Insight Focus

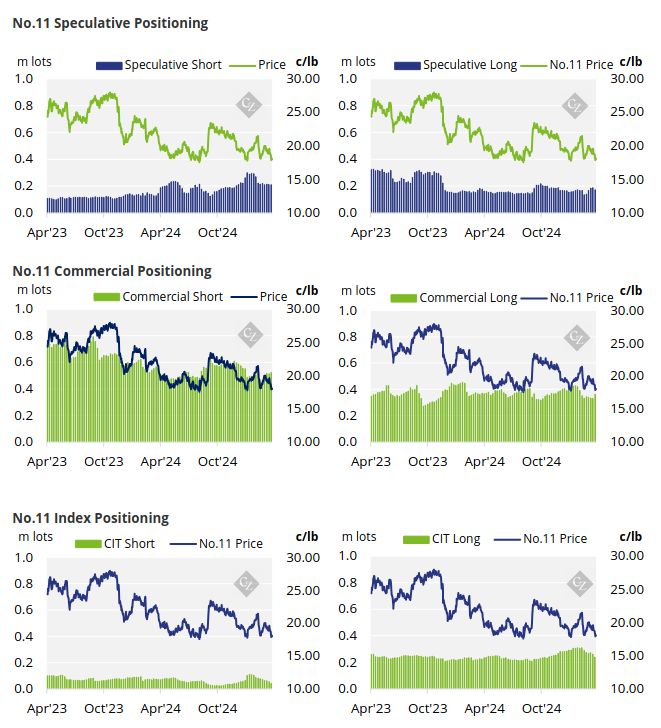

The raw sugar futures traded lower last week. Both producers and end-users have added to their positions following the announcement of the US tariffs. Speculators have cut their long positions heavily.

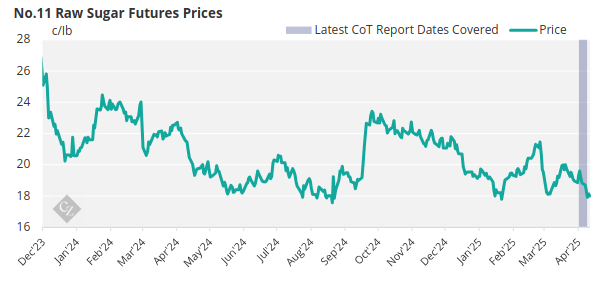

New York No.11 Raw Sugar Futures

The raw sugar futures have traded lower over the past week starting at 18.7c/lb, before hitting a low of 17.9c/lb on Wednesday, and eventually settling at 18c/lb by Friday’s close.

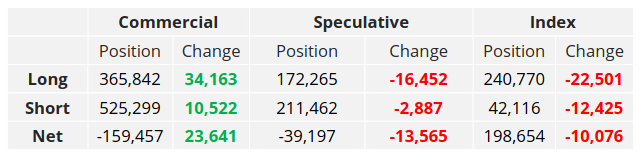

On the commercial side, end-users have taken advantage of the lower price movement following the announcement of US tariffs, as they opened 34.2k lots of long positions. Producers have followed this action by adding 10.5k lots of short positions, perhaps due to BRL and AUD weakness.

No.11 Commitment of Traders Report (April 8, 2025)

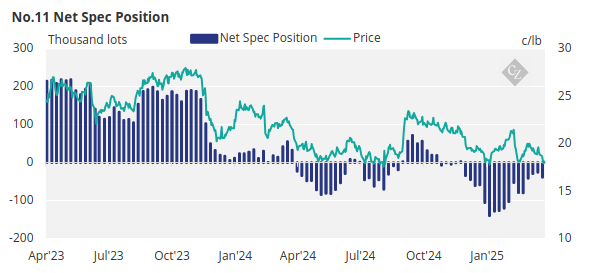

Conversely speculators have cut their long position heavily as they reduced their position by 16.5k lots of longs. They have further closed out 2.9k lots of shorts, bringing the net-short position to now stand at -39.2k lots.

