Insight Focus

- No.11 prices have continued to weaken whilst the No.5 moves sideways-to-low.

- The white premium remains strong enough to encourage additional refined supply.

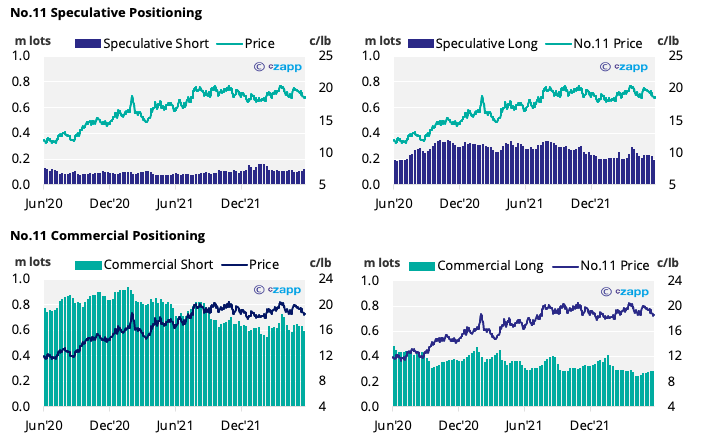

- Raw sugar speculators are becoming less positive in the short term.

New York No.11 (Raw Sugar)

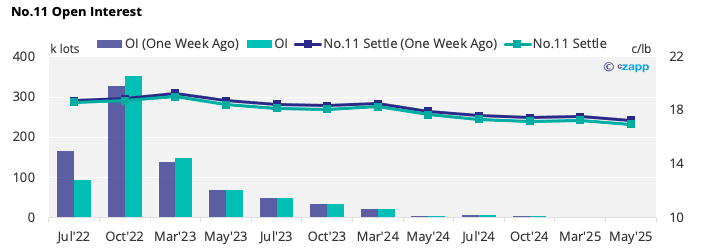

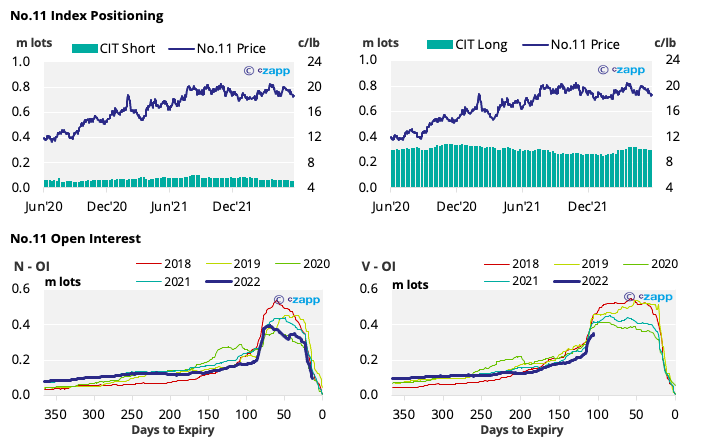

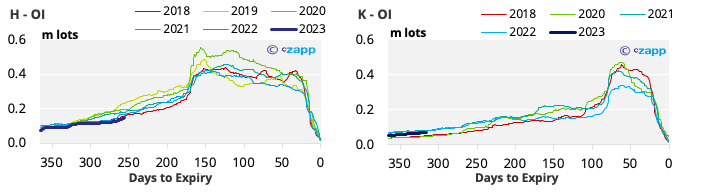

- The No.11 continues to decline in June, closing towards 18.5c/lb by the end of last week – this is near the bottom of the 10-month range.

- With the Jul’22 contract set to expire at the end of the month, total open interest in the contract has halved as positions close out or roll to the Oct’22.

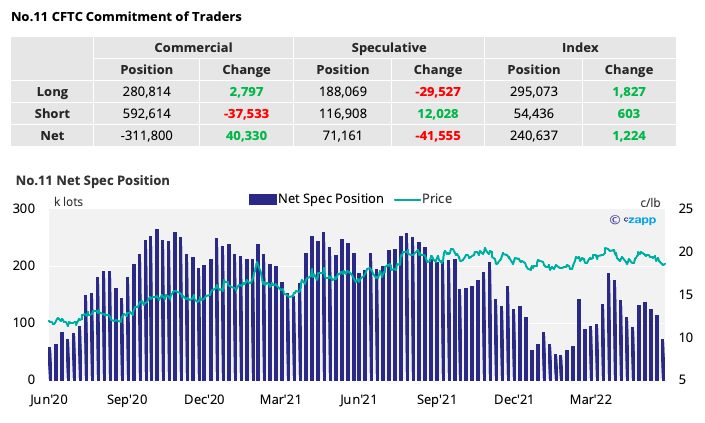

- Despite this, over 12k new spec short positions were added, indicating a less positive outlook by speculators – overall the net spec position has fallen by over 41k lots and is now far more neutral.

- The commercial short position also shrank, falling by around 38k lot ahead of the expiry as positions are closed.

- With prices falling, consumers continue to hedge in small volumes adding almost 3k lots to the commercial long position – though they are still poorly hedged by historical standards.

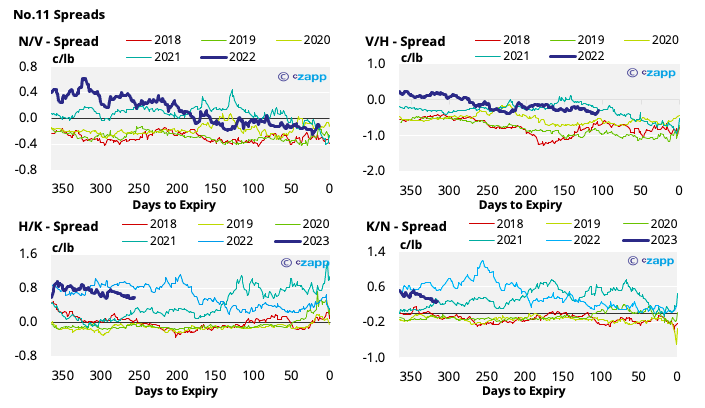

- The No.11 forward curve has flattened slightly but remains in contango for the remainder of 2022.

London No.5 (White Sugar)

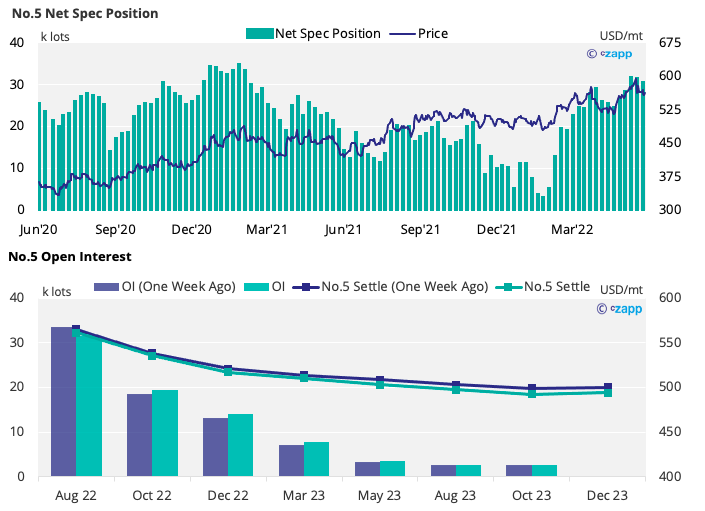

- Bullish appetite by white sugar speculators has stalled with the net spec position falling slightly for the 3rd week in a row.

- As such, No.5 prices have come off the high’s seen at the start of the month and look to have settled near 560USD/mt for the time being.

