Insight Focus

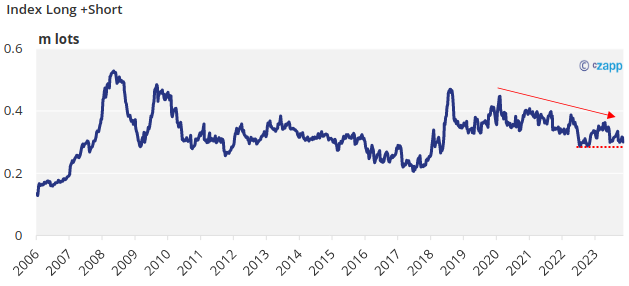

- The index long position in raw sugar has fallen to the lowest level in 6 years.

- This may indicate indices are rebalancing away from sugar/commodities.

- Sugar has been in a bull market for 43 months, one of the longest on record.

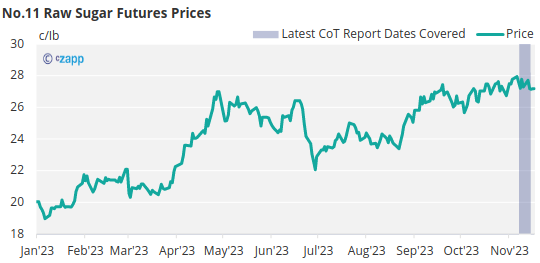

New York No.11 Raw Sugar Futures

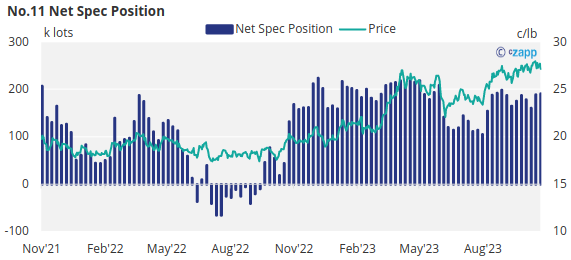

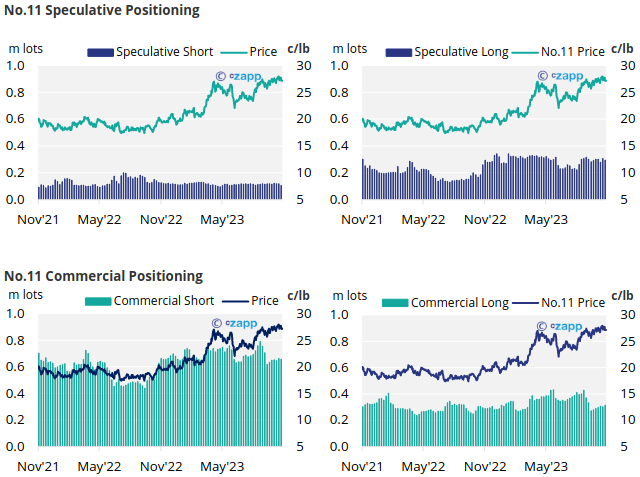

Raw sugar futures remain close to 12-year highs at around 28c/lb.

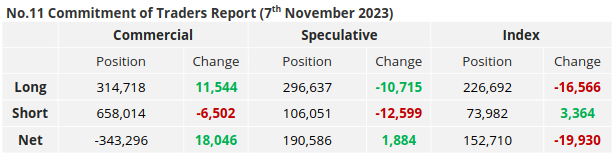

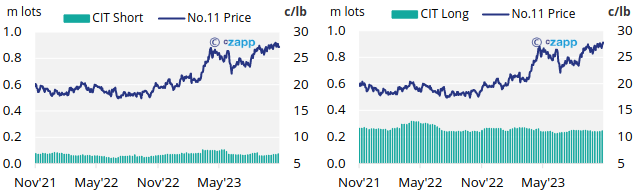

After one of the longest bull runs on record, commodity indices appear to be rebalancing away from sugar. The index long in raw sugar has fallen to its lowest level since December 2017 at 227k lots. However, the index short hasn’t grown; indices seem to be leaving sugar rather than switching directional view. As a result, index involvement in raw sugar is close to post-covid era lows.

The index move hasn’t been mirrored by speculators. They continue to hold a large net long position in sugar, just below 200k lots.

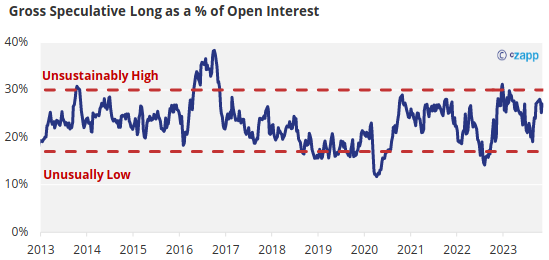

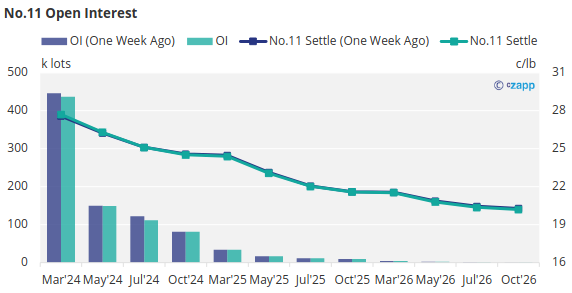

The speculative long accounts for around 27% of open interest. It’s been at this level since September.