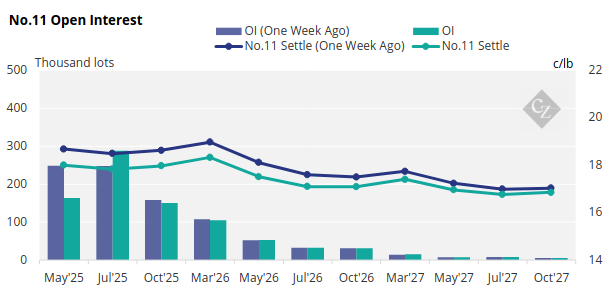

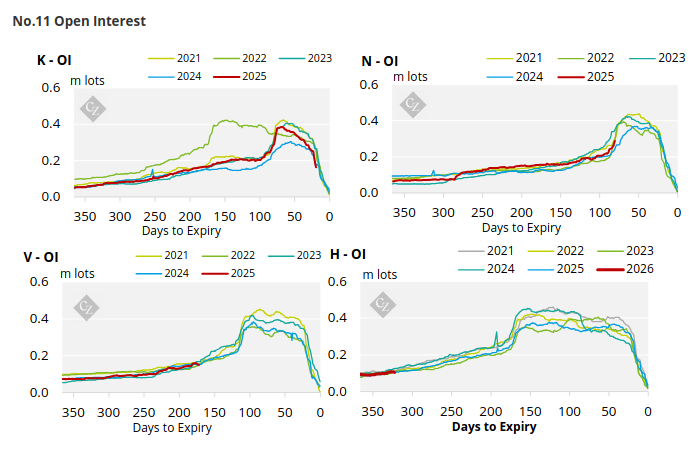

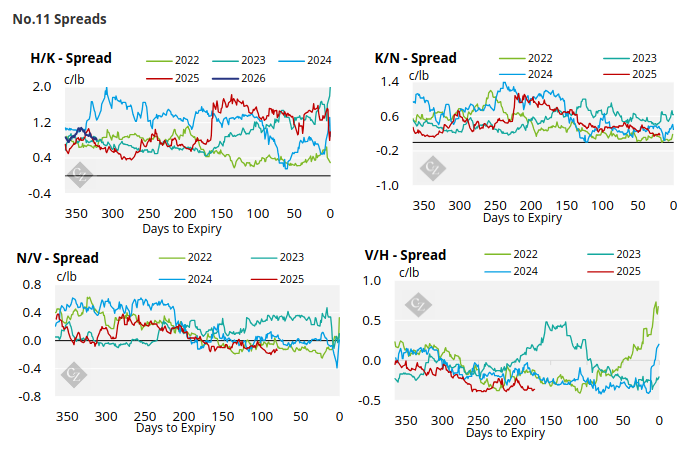

No.11 Open interest

The No. 11 forward curve has flattened across the board.

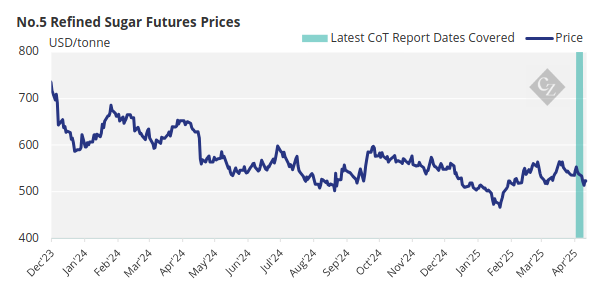

London No.5 Refined Sugar Futures

The No.5 refined sugar futures followed a similar path to the no.11 raw sugar as it traded lower over the past week. The refined sugar futures started at USD 533.9/tonne and hit a mid-week low of USD 513.3/tonne, before closing at USD 523/tonne on Friday.

