Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

NEW YORK SUGAR #11 OCTOBER 2023

Impossible to call it right at this second as NY continues to twirl around the mid band (24.05). If it could secure its grip aboard that feature, last weeks’ setback could still be filed in the corrective drawer and escape beyond 25.30 could exceed a continuation Fib retracement and make a more persuasive argument to being back in the saddle. It is simply too soon and too unclear to make any such assumption now though and a more emphatic ouster from the 24’s, especially if the Dollar meantime popped 102, would warn of an intensifying downturn towards 20.50 instead.

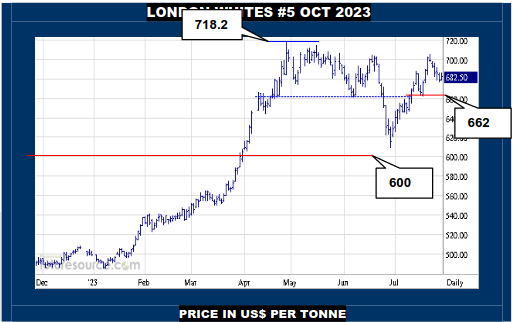

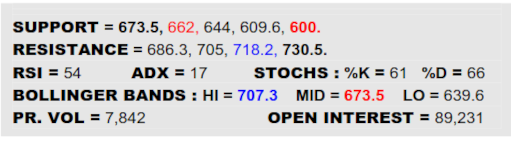

LONDON WHITES #5 OCTOBER 2023

The bull crowd must hope that London is calling the tune as it managed a rather covert little inside day Monday while staying safely out ahead of its mid band still (673.5). Insiders usually herald a directional change so this one infers trying to cast off last weeks’ dip and get on the throttle again, defeat of 686.3 pinning the sights on 705 once more with an eye to the 718.2 high. A Dollar exit over 102 and/or NY really tumbling from the 24₵’s would be tough to withstand though, in which case beware a mid band break pressing on below 662.

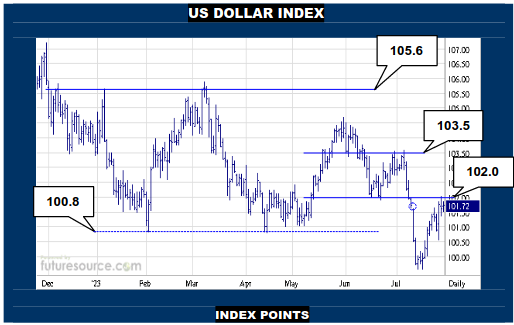

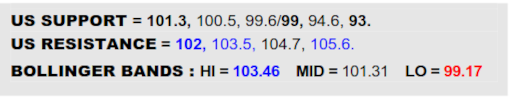

US DOLLAR INDEX

Gathering back a delve into the 99’s that just missed a longer term Fibonacci retracement (99) had the rumble of a false breakdown so the Dollar looks dangerous to commodities but after patching the 101.60’s gap, it has just hinted at a little cooling at the 102 resistance as Monday was poised to become an inside day. Still very mindful that a clean thrust over 102 would beef up the comeback and make 109.8 look a tall order for the B-Berg. However, if the insider caused the US currency to swerve back through its mid band (101.3) and out of the 101’s, so the swell could unravel and bring renewed oxygen to the commodity arena.

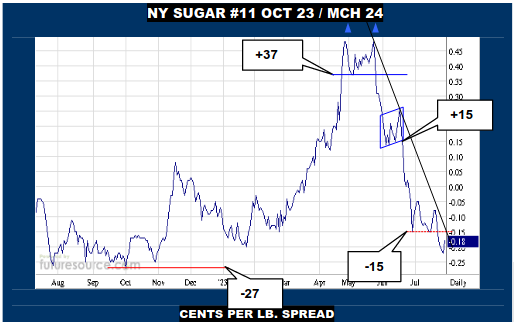

NY SUGAR #11 OCT 23 / MCH 24 SWITCH

VALUE : -18

The breakdown through a -15 ledge last week wasn’t as punishing as a preceding bear flag breakdown from +15 and Oct/Mch reacted back up a bit Monday as flat price fought to hang on at its mid band. If Oct could meantime shore up the 24₵ footing and in so doing coax the switch back across the -15 ledge hosting a steep downtrend and the mid band just behind (-13), there would be more of a sense of stabilizing that would buoy ideas of trying for the 25₵’s again and maybe still reaching for +15 again here. However, if held at bay by -15, there wouldn’t be much of substance to highlight and the -25/-27 lows could yet be in peril.

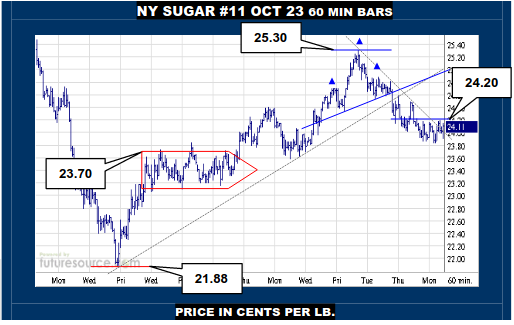

NY SUGAR #11 OCT 23 INTRADAY SNAPSHOT

The magnified intraday chart shows NY wriggling free of last weeks’ near term downtrend during the course of Mondays’ session. Even so, it still needs to punch clear of 24.20 to put more weight behind this immediate trend escape to better engage forward gears again and thus take aim at the 25₵ vicinity where the ex-uptrend and a neckline to a small H&S-like top are currently in close company. If the market failed to find that extra puff to defeat 24.20, so the downtrend shedding just couldn’t be vindicated and there would remain risk to the 23.80’s still where a more comprehensive breakdown could thus feature.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.