Insight Focus

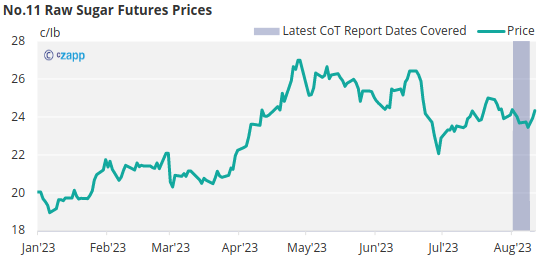

- The No.11 raw sugar futures have traded sideways, hovering around 24c/Ib.

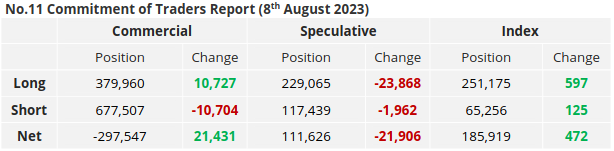

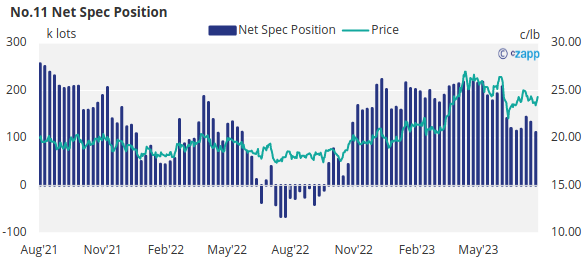

- Both raw and refined sugar speculators have decided to close their long positions.

- The V/V white sugar premium remains stable at 160USD/mt.

New York No.11 Raw Sugar Futures

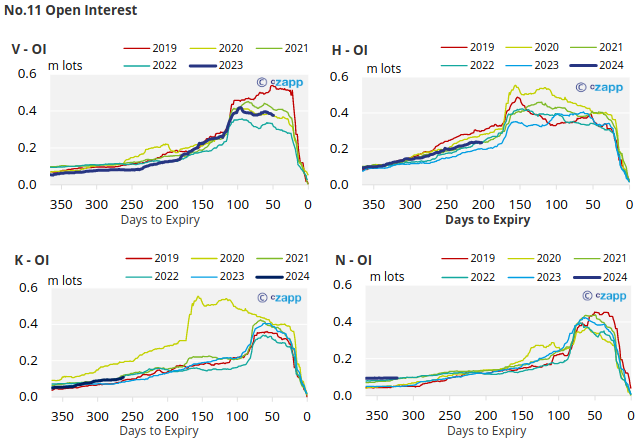

The No.11 raw sugar futures prices strengthened slightly over the last week, before closing at 24.3c/lb by Friday.

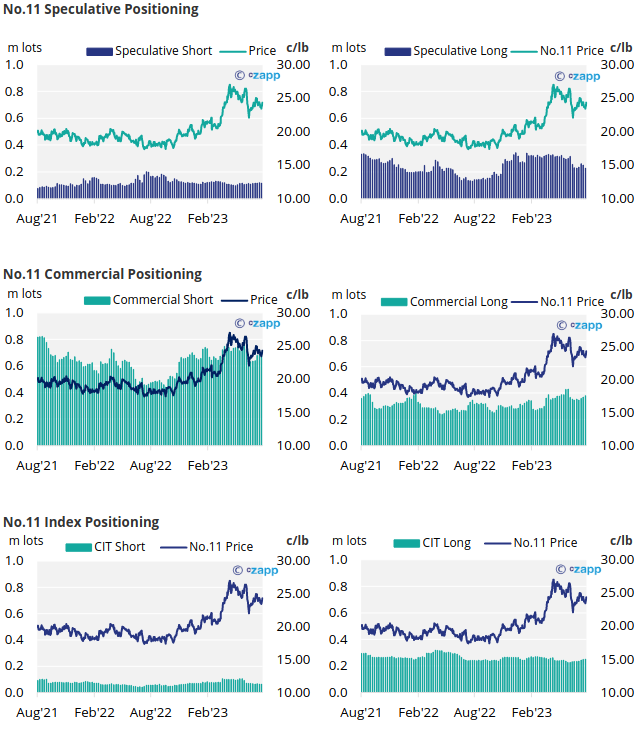

During this timeframe, speculators have decided to close out 23.8k lots of long positions.

With some spec short positions also closed, the overall net spec position has decreased to 111k lots, the lowest number of positions held since December 2022.

Looking over to the commercial side, producers have closed out 10.7k lots of short positions, while the consumers have added a similar number of long positions, most likely when prices were hovering around 23c.

