Insight Focus

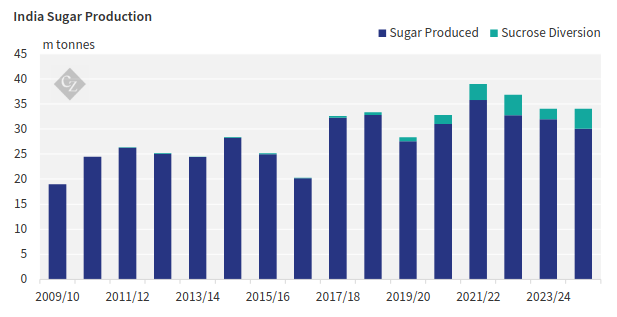

We have lowered our sugar production estimate for India in the 2024/25 season from 32.5m tonnes to 30m tonnes. This remains above market consensus. The Indian government decision to allow sugar exports this year makes sense in the context of a higher-than-expected crop.

Crop Downgrade

Over the weekend the Indian government has allowed 1m tonnes sugar exports in 2024/25.

The timing was unusual: the government had previously indicated it wanted more certainty on the size of this year’s sugar production before making a decision, and so we’d expected an announcement in February or March. It also came at a time when many analysts had dropped their sugar production forecasts from around 30-32m tonnes to 27-29m tonnes for this season.

We have always been at the very top end of Indian sugar production estimates for 2024/25, at 32.5m tonnes. This is based on our belief that cane area in India is much higher than many observers think. We retain that view; but it’s now clear that sucrose yields in Karnataka (and to a lesser extent Maharashtra) are lower than we’d hoped. We are therefore adjusting our sugar production forecast lower, to 30m tonnes sugar.

Based on our new forecast, India will make enough sugar this year to support 1m tonnes of exports and so the government’s recent announcement makes sense.

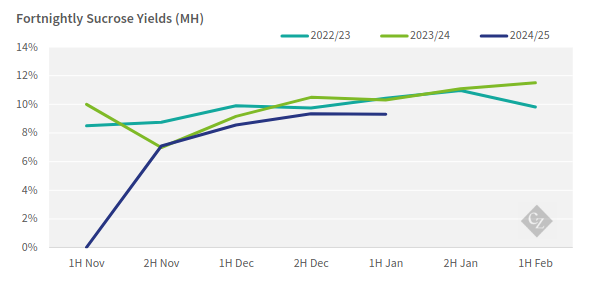

Poor Sucrose Yields in Karnataka

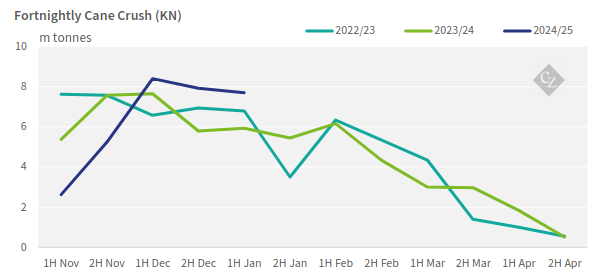

Cane crushing progress in Karnataka (KN) has been excellent so far this season. The number of mills in operation is also at a 5-year high.

Our current forecast is for UP to make 8.7m tonnes sugar, which is too low. We have therefore raised our UP sugar production forecast to 11m.

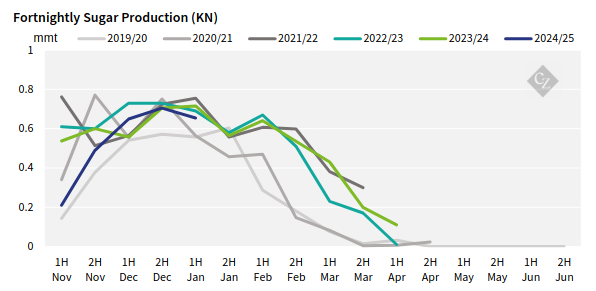

Sugar production per fortnight is normal, but it is poor in comparison to the fortnightly cane crush. This strongly suggests the cane quality isn’t as good as we’d hoped.

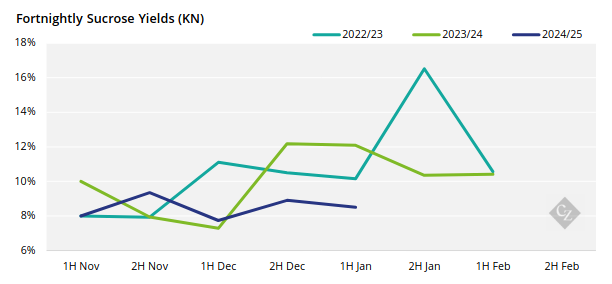

However, the more concerning factor is the sucrose yields in Karnataka. They are significantly lower than the past 2 seasons.

Karnataka experienced heavy rainfall throughout December, which could have affected sucrose yields negatively. With a delayed start to the season and poor sucrose yields, we will likely not see the usual levels of sugar production in Karnataka this season. We have adjusted our sugar production forecast from 4.6m tonnes to 4.0m tonnes.

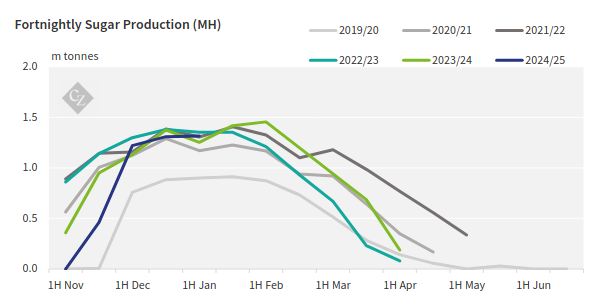

A Late Start to Cane Crushing in Maharashtra

Cane crushing in Maharashtra (MH) is progressing around a fortnight behind normal this season.

If we adjust the crush statistics by a fortnight, we can see that cane crushing levels are normal. So is the fortnightly sugar production.

Like Karnataka, fortnightly sucrose yields are lower than in previous seasons, though the shortfall is less pronounced.

The slow start to cane crushing makes it unlikely that Maharashtra will be able to reach our original cane target, so we have adjusted our sugar production forecast lower, to 10m tonnes.

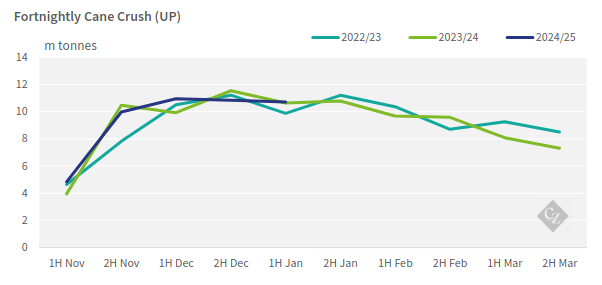

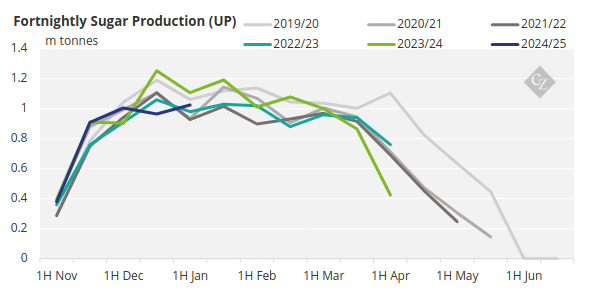

Uttar Pradesh Experiencing Better Season Than Anticipated

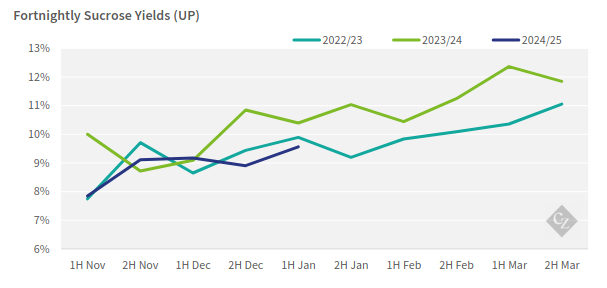

Cane crushing and performance are better in Uttar Pradesh (UP).

The fortnightly cane crush is at normal levels so far; so is the fortnightly sugar production.

It’s the same story for sucrose yields which are at a normal level.

If we assume that from here on fortnightly sugar production:

- Only hits the minimum we’ve seen in the past 5 years, UP will make 9.3m tonnes sugar.

- Reaches the average we’ve seen in the past 5 years, UP will make 10.8m tonnes sugar.

- Reaches the maximum we’ve seen in the past 5 years, UP will make 12.7m tonnes sugar.

Our current forecast is for UP to make 8.7m tonnes sugar, which is too low. We have therefore raised our UP sugar production forecast to 11m.