Insight Focus

- Fonterra maintains 79.1% market share for their FY23.

- Olam Food Ingredients factory in Tokoroa embarks upon its first milking season, intensifying competition.

- Dairy futures are mostly trading above trend, especially cheese and Class III milk on the CME.

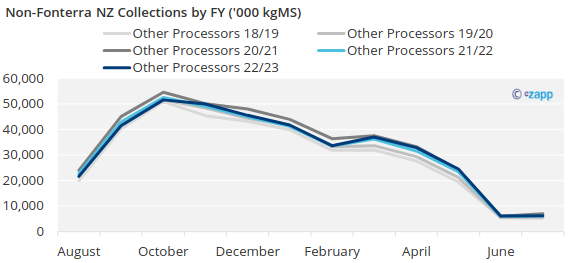

New Zealand Milk Collections:

- The latest milk collection figures for the month of July have been reported by all dairy processors. This marks New Zealand’s fourth best milk collection year ever (on and August to July basis) and importantly to note it marks the non-Fonterra processors second best milk collection year ever.

- Fonterra finished their financial year with market share of 79.1% of New Zealand’s milk which is exactly the same as the prior FY. The Fonterra farmers’ efforts in April and May saved the day for New Zealand’s largest processor – a marked uplift in their collections in these months is responsible for Fonterra just beating their collections last year and maintaining their market share.

- We are getting close to being able to see how the beginning of the season is shaping up for farmers as we approach the “wall of milk”. If milk growth has truly stopped in New Zealand, then this season will be the most important ever for manufacturers who are competing over a fixed pool of milk. The added spice for this season being the new Olam Food Ingredients factory in Tokoroa embarking on their first full production season in the Central North Island. This region is an area already crowded with processors and is likely to be a real battleground.

- The stage is set with pastures nationwide more moist than usual but drying out quickly on the back of New Zealand’s coldest August in the past seven years.

Market snippets:

- Fonterra has launched Skimmed Milk Powder (SMP) and Instant Whole Milk Powder (WMP) on GDT Pulse. They have removed volume from GDT Events to support these launches.

- China can import New Zealand milk powder duty-free from 2024 arrivals. Chinese GDT buyers are believed to be holding off until events with November/December ETDs to take advantage of this. This is interesting context with the background of Fonterra having aggressively loaded offer volumes for WMP and SMP on GDT for September to November events. There is over 60% more WMP on offer this month than in September 2022 and on average almost 30% more of each product is available in each Sep-Nov vs. both of the past two years! Have Fonterra mistimed this dynamic or are they trying to manage the interplay between their Milk Price and EBIT..? Some would argue that such a big deviation could only be intentional.

- Algeria have changed their process for issuing Sanitary Derogations (i.e. import permits). This has been the reason for the recent delays. There is now a council responsible for this process which is headed up by the Algerian Prime Minister. They have been reviewing all import requests (not just dairy, i.e. including cereals etc.). Permits are expected to be issued any day now.

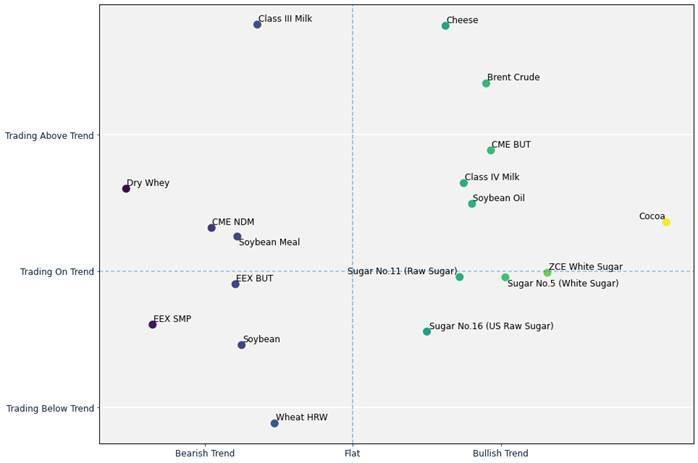

Dairy futures are almost all trading “above trend”:

- CZ’s Quantitative Analysis team have an algorithm which identifies the most significant commodity market trends over a two-week up to a 6-month timeframe, as well as the deviation away from the current trend.

- It’s interesting to note that all trending dairy futures are trading at or above their established trend (whether that be bullish or bearish); the only exception being EEX SMP.

- Cheese and Class III on the CME jump out as being the most “above trend” of all of the markets we follow and which our algorithm has selected.

- Momentum is the phenomenon in which asset prices continue moving in their current direction over a certain period, be that upward or downward – this phenomenon is directly in contrast to mean-reversion (which we talked about this week).