Insight Focus

- In 2021/22 EU olive oil production and demand were high.

- This came at a time when supply of other cooking oils was disrupted.

- However, in 2022/23 it looks like its fortunes could be reversed.

The EU olive oil industry has been a beneficiary of the recent supply chain troubles faced by other cooking oils, sunflower, palm, and rapeseed. Olive oil production in 2021/22 was strong and there has been evidence of substitution towards the product in recent months.

Now, the tables could be turning as EU olive oil production is forecast to fall in 2022/23 whilst other oilseed supply is in recovery.

Strong Production in 2021/22 despite Weather Disruption

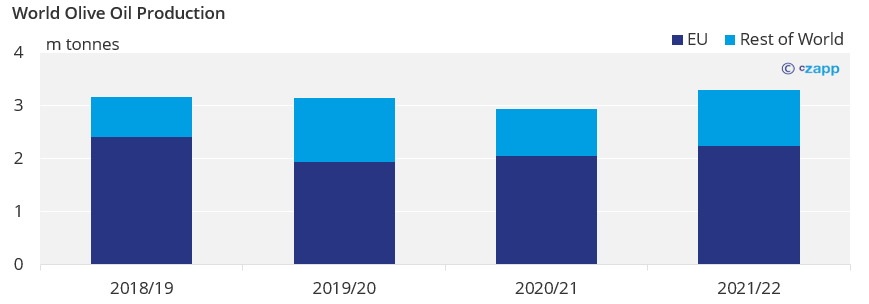

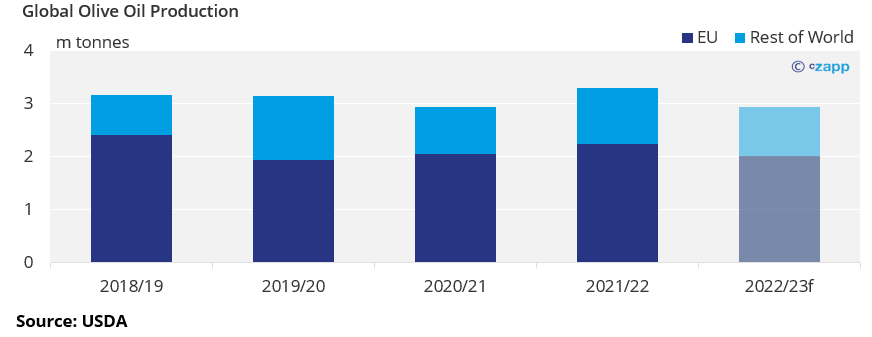

In 2021/22, EU olive oil production will hit 2.2m tonnes, the highest since 2018/19.

The EU produces around 67% of all olive oil globally, and consumes 50% of it, making it the focal point of the industry.

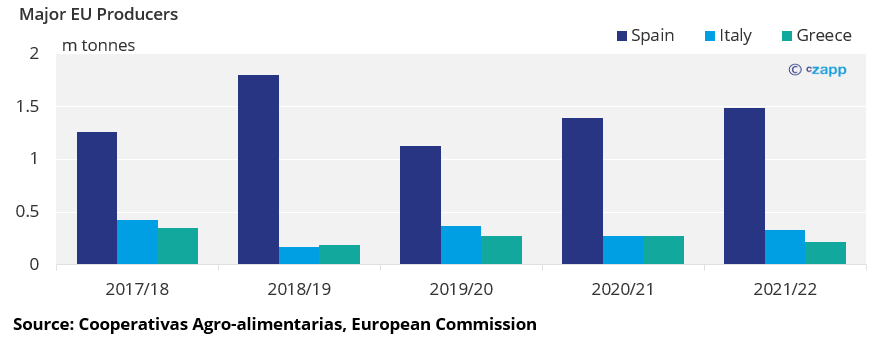

This is despite persistent adverse weather in Spain, Italy, and Greece which together account for 90% of EU production.

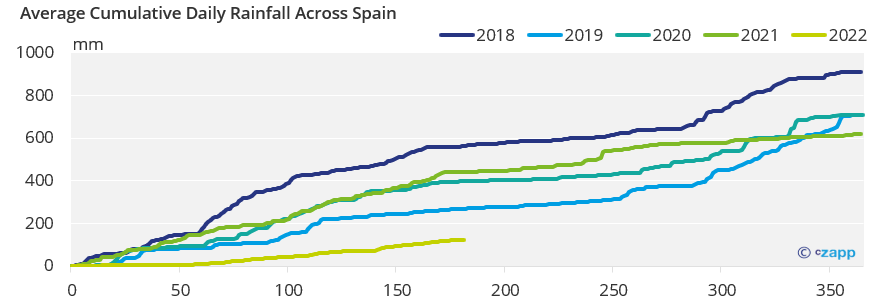

Heatwave and drought in Andalusia, the main Spanish growing region has affected olive growers for the last two crop years, with 2021/22 reportedly receiving 50% less rainfall than in 2020/21 according to the Spanish Meteorological Agency, which was already considered a dry year.

Despite this, production rose year on year to almost 1.5m tonnes in 2021/22, 67% of EU production.

Italy reported a 50k tonne recovery from 2020/21 to produce 330k tonnes of olive oil in 2022/23.

While in Greece, a mild winter, followed by both frosts and heatwaves early in 2022 did hamper production, 2021/22 yielded only 215k tonnes, a 50k drop from 2020/21.

Signs of Substitution as Cooking Oil Supply Disrupted

While the EU enjoyed a strong 2021/22 campaign:

- Large scale exports of sunflower oil from Ukraine became impossible due to the war.

- Indonesia temporarily banned palm oil exports to stabilise domestic supply.

- Canola crops in Canada and South America were hit by unfavourable weather.

