Insight Focus

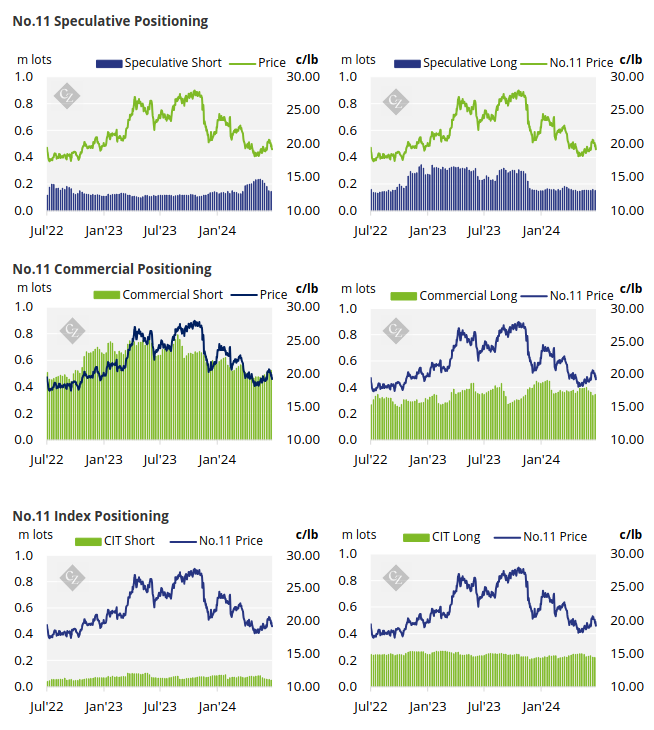

Raw sugar futures traded between 19-20c/lb. Speculators closed out both long and short positions. Both producers and end-users have added to their positions.

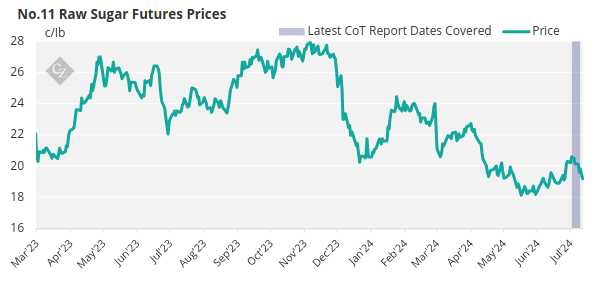

New York No.11 Raw Sugar Futures

The raw sugar futures market traded between 19-20c/lb last week, closing at 19.2c/lb on Friday.

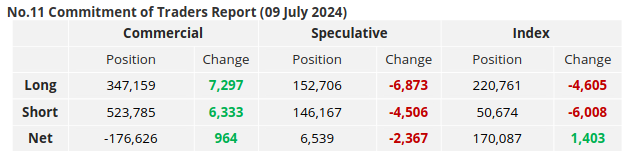

Both producers and end-users have opened fresh positions last week. Producers opened 6.3k lots of short positions, while end-users opened 7.3k lots of long positions.

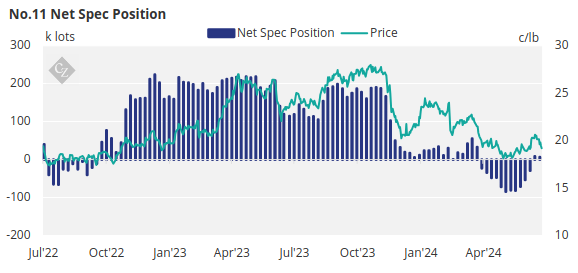

By contrast, speculators have closed out positions over the past week. Speculators closed out 6.9k lots of long positions and 4.5k lots of short positions.

Speculators have not been net short in the market following the July raw sugar futures expiry and their net position now stands at 6.5k lots, which is neutral.

