Insight Focus

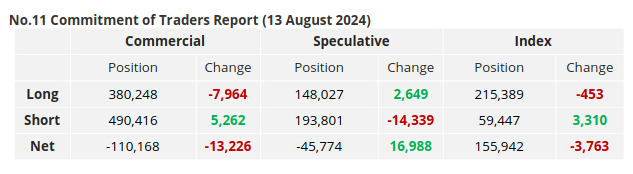

Raw sugar futures traded sideways between 17-18.5c/lb. Speculators closed out some of their short positions. Specs remain net short.

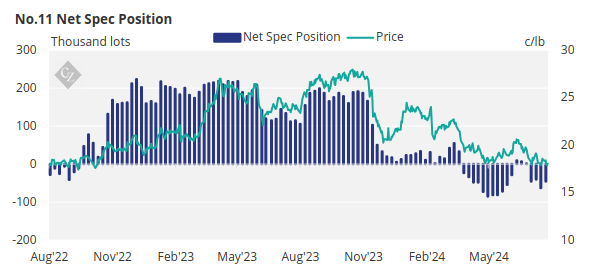

New York No.11 Raw Sugar Futures

The raw sugar futures market traded sideways between 17-18.5c/lb over the past week, closing at 18.03c/lb on Friday.

Speculators closed out 14,300 lots of shorts. Speculators further opened a minimal number of long positions, adding 2,600 lots.

Speculators are now net short in the sugar market by -45,800 lots.

Producers opened 5,300 lots of short positions while end-users closed out 8,000 lots of long positions, over the past week.

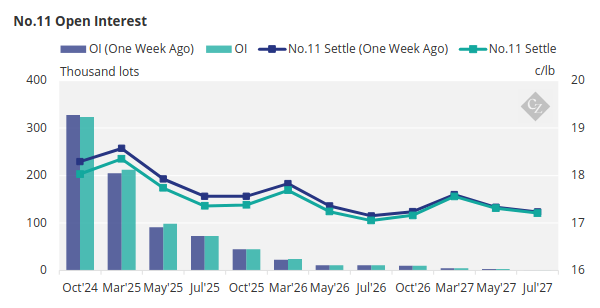

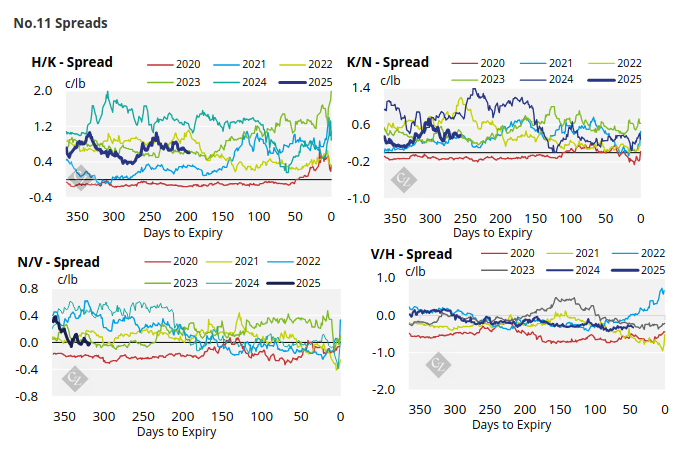

The No.11 futures curve has seen a slight decline across majority of the board but remains in backwardation from March’25 onwards.