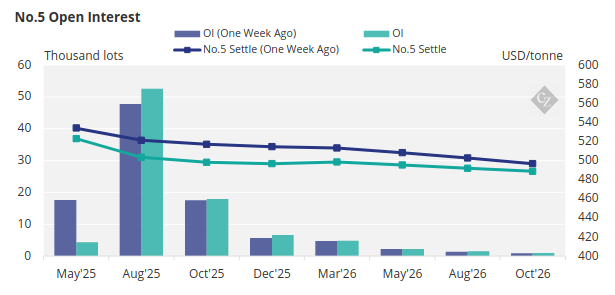

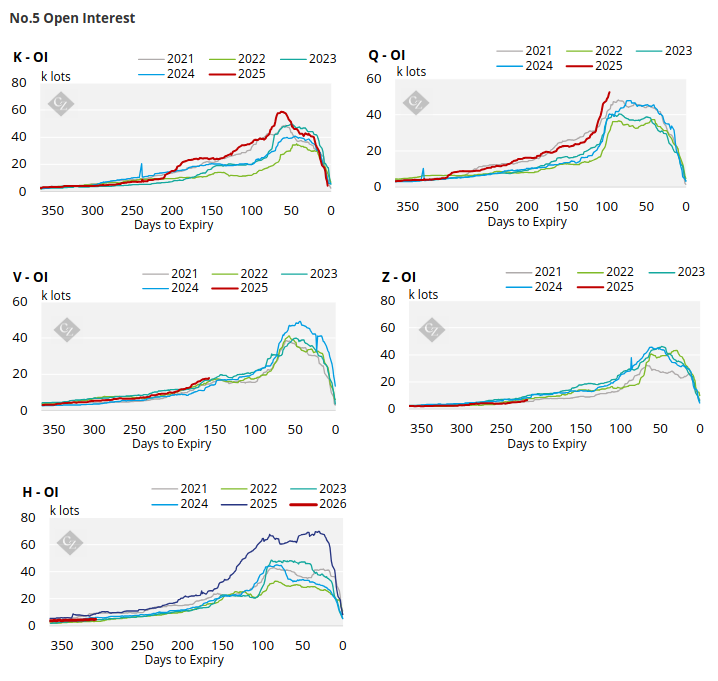

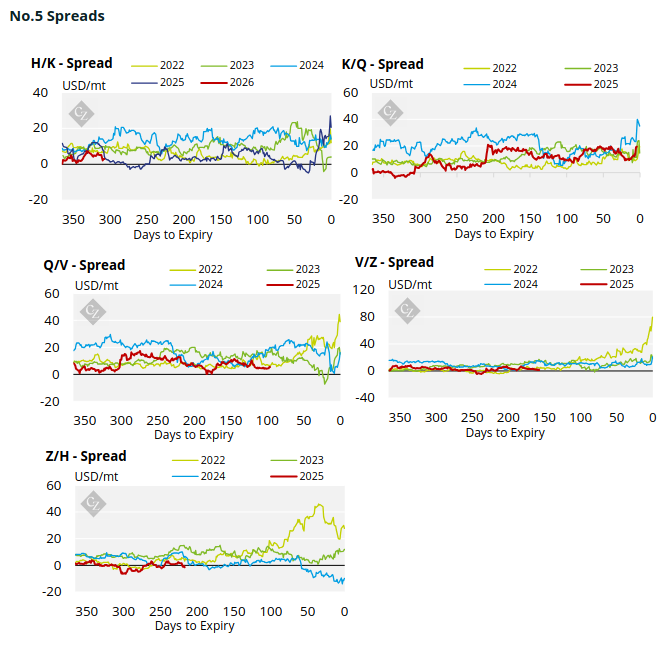

No.5 Open Interest

The No.5 refined sugar futures curve has weakened across the board.

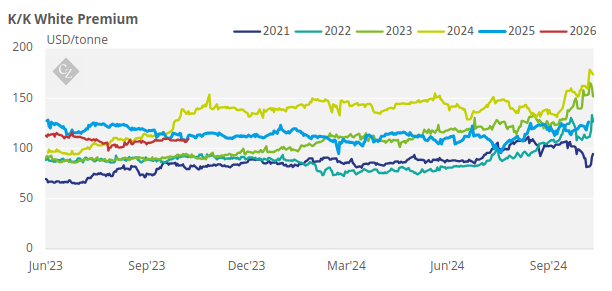

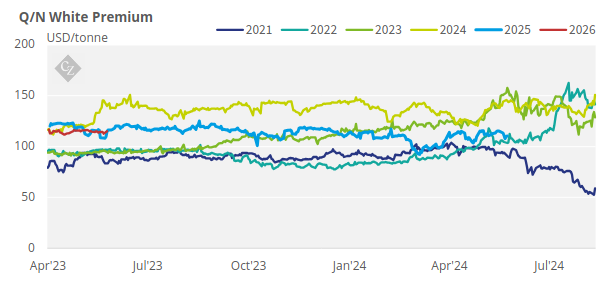

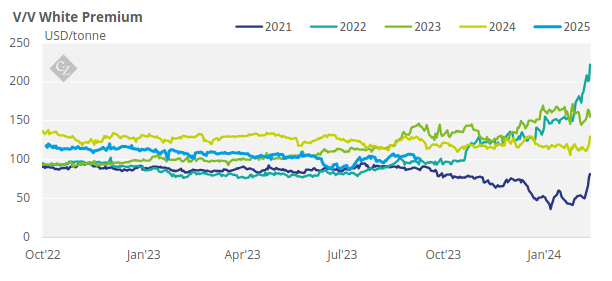

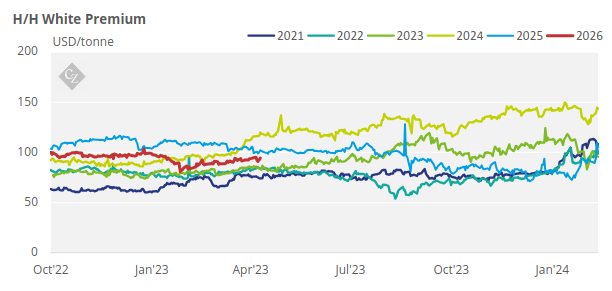

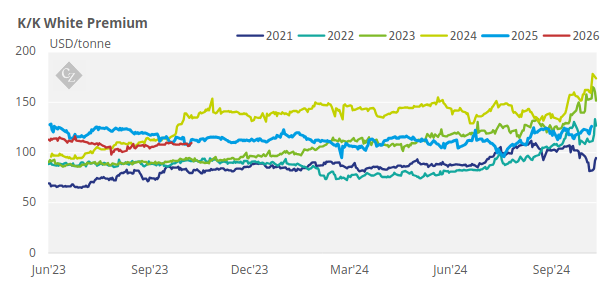

White Premium (Arbitrage)

The K/K white premium traded between USD 118.5-126.2/tonne over the past week.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix