Insight Focus

- Raw sugar hedging has slowed post-July futures expiry.

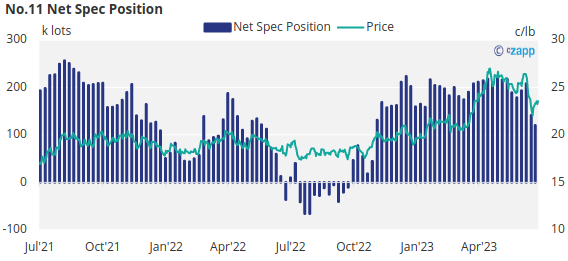

- The net speculative position has also fallen as specs liquidate longs.

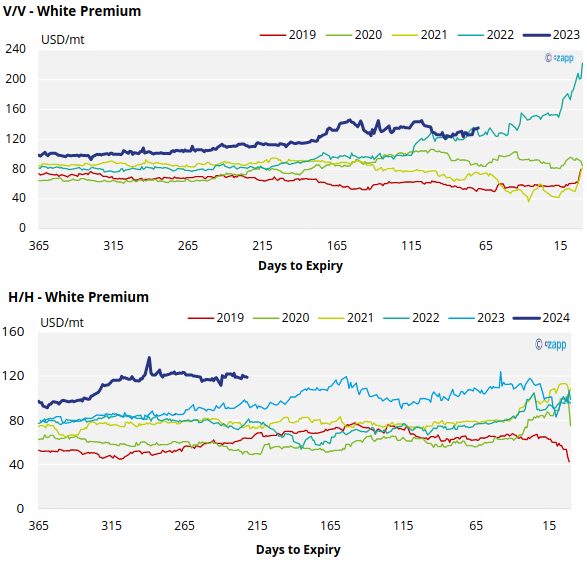

- V/V white sugar premium has strengthened in the last week, now standing at 135USD/mt.

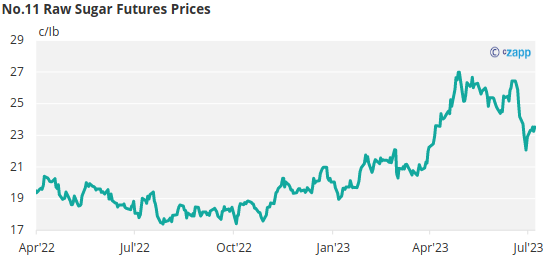

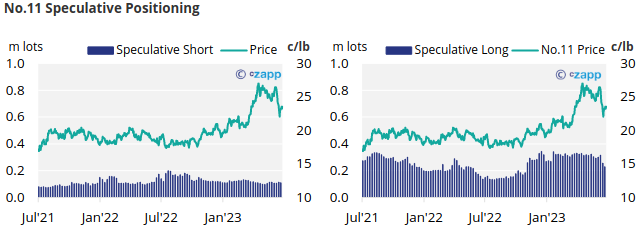

New York No.11 Raw Sugar Futures

The No.11 sugar futures has rebounded in the week leading up the 4th of July, reaching 23.5c/Ib by Friday’s close.

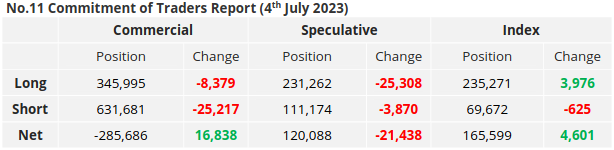

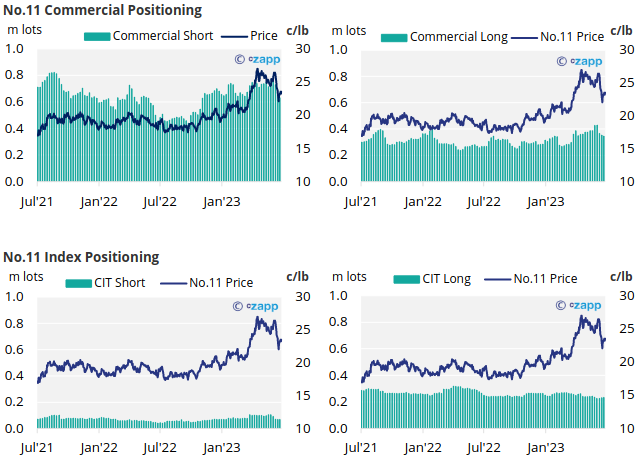

By the 4th of July (latest CoT CFTC report), speculators have closed a further 25k lots of long positions.

As a result, the net spec long in raw sugar has now reached its lowest level since November, when the rally from 17.5c to 27c began. With some spec short positions closed, the net spec position has retreated by over 21k lots to 120k lots.

