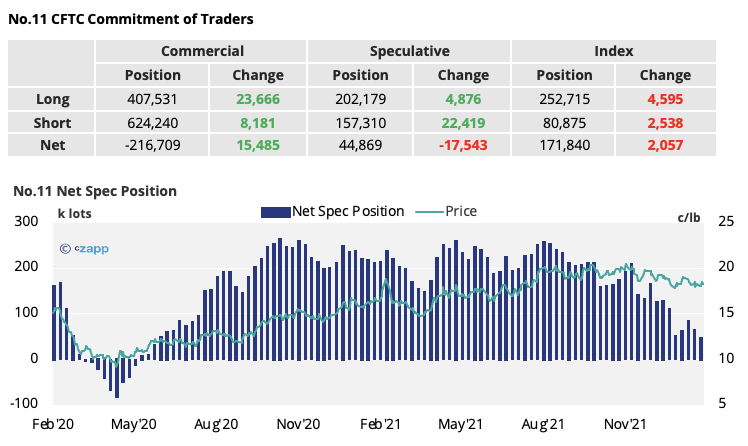

- The spec short has increased by over 22k lots to the highest level seen since Jun’20.

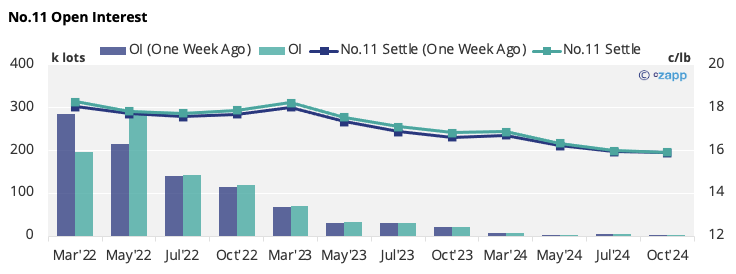

- The No.11 continues to trade sideways between 18 and 18.5 c/lb.

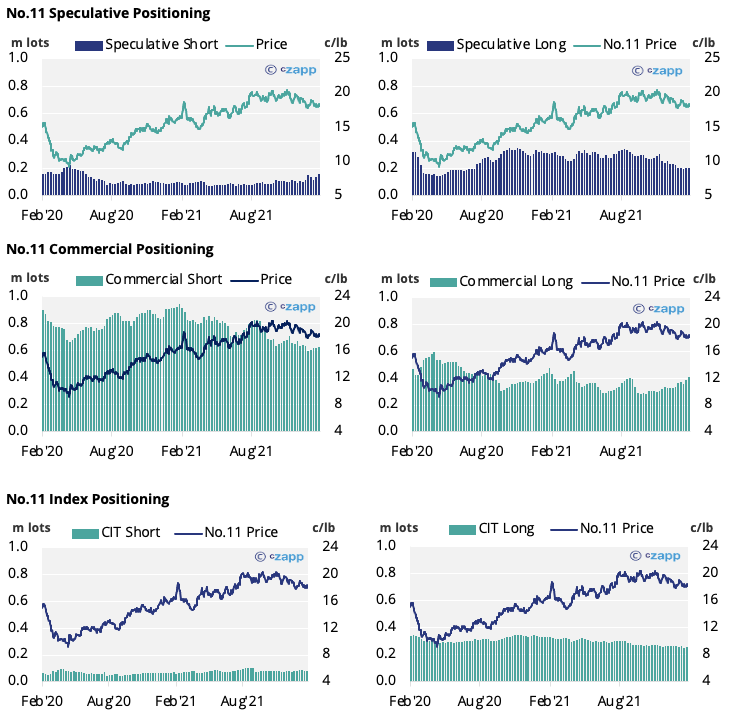

- Consumers are still keen to take advantage of dips in price, adding over 23k in hedges.

