Insight Focus

Sugar futures continue to drift lower. Speculative interest in the market remains low.

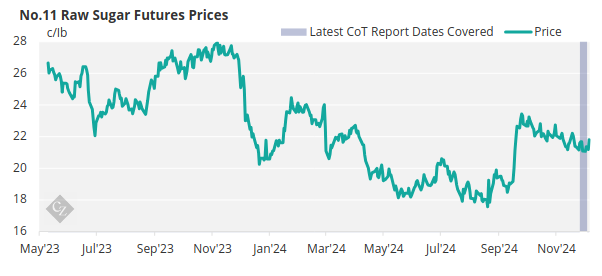

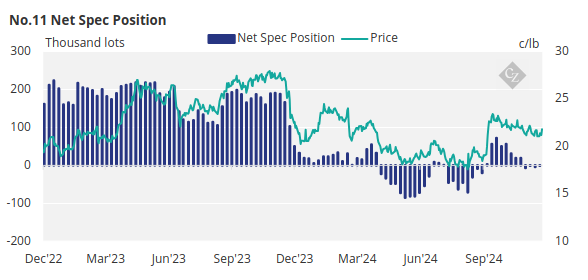

New York No.11 Raw Sugar Futures

Raw sugar futures have been drifting lower for all of Q4’24. They are now threatening to fall below recent lows of 20.70/21c.

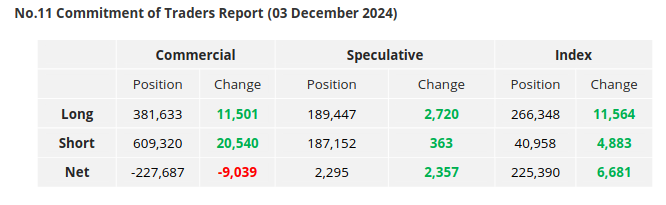

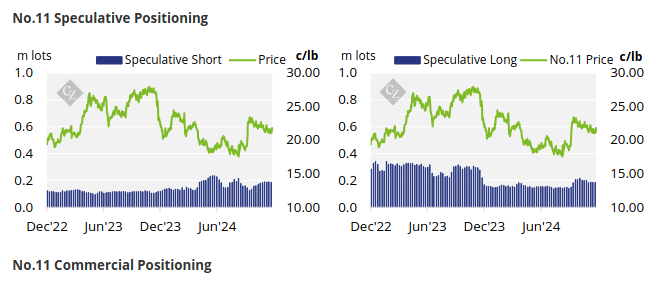

Speculators remain on the sidelines. The net spec position has been essentially zero since the start of November and there’s been no major change in the past month.

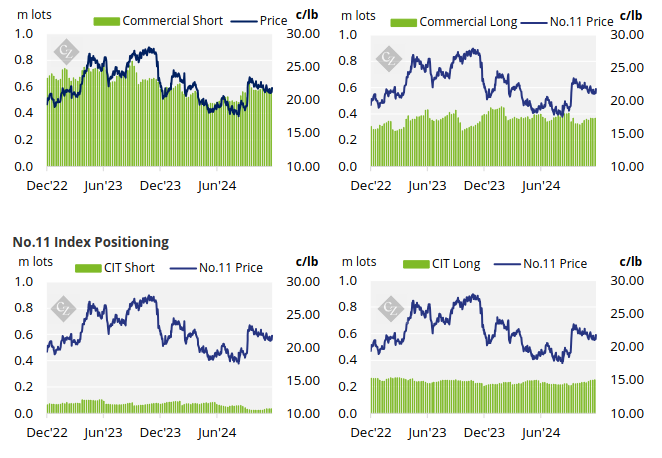

Most of the week’s price action has instead been hedging. Producers sold 20.5k lots in the week; end users bought 11.5k lots. The index net long has risen to its highest level since the middle of 2022.

