Insight Focus

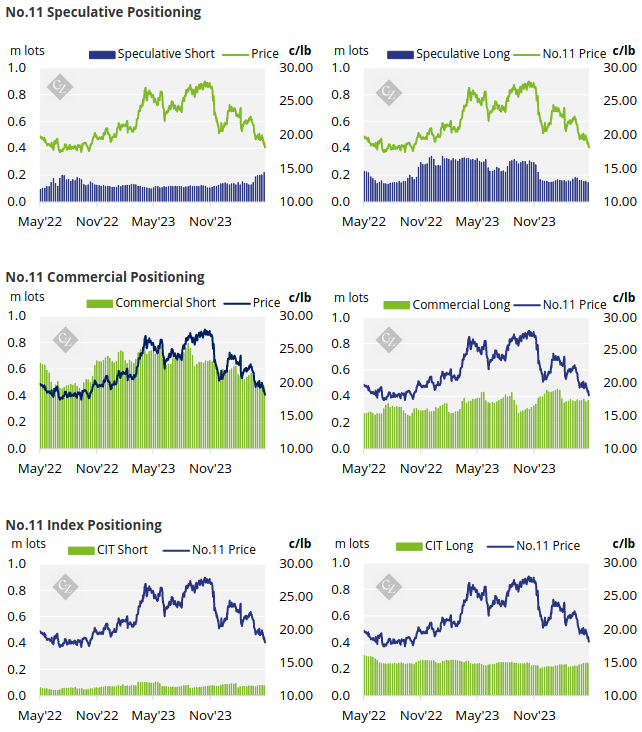

Raw sugar futures traded below 19c/lb. End-users have taken advantage of the price drop, adding heavily to their hedges. Speculators have started adding to their shorts again.

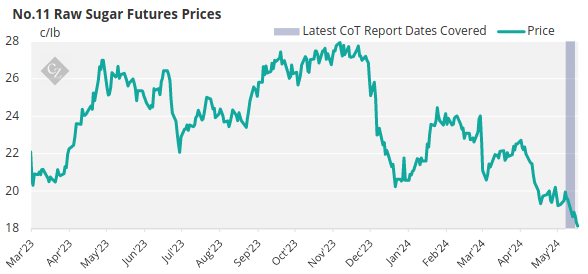

New York No.11 Raw Sugar Futures

The raw sugar futures market dropped below and traded between 18-19c/lb, closing at 18.1c/lb on Friday.

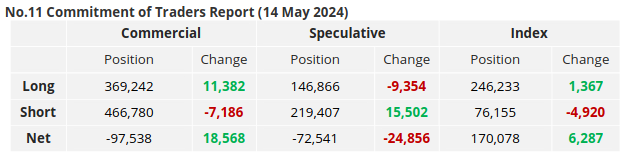

Looking at the commercial participants, end-users have taken considerable advantage of the price drop, adding 11.4k lots of long positions. Producers have not added to their hedges and have closed out 7.2k lots of short positions. They will likely hold out until any sort of price strength.

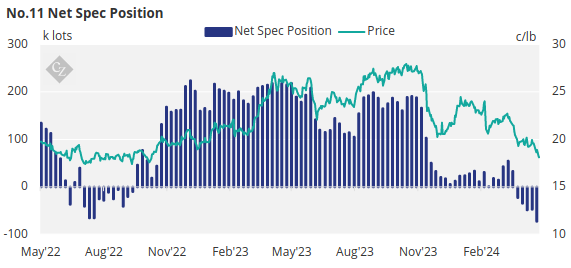

Speculators have added the largest number of short positions we have seen so far since the market started trading below 20c/lb. They are now net short in the sugar market by 72.5k lots. This is also the largest net short position speculators have held since the market break.