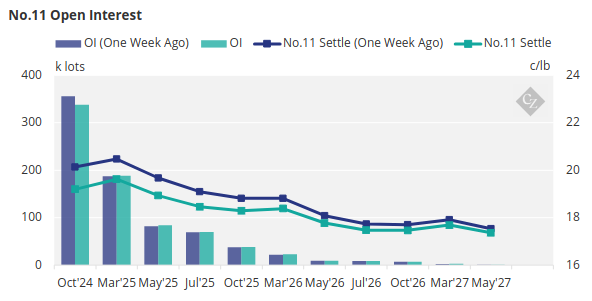

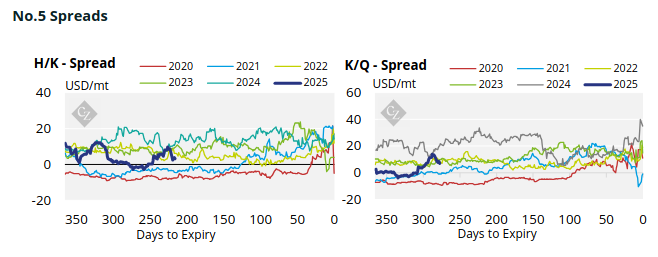

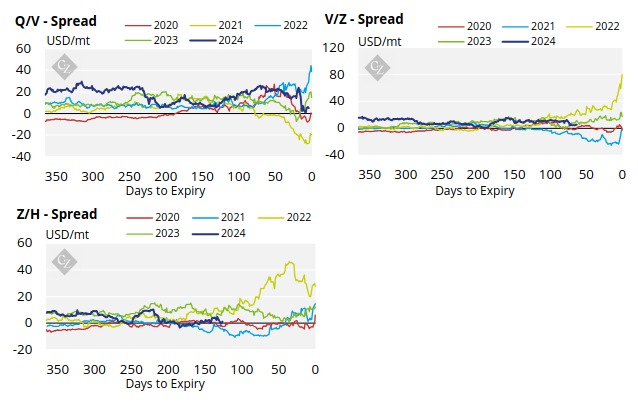

The No.11 futures curve has flattened across the board.

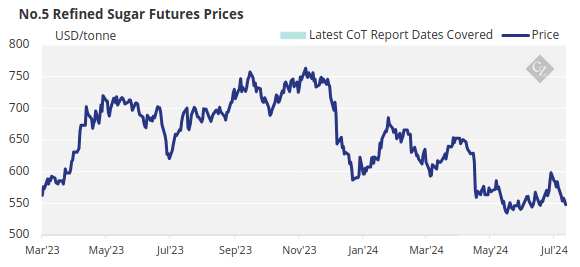

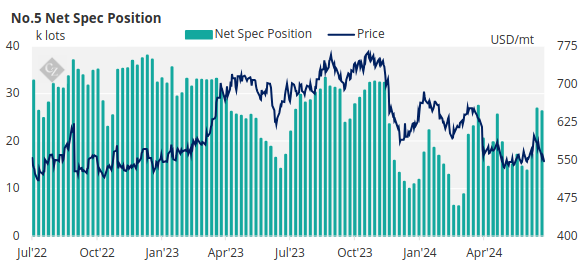

London No.5 Refined Sugar Futures

The No.5 refined sugar futures traded lower between 547-560 USD/mt in the past week, closing at 547.6 USD/mt on Friday.

Speculators closed out less than 1k lots of longs bringing the net spec position down to 26.3k lots.

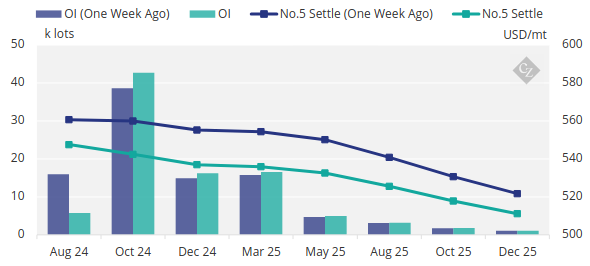

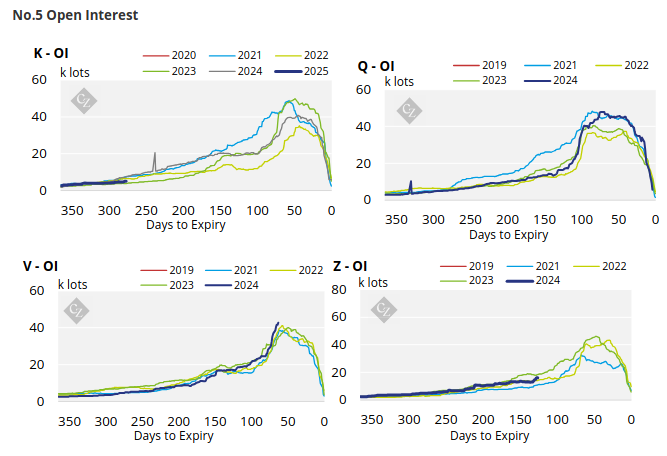

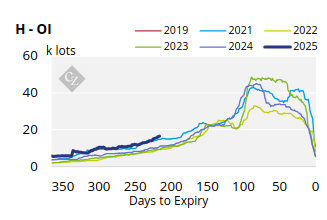

No.5 Open Interest

The No.5 refined sugar futures curve has flattened across the board but remains in backwardation from May 2025 onwards.

