Insight Focus

- Raw sugar speculators add new short positions, reversing closures from the previous update.

- White sugar speculators increase net spec position to 18-month high, following strength in the No.5.

- Likewise, the sugar white premium reaches new heights in 2022.

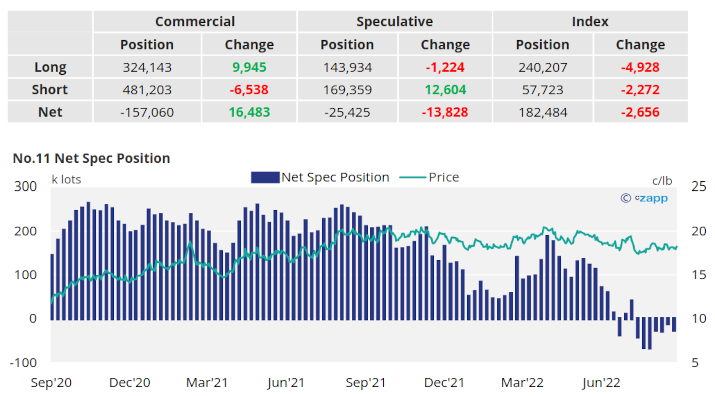

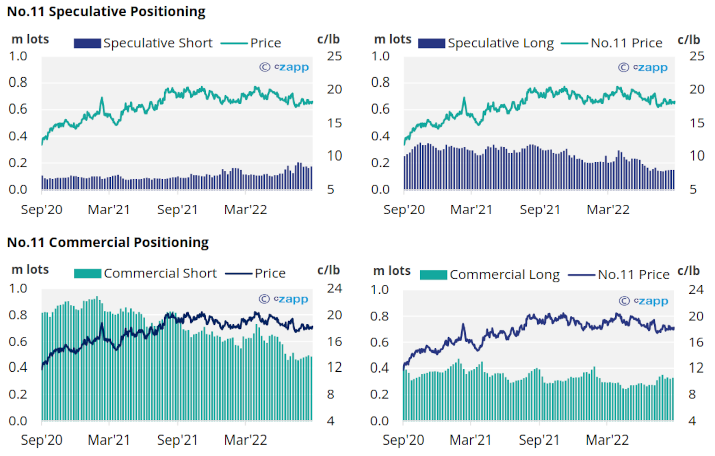

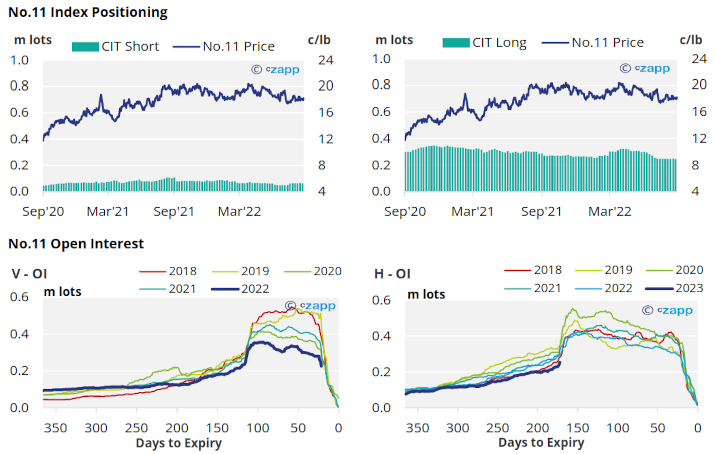

New York No.11 (Raw Sugar)

- The No.11 has been trading between 18c and 18.5c/lb for the last month, closing at 18.2c/lb on Friday.

- Raw sugar speculators have opened 13k lots of fresh short positions, and closed 1k of existing long positions by the 6th of September.

- This moves the net spec position back towards 25k lots short, around where it has been for 3 of the last 4 weeks.