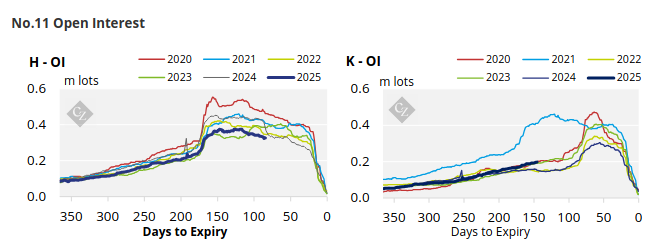

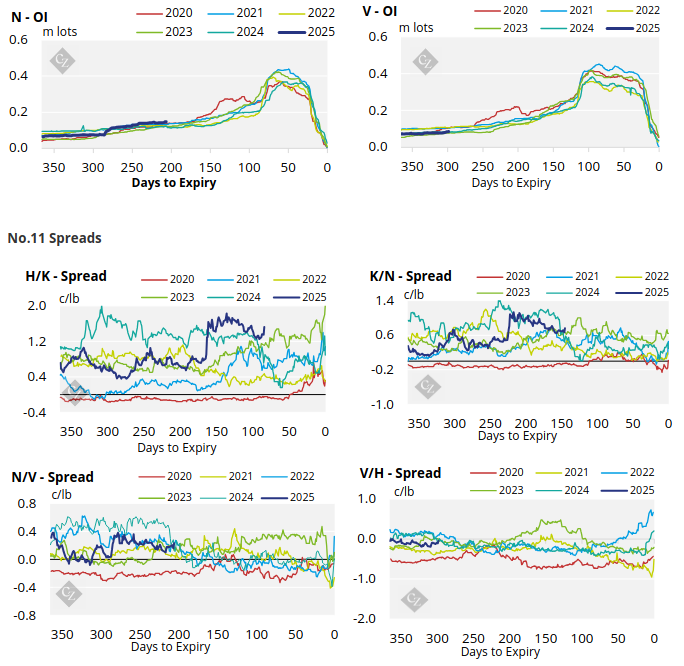

The No. 11 forward curve remains backwardated for almost every spread.

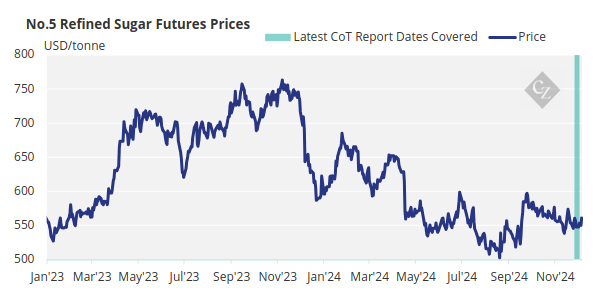

London No.5 Refined Sugar Futures

The No. 5 refined sugar futures have weakened towards recent lows of USD 522/tonne in the past week.

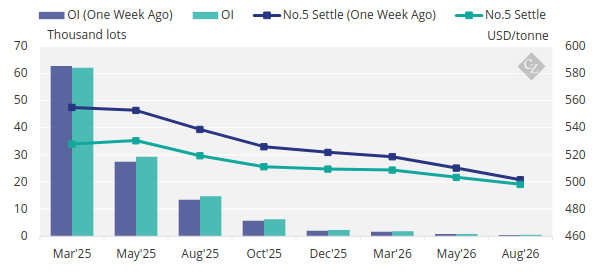

No.5 Open Interest

The No.5 refined sugar futures curve has weakened across the board.