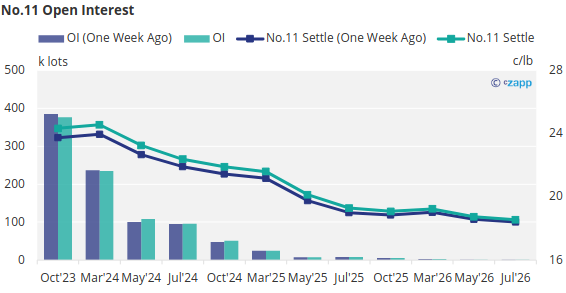

With contracts strengthening slightly across the board, over the last week, the No.11 curve remains inverted through to 2025.

London No.5 Refined Sugar Futures

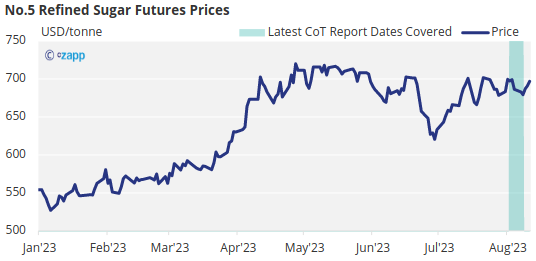

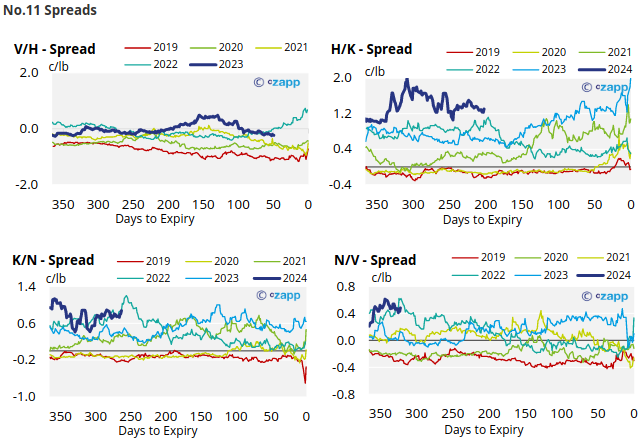

The No.5 refined sugar futures strengthened towards the middle of last week, rising from 682USD/mt at the start of the week to 697USD/mt last Friday.

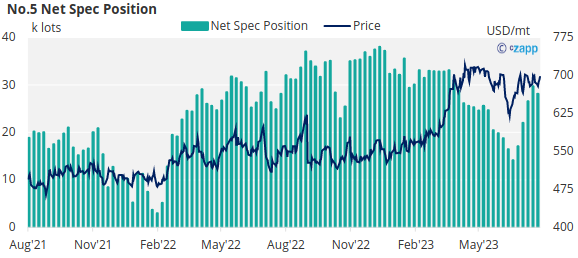

After building up their net spec positions over several weeks, the refined sugar speculators have chosen to liquidate 1.6k lots of long positions, reducing their total net spec positions to 38k lots.

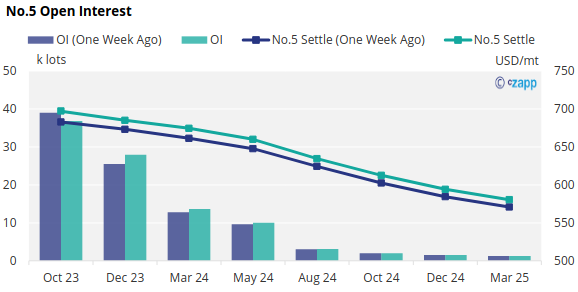

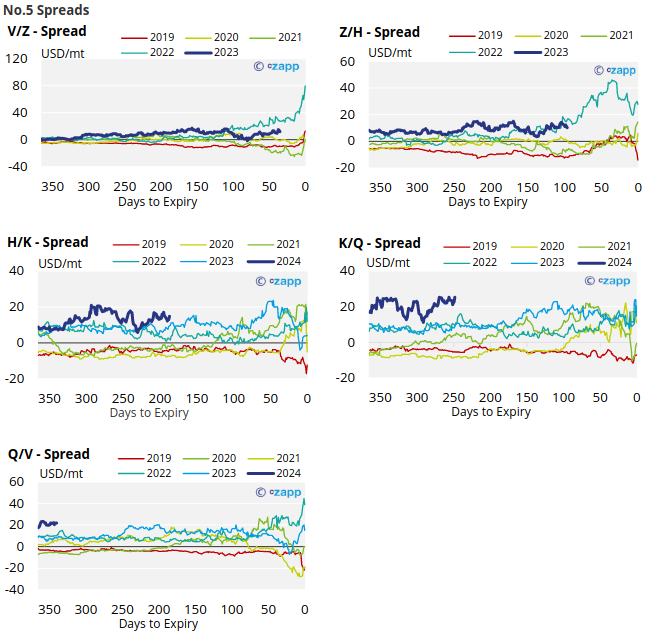

The No.5 forward curve remains inverted through to March 2025.

