Insight Focus

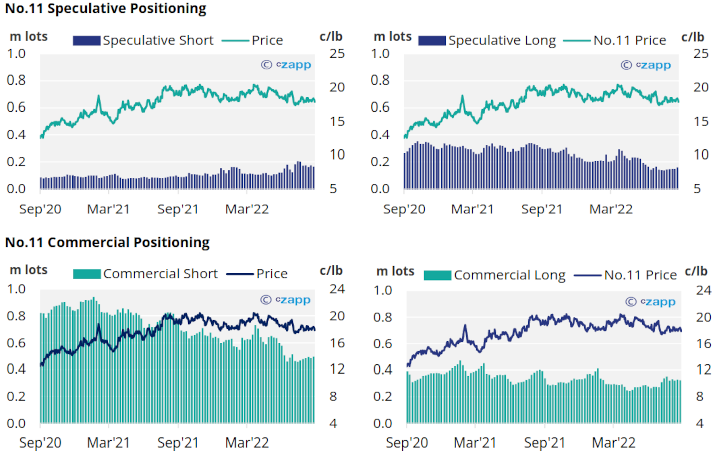

- Raw sugar speculators closed short positions and opened long positions.

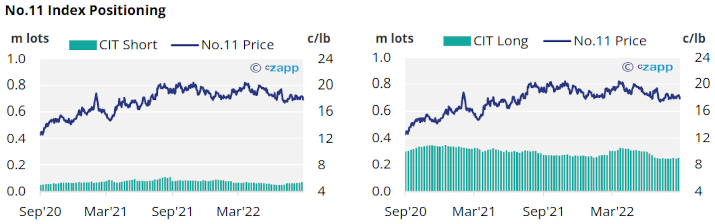

- White sugar speculators continue to increase net spec position.

- However, with the recent drop in No.5 prices the white premium has decreased but still in uptrend.

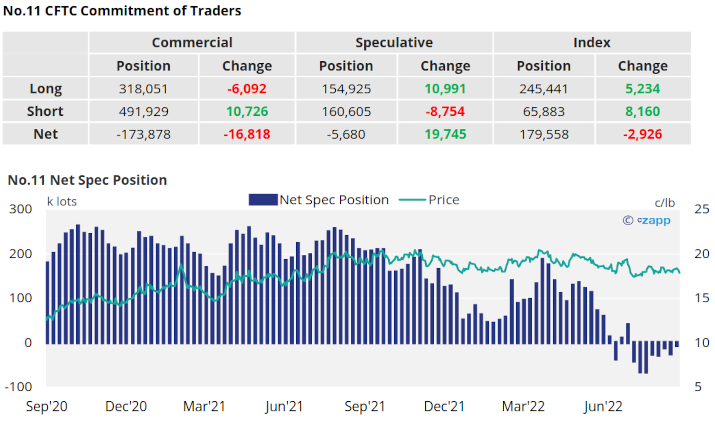

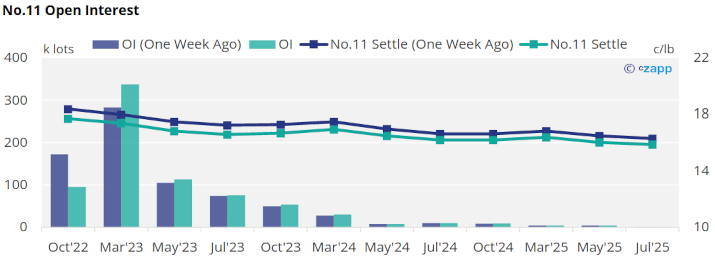

New York No.11 (Raw Sugar)

- The No.11 has dipped below 18 after trading around 18 c/lb to 18.4 c/lb last week.

- Raw sugar speculators had closed over 8k lots of short positions and opened 11k long positions by the 13th of September.

- The net spec position is now around 5k lots short.

- Consumers have closed 6k lots whilst producers added 10k lots over the same period

- The entire No.11 forward curve is now below last week’s.