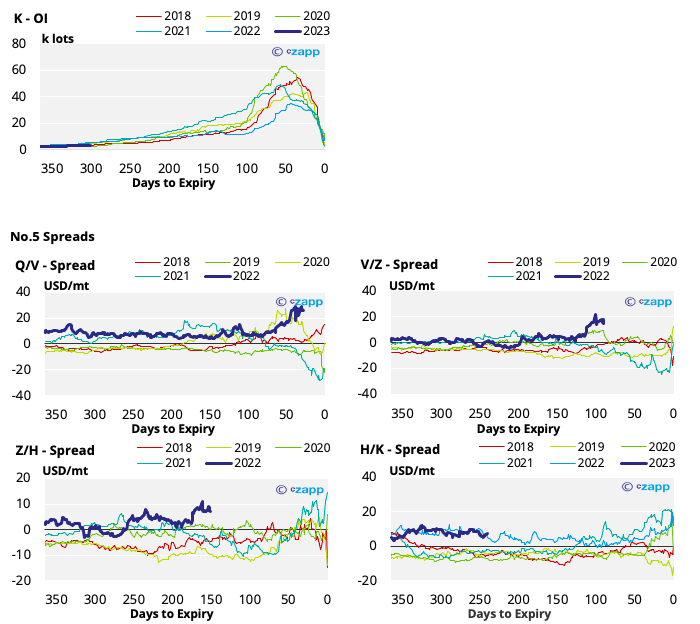

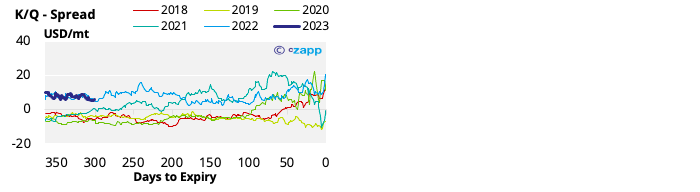

- The white sugar forward curve remains heavily backwardated across 2022 and 2023 – all 2022 spreads are at a strong premium.

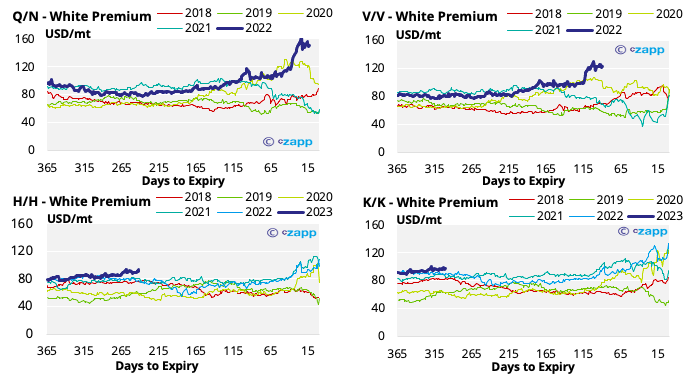

White Premium (Arbitrage)

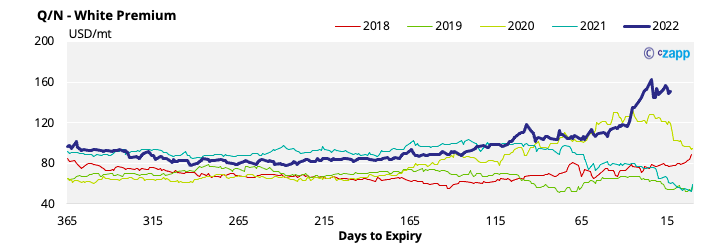

- The Q/N white premium still sits around 150USD/mt, this should encourage extra refined supply onto the world market.

- At this level re-export refiners should be able to comfortably operate profitably, along with some discretionary refiners.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

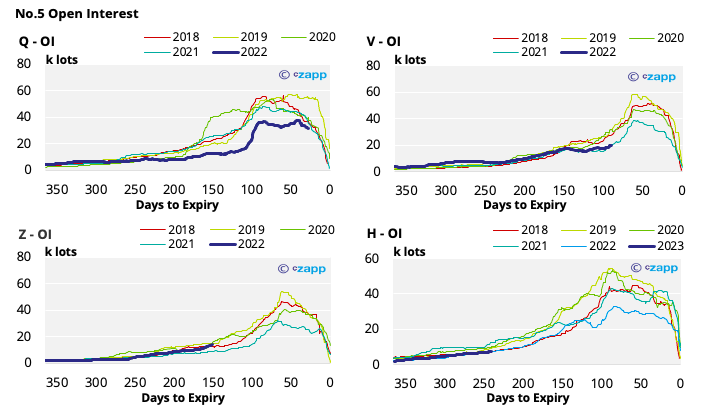

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…

PET Raw Material Futures Outlook

Ask the Analyst: Can India Export 8m Tonnes of Sugar Next Season?