Insight Focus

- The No.11 strengthened slightly over the past week.

- This provided producers a good opportunity to increase their hedges.

- The Q/N white sugar premium has weakened significantly, standing at 121USD/mt.

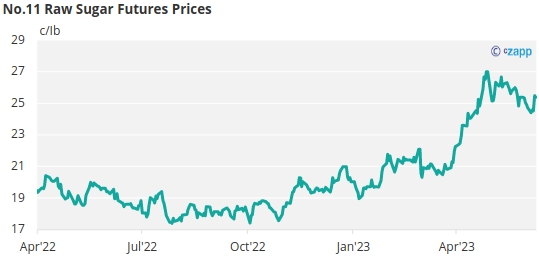

New York No.11 Raw Sugar Futures

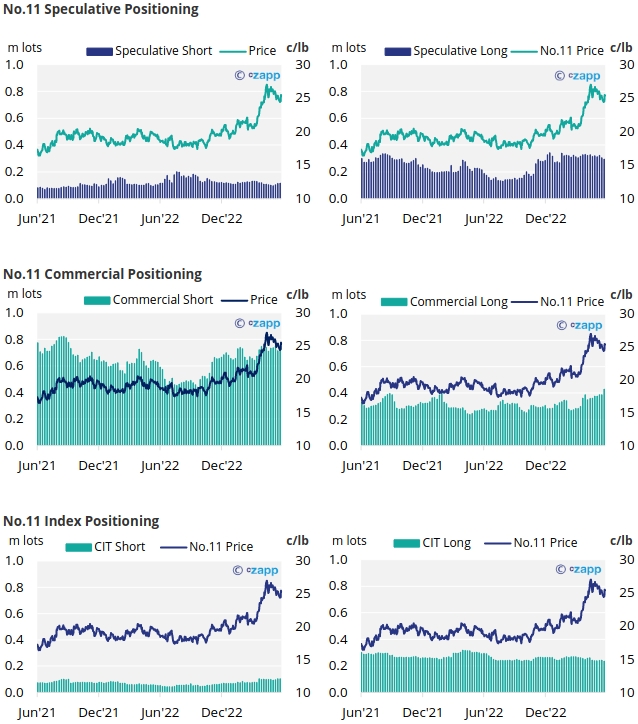

The No. 11 sugar futures strengthened over the past week, going from 24.4c/Ib at the start of the week to 25.4c/Ib by Friday’s close.

At the start of the week, the No.11 was the lowest it had been in recent months, providing a good opportunity for consumers to increase their hedges. As a result, by the 6th of June (the most recent CoT CFTC report), raw sugar consumers were able to buy into this slight price drop, adding over 42.5k lots of new hedges.

Producers were willing to sell later in the week, when prices were around 25.4c/Ib, and thus added 25.5k lots of short positions.

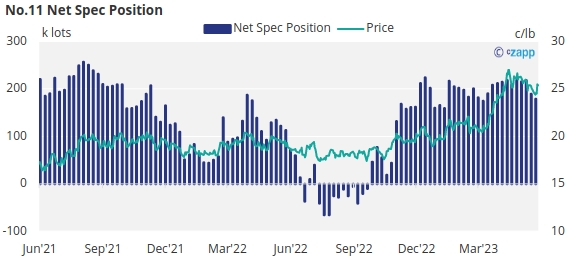

Turning our attention to the speculators, a slight slip in the No.11 futures price has resulted in the speculative long position to retreat by 9.6k lots. As a result, the net spec position has fallen just under 178k lots long.

