Insight Focus

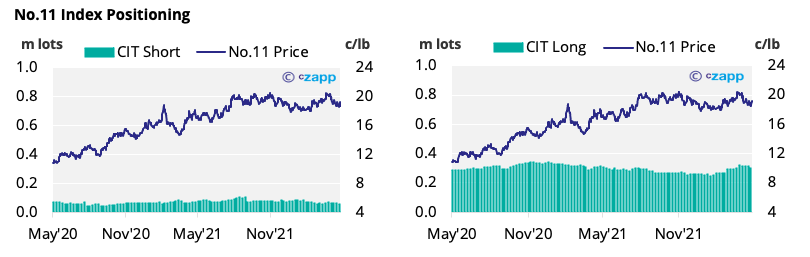

- Sugar speculators continue to lift long positions.

- Consumers begin to add a small amount of cover.

- No.11 prices have rallied above 19c/lb by the end of last week.

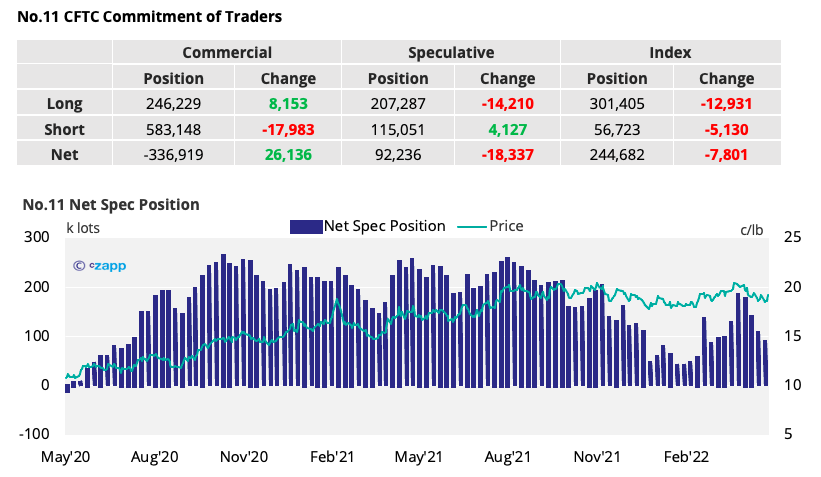

New York No.11 (Raw Sugar)

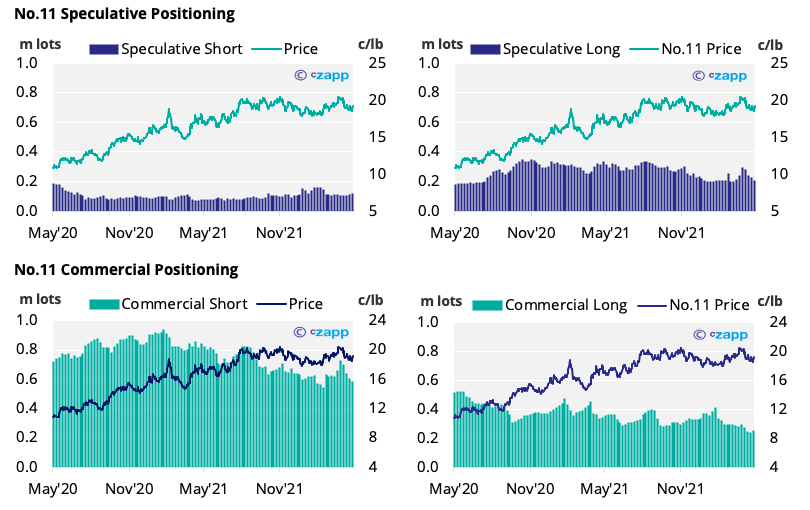

- As of the 10th of May, the net spec position fell by over 18k lots as the long position decreased and a small number of new short positions were added.

- At this stage, prices were weak enough to encourage a small amount of consumer buying, with more than 8k lots added.

- Despite this, consumers are still very poorly hedged and with the No.11 now back above 19c/lb could struggle to add more cover and a good price.