- Consumers have added 10k lots whilst producers closed 7k lots over the same period

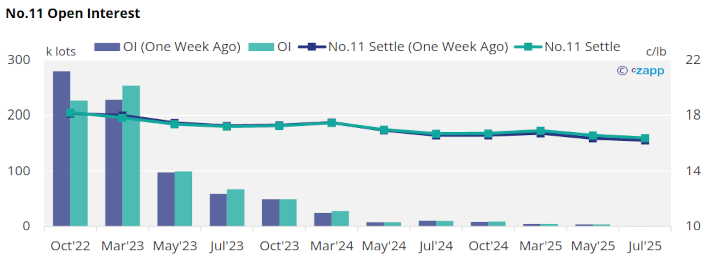

- The No.11 forward curve remains slightly inverted to Jul’23 moving into contango to Mar’24.

No.11 CFTC Commitment of Traders

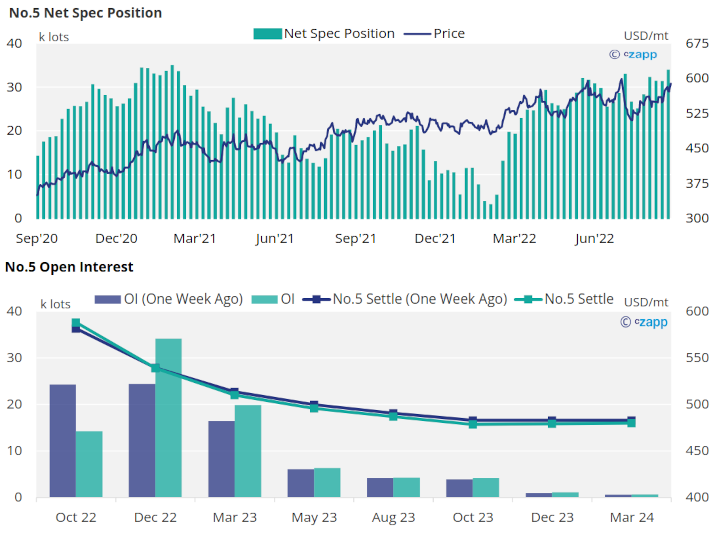

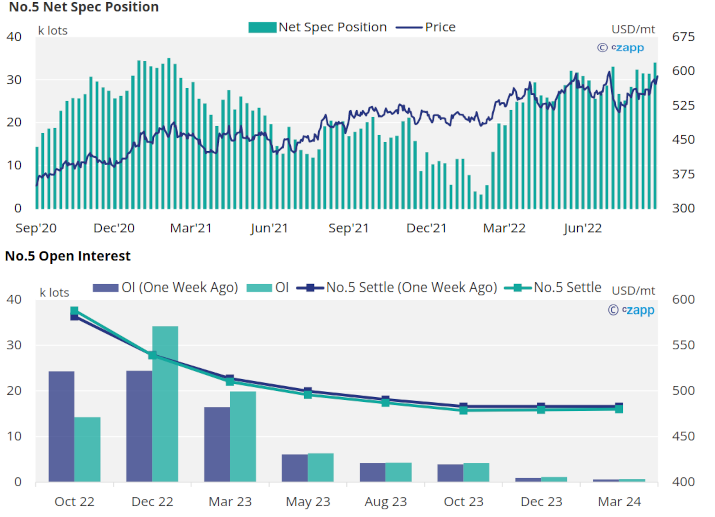

London No.5 (White Sugar)

- The No.5 has moved back into its uptrend, trading through 580USD/mt by the end of last week.

- By the 6th of September with prices moving upwards, the net spec position has reached 31k lots – a new height for 2022 and the largest since Feb 2021.