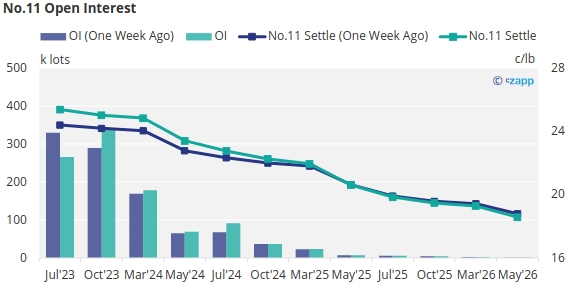

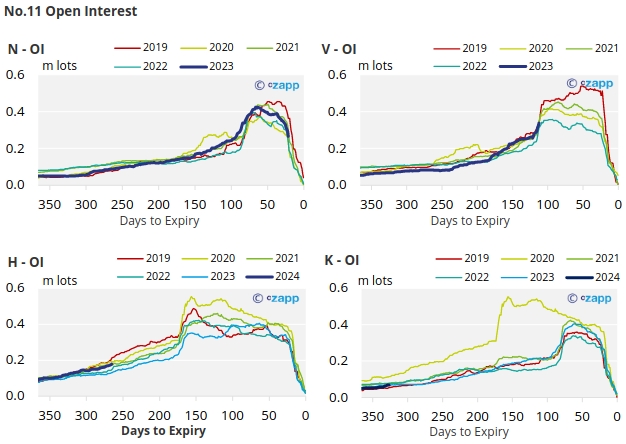

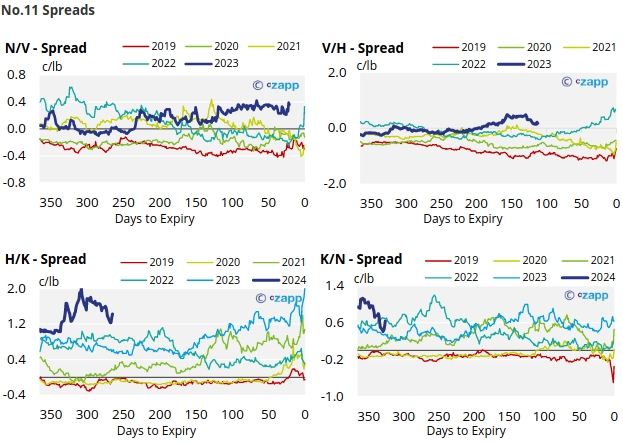

The No.11 forward curve has become increasingly backwardated over the last week, particularly in the nearby contracts, this reflects current tightness in the raw sugar market.

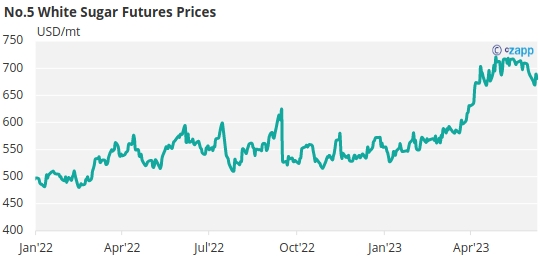

London No.5 Refined Sugar Futures

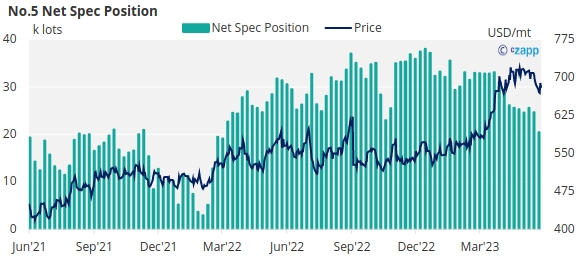

Refined sugar prices have also continued to weaken over the last week, moving below 681USD/m by the end of trading on Friday.

Perhaps aiding this decline, refined sugar speculators have closed around 4.2k lots of long positions by the 6th of June. This is the largest one week change since February and leaves the net spec position at its lowest point since December 2022.