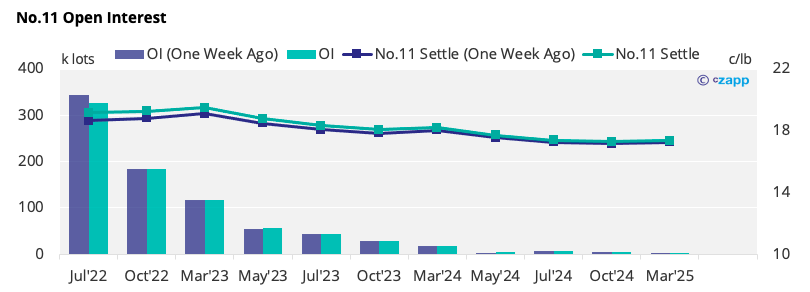

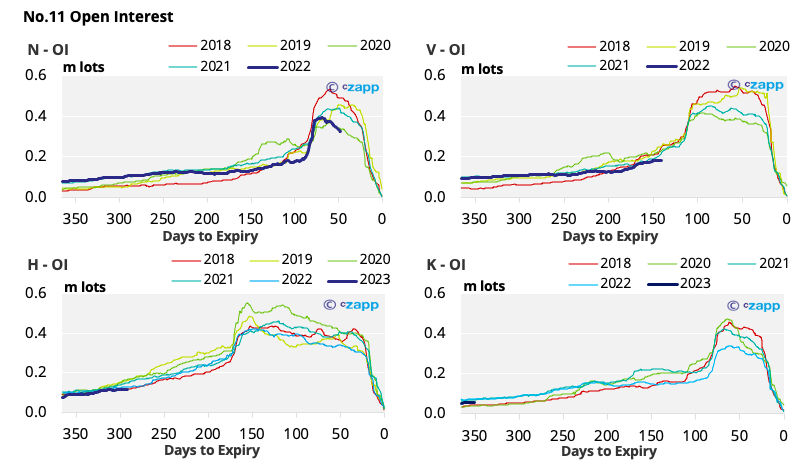

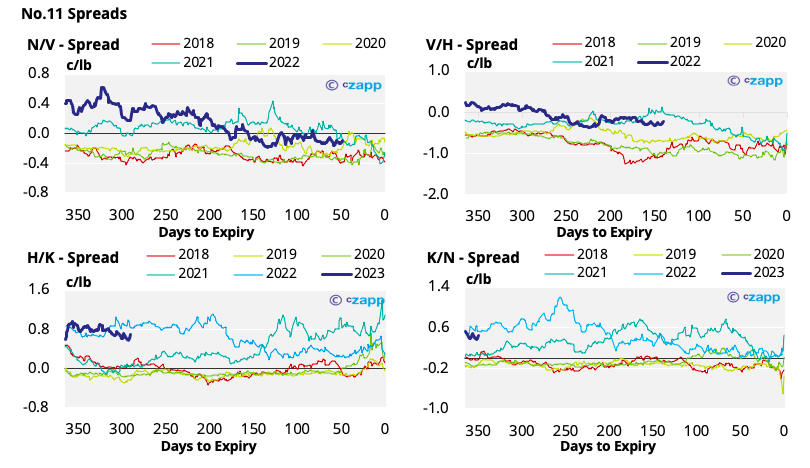

- The No.11 forward curve is still slightly contango towards H’23, then backwardated across 2023.

