Insight Focus

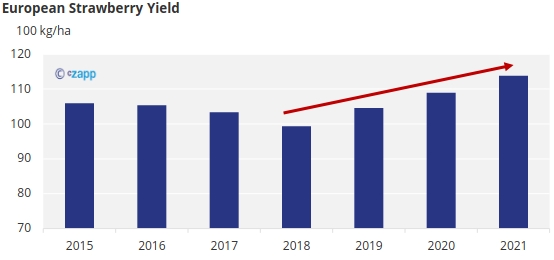

- The EU’s strawberry crop has yielded greater quantities in the past few years.

- This year, prices have been under pressure due to a large Greek crop.

- In terms of quality, May is expected to yield the best crops.

Europe Prioritises Efficiency

In the past six years, Europe’s strawberry harvest has become much more efficient. While overall production has remained stable at around 1.7m tonnes, harvested area has dropped by about 14,000 hectares.

This is largely thanks to various yield-enhancing programs such as the GoodBerry project. Implemented between 2016 and 2020, new cultivation techniques were developed and applied to accelerate growth of high-quality strawberries. The quality of the strawberry will depend on the variety each farmer decides to work with and the end use of the strawberry. For instance, for strawberry concentrate low turbidity and a red colour are important, no matter the variety.

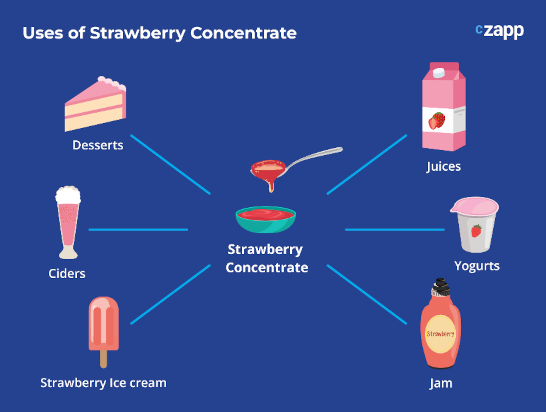

This increase in yield is relevant not just for farmers looking to sell fresh strawberries, but for retail brands that require strawberry concentrate for their products. By increasing yields, manufacturers of strawberry yogurts, ciders, ice creams, juices and more can generate more efficiency through their supply chains, as well as improving environmental impacts.

Diversification Eliminates Seasonality Concerns

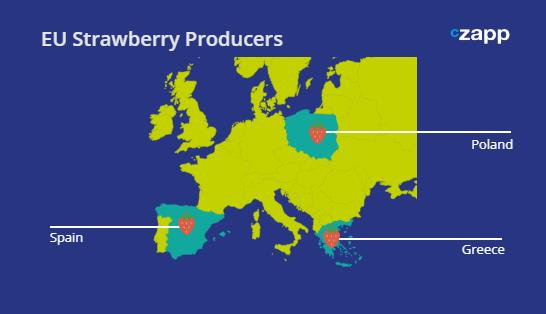

Strawberry production is relatively diversified geographically. China is by far the largest producer of strawberries in the world, followed by the US and Mexico. Within Europe, Spain and Poland are significant producers but Greece has also begun to ramp up exports.

This global production chain is important not just to ensure freshness but to guarantee affordable prices and availability. With summer just around the corner for the Northern Hemisphere, the strawberry season is starting in Europe and across the Mediterranean.

Intra-European imports are particularly important, especially for Germany and the UK. However, non-European suppliers also have some opportunities to export to the continent.

Spanish crop

As the largest producer and supplier in Europe, Spain produces around 400k tonnes of strawberries per year. But over the past few years, unfavourable weather has impacted the crops, not just in terms of size but also limiting ripeness. In the first few months of 2023, an unexpected cold snap created issues for the Spanish crop in the key region of Huelva. Now, the crop has been reduced by 30%. It is worth noting that weather conditions meant the Spanish strawberry season was later than usual this year, having been delayed until the end of March. This had an impact on the other large producing countries.

Greek crop

Meanwhile Greece, as the second-largest EU exporter, expanded its strawberry allocation compared to previous seasons. Unlike the Spanish crop, it is progressing well, and prices have remained in a relatively stable range. Now that spring has arrived, and the first production cycle peaked in Spain and Greece prices have dipped slightly.

Polish crop

This production peak in Spain and Greece coincided with a drop in Polish strawberry prices. The price for fresh strawberries of Polish origin fell to between $2.33/kg and $3.26/kg – almost halving in value between March 24 and April 6. In the upcoming weeks as we approach May, the weather is set to get warmer. At this point, strawberry quality will reach its peak and an increase in strawberry demand is expected.

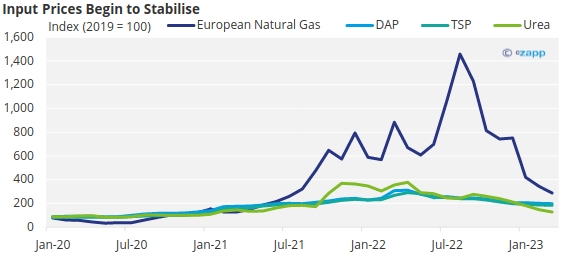

Rising Costs Impact Margins

Is important to keep in mind that European strawberry producers are facing an ever-increasing cost of production and packing. A lack of labour for harvesting and increases in the cost of inputs have led to an increase of 30-35% compared to last year. These costs have largely been absorbed by the producers but are expected to transfer to the retail segment for the future viability of the market. The good news is that the cost of certain inputs, such as natural gas and fertilisers, are beginning to decrease.

The European market has also garnered some interest from Asia and the Gulf as Egypt’s harvest wrapped up. However, the freight rate is still relatively high and may rise again, which makes the European market more workable for EU producers.