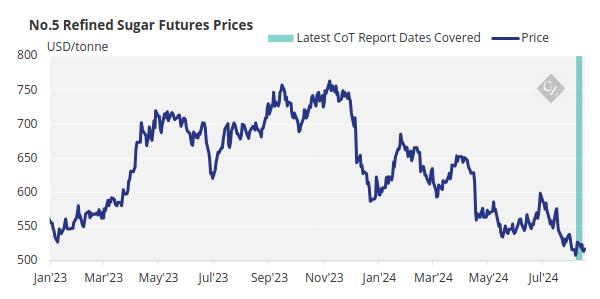

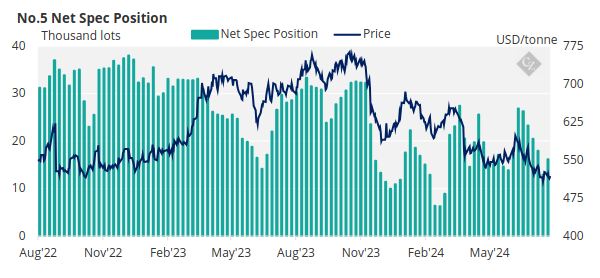

London No.5 Refined Sugar Futures

The No.5 refined sugar futures traded between USD 513-523/tonne over the past week, closing at USD 516.7/tonne on Friday.

Speculators opened 3,300 lots of longs bringing the net spec position up to 16,100 lots.

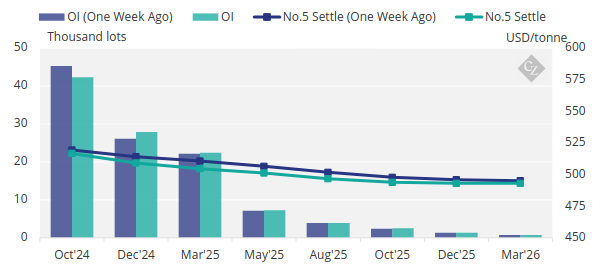

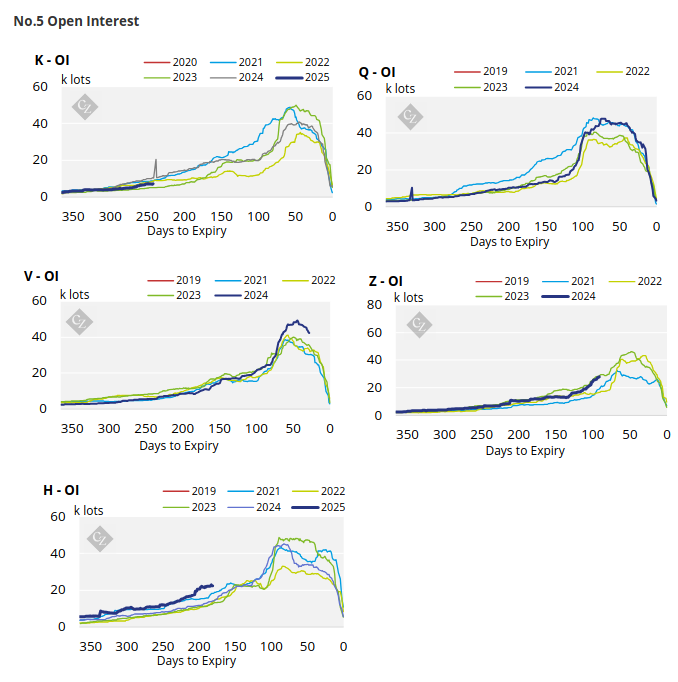

No.5 Open Interest

Following a similar trajectory to the No.11, the No.5 refined sugar futures curve has weakened slightly across the board.