This is towards the high end of the sustainable range and suggest that speculators could struggle to push the market out of its 2023 sideways price range unless open interest increases dramatically, perhaps through increased producer hedging to absorb the speculative buying.

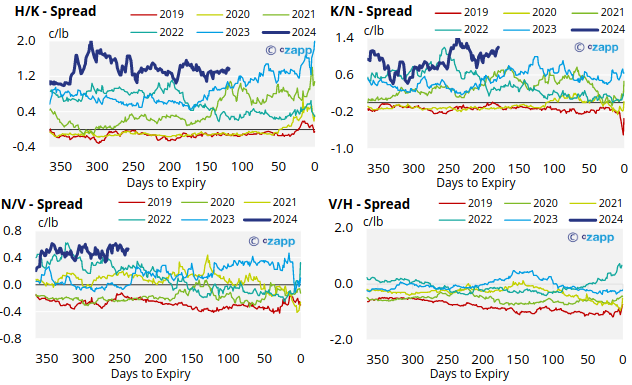

Consumers have no reason to rush their hedging, especially with the entire futures curve heavily backwardated.

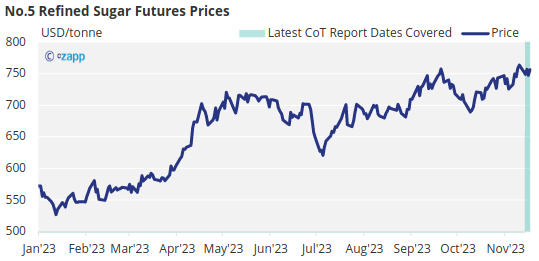

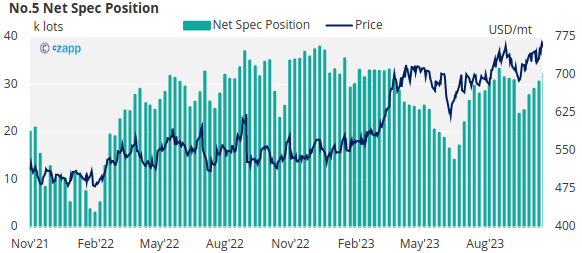

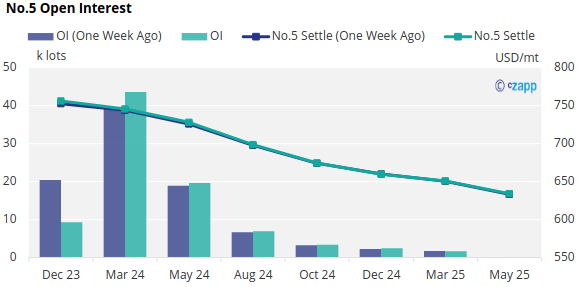

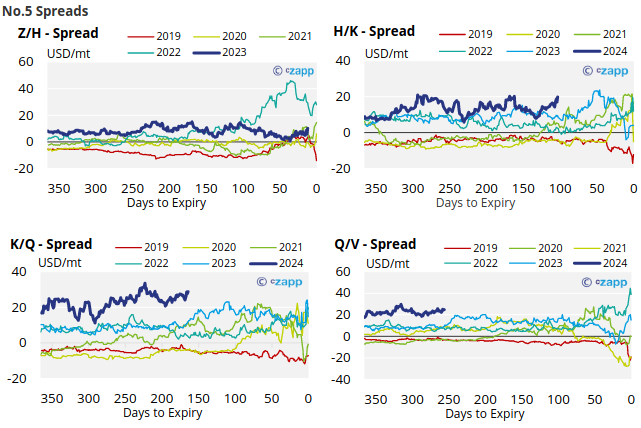

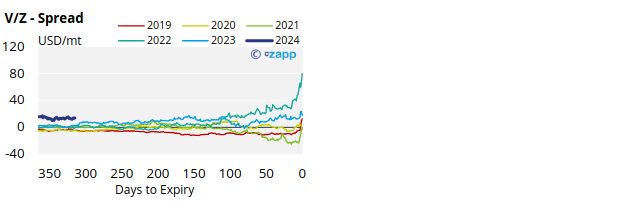

London No.5 Refined Sugar Futures

The refined sugar futures continue to lead the charge. In contrast to the raw sugar futures, the refined market has been in an uptrend.

Speculators remain heavily long the refined sugar futures.

The refined sugar futures curve remains heavily backwardated.