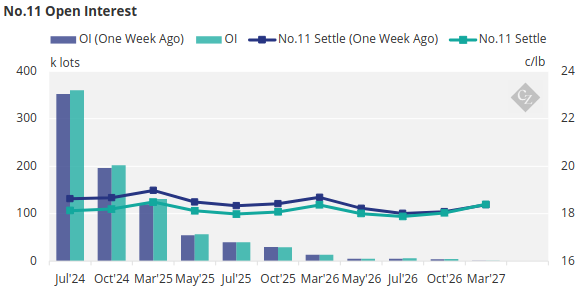

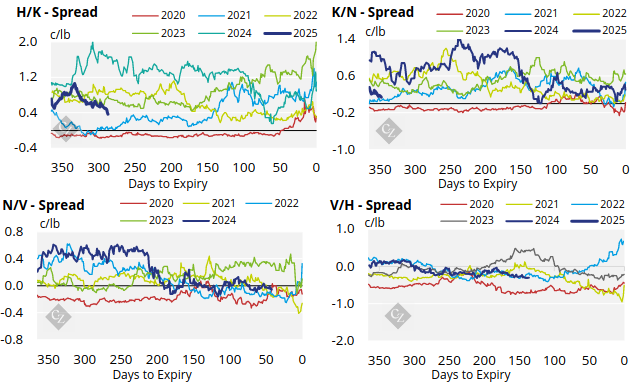

The no.11 futures curve flattened slightly over the past week but remains flat for much of 2024 and is then gently backwardated to 2027.

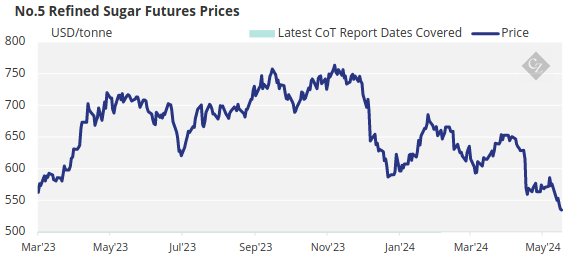

London No.5 Refined Sugar Futures

The No.5 refined sugar futures traded at 550USD/mt on Monday before it weakened to 534.7USD/mt by Friday’s close.

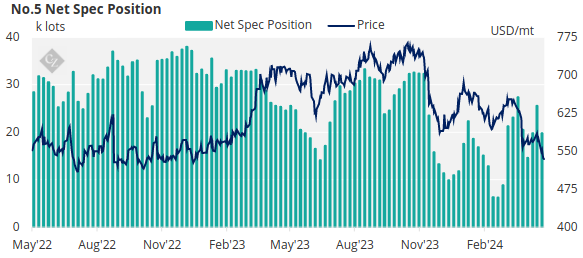

Speculators closed out 5.8k lots of recently opened longs, bringing the overall net spec position back down to 19.7k lots.

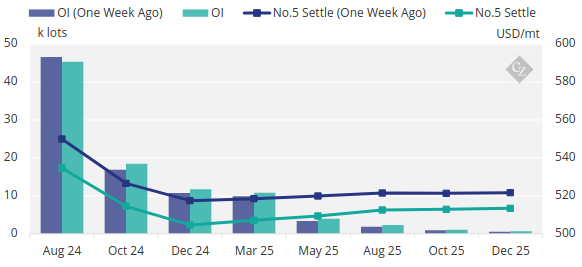

The refined sugar futures curve has flattened over the past week, with the curve remaining in backwardation through to Dec’24.

