Insight Focus

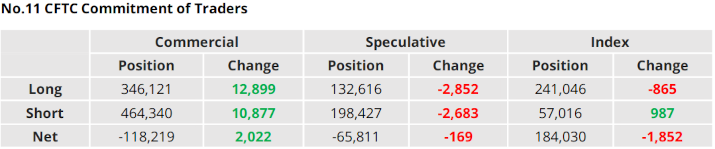

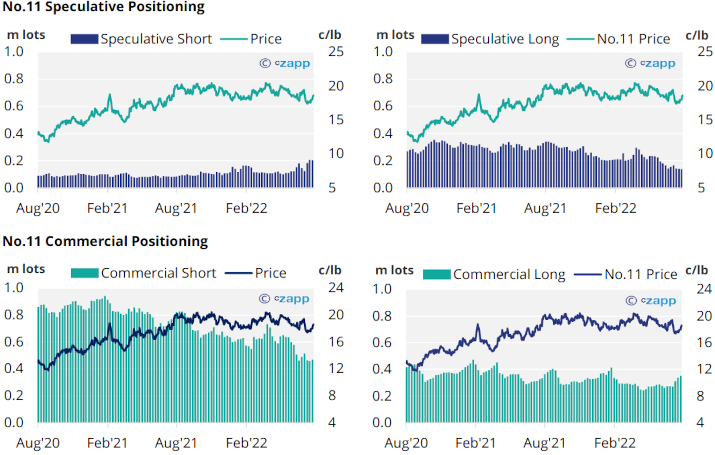

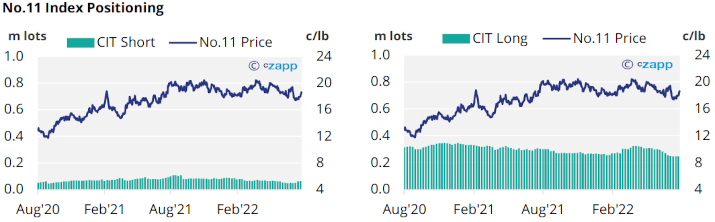

- Net commercial and spec positions very similar to the last update despite upwards price movement.

- Speculators close both long and short positions amid lack of clear price direction.

- Raw sugar consumers and producers both took advantage of opportunities to add hedges.

New York No.11 (Raw Sugar)

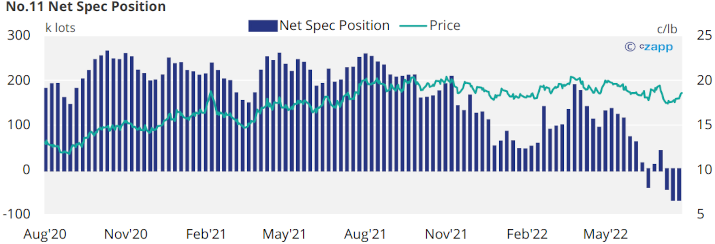

- No.11 prices have recovered back above 18.5c/lb over the last week of trading.

- By the 9th of August producers added new sugar hedges faster than old ones rolled off for the first time in several weeks with over 10k new short positions added.

- Raw sugar consumers also furthered their hedging regime, adding over 12k lots of long positions.

- The net spec position remains broadly unchanged as speculators remove almost equal volumes of long and short positions – speculators are still net sellers of raw sugar.

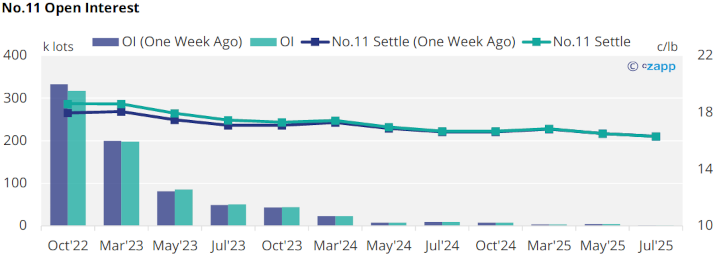

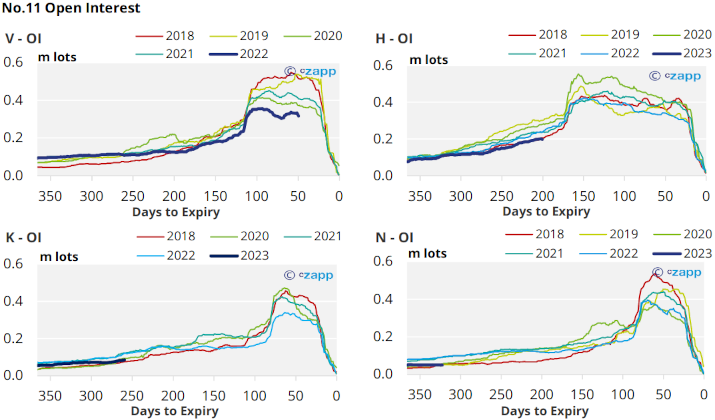

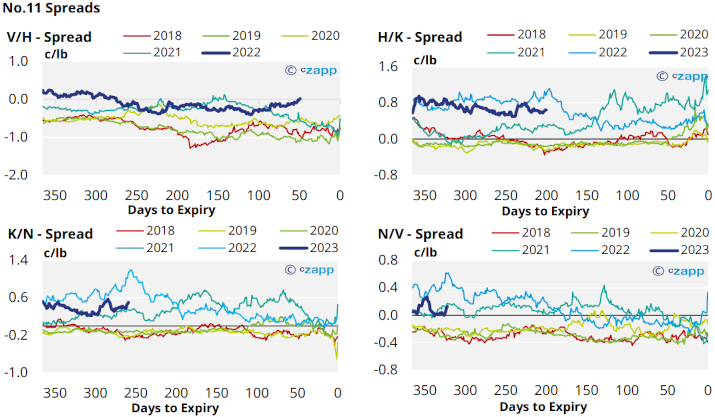

- The No.11 forward curve has flattened into Mar’23, falling into backwardation for the rest of 2023.

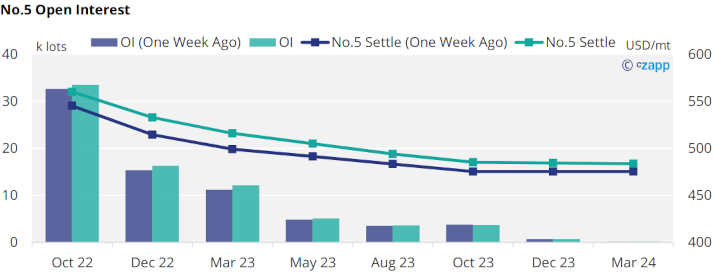

London No.5 (White Sugar)

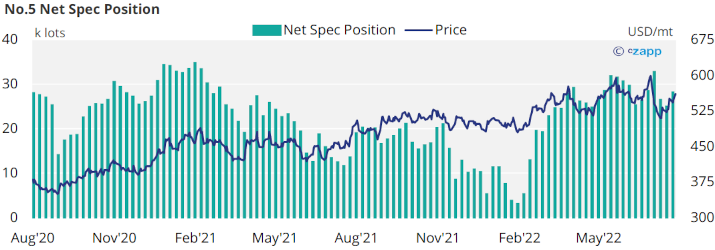

- No.5 prices have strengthened towards 560USD/mt over the last week, returning the market to the uptrend channel.

- By the 9th of August the net spec position has risen by 3.5k lots to over 28k lots, reversing the previous two weeks move towards neutrality