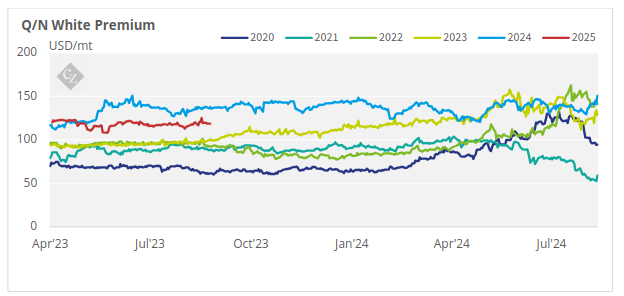

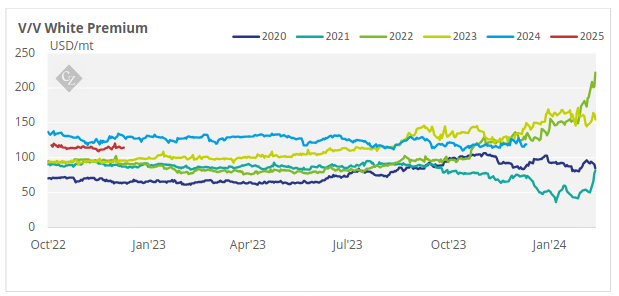

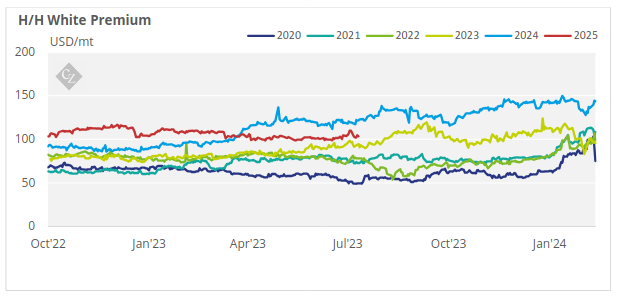

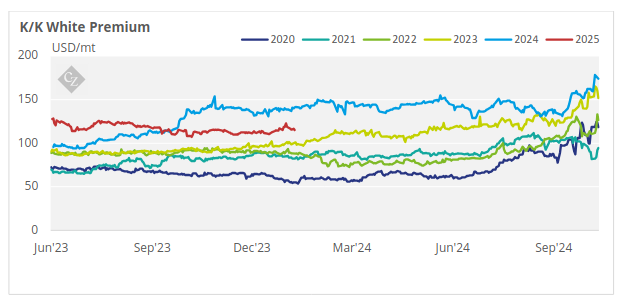

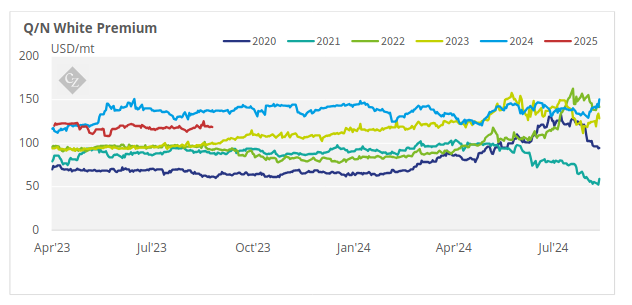

White Premium (Arbitrage)

The Q/N white premium, traded sideways over the past week, closing at 118.6 USD/mt on Friday.

The no.11 raw sugar futures market is in carry, while the no.5 refined sugar market is in backwardation. This combination provides a big opportunity for re-export refiners to produce refined sugar profitably.

Many re-exports refiners need around 105-115USD/mt above the No.11 to profitably produce refined sugar. The current white premium is still above this level, which means we should theoretically see a pick-up in demand soon.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

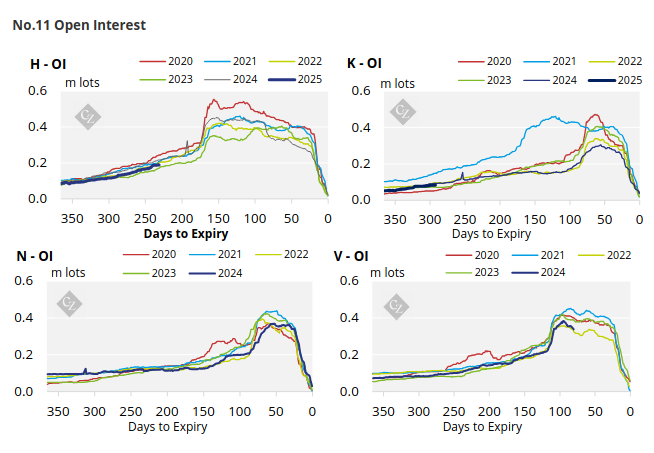

No.11 (Raw Sugar) Appendix

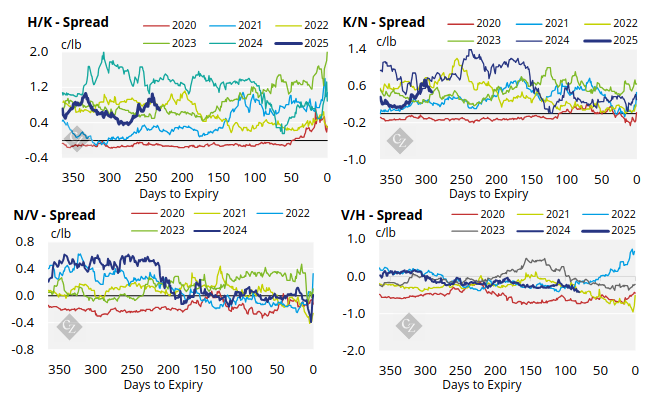

No.11 Spreads

No.5 (White Sugar) Appendix

White Premium Appendix