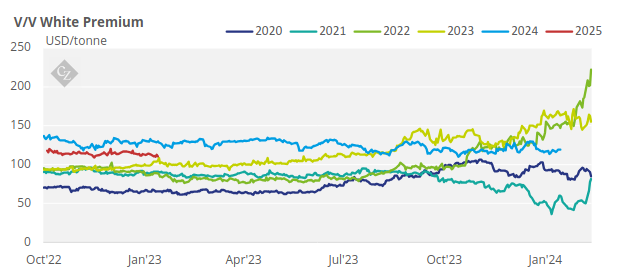

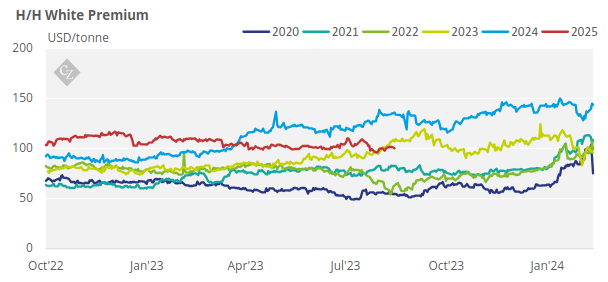

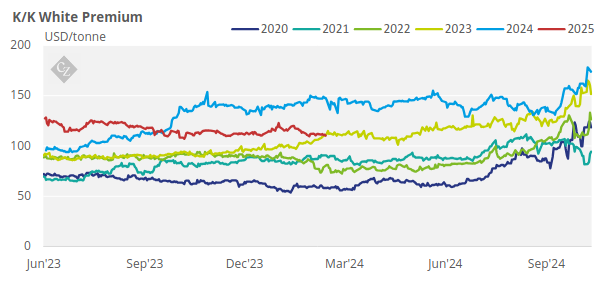

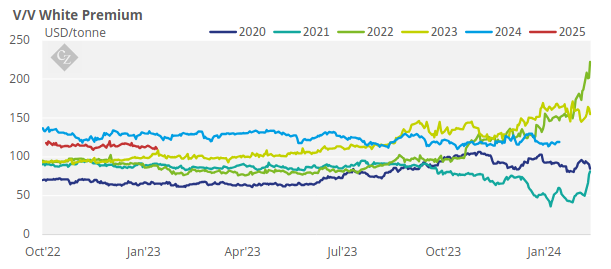

White Premium (Arbitrage)

The V/V white premium, traded between USD 116-119/tonne, closing at USD 119.2/tonne on Friday.

Many re-export refiners need around USD 105-115/tonne above the No.11 to profitably produce refined sugar. The current white premium is just above this level.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

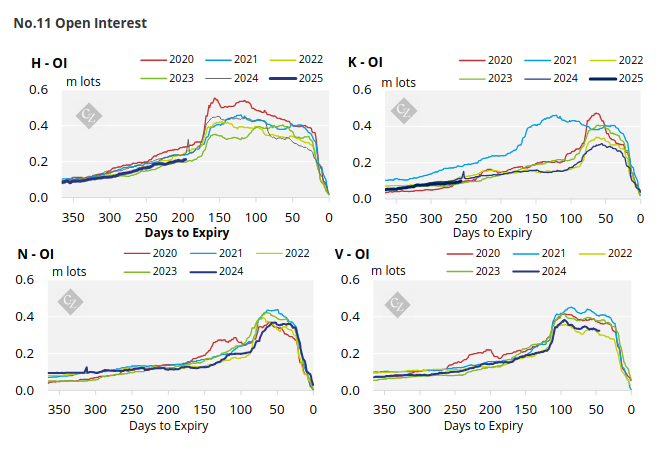

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

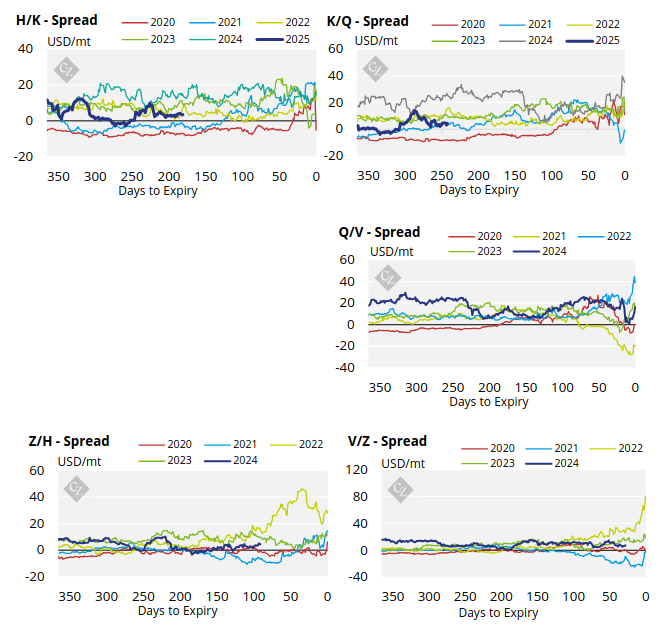

No.5 Spreads

White Premium Appendix