Insight Focus

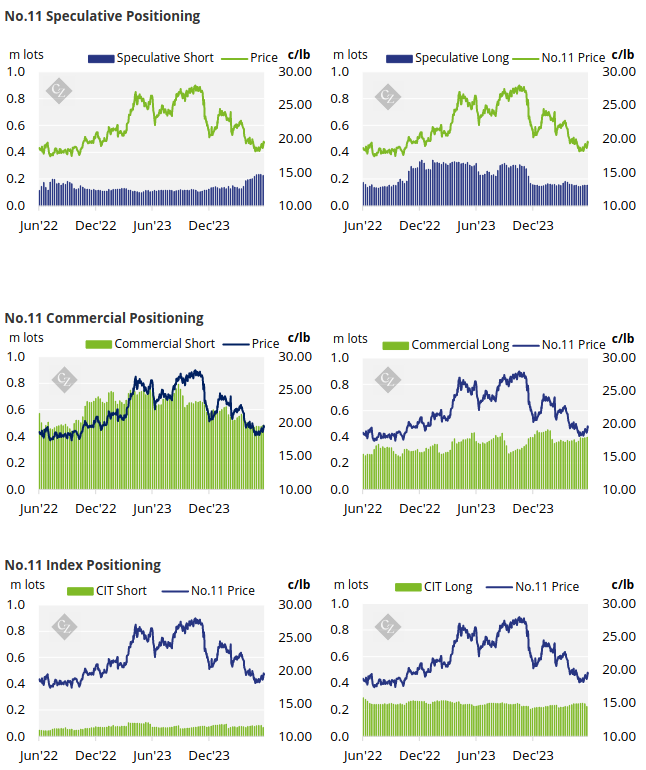

Raw sugar futures have strengthened. Producers sold into the price strength. The index position has fallen.

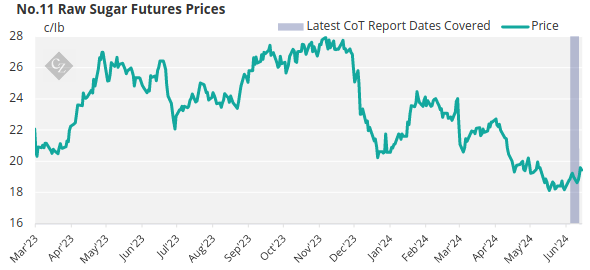

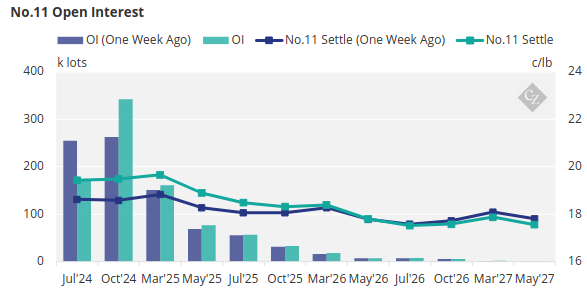

New York No.11 Raw Sugar Futures

The raw sugar futures market continued to trade in the 18-19c/lb range before strengthening by the middle of the week, hitting 19.4c/lb by Friday’s close.

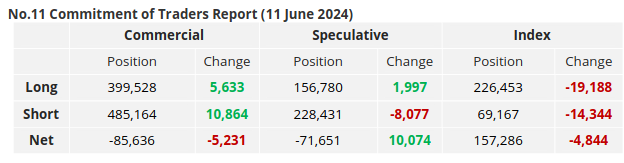

Producers have clearly taken advantage of the price strength amidst their low hedge cover, adding 10.9k lots of short positions. While end-users have opened 5.6k lots of long positions.

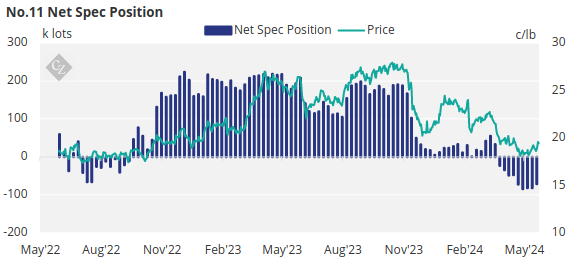

Speculators have closed out 8.1k lots of recently opened short positions and have added 2k lots of short positions. The net spec position remains short at -71.7k lots.

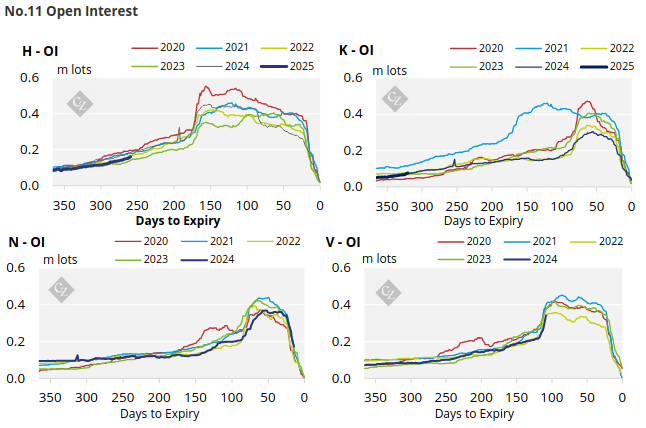

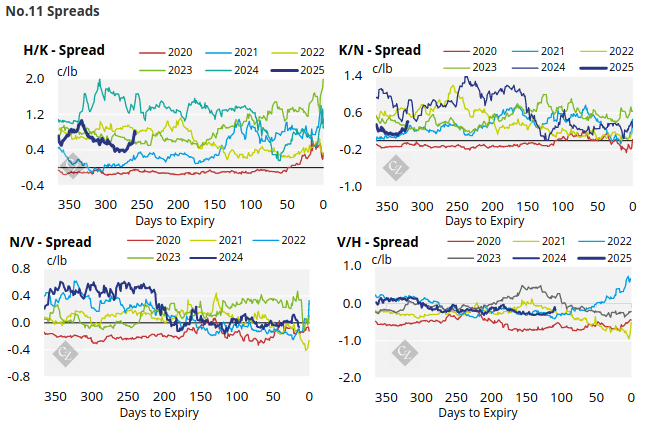

The No.11 futures curve has strengthened towards the front of the curve over the past week but remains flat across the board.

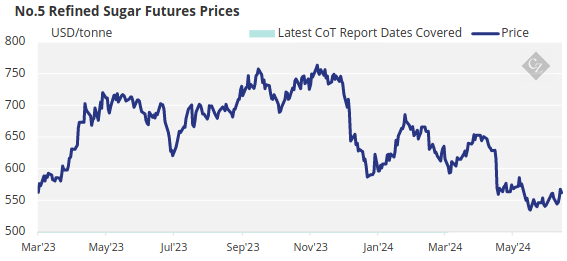

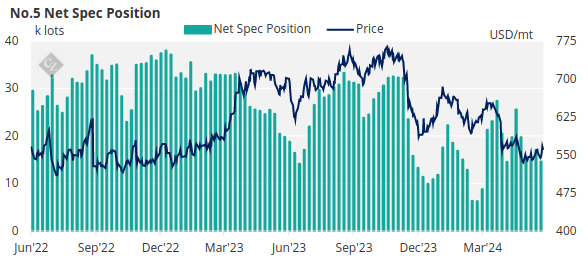

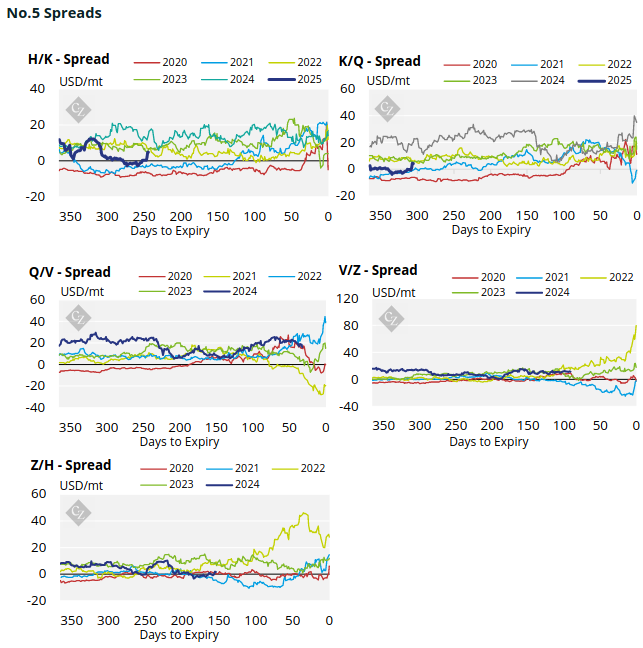

London No.5 Refined Sugar Futures

The No.5 refined sugar futures traded higher in the past week, closing at 562.1 USD/mt on Friday.

Speculators closed out 2.5k lots of longs, bringing the net spec position down to 14.6k lots.

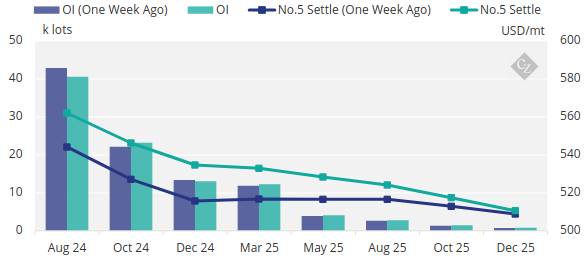

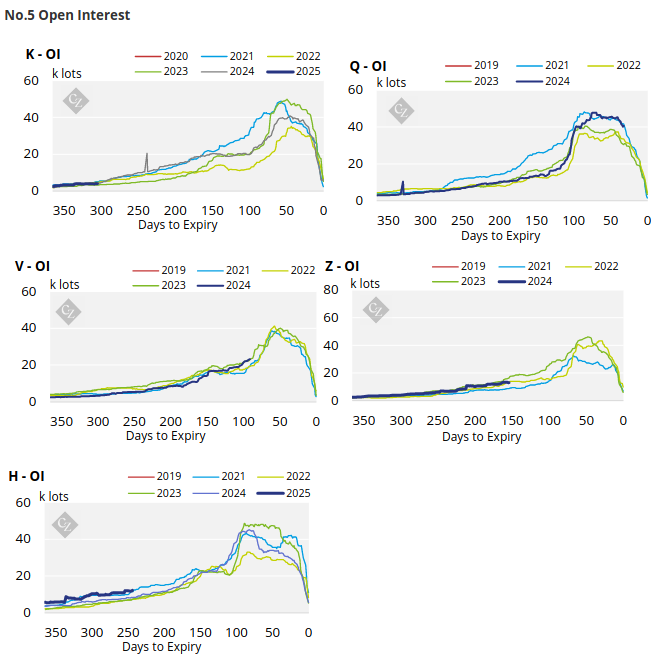

No.5 Open Interest

The refined sugar futures curve has strengthened significantly over the past week but remains in backwardation through to Dec’24.

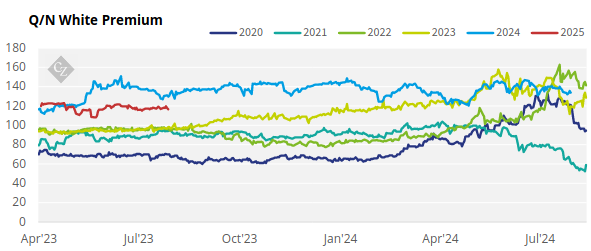

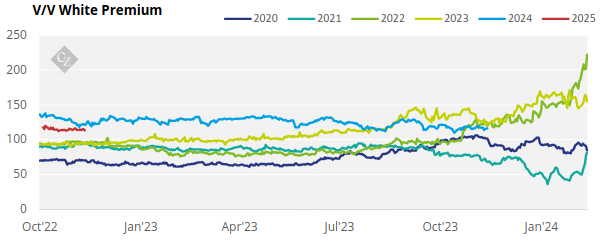

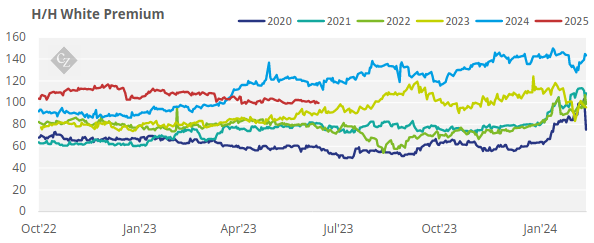

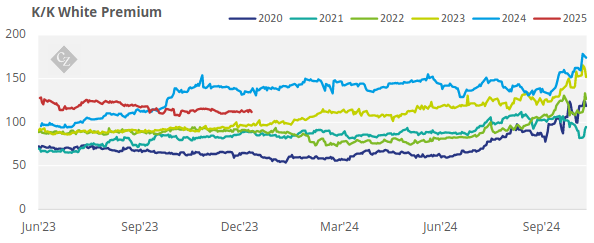

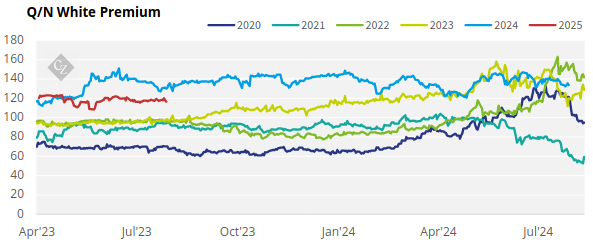

White Premium (Arbitrage)

The Q/N white premium has traded slightly lower over the past week, closing at 133.8 USD/mt on Friday.

Many re-exports refiners need around 105-115USD/mt above the No.11 to profitably produce refined sugar. The current white premium is well above this level, which means we should theoretically see a pick-up in demand soon.

For a more detailed view of the sugar futures and market data, please refer to the appendix below

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix