Insight Focus

- No.11 prices have fallen slightly, while No.5 price continue strengthening.

- The white premium now trades at 145USD/mt, encouraging more refined sugar.

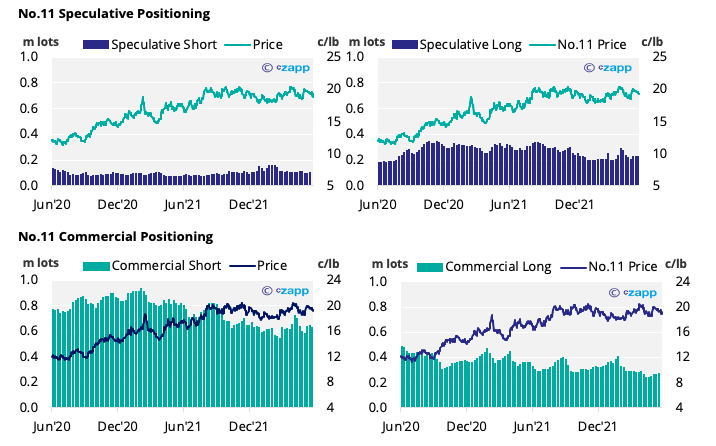

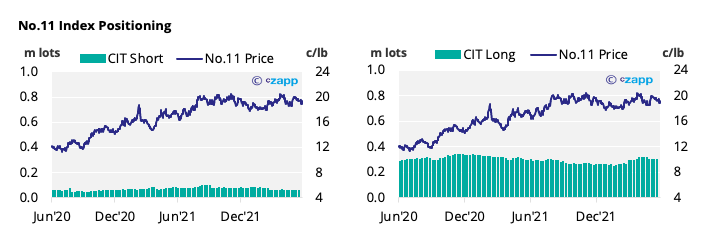

- Commercial and speculative positions have not changed drastically since the previous update.

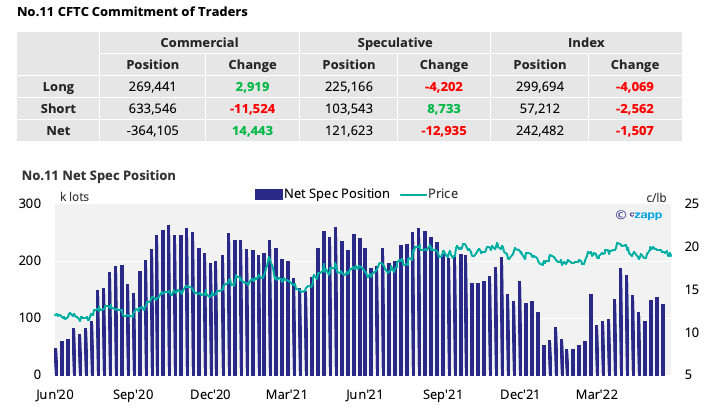

New York No.11 (Raw Sugar)

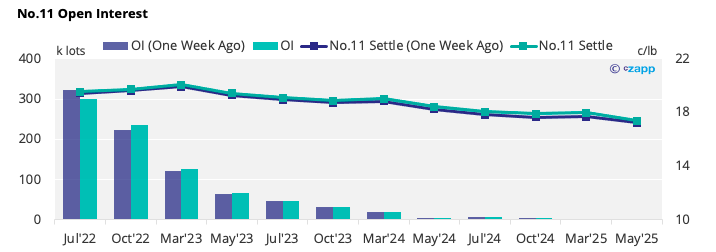

- The No.11 have fallen to the bottom of the range at 18.70c/lb.

- As of the 7th of June, the net spec position fell by over 12k lots as the long position decreased and a small number of new short positions were added.

- Consumers are still very poorly hedged, but with the No.11 now towards the bottom of the range we hope consumers will start buying.

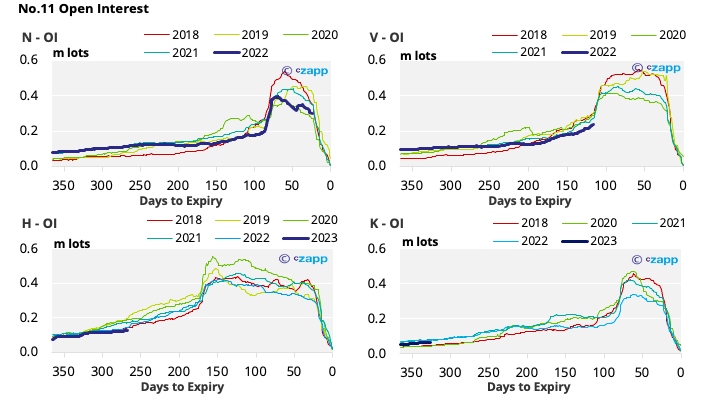

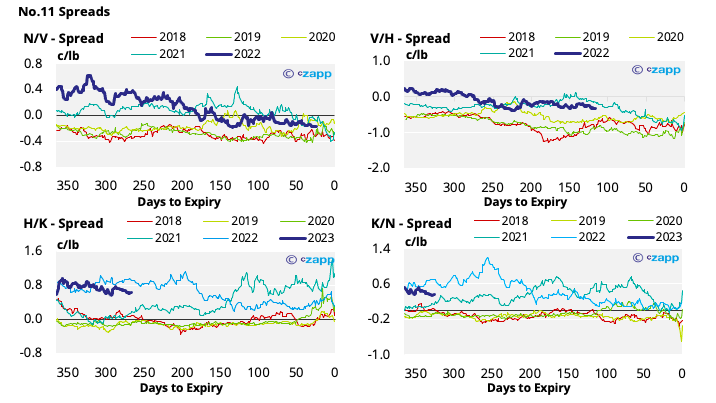

- The No.11 forward curve is still slightly contango towards H’23, then backwardated across 2023.

