Insight Focus

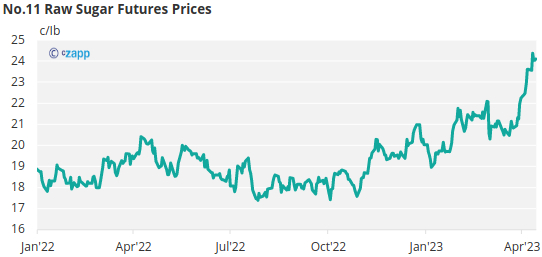

- No.11 raw sugar prices have strengthened over the last week, approaching 6-year highs.

- Likewise, No.5 refined sugar prices briefly traded above 700USD/tonne, close to a ten-year high.

- Consumer buying ahead of the May futures expiries has fuelled both markets.

New York No.11 Raw Sugar Futures

No.11 raw sugar futures prices marked a six-year 2023 high of almost 24.4c/Ib last week, before falling slightly to 24.1c/lb by Friday.

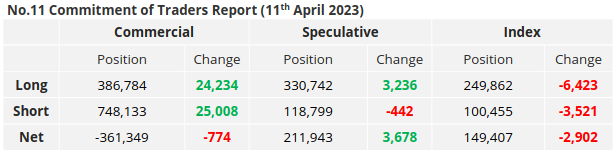

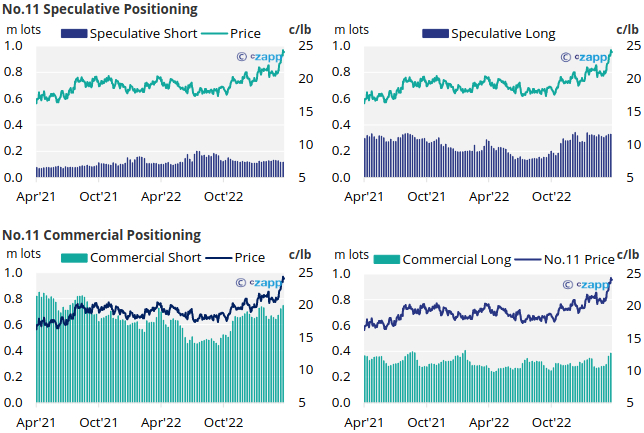

By the 11th of April (latest CoT CFTC report), both raw sugar producers and consumers had added new hedges, 25k and 24k lots respectively. Producers are likely reacting to this abnormal price strength whilst consumers hand-to-mouth buy in advance of the May’23 expiry.

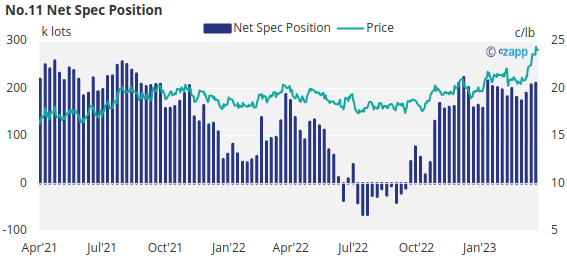

Over the same timeframe, raw sugar speculators opened approximately 3k lots of new long positions and cut fewer than 0.5k short positions as raw sugar prices strengthened. As such the net spec position has extended by around 3.5k lots to 212k lots long.

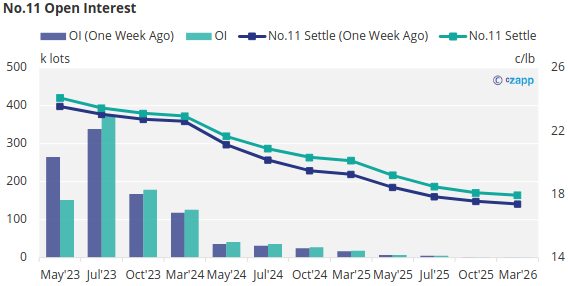

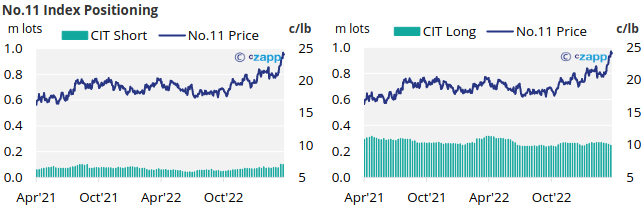

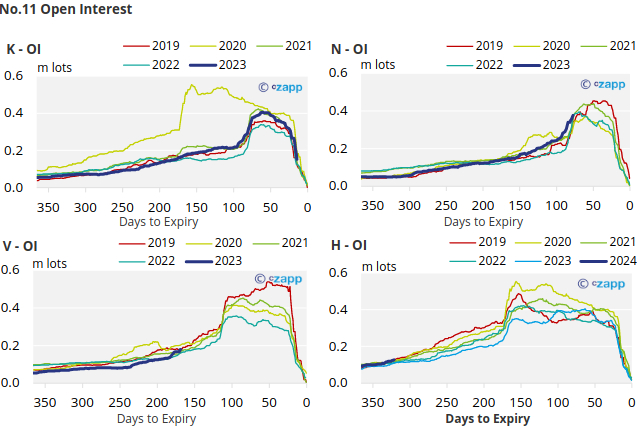

With contracts strengthening across the board, over the last week, the No.11 forward curve is still inverted.

