- The sugar futures markets remain under pressure.

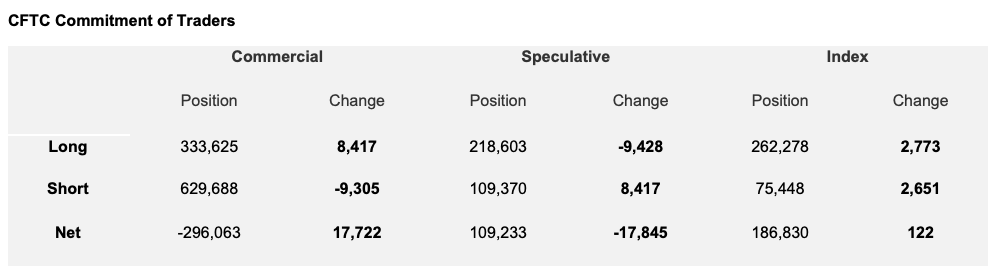

- Speculator sentiment has changed in recent weeks, with new shorts being added alongside closed longs.

- The 2022 raw sugar spread structure has flattened, which should bode well for physical demand.

New York No.11 (Raw Sugar)

- The No.11 price is nearing 18 c/lb, with speculators appearing more bearish as they open new shorts.

- The commercial long is showing slow but steady growth as falling prices and flattening spreads make forward buying a more attractive proposition.

No.5 London (White Sugar)

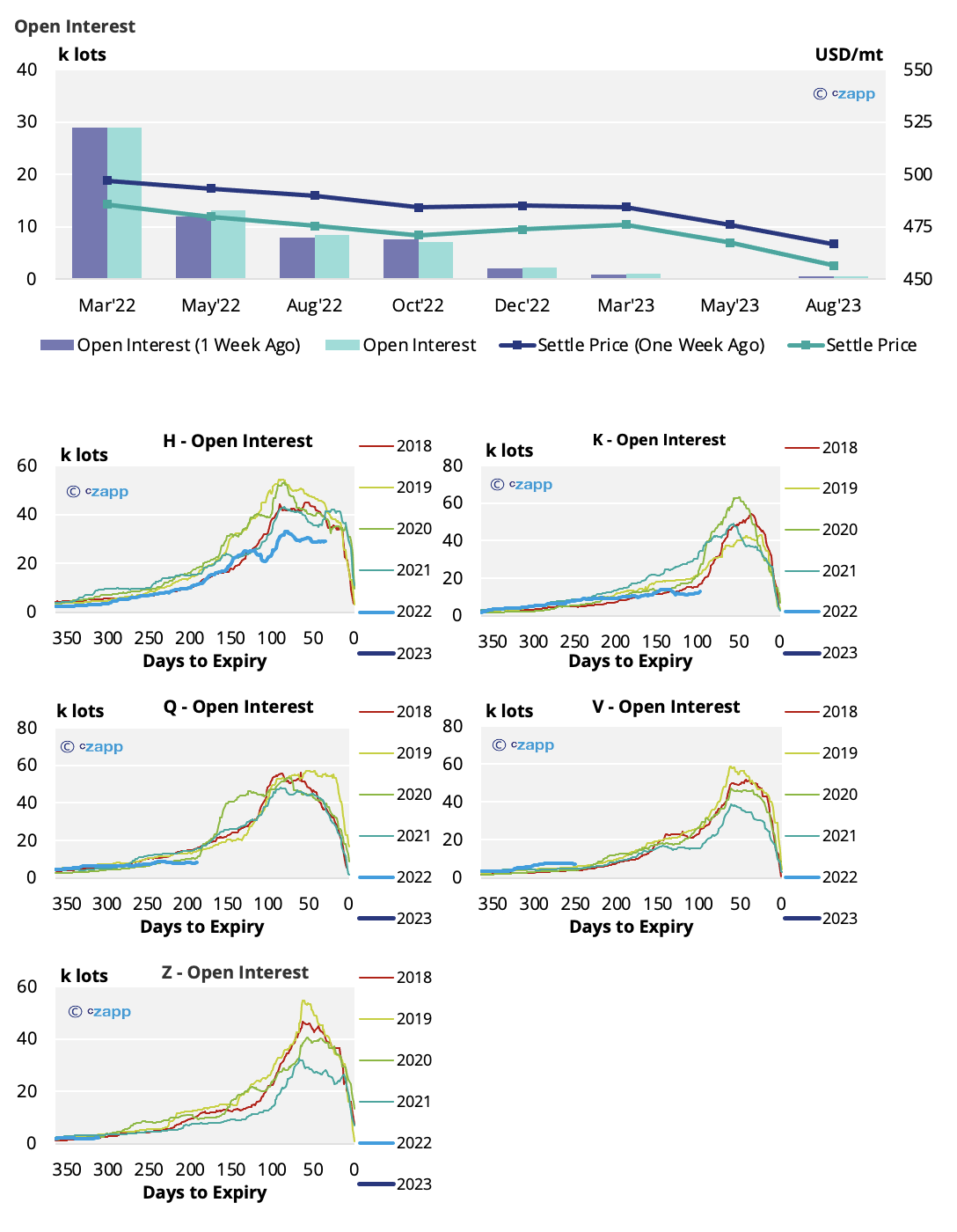

- The No.5 has not seen the same pressure as raws, but the front month price is still below 500 USD/mt.

- Open interest remains low by historic standards, but the strengthening white premium suggests physical demand is starting to recover.

White Premium (Arbitrage)

- The 2022 white premiums are still strengthening.

- The level remains lower than the margin needed by the refineries, especially considering how high freight rates have impacted refiner costs, but the gap is closing.

- This could mean re-export refiner activity picks up soon.

Other Insights That May Be of Interest…