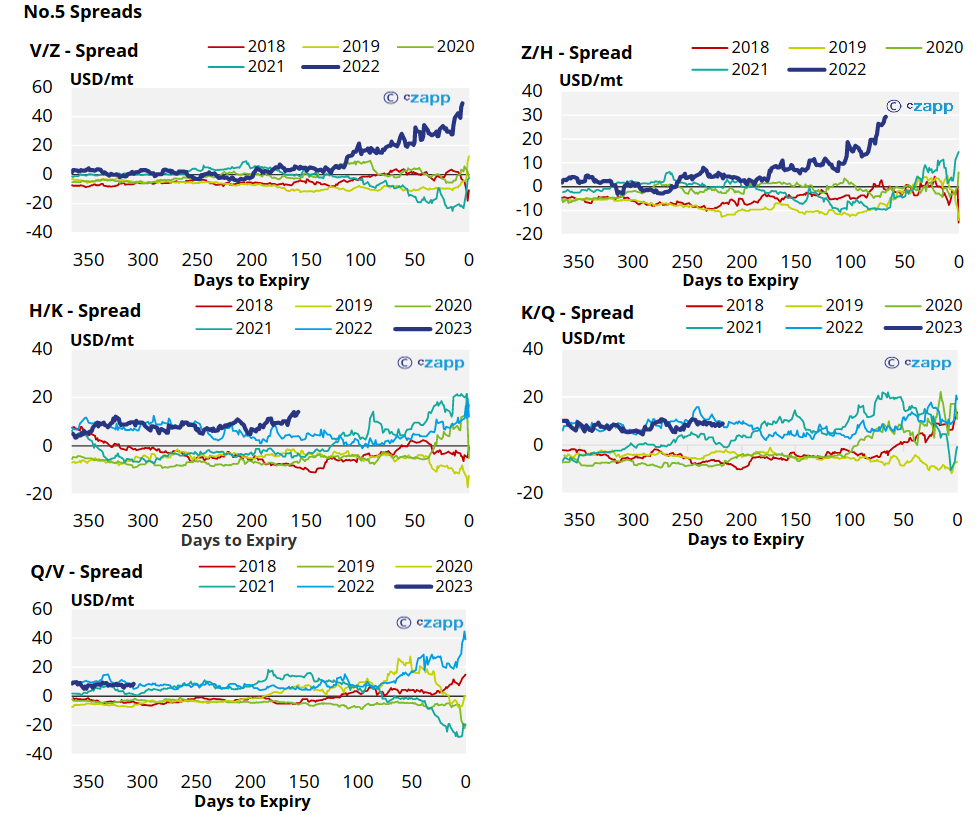

- The V/Z spread has widened above 45USD/mt as the the V’22 expiry draws near.

- This leaves the forward curve heavily backwardated to the end of 2023.

London No.5 (White Sugar)

- The No.5 has moved back into its uptrend, trading through 580USD/mt by the end of last week.

- By the 6th of September with prices moving upwards, the net spec position has reached 31k lots – a new height for 2022 and the largest since Feb 2021.

- The V/Z spread has widened above 45USD/mt as the the V’22 expiry draws near.

- This leaves the forward curve heavily backwardated to the end of 2023.