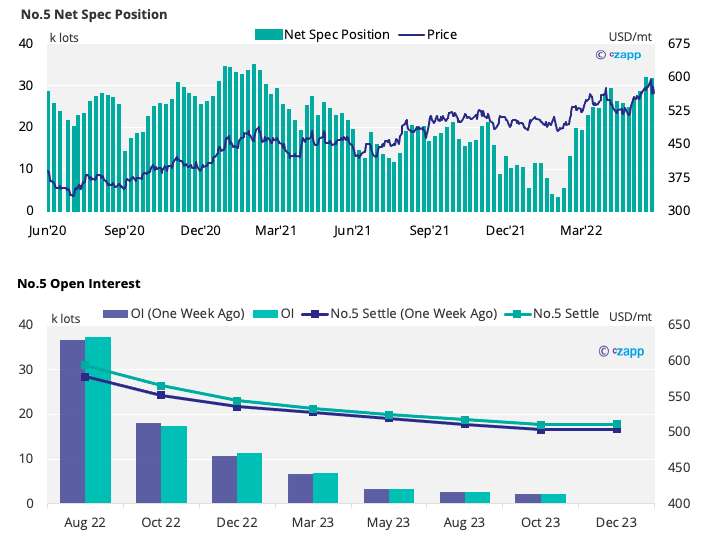

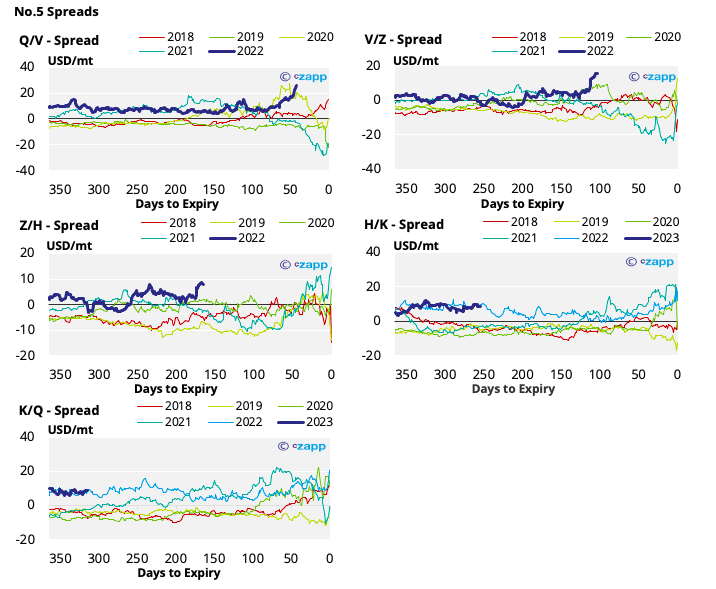

London No.5 (White Sugar)

- No.5 prices have fallen below 570USD/mt.

- By the latest CFTC COT update on the 10th of June, the spec long rose by almost 4k lots, bringing the net spec position, highest in over a year.

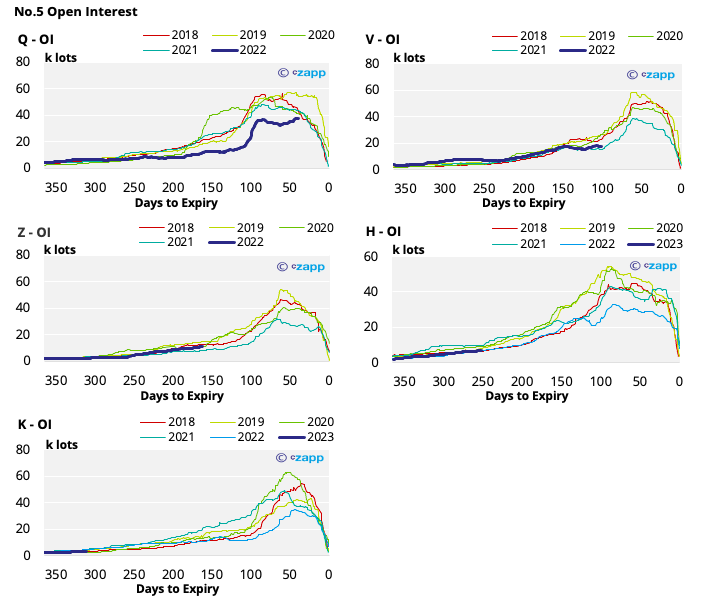

- The near month contracts have seen the most buying, significantly increasing the level of backwardation in the futures curve further across 2022 and 2023.

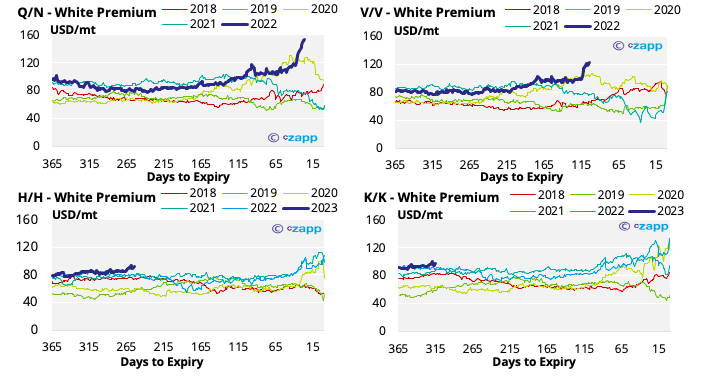

White Premium (Arbitrage)

- With the No.5 outperforming the No.11, the white premium has surged above 145USD/mt by close of trading last week.

- Even though the white premium weekend compared to last week, re-export refiners should be able to comfortably operate profitably as well.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…