Insight Focus

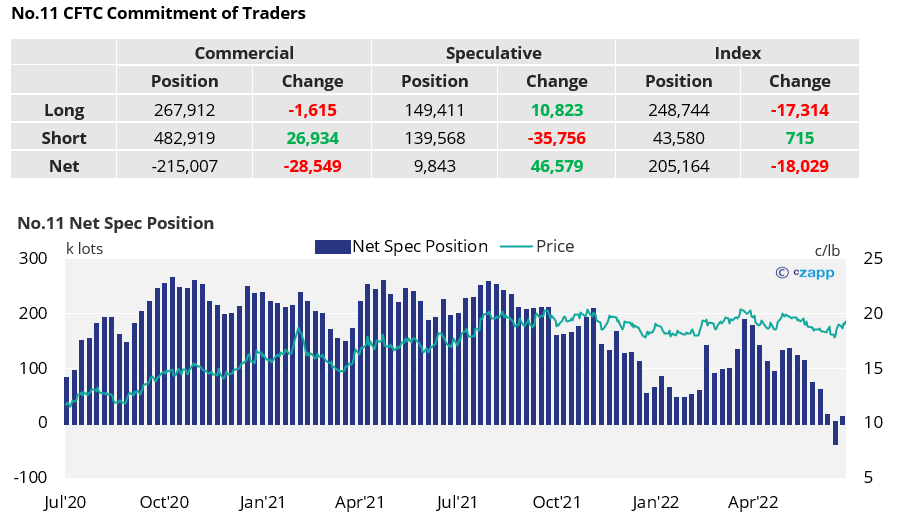

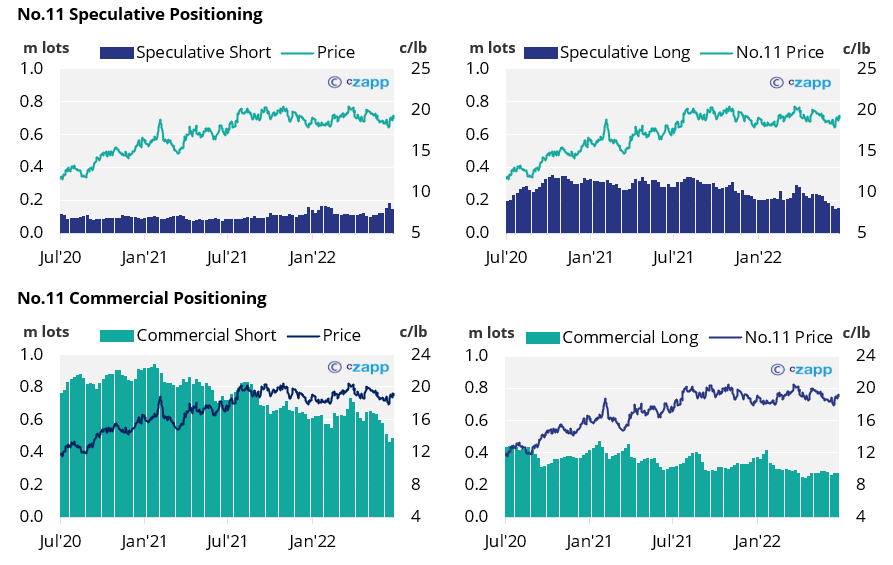

- Many recently opened speculative short positions have been reversed.

- Producer hedging has picked up following higher prices.

New York No.11 (Raw Sugar)

- No.11 prices have maintained around 19c/lb after falling below 18c at the beginning of the month.

- This sustained pressure on many recent speculative short positions, opened when the market was below 18.5c/lb, has meant that over 35k lots of short positions have been closed by the 12th of July.

- The net spec position has returned towards neutrality at 10k lots as speculators are again net long of sugar.

- Raw sugar producers have capitalised on strengthening prices, adding almost 27k lots of hedges to the 12th of July, this has reversed a recent trend of falling open interest by producers.