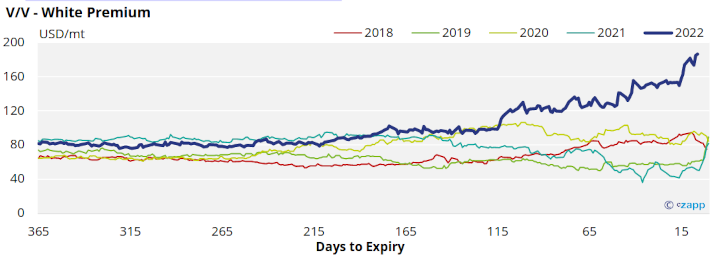

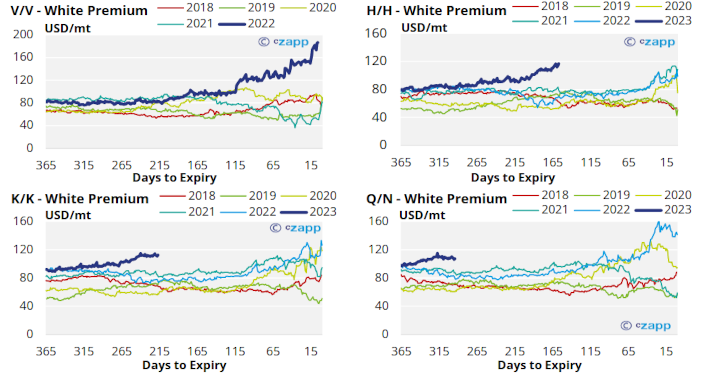

White Premium (Arbitrage)

- The white premium continues to move higher, following the strengthening No.5 – it has now brokenhrough 180USD/mt.

- We think that this should be enough for some discretionary refiners to start increasing their raw sugar demand and start re-exporting refined sugar.

- Likewise, traditional re-export refiners will be maximising their throughput.

- Additionally the next H/H, K/K, and Q/N white premiums are all trading above 110USD/mt, these are unusually high this far in advance of their expiry.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

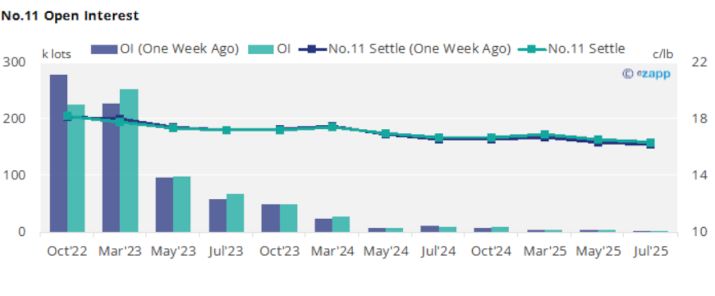

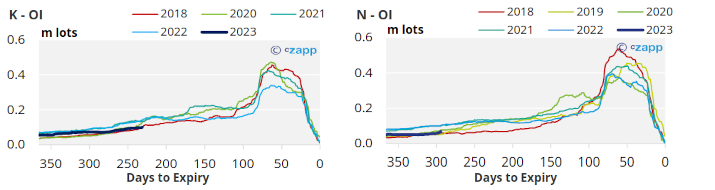

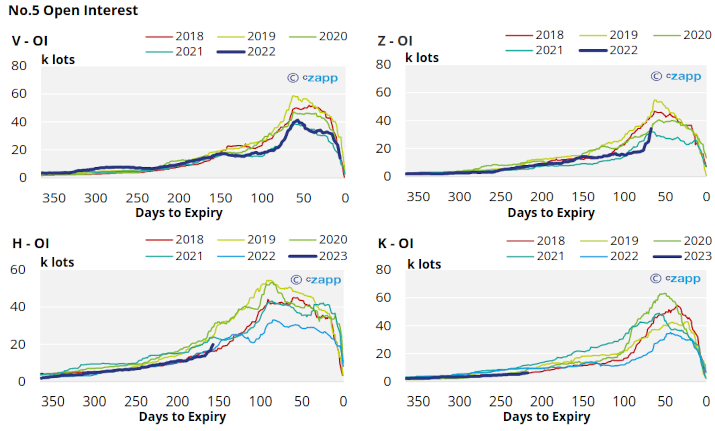

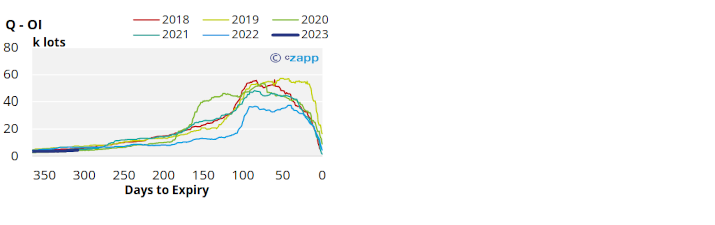

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…