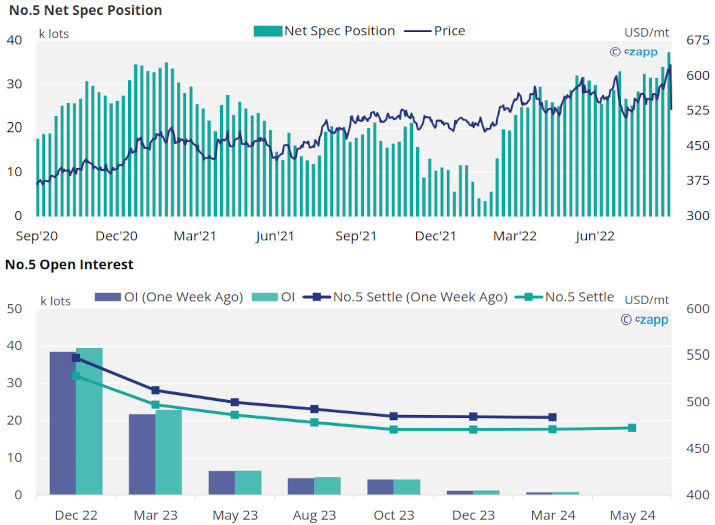

London No.5 (White Sugar)

- By the end of last week, the No.5 price dropped to 540USD/mt.

- The net spec position has reached 34k lots by the end of the 13th of September, reaching new height for 2022.

- The No.5 forward curve is now below last week’s.

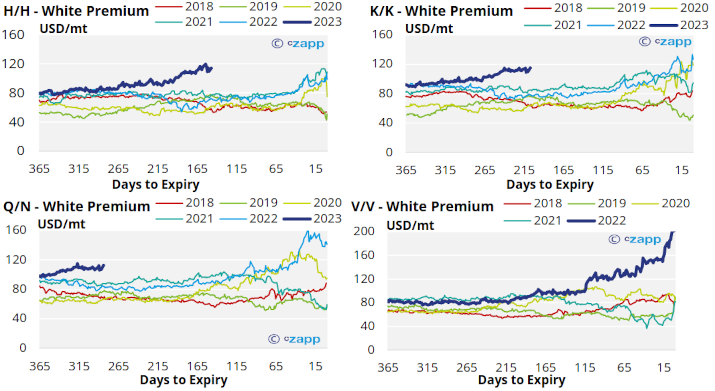

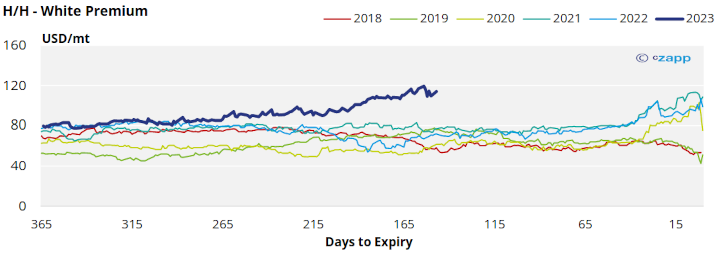

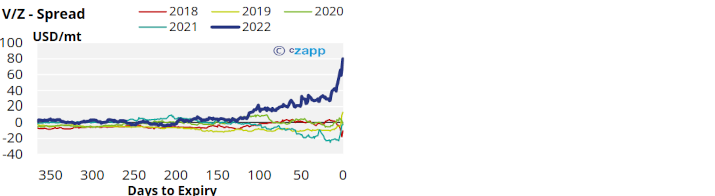

White Premium (Arbitrage)

- The white premium dropped to114 USD/mt, following the drop in No.5 prices.

- Even with the drop in the white premium continues to be in uptrend and should be enough for some discretionary to start increasing their raw sugar demand and start re-exporting refined sugar.

- Like last week, the next K/K and Q/Nwhite premiums are all trading above 110USD/mt, these are unusually high this far in advance of their expiry.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