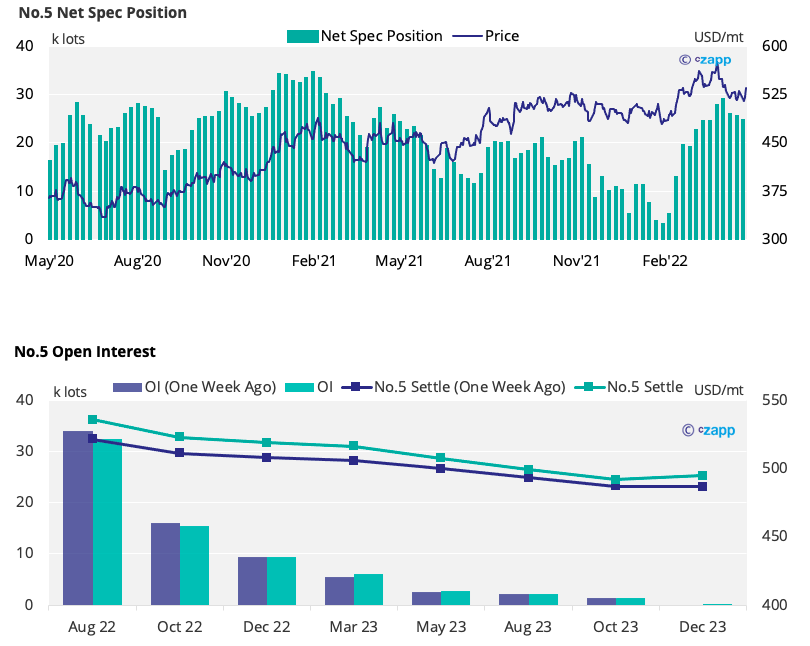

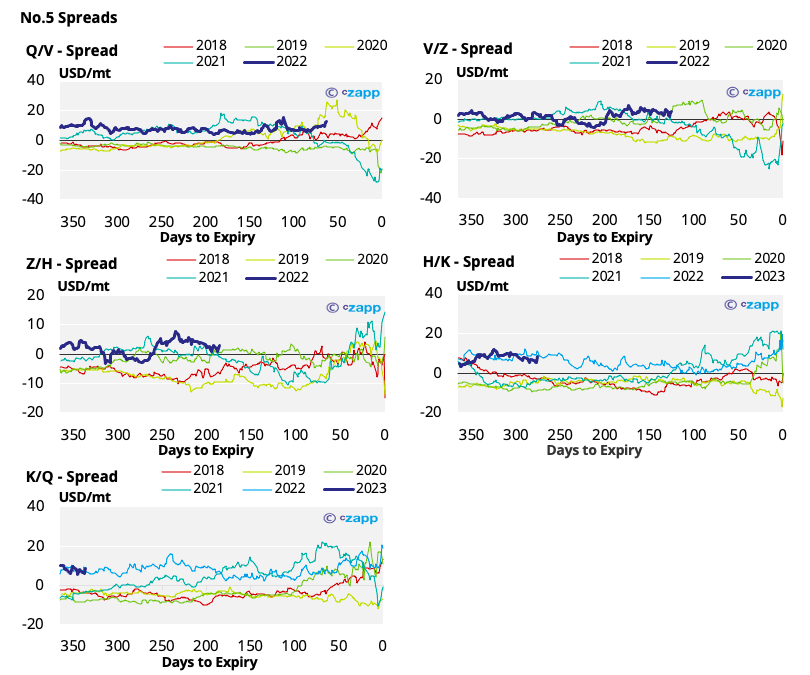

London No.5 (White Sugar)

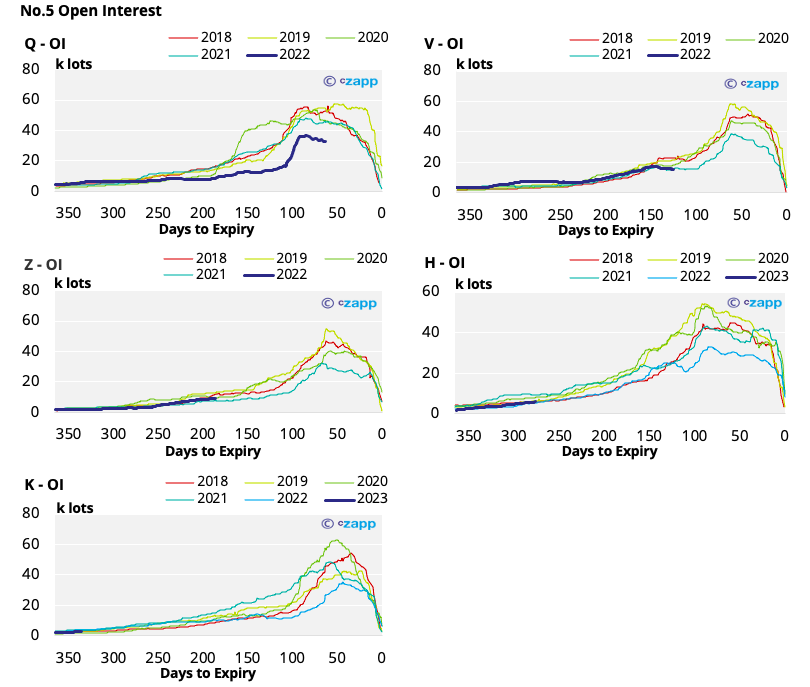

- The white sugar net spec position continues to gradually track downwards as prices lingered around 520USD/mt as of the 10th of May.

- However, by the end of trading last week, the No.5 had rallied back above 530USD/mt.

- The futures curve remains backwardated across 2022 and 2023.

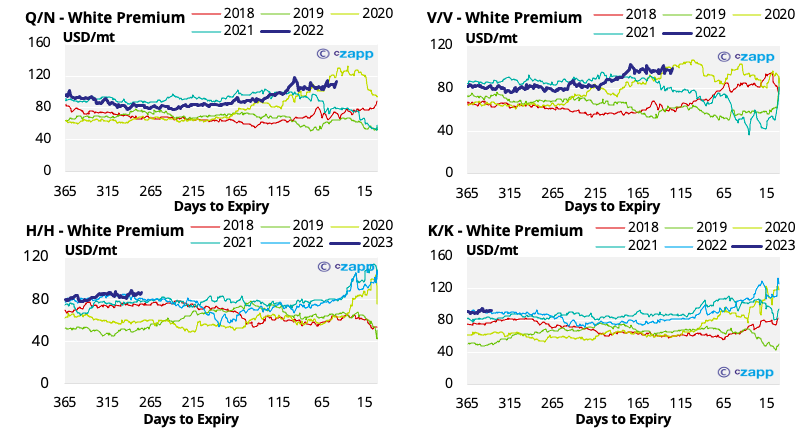

White Premium (Arbitrage)

- The Q/N white premium is currently around 110USD/mt.

- We think some re-export refiners may struggle to operate profitably at this level.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…