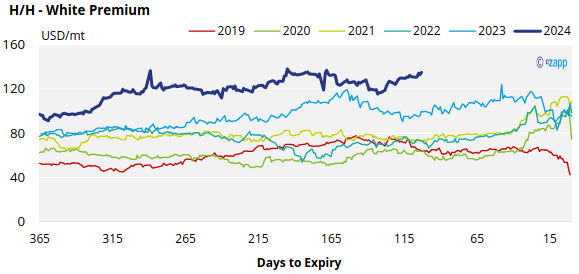

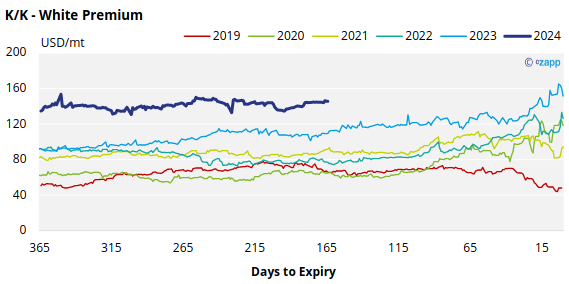

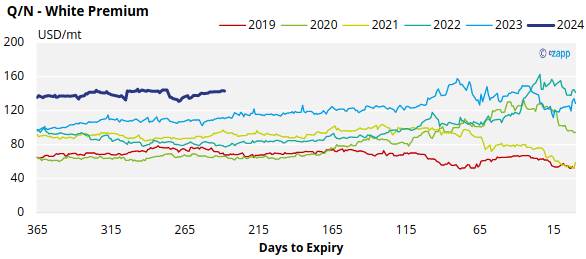

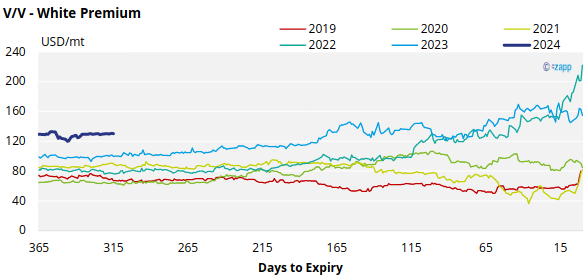

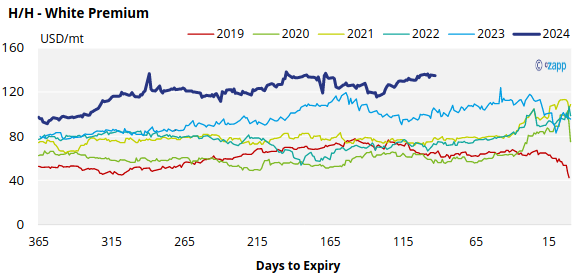

White Premium (Arbitrage)

The 2024 white premiums remain strong. We’ve not seen this kind of strength in the H/H white premium at this stage in the cycle in at least 5 years.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

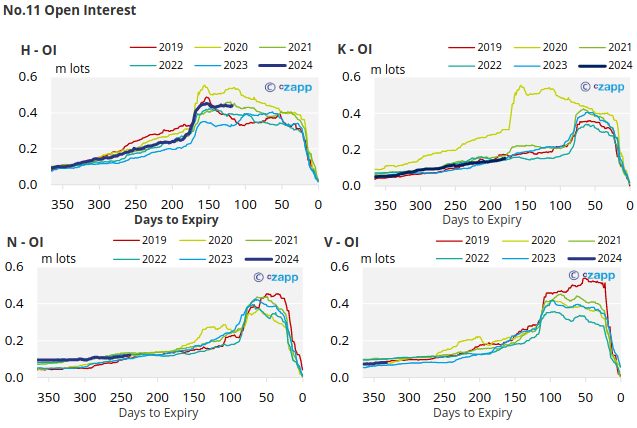

No.11 (Raw Sugar) Appendix

No.11 Index Positioning

No.11 Spreads

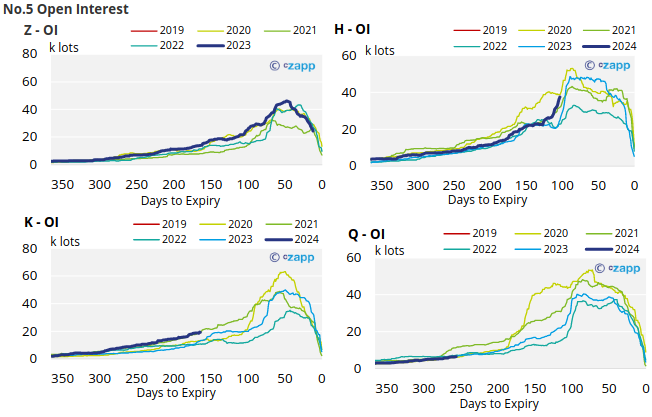

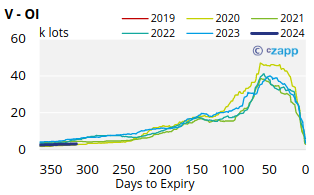

No.5 (White Sugar) Appendix

White Premium Appendix