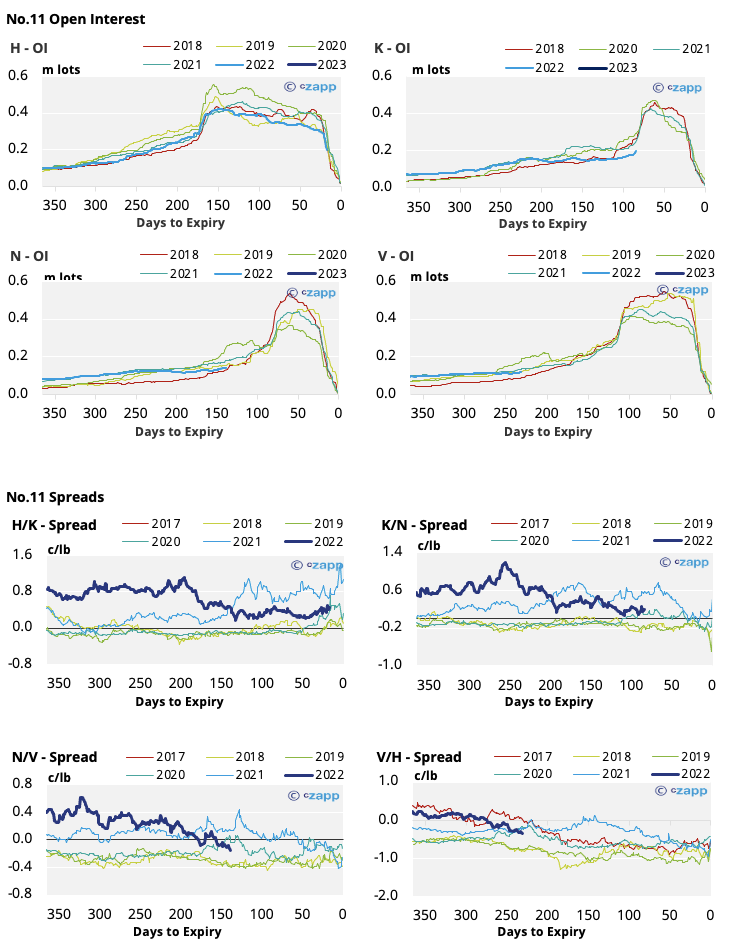

New York No.11 (Raw Sugar)

- The specs have added a meaningful volume of short positions for the second week in a row.

- This could indicate the forming of a bearish opinion amongst speculators, but a modest increase in the spec long suggests there’s still plenty of uncertainty as well.

- Whilst the H’22 is still active, the forward curve remains close to flat for the next 12 months, making forward buying more attractive.

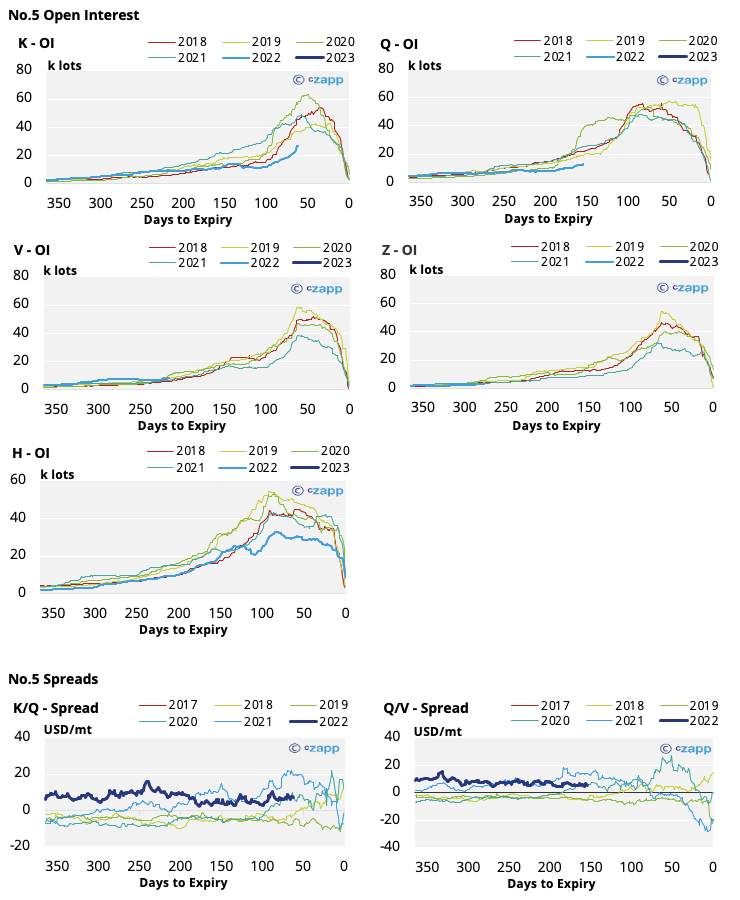

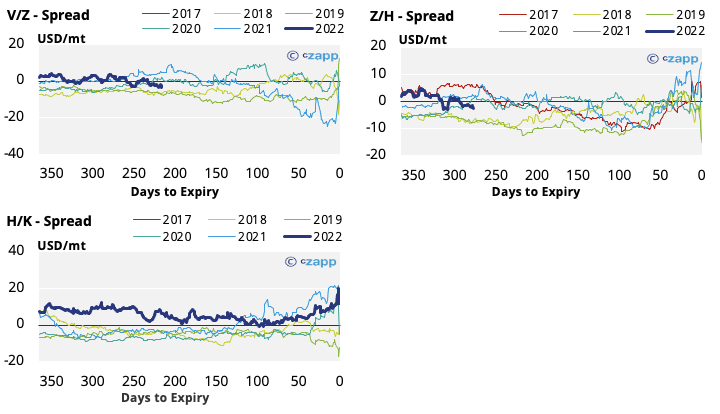

London No.5 (White Sugar)

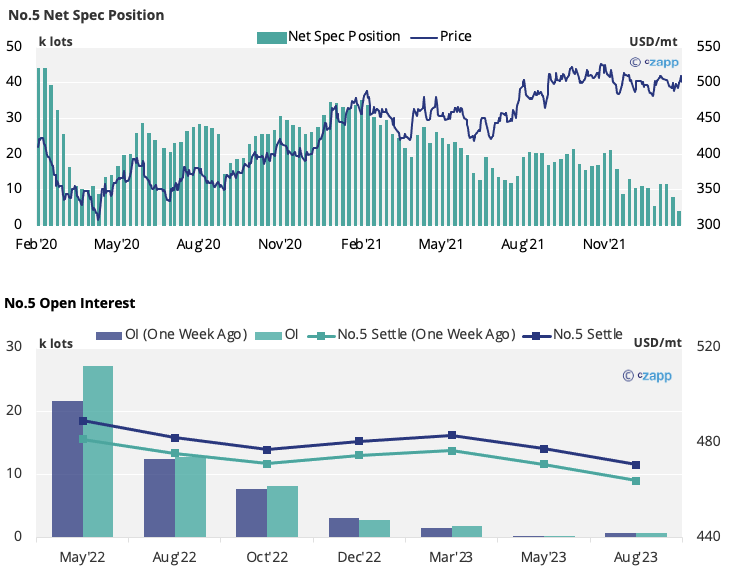

- The No.5 has traded mostly sideways between 480 and 490 USD/mt.

- The net spec position continues to trend towards neutrality, echoing changes in the No.11.

- With the H’22 now expired, the forward curve looks flatter for the rest of 2022.

- The open interest for the K’22 and Q’22 contracts remains below historic levels.

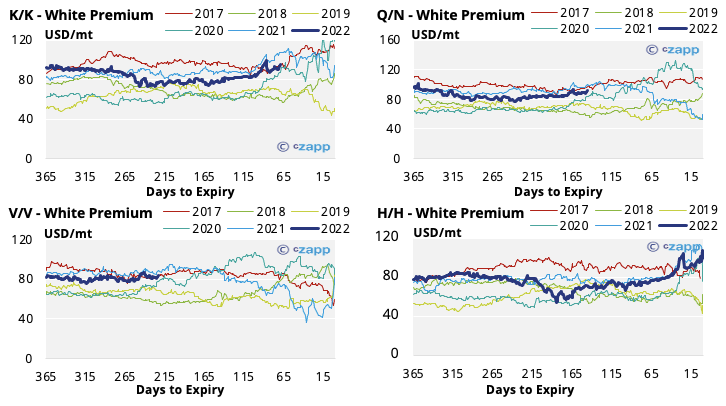

White Premium (Arbitrage)

- With the H’22 now expired, the K’22 white premium is strengthening and sits just below 100 USD/mt.

- With cash values or discounted raws spreads, this could overcome the level needed for re-export refiners to operate profitably.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…