On the commercial side, raw sugar producers closed over 25k lots of short positions, while consumers closed only 8.3k lots.

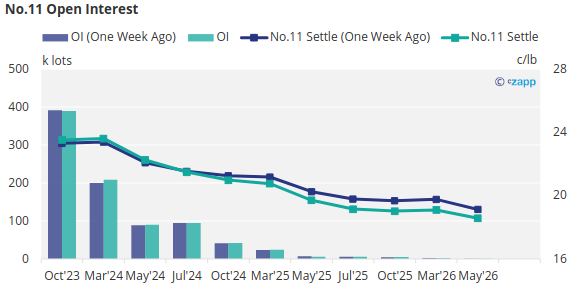

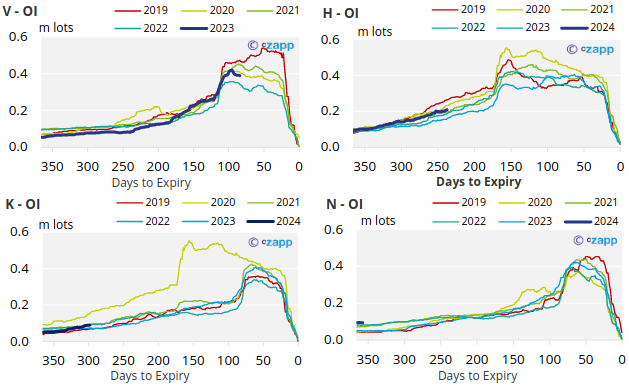

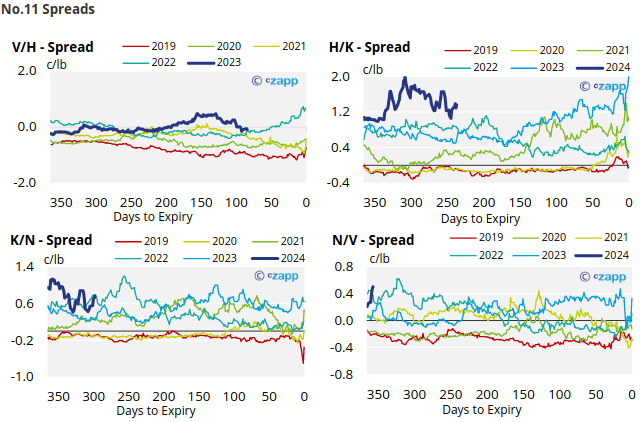

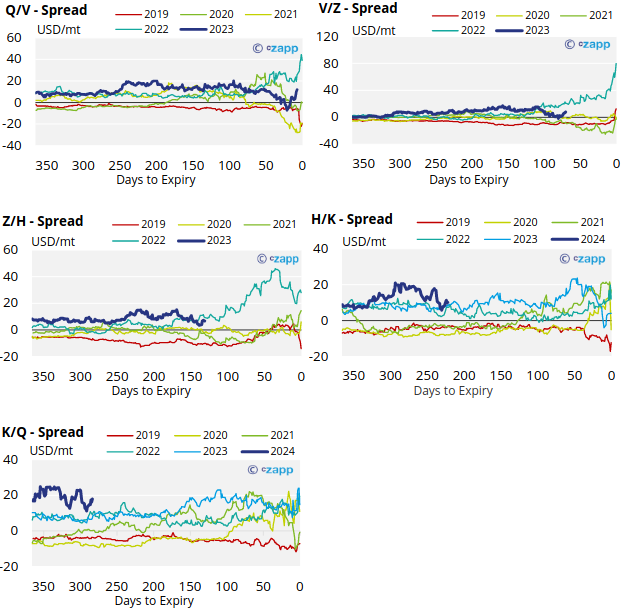

The No.11 forward curve has become increasingly backwardated over the last week, particularly in the nearby contracts, this reflects current tightness in the raw sugar market.

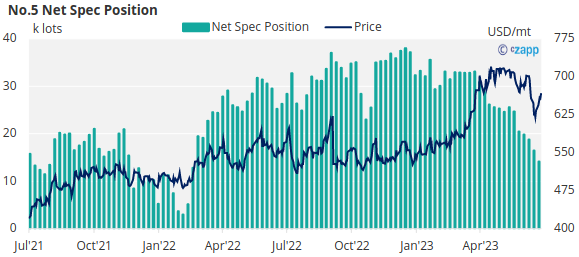

London No.5 Refined Sugar Futures

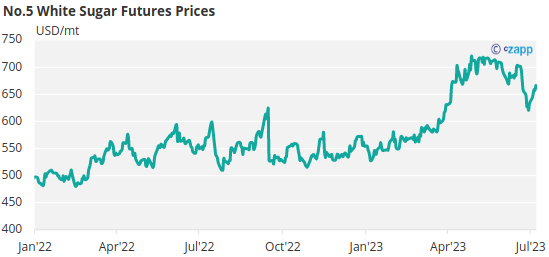

The No.5 refined sugar price has rallied slightly over the past week, going from 643USD/mt to 666USD/mt by Friday’s close.