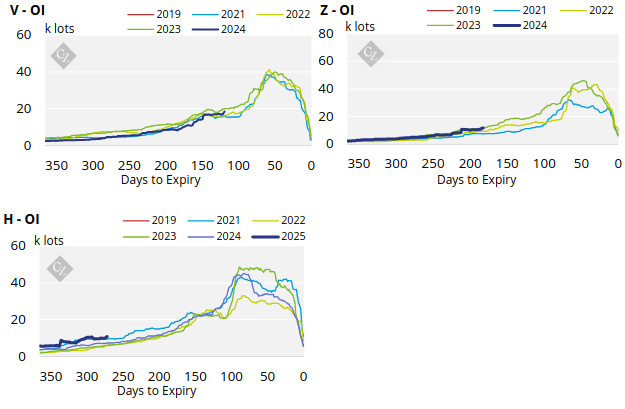

No.5 Open Interest

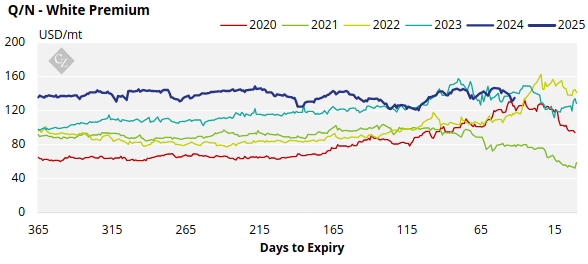

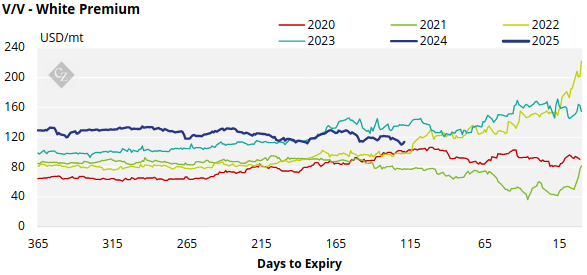

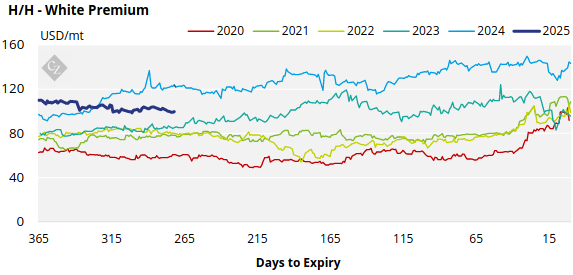

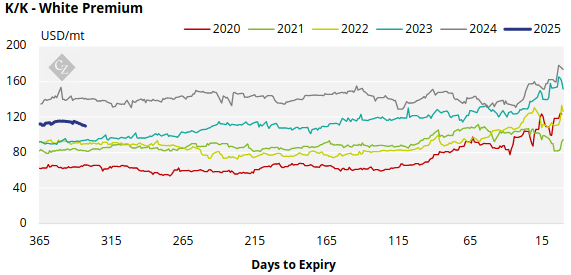

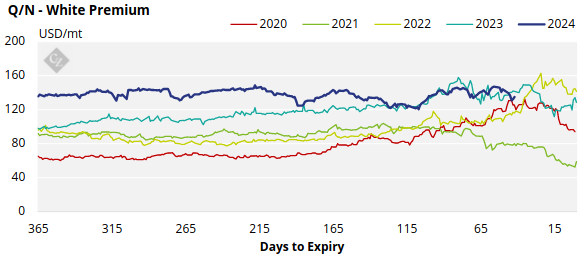

White Premium (Arbitrage)

The Q/N white premium traded lower at 135USD/mt over the past week.

Many re-exports refiners need around 105-115USD/mt above the No.11 to profitably produce refined sugar. The current white premium is well above this level, which means we should theoretically see a pick-up in demand soon.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

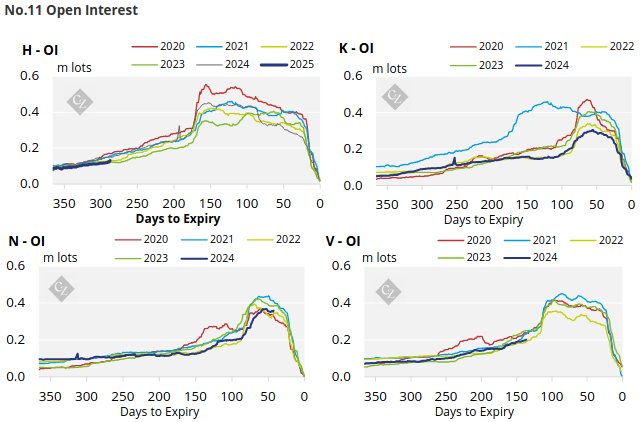

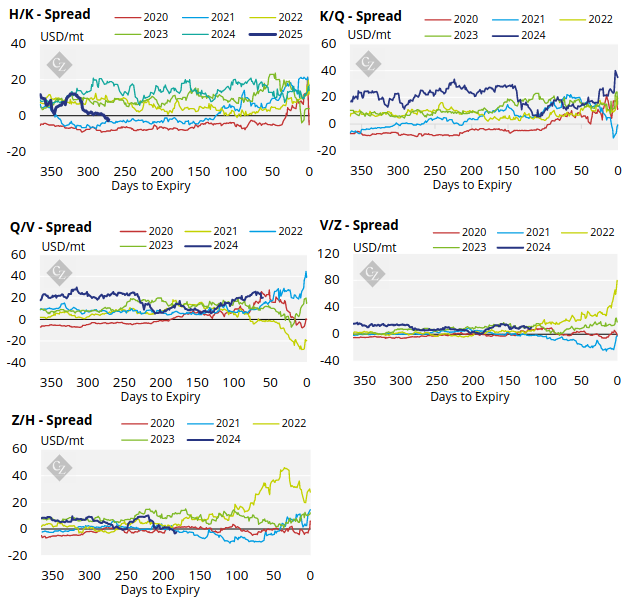

No.11 Spreads

No.5 (White Sugar) Appendix

No.5 Spreads

White Premium Appendix