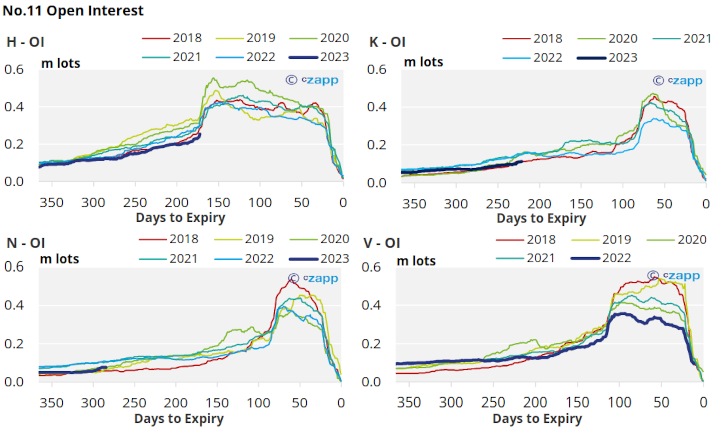

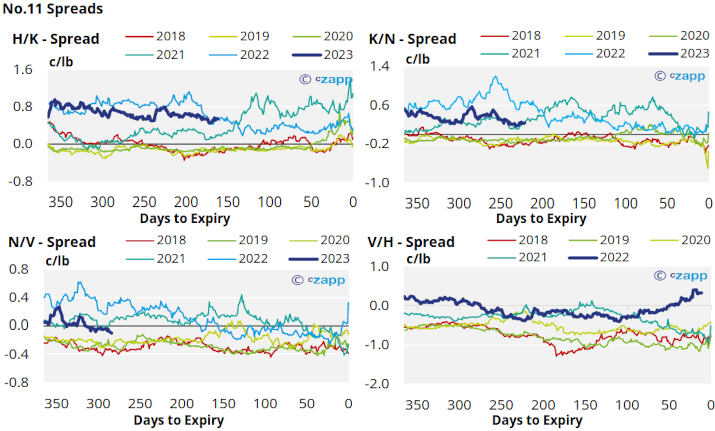

No.11 (Raw Sugar) Appendix

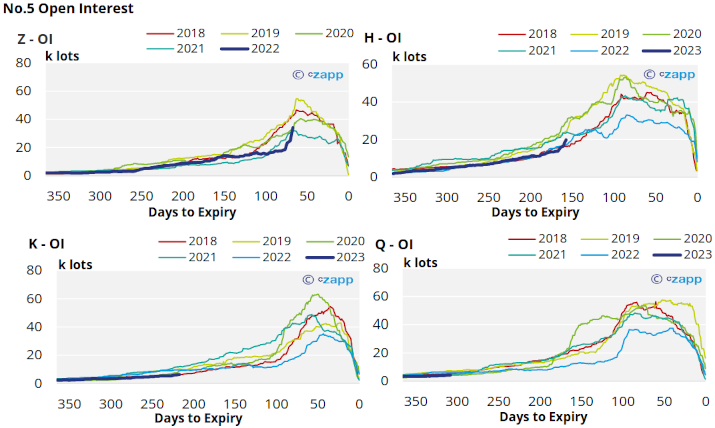

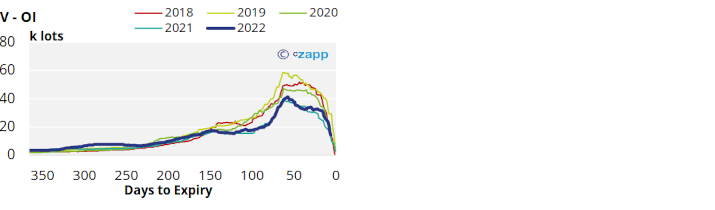

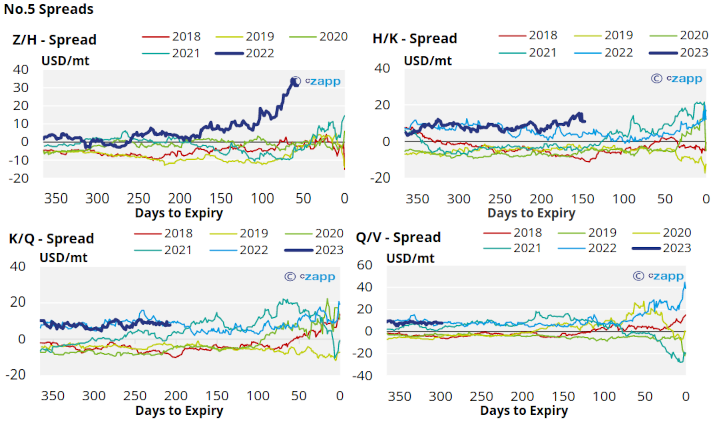

No.5 (White Sugar) Appendix

White Premium Appendix