15, investment funds had flipped their net short position into a net long — the first time funds had been net bullish in 15 months.

The net long position strengthened in the week ending November 22, when funds boosted their position from 1.4 million EUAs to almost 9 million.

Source: ICE

The switch marked the end of a lengthy bearish bet that began when EUA prices were above EUR 83 in August 2023 and reached its peak at 39 million EUAs in February, when prices briefly traded at EUR 51.

Since then, as the chart shows, the net short position has gradually reduced as EUA prices have stabilised in the EUR 65-75 area. Now, however, funds are starting to amass long positions as the winter heating season begins, and speculation rises that Europe’s coal-fired power plants will need to return to full-time operation as gas prices stay too high for its use in electricity generation.

Gas Price Fluctuations Impact EUA Demand

The day-to-day gas market is closely monitoring pipeline networks for signs that Russian gas flows are declining, which is seen as a precursor to the end of pipeline flows at the end of this year. Additionally, competition for LNG cargoes from Asia means European prices must match or exceed the levels being bid in Asian markets.

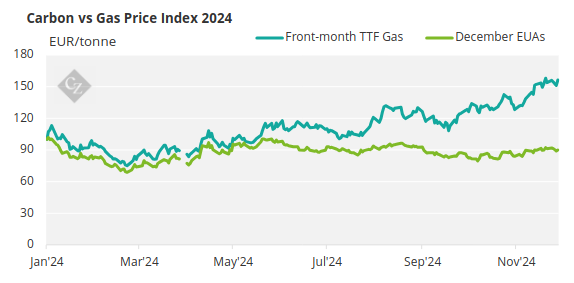

Indeed, it’s natural gas prices that are acting as the primary driver for carbon. The higher TTF natural gas prices rise, the more likely it is that supplies will be diverted into storage instead of power generation, increasing the call on coal-fired plants and boosting demand for EUAs.

Conversely, lower gas prices reflect perceptions that supply is plentiful and that the fuel can replace coal for power generation. This also depresses EUA prices. Consequently, the correlation between TTF and EUA prices has been unusually high in recent months, despite EUAs being significantly lower year-to-date and TTF reaching twelve-month highs.

Source: ICE

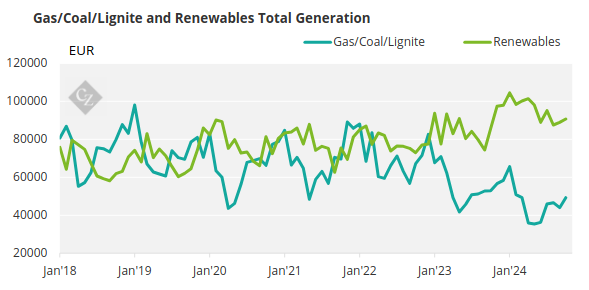

The correlation is somewhat tempered by the fact that EUA supply is also more than enough to meet demand. The increasing role of renewables, and a healthy hydropower balance this year has trimmed the call on fossil-fired power.

In the year to October, gas, hard coal and lignite-fired generation fell by 18%, according to data from the grid agency ENTSO-E, while renewables output rose by 15%. At the same time, anecdotal industry data, such as purchasing managers’ indexes, remain weak, indicating a recovery that is slow to start.

Source: ENTSO-E

The optimism of investment funds over EUA prices may reflect a seasonal uptick in activity and prices as the market approaches the expiry of the December contract, as well as bullish sentiment in natural gas as the expected cut-off of Russian pipeline gas supplies approaches.