Insight Focus

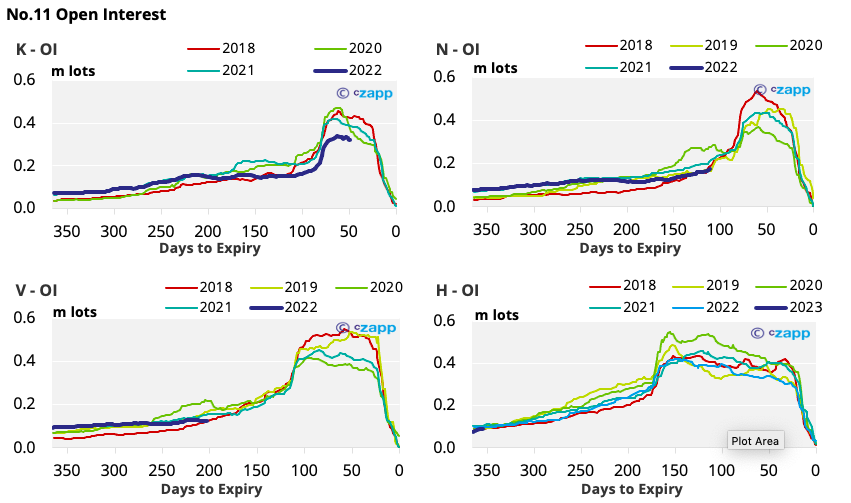

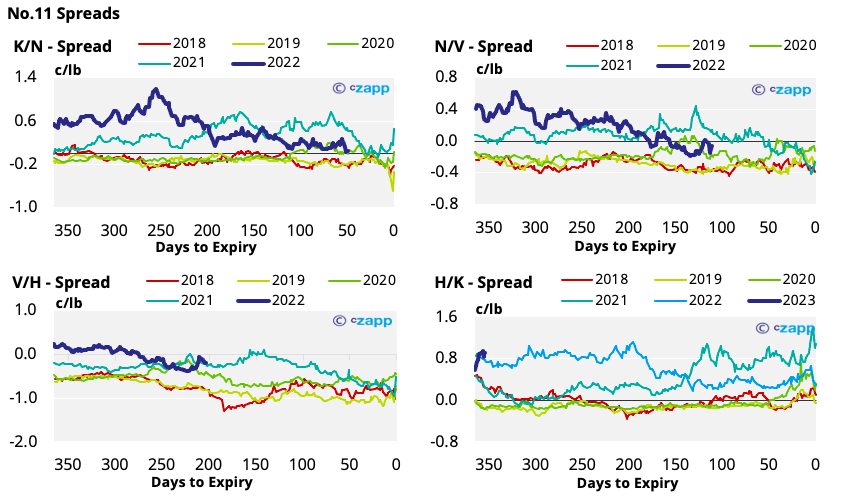

- The No.11 has rallied above 19c.

- The weekly increase in net spec position was the third largest on record.

- Sugar producers have exploited the rise above 19c, adding lots of cover.

New York No.11 (Raw Sugar)

