Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

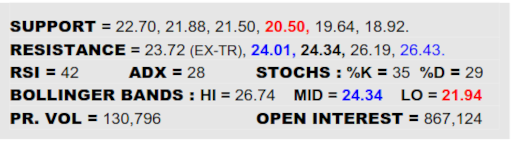

NEW YORK SUGAR #11 OCTOBER 2023

A few days’ oxygen following the retirement of the Jly contract seemed to already be losing its fizz in NY Thursday, the wheels starting to spin beneath the ex-uptrend to post an inside day. This warns to be on watch in the next session or two as a swat back out of the 23’s would confirm the insider and the idea of being blocked by the ex-trend, which could draw more Fund selling and set the ball rolling again down through 21.88 towards the better weekly support at 20.50. Must otherwise hold the 23’s and wade through the 24.01 top rim and mid band (24.34) to pop the lid.

LONDON WHITES #5 OCTOBER 2023

Much the same as NY, London has approached its ex-uptrend and the double top border during the recent swell (659/661) but began to show some fatigue Thursday with an inside day. This implies a vulnerability to floundering and pivoting lower again so watch the 639 area, a close below intensifying that impression and warning of risk down to the better weekly support at 600. Only if the market can demonstrate resilience by holding the 640’s would there remain a shot at that 661/664 obstacle in search of a more penetrative upswing.

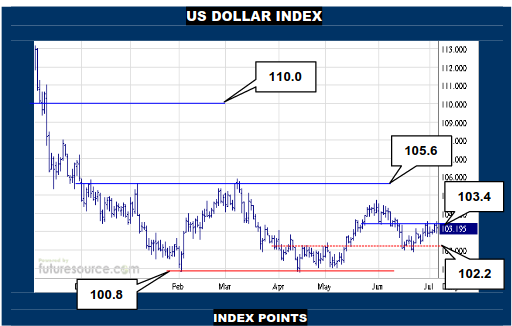

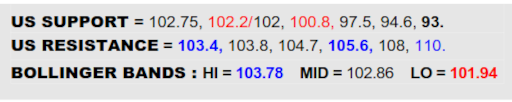

US DOLLAR INDEX

The Dollar has recently sustained its crossing of the mid band to keep focus on the 103.4 mini-top border. Just overhead, the upper Bollinger band is on the verge of also steering higher so there appears to be a moment of opportunity for the greenback to score a next important step towards a broader turn it has been trying to make throughout ’23 thus far. Driving beyond 103.4 and shoving the upper Bollinger into the 104’s would signal growing impetus then and pin the bullseye on a next major hurdle at 105.6, thus troubling for commodities. If the wheels kept spinning at 103.4 though, watch 102.75 as an immediate tripwire to veer south again and give the B-Berg more oxygen.

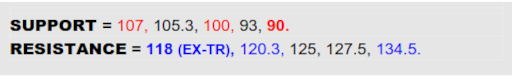

NY SUGAR #11 IN BRAZILIAN REAL

One Mr. Fibonacci might have been hopping around a bit (it’s a pun as his most famous work related to rabbit population growth) since the Q2 retreat of Real priced Raws met a classic 61.8% retracement at 107 of the prior advance before bouncing. However, just as ₵/lb. still has some proving to do at 24₵ to really give its upturn sharper teeth, the same is true here as the ex-uptrend is just now converging with the mid band at 118 and there is a subsequent passport control at 120.3. So where a drive into the 120’s would indeed suggest a useful catch and turn north, alas if foiled in the mid to high teens, beware this being only temporary relief and be ready for a new swat lower that could press on towards a next main shelf at 90.

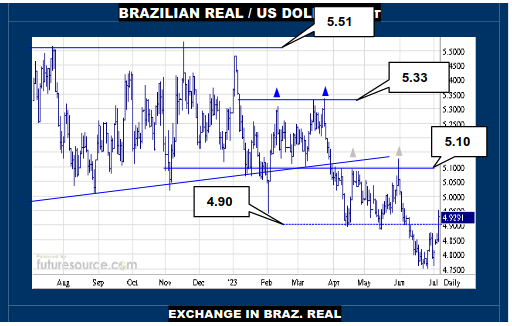

BRAZILIAN REAL / US DOLLAR SPOT

VALUE : 4.929

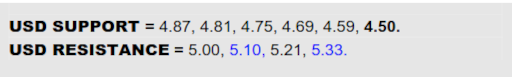

The Dollar has bounced back from a couple of holds at 4.75 late in Jun and lunged through the 4.90 resistance marking the rim of the recent Q2 dual top Thursday. This is being matched by quite a lively reaction from RSI so there is suggestion of the upturn catching light and thus having scope on towards a next top hurdle at 5.10 where the broader pre-Q2 top terrain would be in play once more. A more encouraging scene then and one must be mindful of the inverse correlation factor that generally exists between this chart and that of NY Raws. Only a prompt twist back under 4.87 would instead propose that the overhead clutter had intercepted the rebound.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.