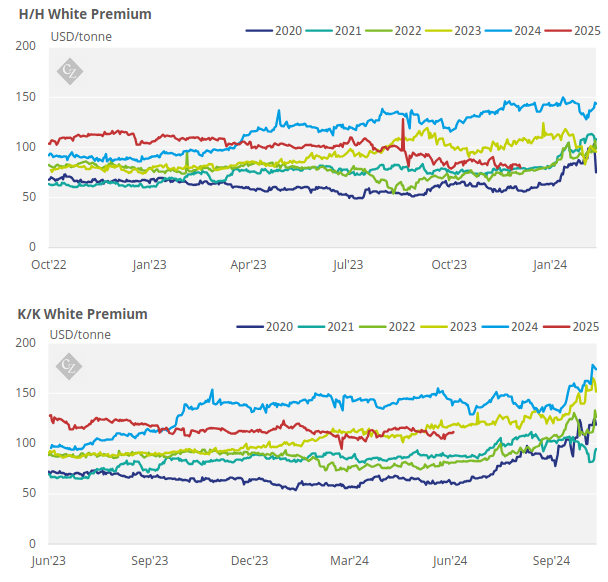

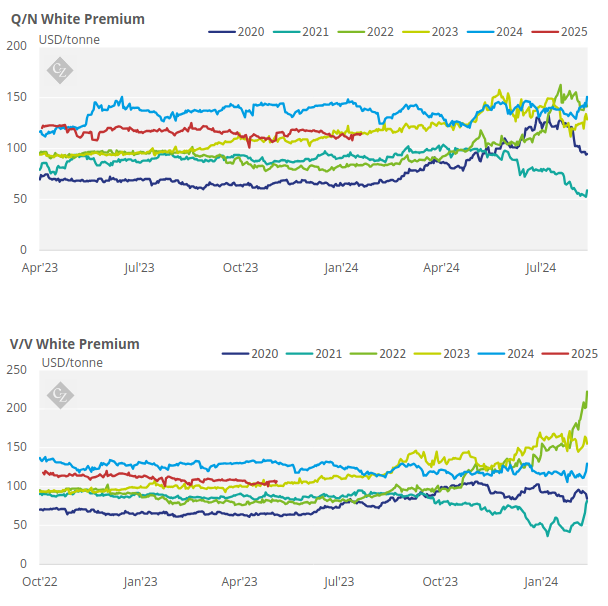

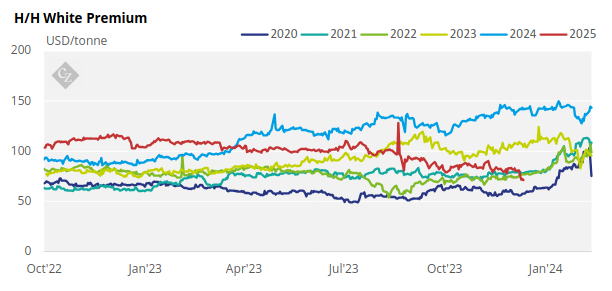

White Premium (Arbitrage)

The H/H white premium has weakened sharply in the past week.

It is now below the level at which many of the world’s re-export refiners can operate profitably.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

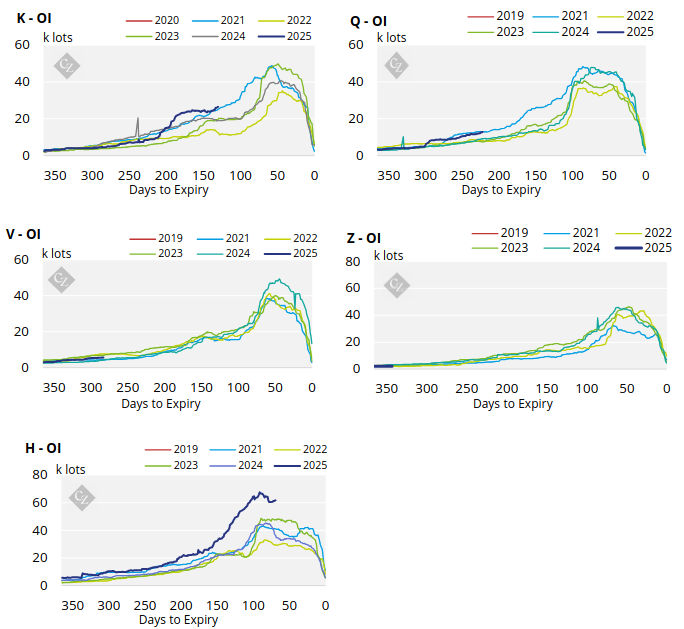

No.5 Open Interest

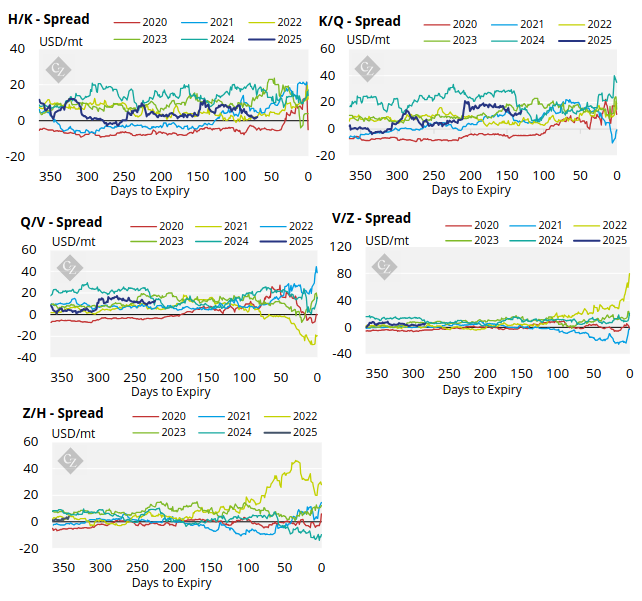

No.5 Spreads

White Premium Appendix