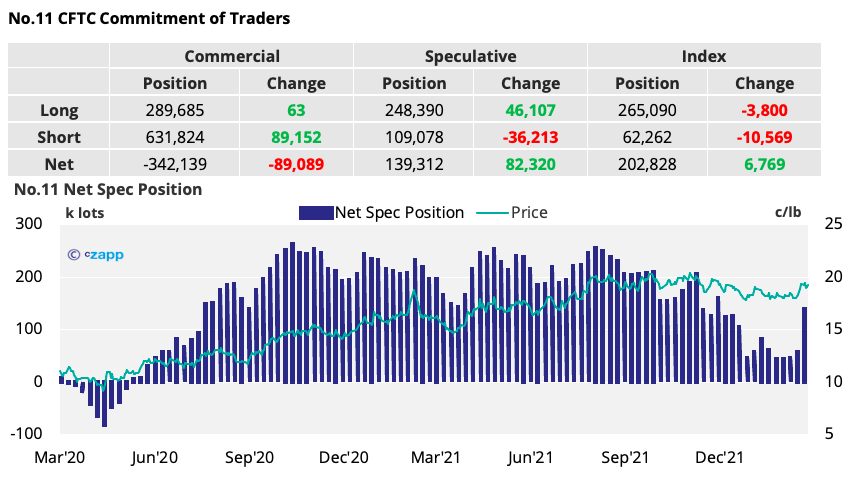

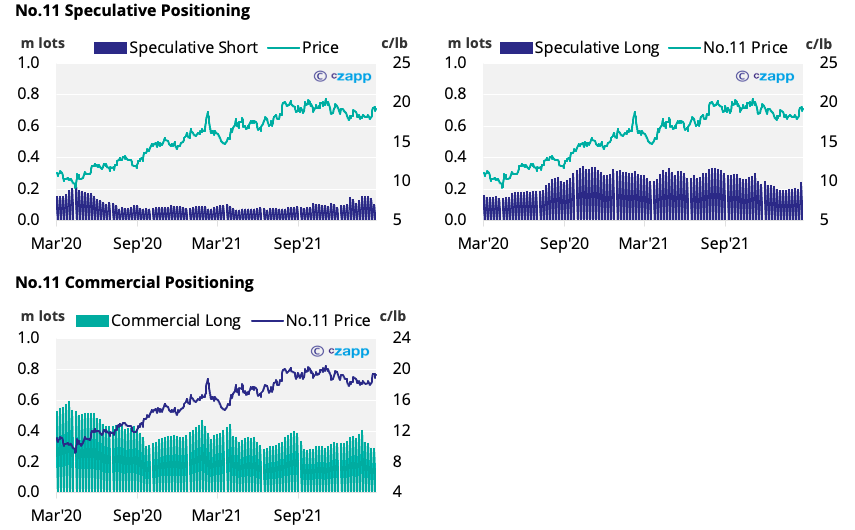

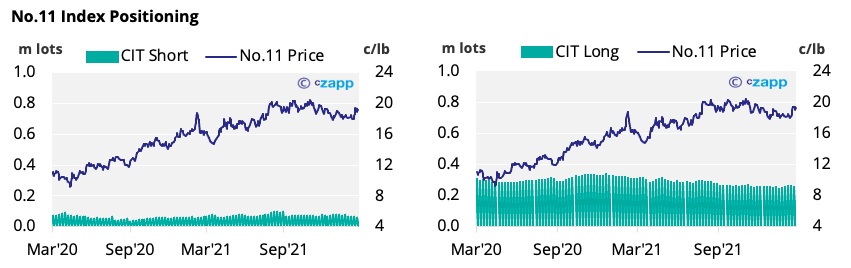

- The No.11 rally at the start of March has been reflected by a large increase in bullish speculation.

- As of the 8th March, the spec long grew by over 46k lots, whilst the spec short shrunk by 36k lots.

- The net spec position grew by over 82k lots in response, the largest weekly rise since the start of 2020.

- This marks the end of the low spec involvement in sugar seen so far this year.

- Producers have also been keen to exploit the rise above 19c, adding almost 90k lots to the commercial short – consumer hedging by contrast has almost completely halted.

- No.11 prices since the 8th March have hovered just above 19c.

