Insight Focus

- Both the No.11 and No.5 sugar futures have strengthened over the past week.

- Refined sugar speculators have increased their long positions.

- Raw Sugar Speculators have not been heavily active in the market.

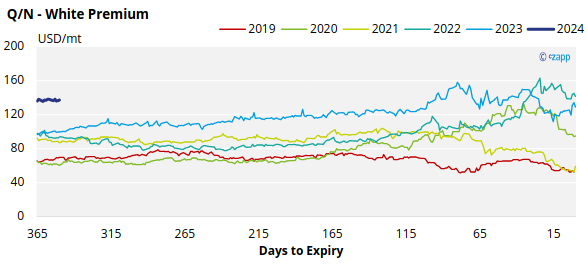

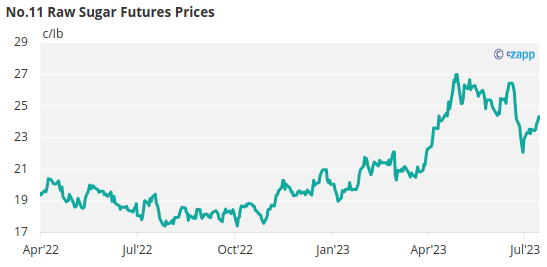

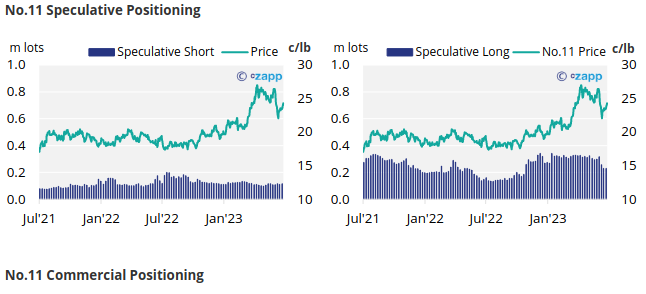

New York No.11 Raw Sugar Futures

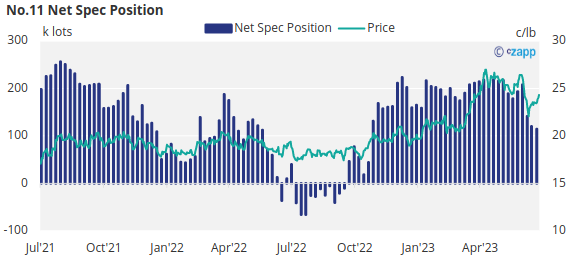

The No.11 sugar futures has strengthened over the last week, going from 23.4c/Ib at the start of the week to 24.3c/Ib by Friday’s close.

Following several weeks of reduced activity, both consumers and producers have been active in the last week, with consumers adding around 9k lots of new positions and producers adding 6.6k lots of short positions.

That said, raw sugar speculators have opened over 4k lots of short positions and closed around 1.5k lots of long positions.

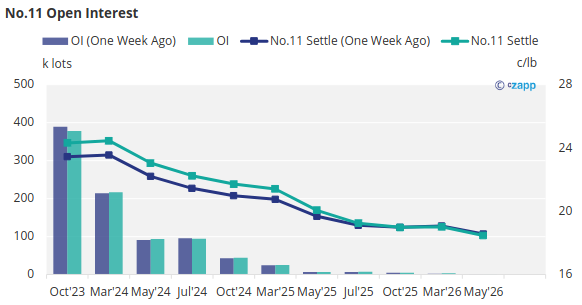

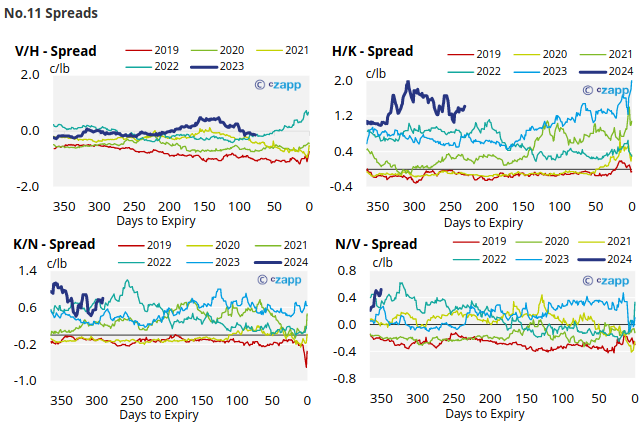

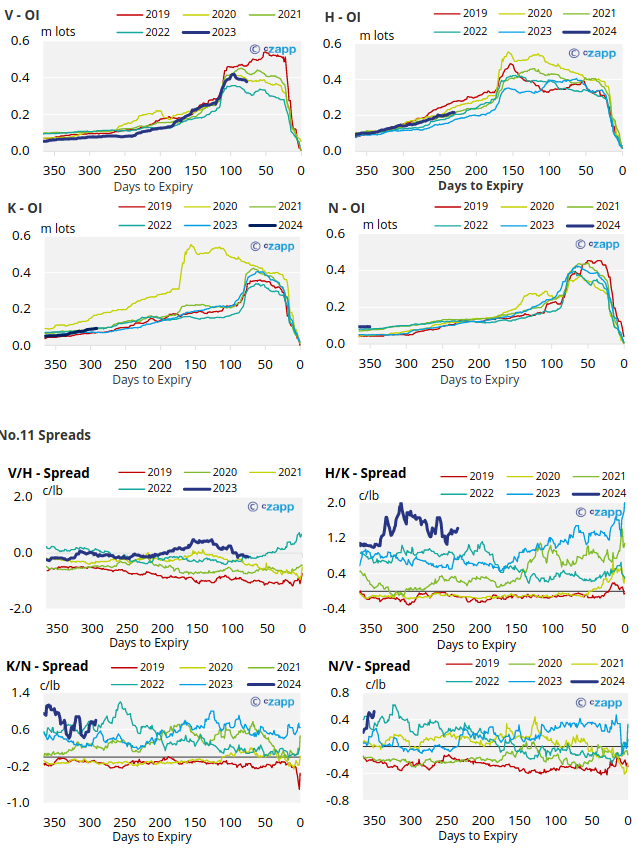

With contracts strengthening slightly across the board, over the last week, the No.11 curve remains inverted in 2024 and 2025.

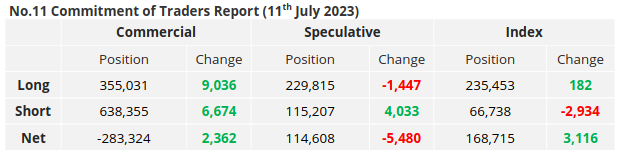

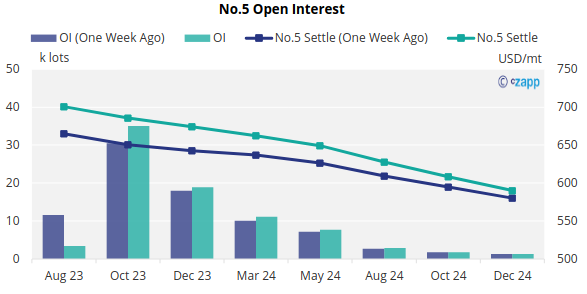

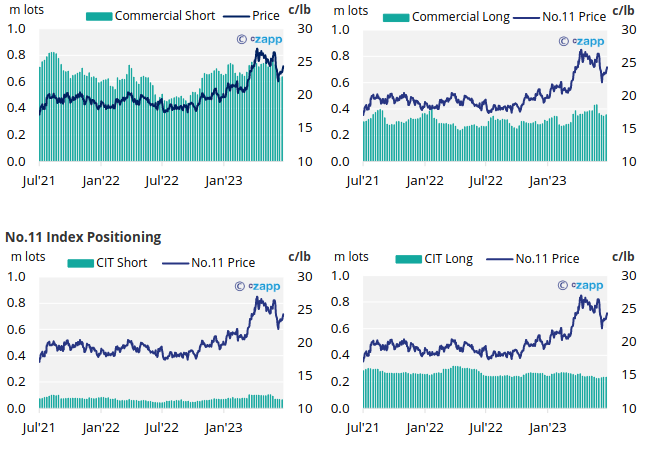

London No.5 Refined Sugar Futures

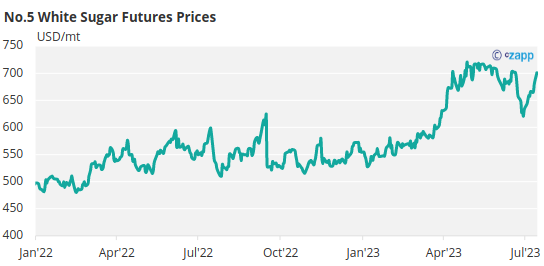

The No.5 refined sugar prices has been on an uptrend for a few weeks, reaching 685.7USD/mt on Friday.

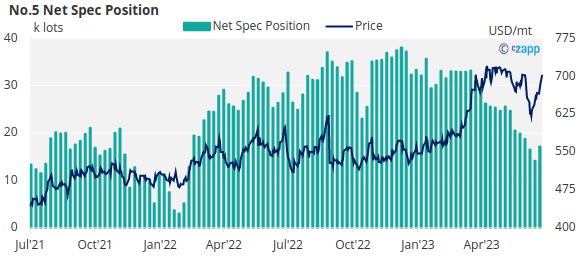

Refined sugar speculators have been decreasing their net spec positions for months since April, despite the market reaching decade-high prices.

That said, following the No.5 futures expiry, speculators have increased their net spec positions by 3k lots over the last week, bringing the total net spec positions to just over 17k lots.

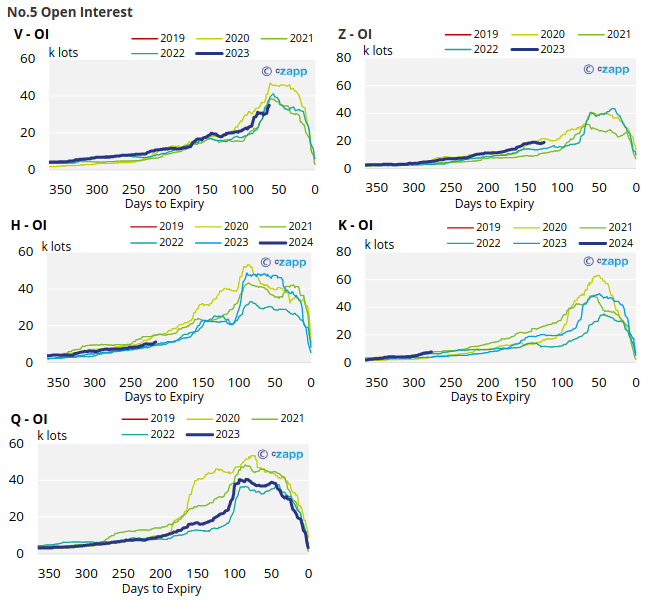

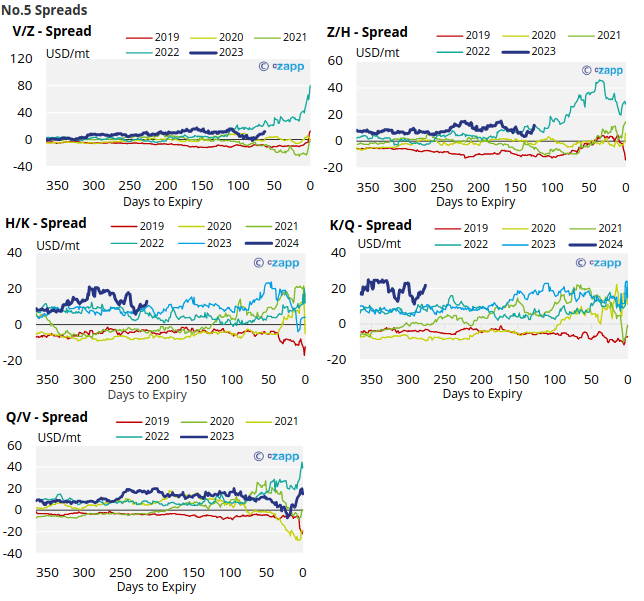

With contracts strengthening across the board, the No.5 forward curve remains inverted through to December 2024.

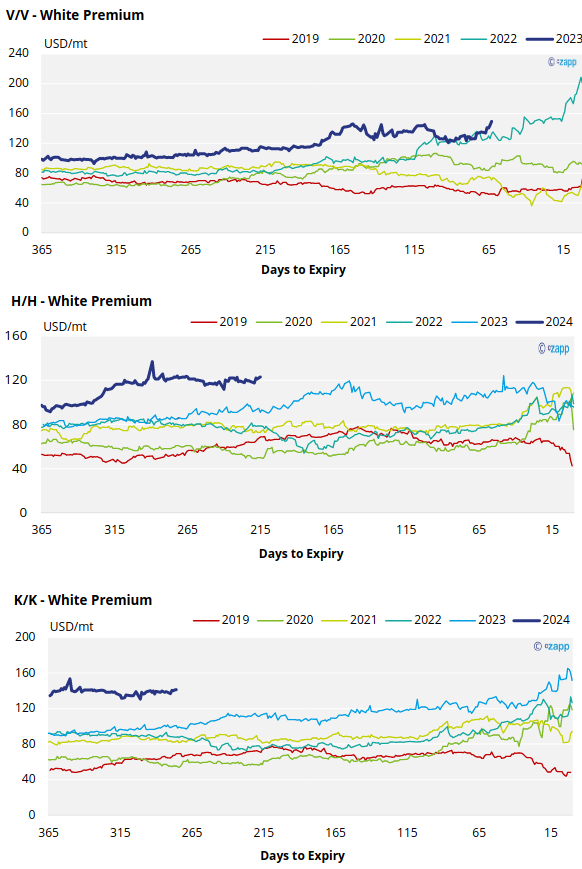

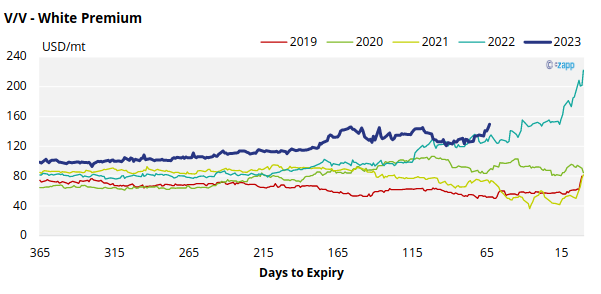

White Premium (Arbitrage)

The V/V sugar white premium has increased to 149.5USD/mt, up 14USD from the previous week.

Many re-exports refiners need around 110-120USD/mt above No.11 to produce refined sugar, so the current white premium is enough to encourage this.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.11 Open Interest

No.5 (White Sugar) Appendix

White Premium Appendix