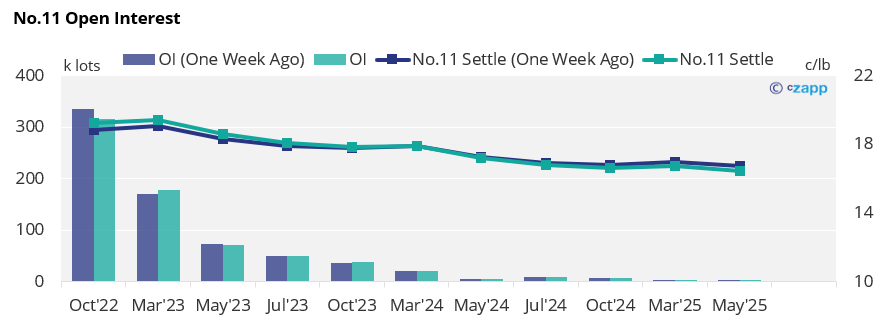

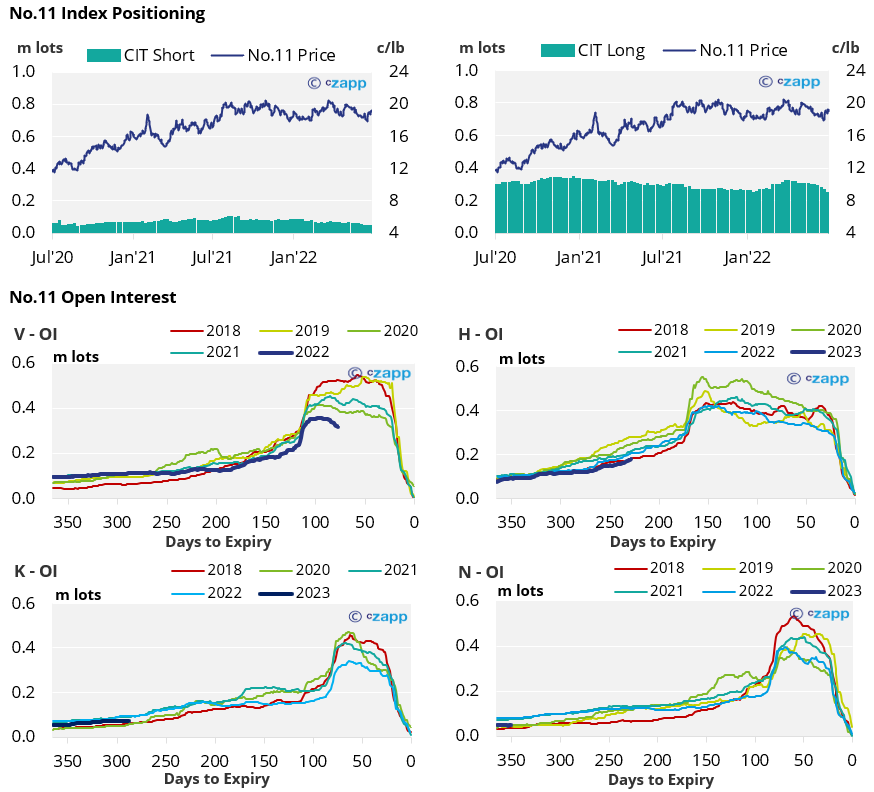

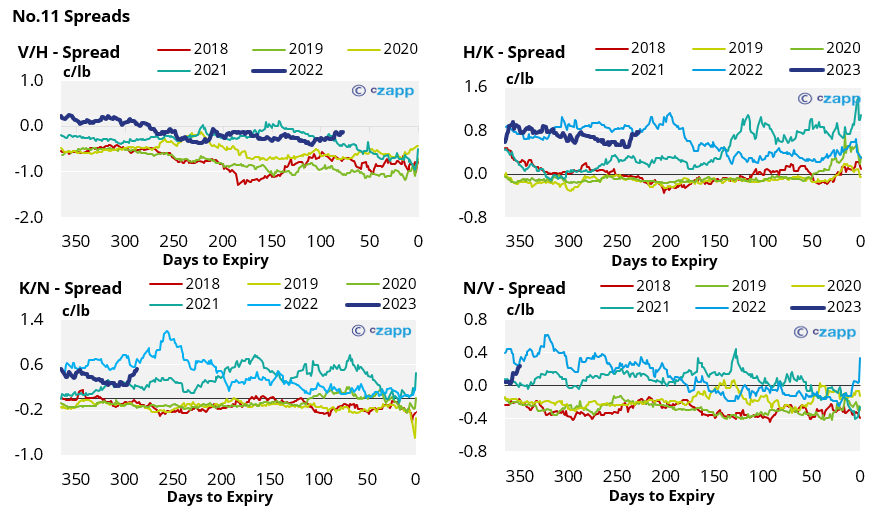

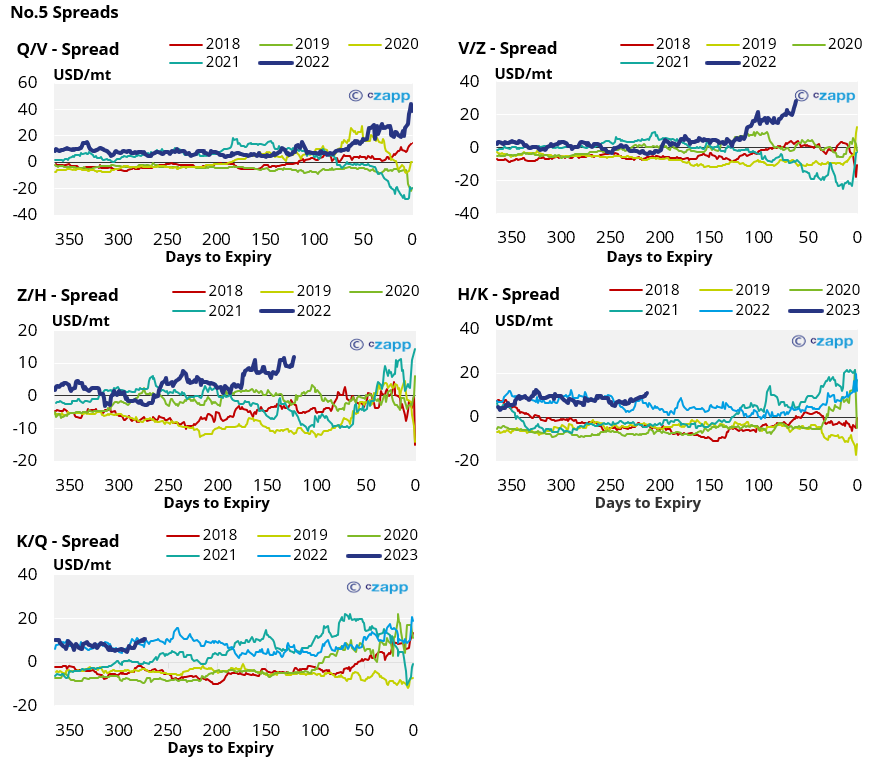

- The No.11 forward curve is still flat in 2022, becoming backwardated into 2023.

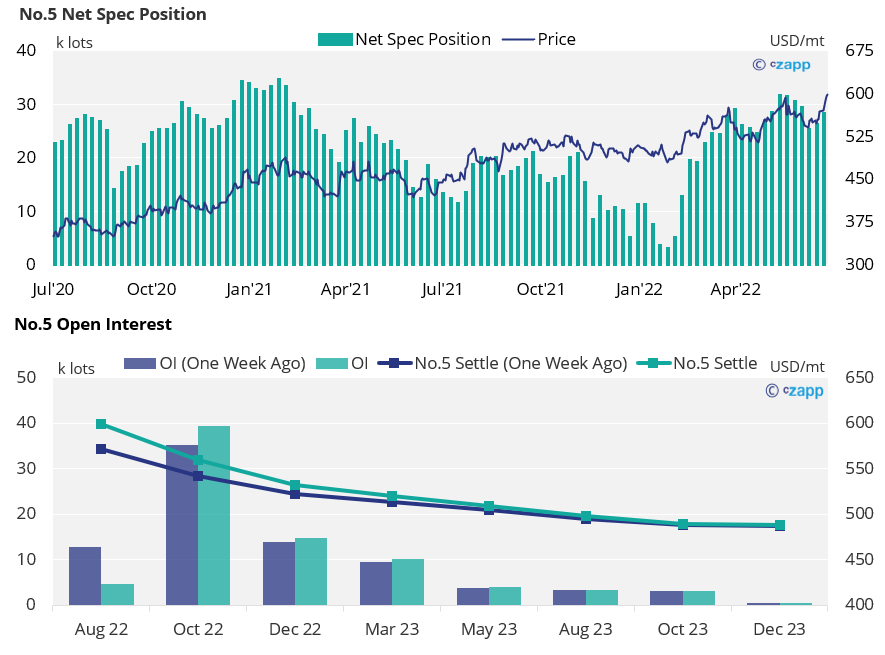

London No.5 (White Sugar)