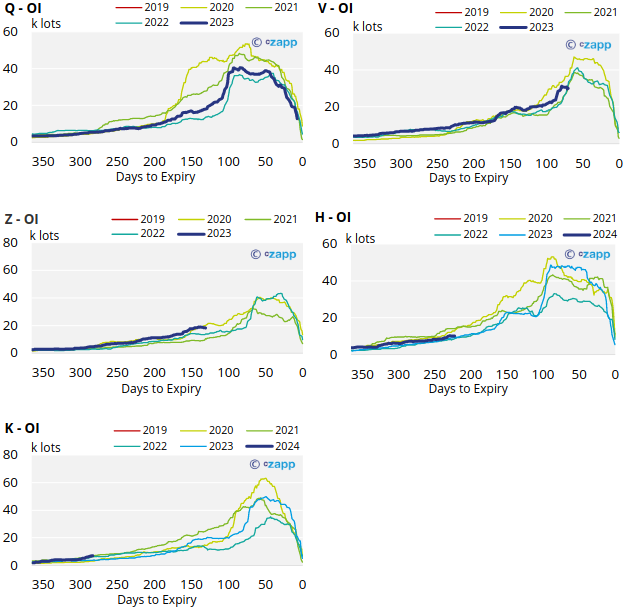

Refined sugar speculators, like raw sugar speculators, have been reducing their long position for several weeks, closing over 2.4k lots in the last week. As a result, the net spec position has dropped to 14k lots, the lowest in over a year.

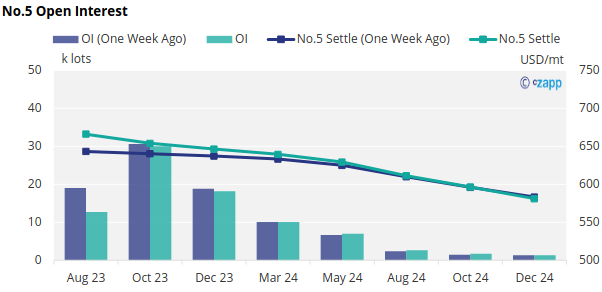

The No.5 forward curve remains inverted through to December 2024.

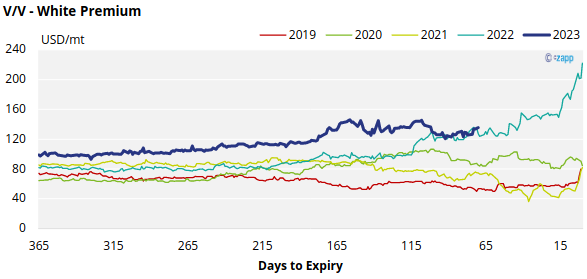

White Premium (Arbitrage)

The V/V sugar white premium has strengthened slightly over the past week, now trading at 135USD/mt.

Many re-exports refiners need around 110-120USD/mt above No.11 to produce refined sugar, so the current white premium is just enough to encourage this.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.11 Open Interest

No.5 (White Sugar) Appendix

No.5 Open Interest

No.5 Spreads

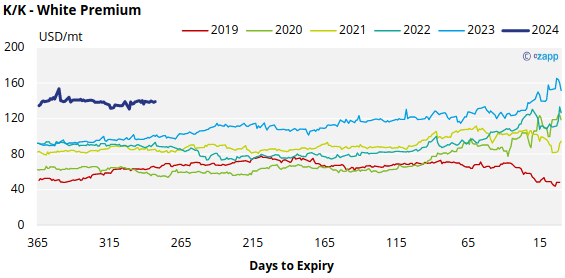

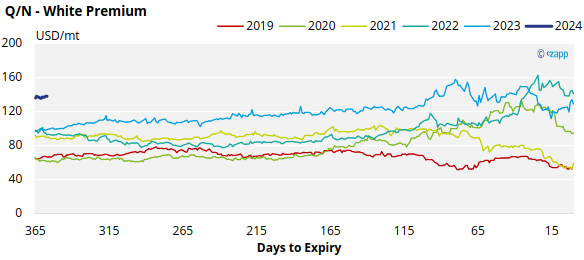

White Premium Appendix