Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

NEW YORK SUGAR #11 OCTOBER 2023

“Just when I thought I was out, they pull me back in!” Suggesting more than a few folk remain troubled by a Dollar nosing the 103.5 area, NY’s foray over 24.42 to briefly leave a small inverse H&S was promptly reeled back Thursday. Indeed, not only did that deny the immediate inverse H&S but it also floundered right on the doorstep of forming a bigger one (24.75). Cloak and dagger stuff then and that vigil minding the uptrend goes on (23.63) while still seeking successive hops of 24.42 and 24.75 to better pull out of the summer malaise and not get “pulled back in again!”

LONDON WHITES #5 OCTOBER 2023

A collective groan from the crowd in London too as a glance beyond the 705 barrier failed to dig in Thursday and it reeled back into the murk of that recent 705-677 band. Must always be on alert just after a failed getaway attempt as this is not an unusual time for a whiplash effect to be witnessed so mind 689 initially as a first warning stumbling block to return focus to 677 itself, still ever mindful of plenty of open country below. A Dollar swerve under 102.7 would otherwise really help to regroup and finally deliver that lasting breakaway over 705.

BLOOMBERG COMMODITY INDEX

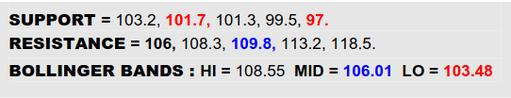

Still ever conscious of the Dollars’ needling a next portal higher (103.5) but since it isn’t absolutely ripping clear, so the B-Berg was trying to find its feet Thursday and managed a small outside day. This of course keeps the commodity index some way clear of its ’23 inverse H&S neckline (101.7) but wouldn’t throw a parade just yet because currency is a lingering issue and Brent has disrupted its mid band this week, even if now trying to rectify that. Clearly a lot of fluidity all round then. There is an opportunity back up towards the mid band here (106) but will have to exceed it and see the Dollar at least back under 102.7 to feel more of shift in the breeze for commodities.

NY SUGAR #11 IN BRAZILIAN REAL

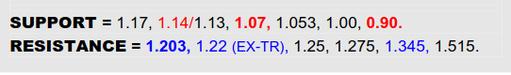

A stab at the 1.20’s for Real priced Raws but in reeling back to the days’ low, it didn’t score a defining invasion. The interim summer downtrend has been broken then but would really want to see a more emphatic transition over this crossroads to persuade of blasting open the Q2 top, similar reassurance also being needed in the basket of Asian currency versions of Raws. If this can still be achieved, the ‘20’s advance would click back into gear and that prior hold at a 1.07 Fib retracement would count all the more, 1.515 then starting to beckon beyond 1.345. Must mind the mid band (1.17) meantime as a first stumbling block, wherein any subsequent loss of 1.14 could become a more serious upending of this picture.

BRAZILIAN REAL / US DOLLAR SPOT

VALUE : 4.985

On the heels of an early Aug flag that hailed an initial downtrend escape, the Dollar has now driven on across the 4.95 resistance to disrupt a lengthier ’23 downtrend and situate a new offset dual bottom that overcomes a prior Q2 double top. Again now seeking to consolidate this achievement in the shadow of the 5.0 figure and perhaps thereby add another flag, a path then beckoning on ahead to the 5.10/5.125 border terrain of a previously bigger top zone prior to Q2 where a more protracted rest-stop would make sense. Otherwise only a swerve back under 4.92 would give reason to question the preceding flag getaway and would then shift focus back towards the mid band instead (4.85).

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.