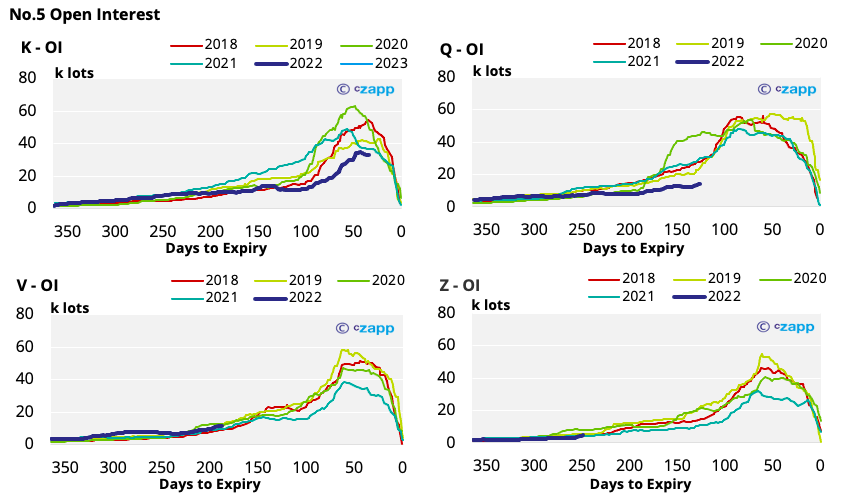

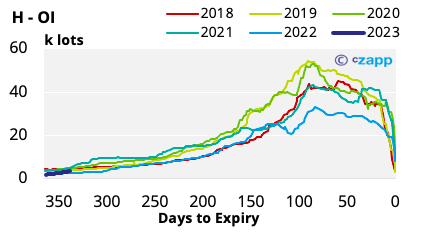

London No.5 (White Sugar)

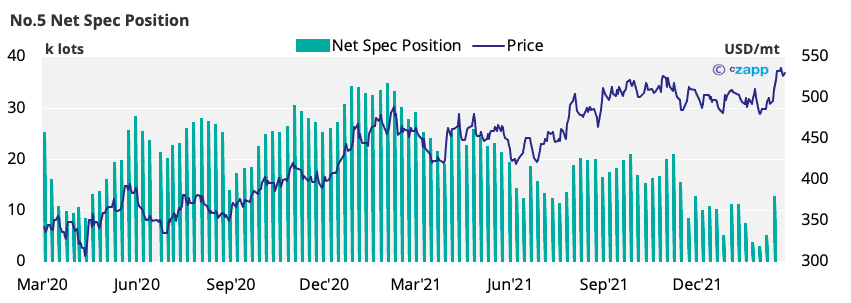

- This new bullish sentiment is mirrored in the No.5 as the net spec position has grown by over 7k lots as of the 8th March CFTC report.

- In the week since the 8th, white sugar prices have stabilised around 530 USD/mt.

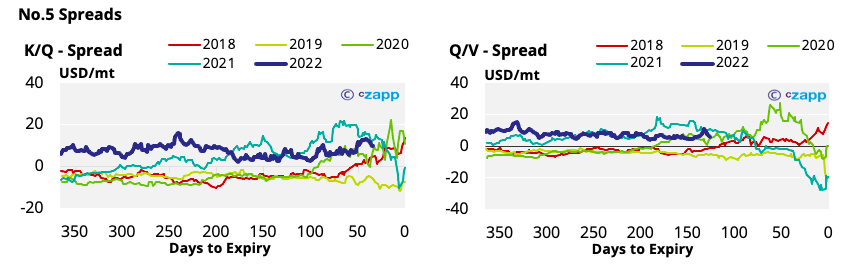

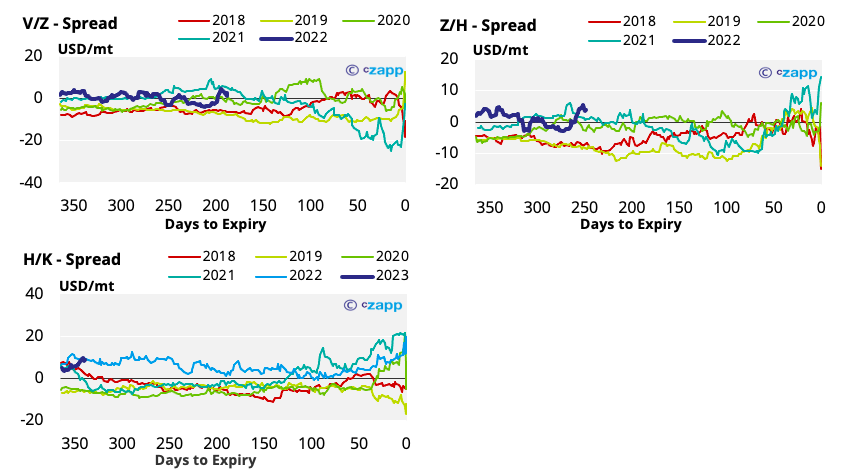

- Whilst flattening slightly, the No.5 forward curve is still backwardated into 2023.