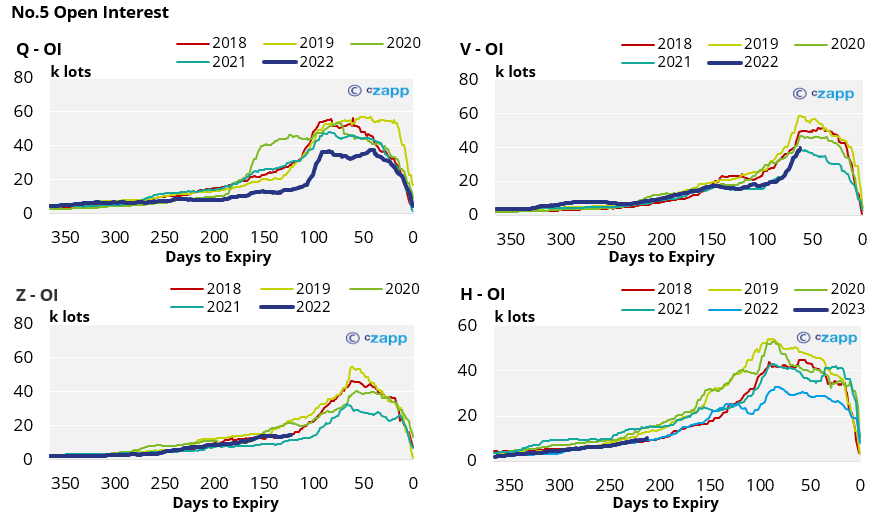

- Following the Aug’22 white sugar contract expiry at the end of last week, the No.5 has strengthened near 560USD/mt.

- As of the 12th of July, the net spec position has moved 2k lots higher as white sugar speculative sentiment remains bullish.

- With the Aug’22 now expired; the white sugar forward curve has flattened but remains backwardated for at least the next 12 months.

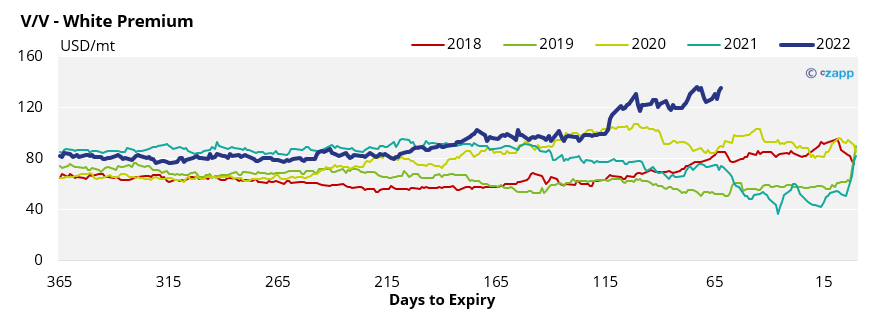

White Premium (Arbitrage)

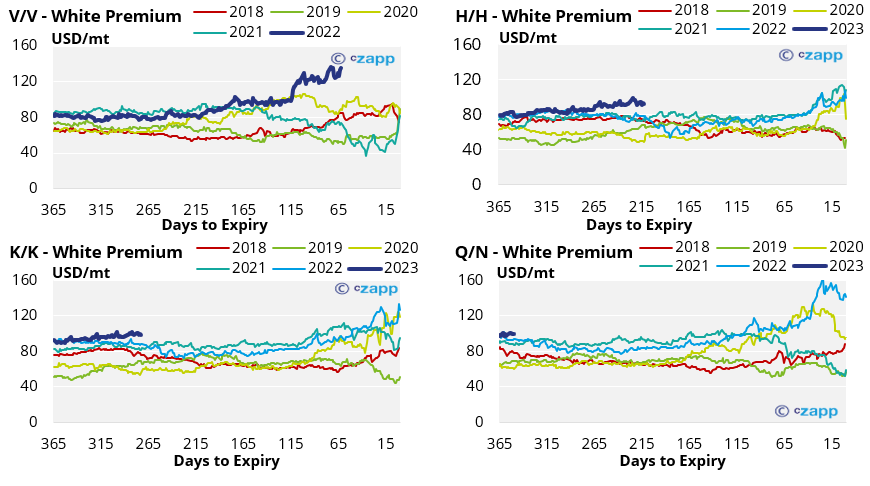

- Relative strength in the No.5 has allowed the V’22/V’22 white premium to widen above 135USD/mt.

- Despite this, some re-export refiners could still struggle to operate profitably which could reduce short term refined sugar supply if this level persists.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

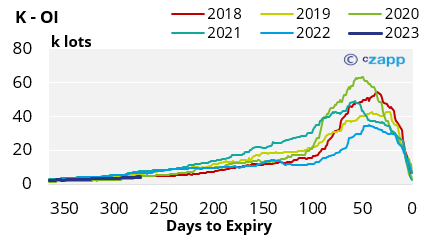

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…

European PET Market Stumbles as Producers Left Blind on Costs