Insight Focus

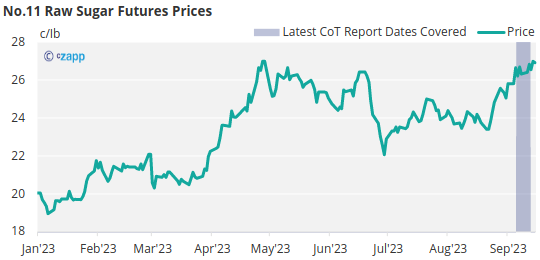

- The No.11 sugar futures traded sideways, hovering around 26c./Ib.

- Producers continue to hedge into these higher prices.

- The H/H white premium currently stands at 125USD/mt.

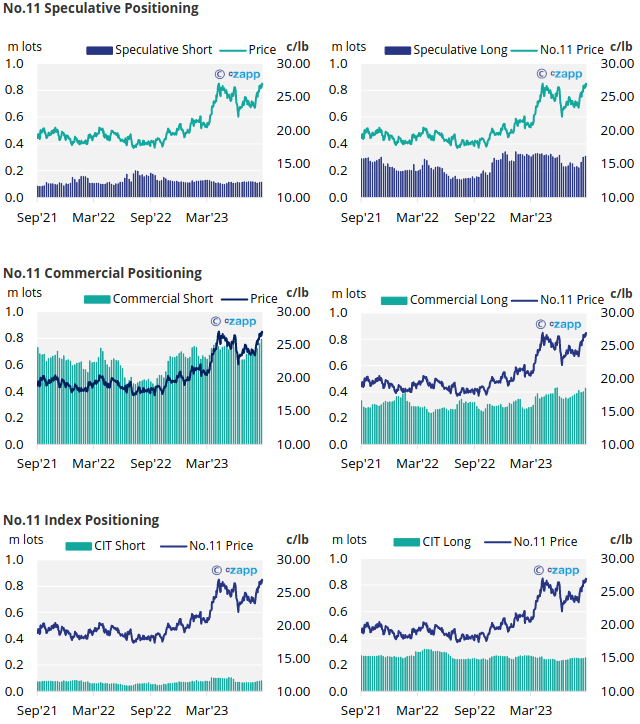

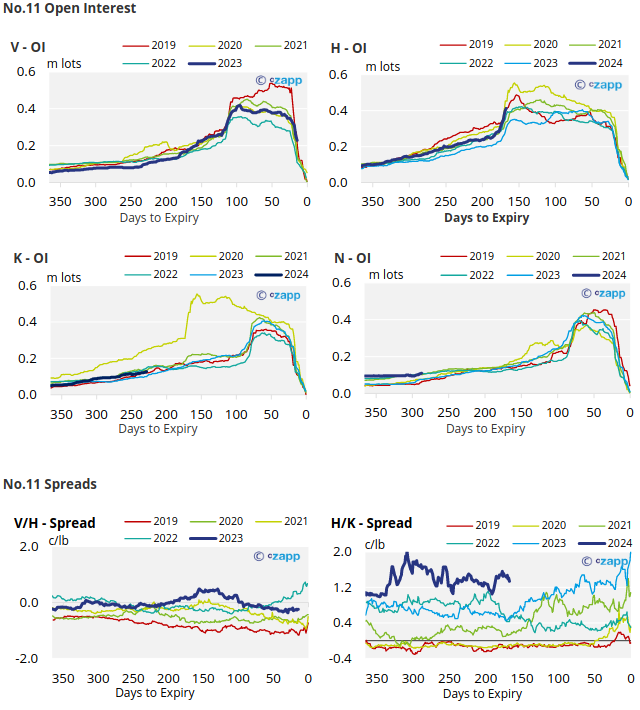

New York No.11 Raw Sugar Futures

The No.11 sugar futures traded sideways over the past week, hovering around 26c/Ib.

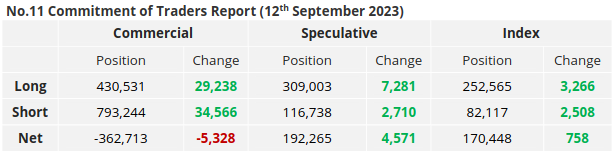

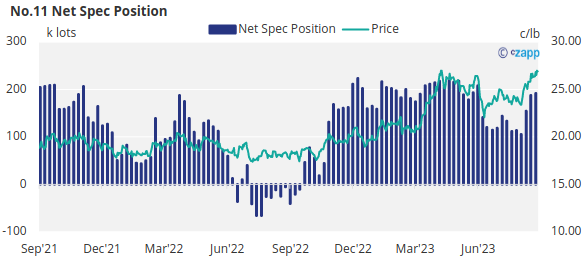

With raw sugar prices at 26c/Ib for the second week in a row, producers added 34.6k lots of new hedges. Consumers also added to their cover, by around 29.2k lots. This is likely to have been final book-management ahead of the October’23 raw sugar futures expiry.

Turning our attention to the speculators, they have also increased their long and short positions, adding around 7.2k lots and 2.7k lots, respectively.

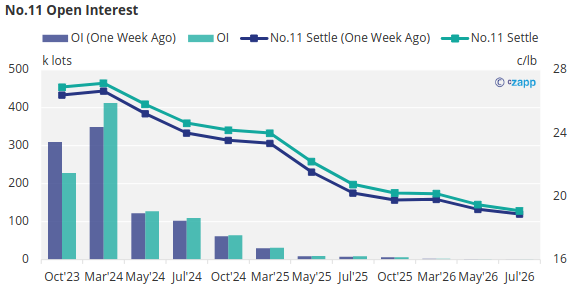

With contracts strengthening across the board, the No.11 forward curve remains inverted in 2024 and 2025.

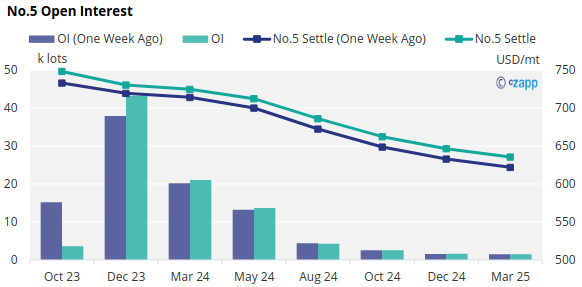

London No.5 Refined Sugar Futures

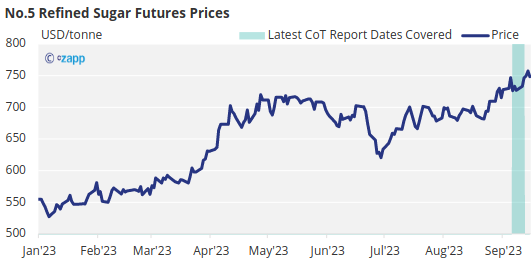

Over the course of last week, in the days leading up to the No.5 futures expiry, the No.5 sugar futures rose from 719USD/m at the start of the week to 730USD/mt last Friday.

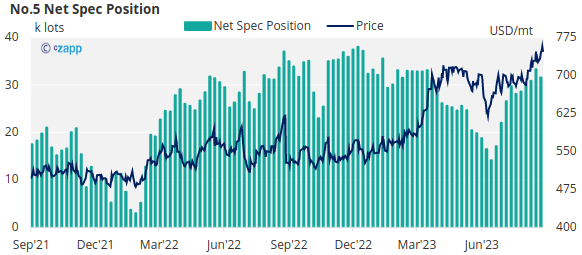

During this timeframe, speculators decided to close out approximately 1.8k lots of positions, reducing net spec position to 31.5k lots.

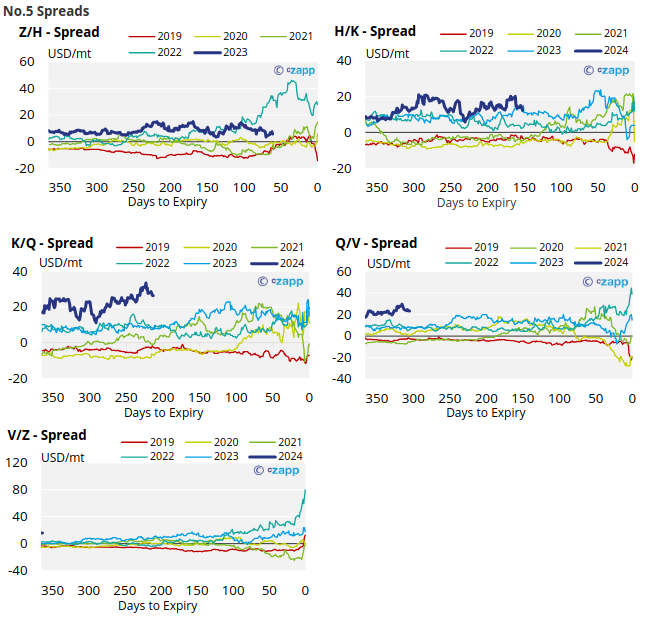

With contracts strengthening cross the board, the No.5 forward curve remains inverted.

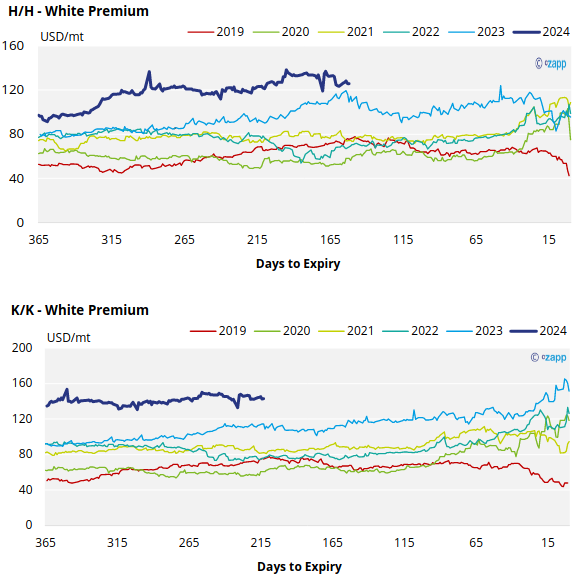

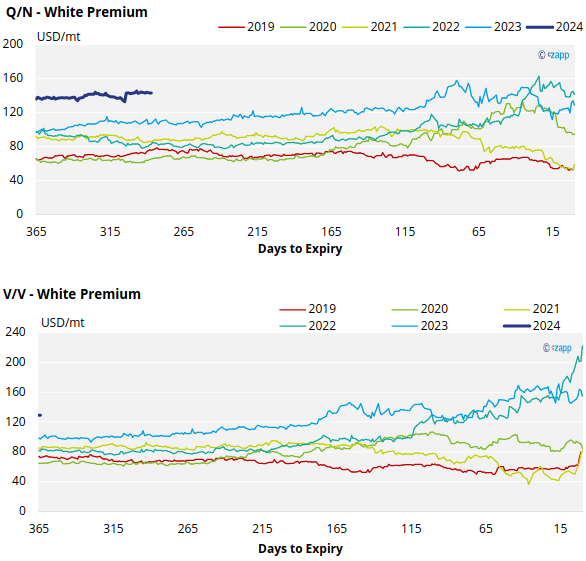

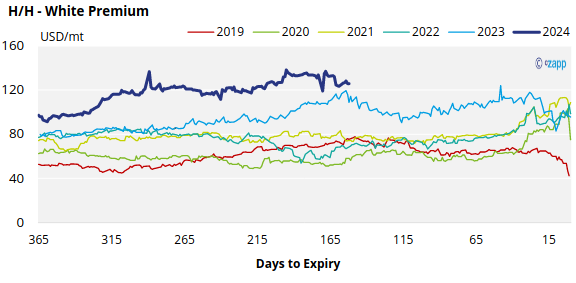

White Premium (Arbitrage)

With the No.5 and No.11 making similar moves in recent weeks, the H/H white premium has been hovering around 125USD/mt.

The refined sugar market is expected to be slightly undersupplied for the remainder of 2023 and the majority of 2024, as evidenced by comparatively strong K/K and Q/N white premiums, both of which are currently standing at 143USD/mt.

We believe that many re-export refiners require at least 90-105USD/tonne over the No.11 to be profitable, which means that the spot white premium provides comfortably enough for these refiners to maximize their throughput.

At this level, higher-cost or discretionary refiners may begin to consider re-exporting in addition to serving their domestic markets.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

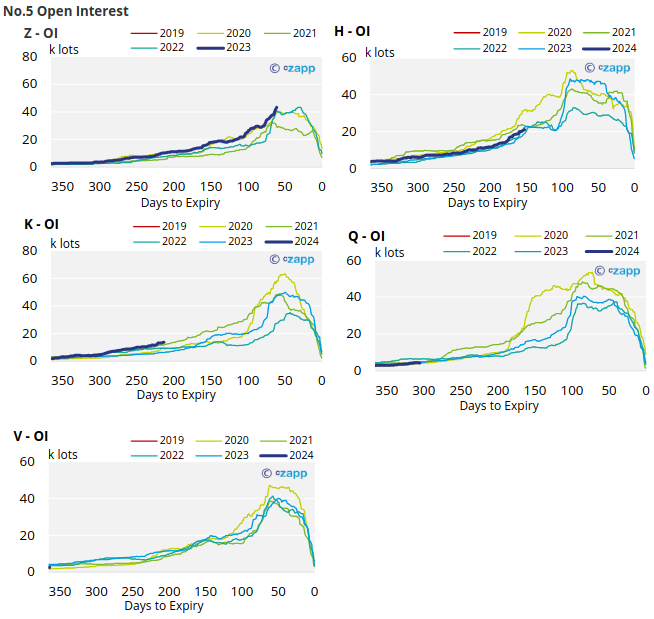

No.5 (White Sugar) Appendix

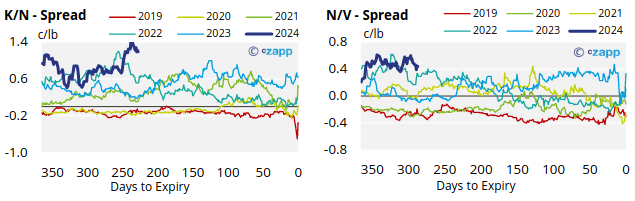

White Premium Appendix