As a result, a serious shortfall in supply emerged in the EU and UK, leaving supermarket shelves bare, except for olive oil. NielsenIQ, a market intelligence firm, said that in May, cooking oil in France was out of stock in 25% of cases, the UK 22% of cases.

Unavailability looks to have forced a change in consumer habits. Filippo Berio a major olive oil supplier reported an uplift in sales as shoppers replaced sunflower and rapeseed oil with olive oil.

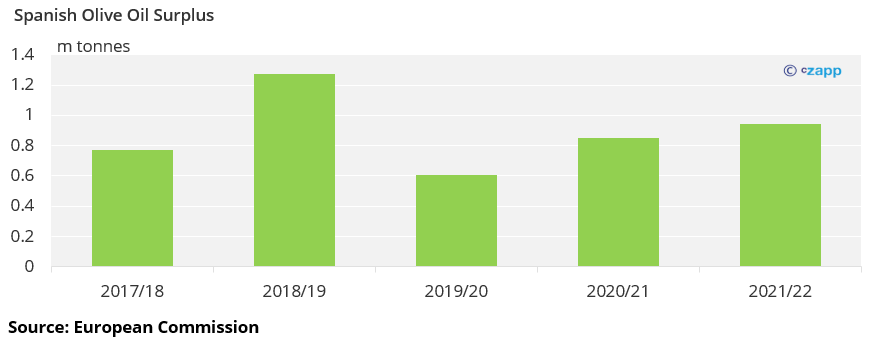

Likewise in Spain, olive oil labelling was allowed to be changed and sold as direct alternative to cooking oils, and sunflower oil was replaced by olive oil in tuna cans in order to maintain supply. Spain reliably produces far more than it consumes and so had a guaranteed supply of cooking oil regardless of disruption to other oils.

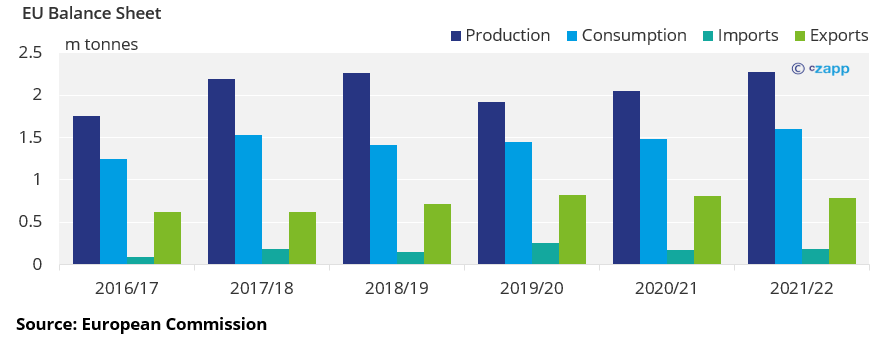

Looking at the whole of the EU, consumption and imports are forecast to rise by over 8% and 9% respectively on the year in 2021/22 whilst exports are expected to fall by 3%. This is despite a 10% year-on-year rise in production.

Thus, the disruption to the supply of sunflower, rapeseed, and palm oils appears to have boosted sales of olive oil within the EU.

Can this be Sustained?

Looking ahead to 2022/23, the USDA has forecast global production will fall around 400k tonnes to below 3m tonnes. Most of this fall is driven by an expected 200k drop in EU production to 2m tonnes.

Olive trees tend to follow a biennial bearing schedule which means a larger crop one year as more nutrients are drawn out of the soil, followed by a smaller crop the next year as the soil is depleted.

The USDA expect that in 2022/23 more trees will be at the low point of this natural alternate bearing cycle. This means that 2023/24 should yield a larger crop again, with everything else equal.

Spain produces around 40% of all olive oil in the EU and is currently facing another year of low rainfall. This is fomenting doubt that Spanish production in 2022/23 will be able to remain close to 2021/22.

The availability of other cooking oils appears to be increasing too:

- The ban on Indonesian palm oil exports has been lifted.

- Canada looks set to recover from a poor canola crop last year.

- Sunflower oil exports are now slowly flowing out of Ukraine via alternative routes.

- The new EU rapeseed crop is about to come online, easing domestic supply.

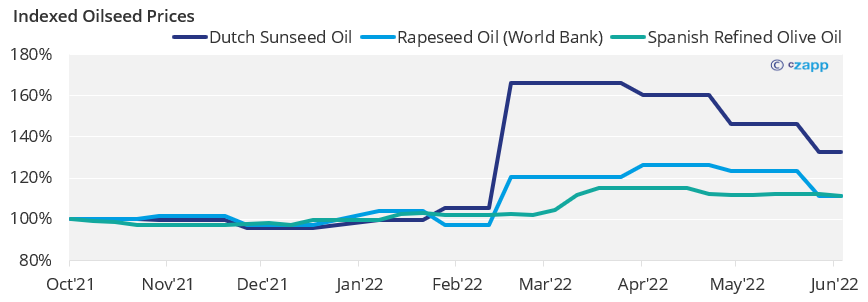

This is reflected in the prices of the various cooking oils. Indexed against October 2021 rapeseed and sunflower oil prices are beginning to fall back to where they were before Russia invaded Ukraine in late February.

Given that olive oil is generally a pricier product, with sunflower and rapeseed prices coming back down, olive oil is becoming a less attractive substitute in markets where it is not currently the default cooking oil (Spain, Italy, Greece, Cyprus etc.).

However, with the situation in Ukraine still far from returning to normality sunflower oil production and exports are unlikely to return to pre-war levels in the next 12 months. Olive oil will still form part of the solution as consumers look to alternatives.

Other Insights that may be of interest

How to Stay Calm in a Crazy Wheat Market

Grains Higher as Hot Dry Weather Hits Europe

Explainers that may be of interest …