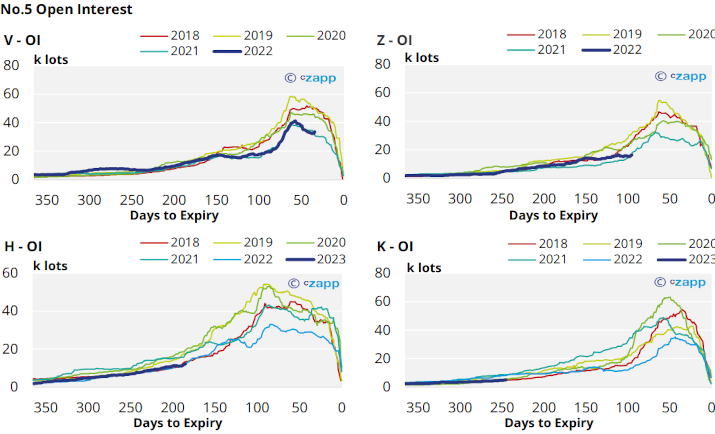

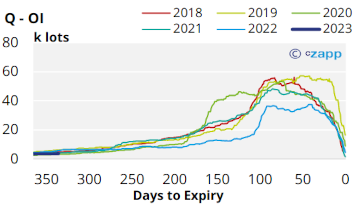

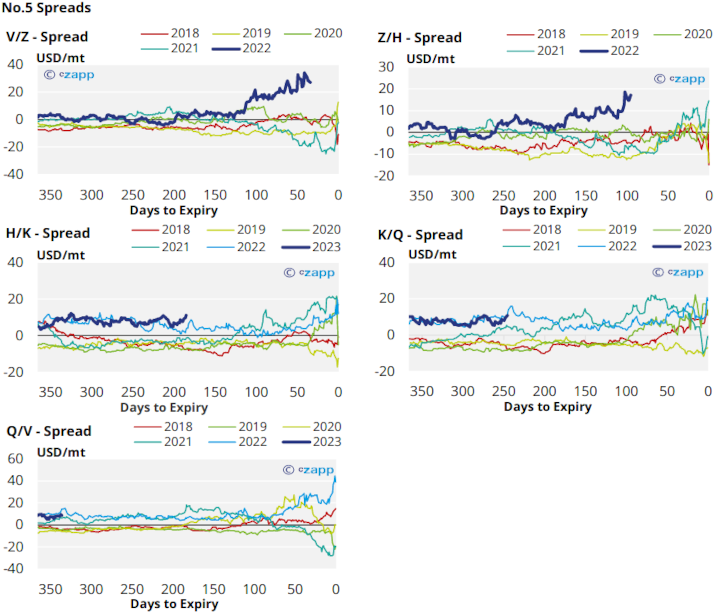

- The No.5 forward curve remains heavily backwardated into 2024, with spreads to May’23 each the widest in at least the last 5 years.

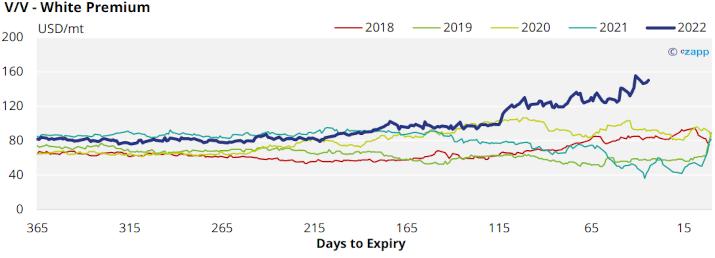

White Premium (Arbitrage)

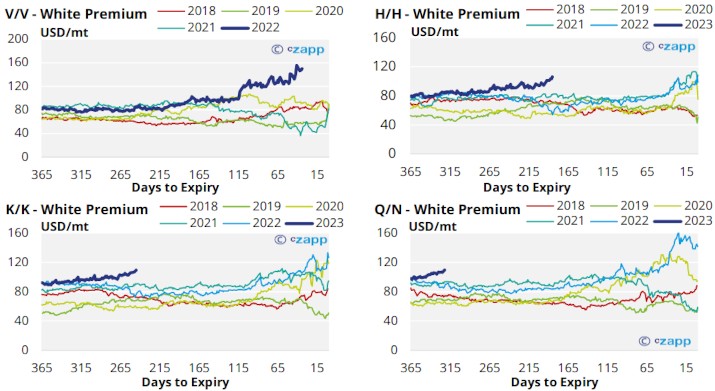

- The sugar white premium has hovered around 150USD/mt as both the No.11 and No.5 recover.

- At this level we should see re-export refiners operating profitably and maximising their throughput.

- We think discretionary refiners will need upwards of 160USD/mt to start buying extra raws cargoes for re-export.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…

Could Mexican Drought Change Flow of Beer to US

Ask the Analyst: Are the Brazilian Sucrose Levels Lower than Last Year?