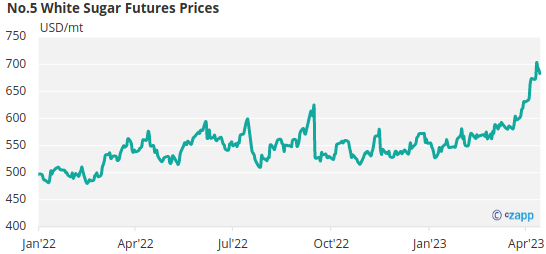

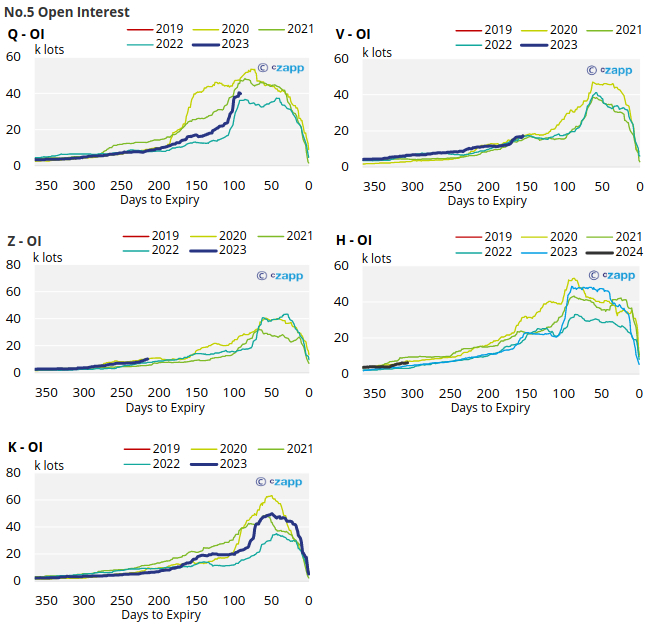

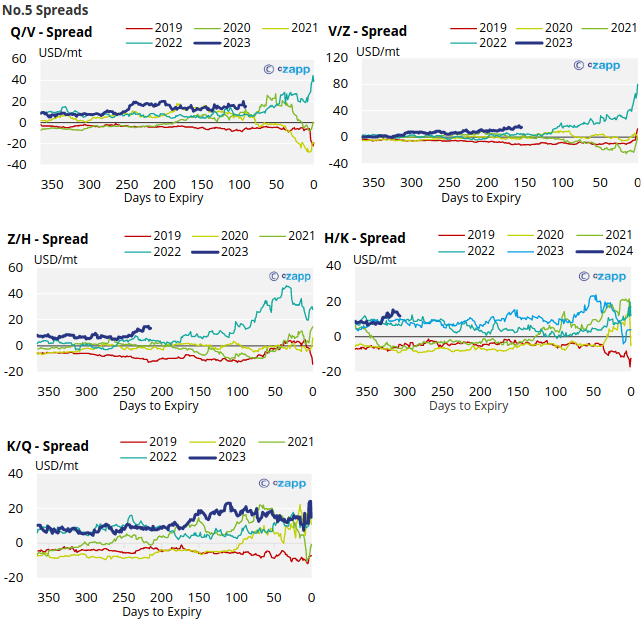

London No.5 Refined Sugar Futures

No.5 refined sugar futures reached above 700USD/tonne for only the second time in the last decade over the last week, before weakening to 668USD/tonne by Friday close as the May’23 contract expired.

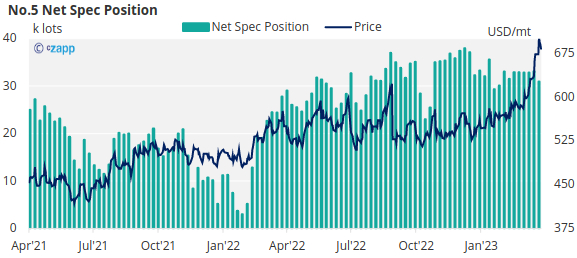

By the 11th of April (latest CoT report) the refined sugar net spec position weakened slightly, now standing at 30k lots, this is still a large, long position for refined sugar speculators.