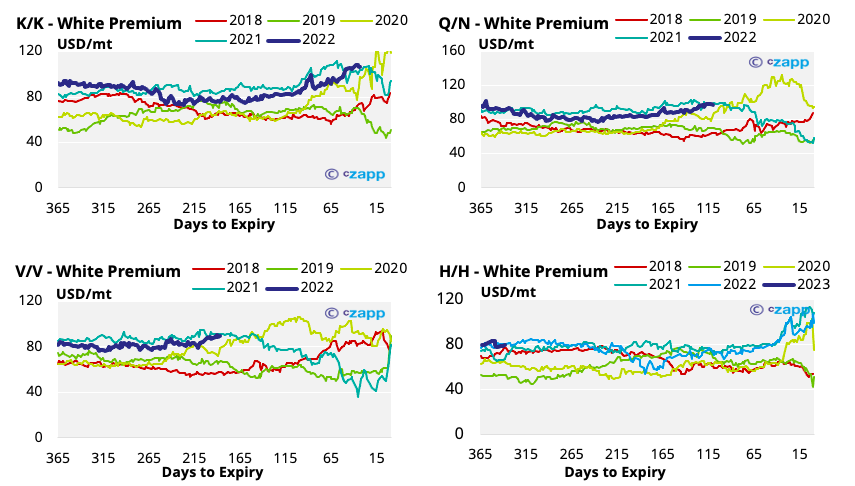

White Premium (Arbitrage)

- The K/K white premium remains strong, sitting comfortably above 100 USD/mt.

- Whilst this is positive for re-export refiners, the oil and energy price rally means their margins could be heavily squeezed through rising energy costs.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

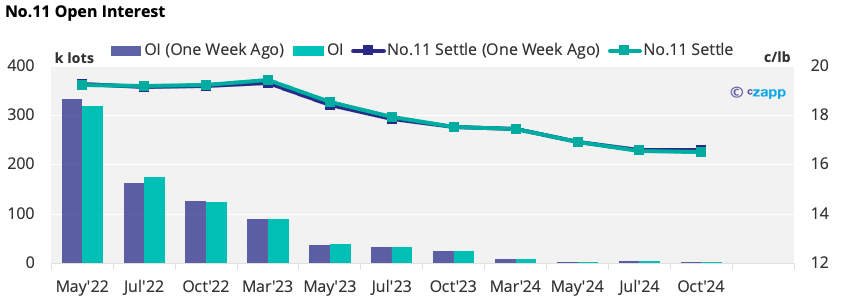

No.11 (Raw Sugar) Appendix

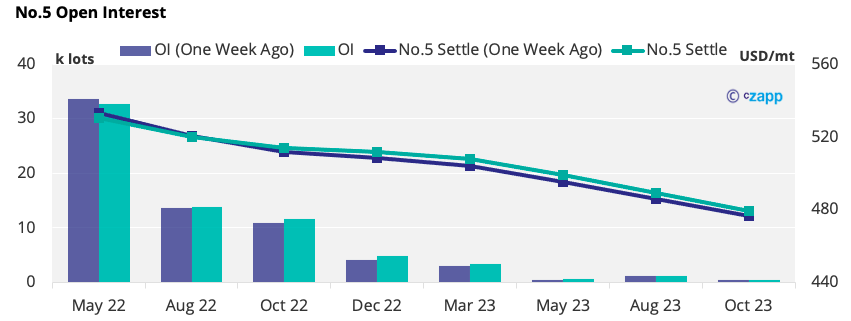

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…

Black Sea Sugar Freight Suffers Little War Disruption

Is ‘Fortress Russia’ Self-Sufficient in Sugar?

Explainers That May Be of Interest…