White Premium (Arbitrage)

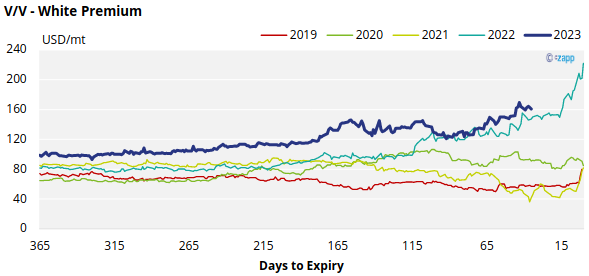

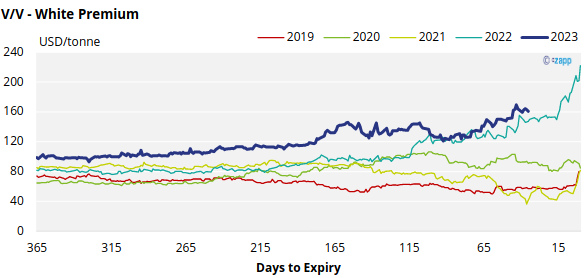

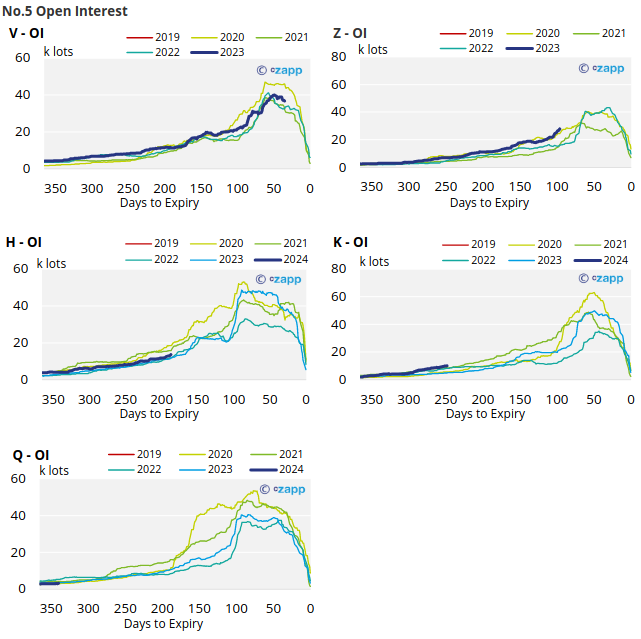

With both raw and refined sugar prices making similar moves over the past week, the V/V sugar white premium has remained stable at around 160USD/mt.

We think many re-export refiners require at least 105-115USD/tonne over the No.11 to operate profitably, this means the spot white premium offers comfortably enough for these refiners to be maximising their throughput.

At this level we could see higher-cost or discretionary refiners begin to consider re-exporting too, rather than just serving their domestic markets.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

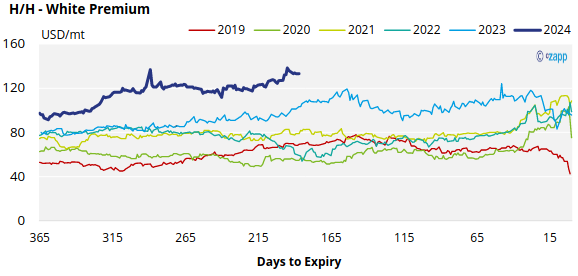

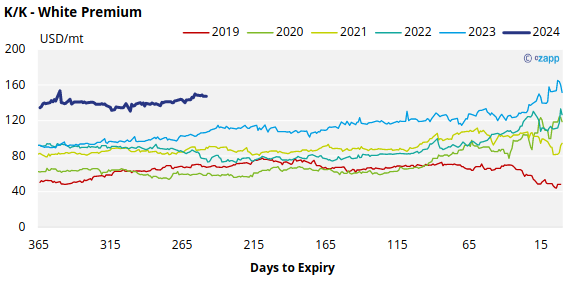

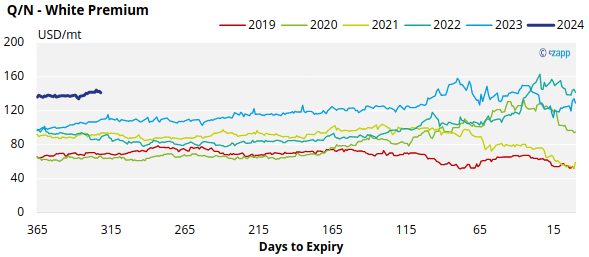

White Premium Appendix