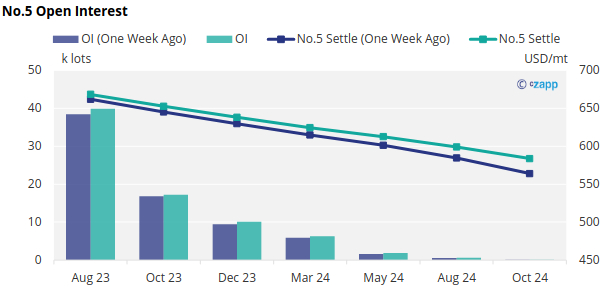

Following the May’23 expiry, the No.5 forward curve remains inverted through to at least Oct 2024.

White Premium (Arbitrage)

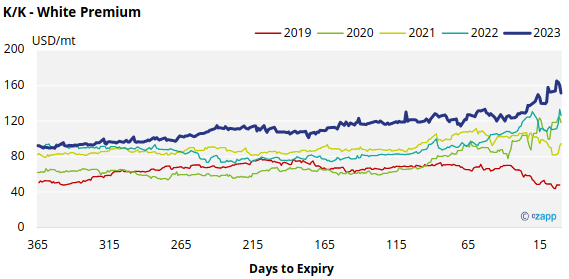

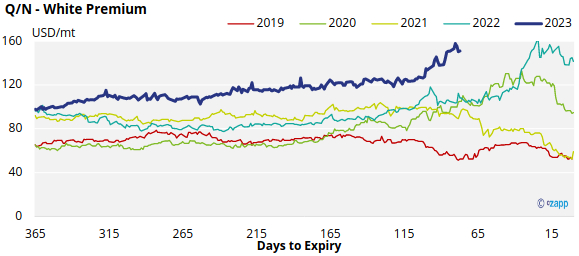

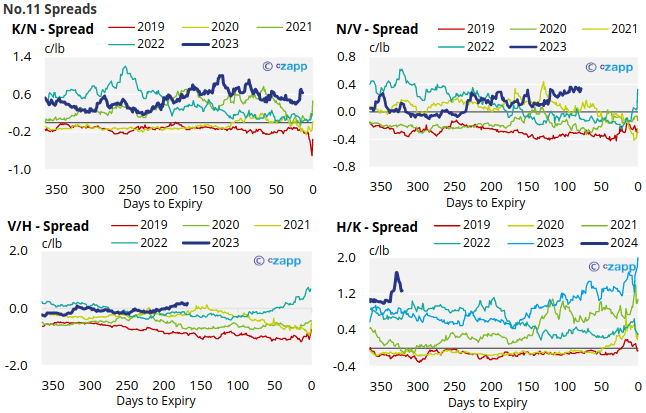

Last week the K/K sugar white premium expired at 152USD/tonne.

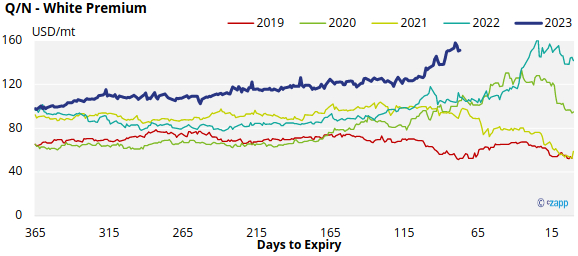

The Q/N sugar white premium currently trades above 150USD/tonne. With world energy prices falling, we think re-exports refiners need around 125-140USD/tonne above the No.11 to profitably produce refined sugar.

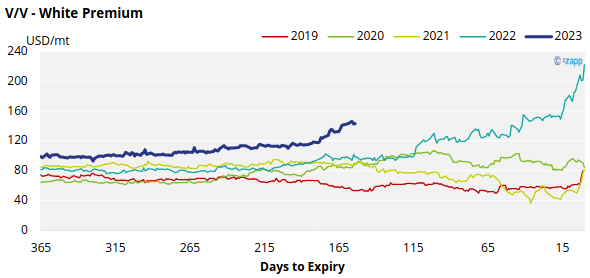

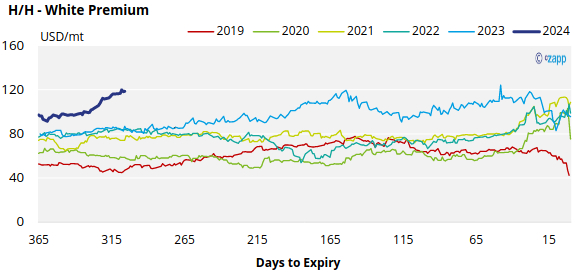

The refined sugar market is expected to be slightly undersupplied for the majority of 2023, as evidenced by comparatively strong V/V and H/H white premiums, which now approach 143USD/tonne and 119UD/tonne, respectively.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix