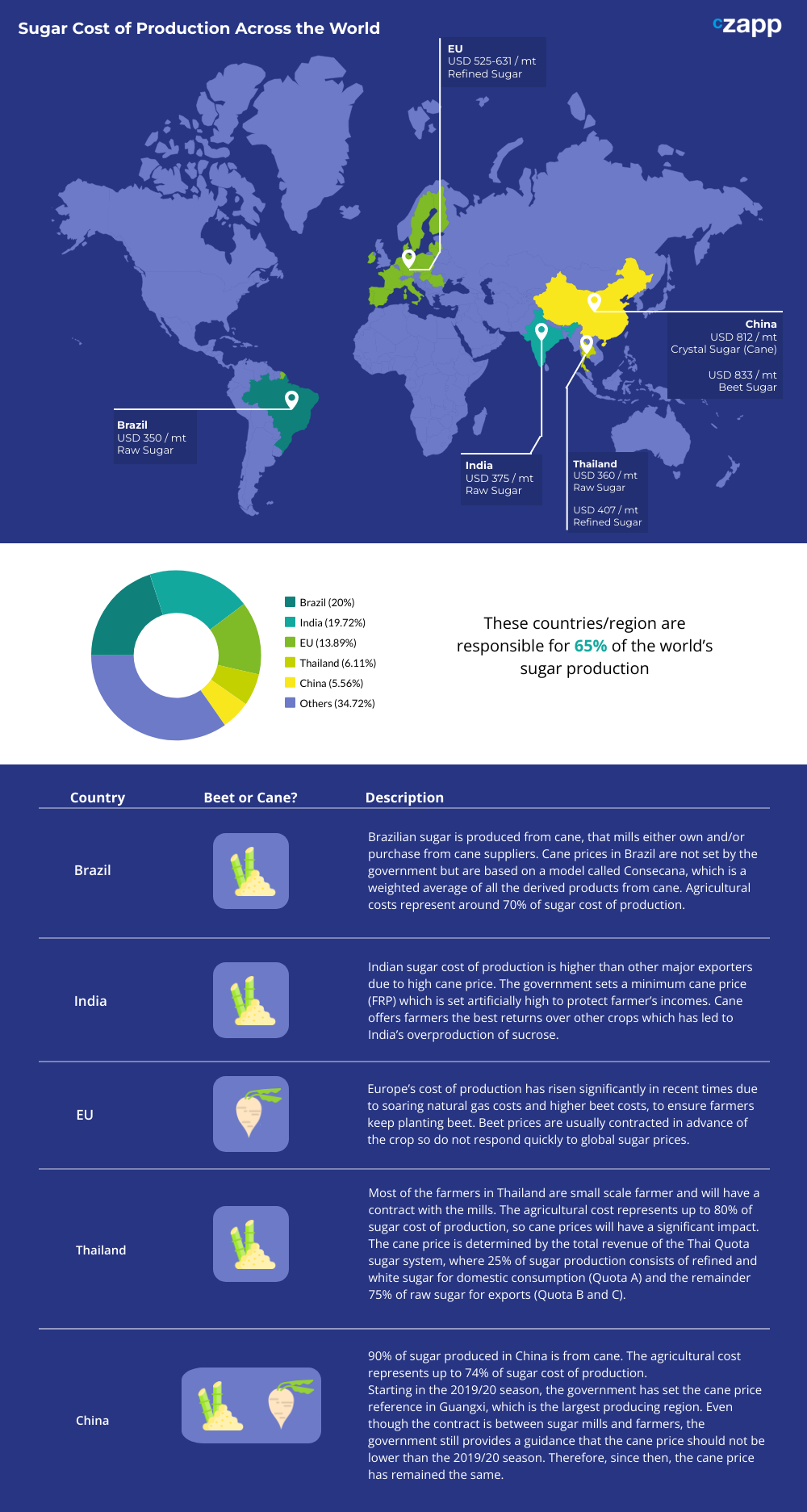

Brazil, India, EU, Thailand, and China are responsible for 65% of the world’s sugar production. Each has its particularities when considering sugar cost of production that can range from USD350/mt for raw sugar in Brazil to USD833/mt for crystal sugar in China.

Brazil USD 350/mt for raw sugar

Brazilian sugar is produced from cane, that mills own and/or purchase from cane suppliers. Cane prices in Brazil are not set by the government but are based on a model called Consecana (link to Consecana panel on Czapp), which is a weighted average of all the derived products from cane. Agricultural costs represent around 70% of sugar cost of production.

India USD375/mt for raw sugar

Indian sugar cost of production is higher than other major exporters due to high cane price. The government sets a minimum cane price (FRP) which is set artificially high to protect farmer’s incomes. Cane offers farmers the best returns over other crops which has led to India’s overproduction of sucrose.

EU USD 525-631/mt for refined sugar

Europe’s cost of production has risen significantly in recent times due to soaring natural gas costs and higher beet costs, to ensure farmers keep planting beet. Beet prices are usually contracted in advance of the crop so do not respond quickly to global sugar prices.

Thailand USD360/mt for raws and USD407/mt for refined

Most of the farmers in Thailand are small scale farmer and will have a contract with the mills. The agricultural cost represents up to 80% of sugar cost of production, so cane prices will have a significant impact. The cane price is determined by the total revenue of the Thai Quota sugar system, where 25% of sugar production consists of refined and white sugar for domestic consumption (Quota A) and the remainder 75% of raw sugar for exports (Quota B and C).

China USD812/mt cane crystal sugar and USD833/mt beet crystal sugar

90% of sugar produced in China is from cane. The agricultural cost represents up to 74% of sugar cost of production, so cane prices will have a significant impact.

Starting in the 2019/20 season, the government has set the cane price reference in Guangxi, which is the largest producing region. Even though, the contract is between sugar mills and farmers, the government still provides a guidance that the cane price should not be lower than the 2019/20 season. Therefore, since then, the cane price has remained the same.