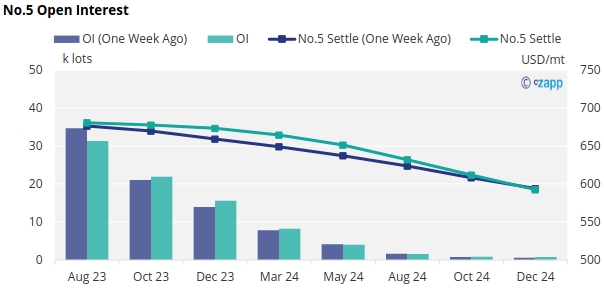

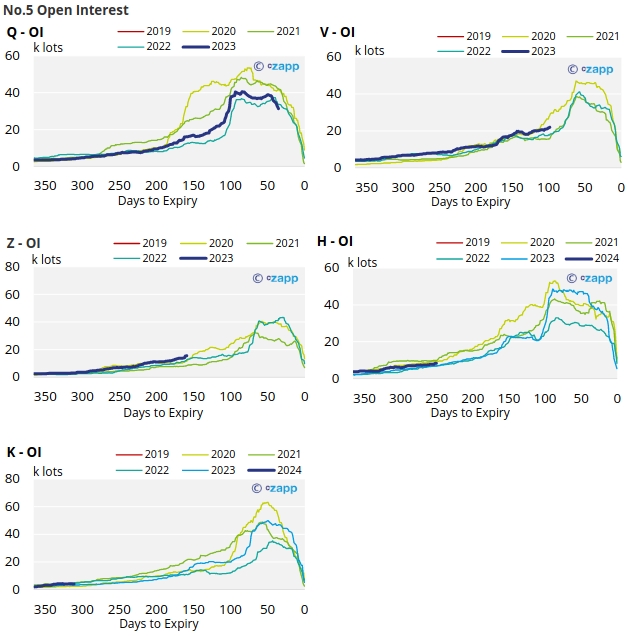

With contracts strengthening slightly across the board, the No.5 forward curve remains inverted through to December 2024.

White Premium (Arbitrage)

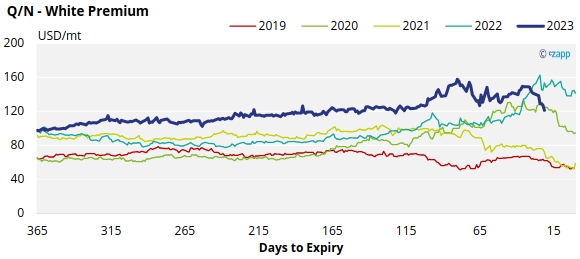

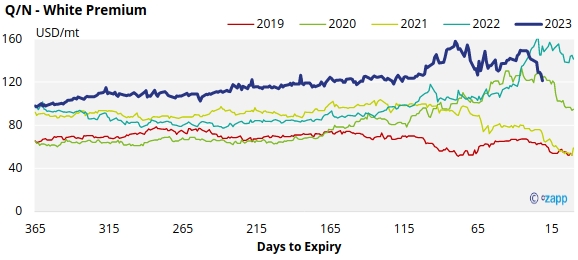

The Q/N sugar white premium has fallen significantly over the past week reaching 121USD/mt by Friday.

Many re-exports refiners need around 110-120USD/mt above No.11 to produce refined sugar, so the current white premium is just enough to encourage this.

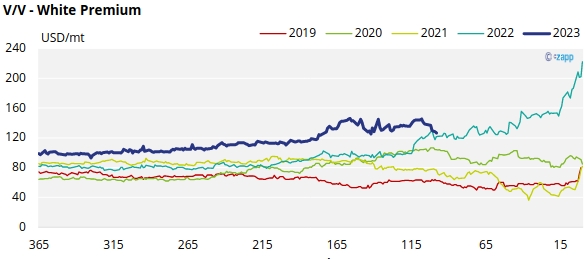

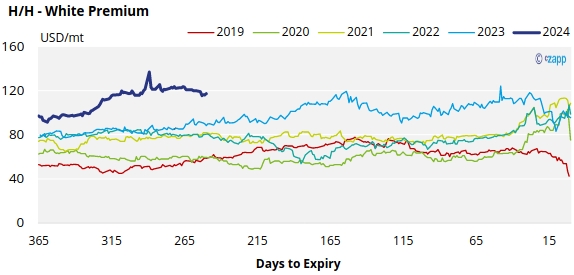

The refined sugar market is likely to be slightly undersupplied for the majority of 2023, and this is reflected in comparatively strong V/V and H/H white premiums, which has also weakened slightly over the past week and now approach 126USD/mt and 117USD/mt, respectively.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

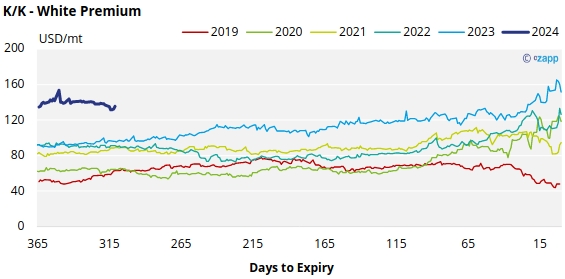

White Premium Appendix