Insight Focus

- The No.11 is still trading above 20 c/lb.

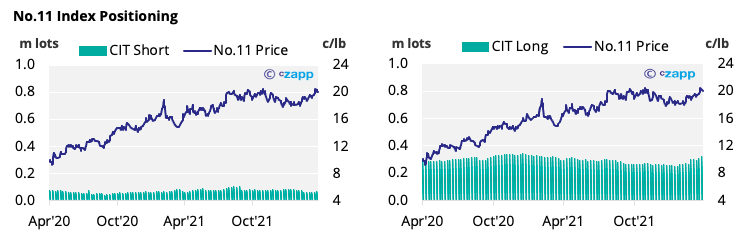

- Speculators have continued to buy.

- Sugar producers have taken advantage of strong raw sugar prices.

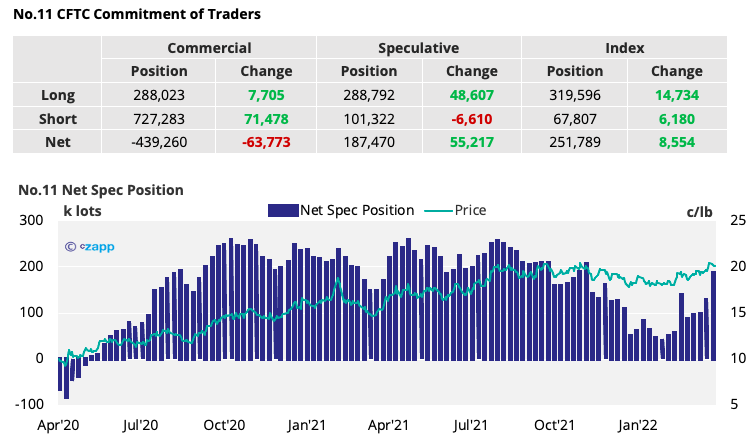

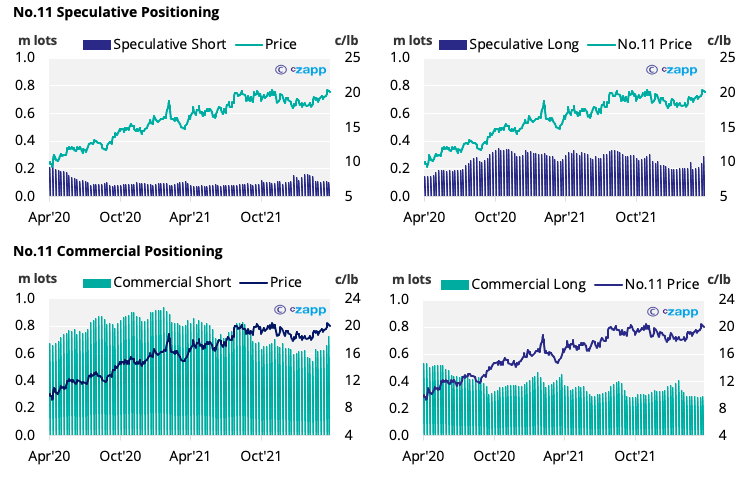

New York No.11 (Raw Sugar)

- The rally above 20 c/lb seen by the 12th April was fuelled by spec buying as almost 50k long positions were added.

- This brings the net spec position back to a level last seen in November 2021.

- The No.11 has maintained above 20 c/lb in the week since then.

- Producers continue to hedge strongly, adding more than 70k lots of short positions by the 12th April, leaving them very well covered.

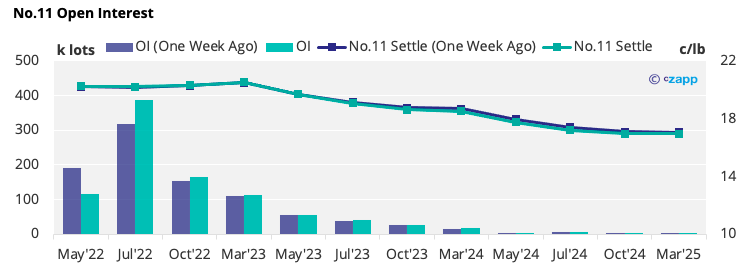

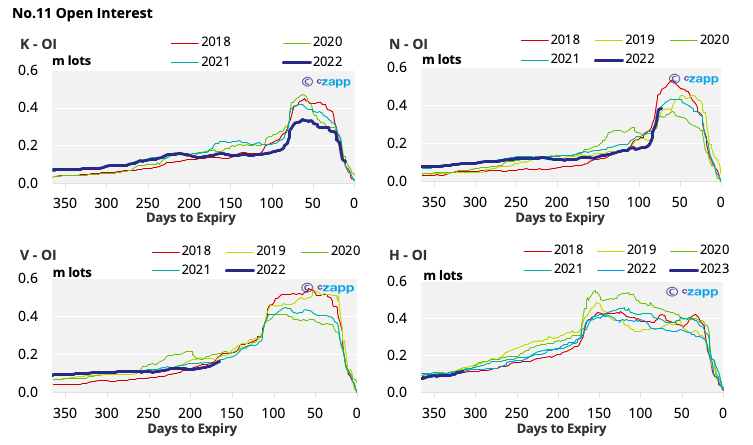

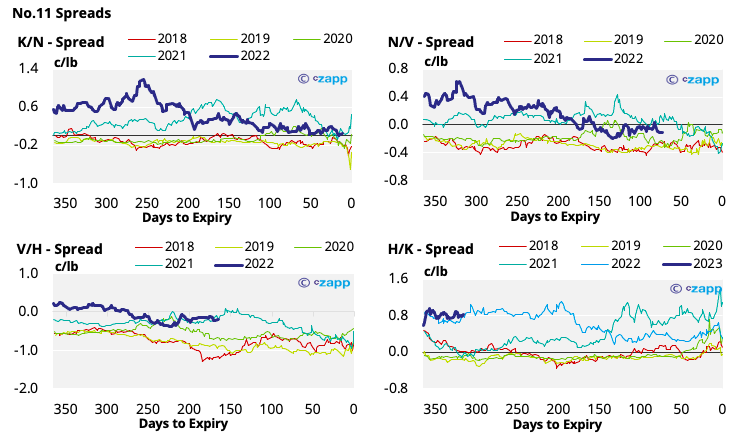

- The No.11 forward curve is still flat to March 2023.

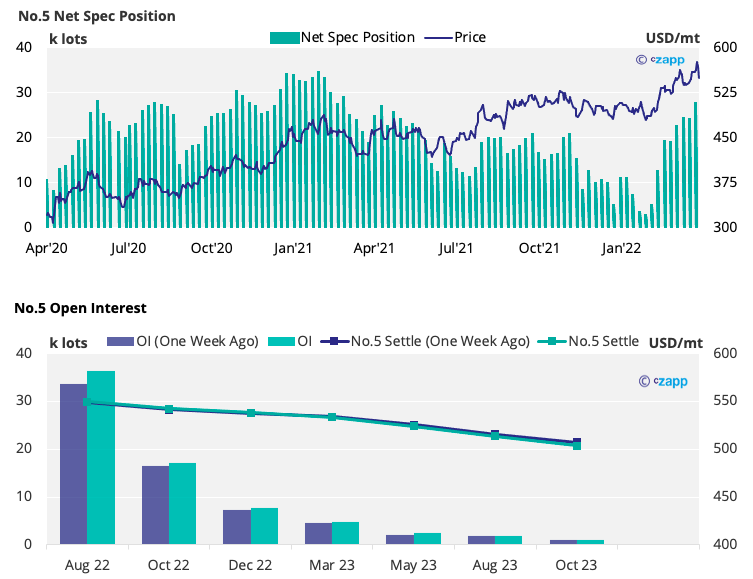

London No.5 (White Sugar)

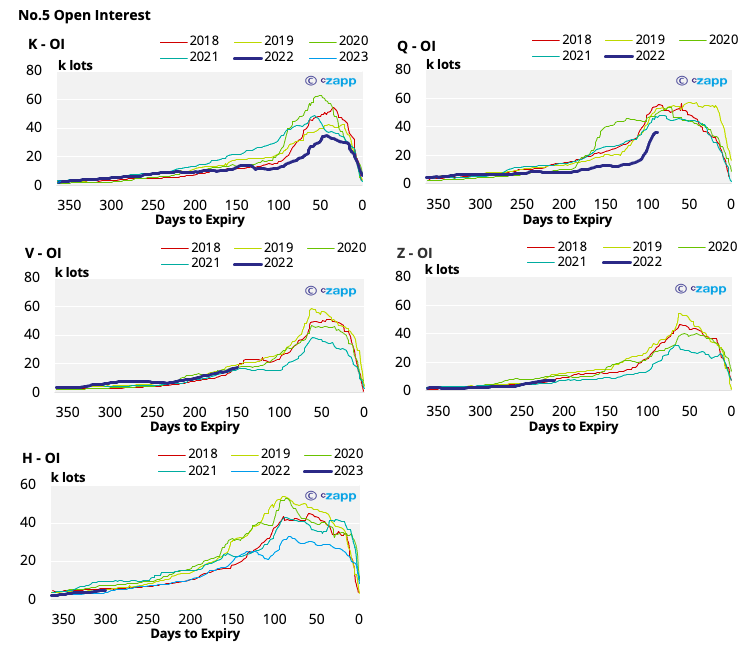

- CFTC data to the 12th April shows that the net spec position has risen further, reflecting No.5 peaks of around 560 USD/mt.

- White sugar prices have since retreated to around 540U SD/mt over the course of the last week as the August 2022 becomes the front month contract.

- The white sugar futures curve remains backwardated through till the end of 2023.

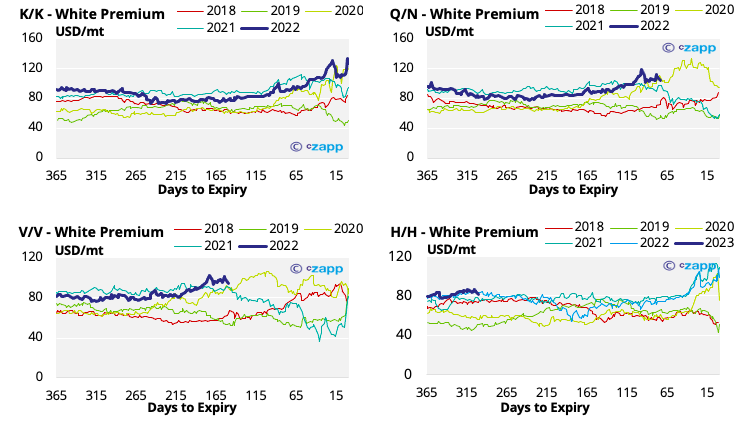

White Premium (Arbitrage)

- With the No.11 staying above 20c/lb and the No.5 falling, the August/July white premium has slid to 105 USD/mt.

- After accounting for increased energy prices, we think re-export refiners may struggle to operate profitably at this level.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

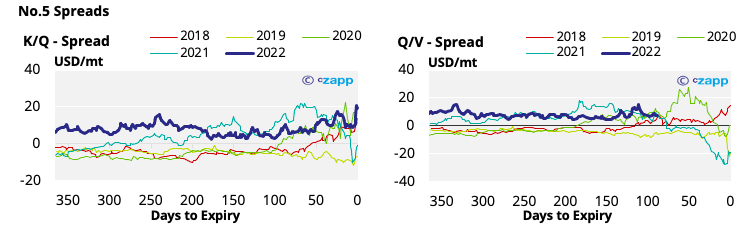

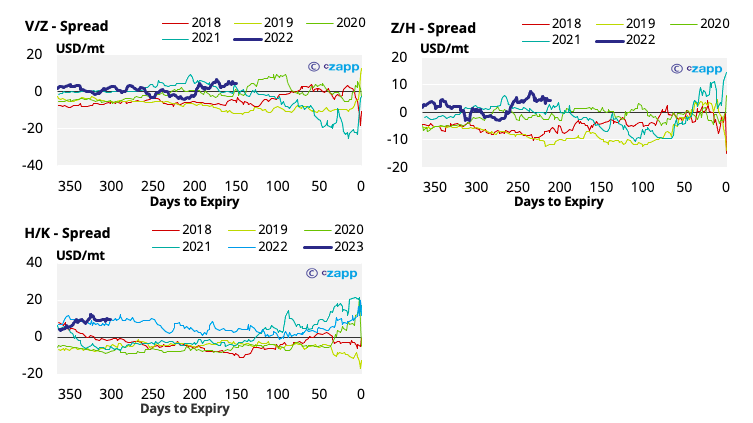

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…

Market View: Sugar & Soy Struggle for Space at Santos

Logistics Delays Hit Sugar Trade Flows

Other Insights That May Be of Interest…