Insight Focus

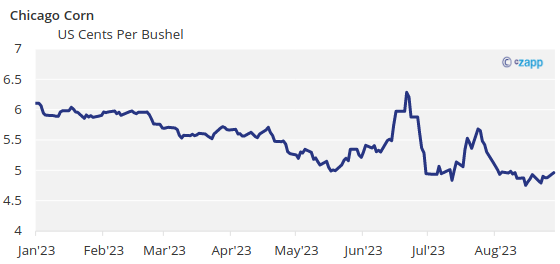

- Chicago Corn prices remain broadly unchanged on the week.

- Heatwaves and droughts continue to rage in the US.

- Meteorologists and farmers worry about crop conditions.

Forecast

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,31 USD/bu.

Market Commentary

The Pro Farmer crop tour in the US found better than expected yields pressing the market lower while European grains were slightly positive. A second week of heat is expected in the US.

The Pro Farmer crop tour in the US last week found better than expected Corn yields in Ohio and South Dakota, Indiana making an all-time high and Illinois +1,5% year on year. Overall, the crop tour reported yields above average and now the doubt is what will the USDA decide in the September WASDE.

The problem is that we had very hot and dry conditions last week in the US growing areas and this week same conditions are expected which will most likely result in Corn condition worsening.

As of last week, US Corn condition worsened 1 pt to 58% good or excellent vs. 55% last year. Corn area under drought increased by 1 point and is now 43%. French Corn is 82% in good or excellent condition or two points lower week on week and vs. 48% last year.

In Brazil, Safrinha Corn is 78,8% harvested vs. 90,2% last year and the first Corn crop is now fully harvested. In Argentina, Corn is virtually harvested with 32,9 mill ton collected but the few hectares still pending to harvest should deliver another 1 mill ton.

In the Wheat front, there was again volatility coming from renewed Black Sea tensions after Russia attacked the Danube port of Izmail and destroyed approximately 15k ton of grains.

US winter Wheat is 96% harvested above last year’s pace of 94% and within the five year average of 96%. Spring Wheat condition fell 4 point and is now 38% good or excellent vs. 64% last year. Spring Wheat is 39% harvested vs. 31% last year. The area of US winter Wheat under drought was 44% up from 43% the previous week. French spring Wheat condition was flat at 76% in good or excellent condition and is 99% harvested. Russian Wheat is 58% harvested. Ukrainian Wheat is now fully harvested making 21,9 mill ton.

In the weather front the US had hot and dry conditions in most growing regions last week in line with the forecast, and same conditions are expected to continue this week. In Brazil, some rains are forecast again during this week. Europe is expecting lower temperatures after the heat wave last week, and some rains.

We could see this week some recovery in US Corn if hot and dry conditions are confirmed for a second week in a row as we will most likely see crop conditions worsening. But overall we think the USDA already corrected Corn yields and the optimism of the Pro Farmer crop your might be offset by persistent dry weather leaving the September WASDE unchanged in terms of yield. Weather and Blacks Sea volatility should define price action once more, but the outlook is for ample supply.

The Pro Farmer crop tour in the US found better than expected yields pressing the market lower while European grains were slightly positive. A second week of heat is expected in the US. We could see this week some recovery in US Corn if hot and dry conditions are confirmed for a second week in a row as we will most likely see crop conditions worsening. But overall we think the USDA already corrected Corn yields and the optimism of the Pro Farmer crop your might be offset by persistent dry weather leaving the September WASDE unchanged in terms of yield. Weather and Blacks Sea volatility should define price action once more, but the outlook is for ample supply. No changes to our average price forecast for Chicago Corn for the 22/23 (Sep/Aug) crop in a range 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,31 USD/bu.