Insight Focus

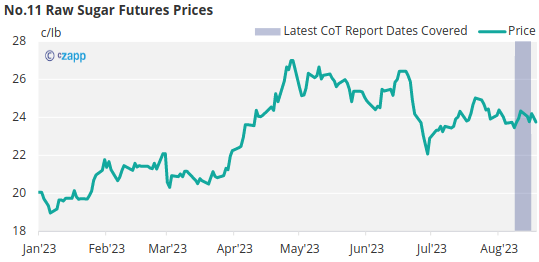

- The No,11 raw sugar futures has traded sideways for a second week in a row.

- Similarly, the refined sugar futures also exhibited a sideways trend, hovering around 687 USD/mt.

- The net speculative position is broadly unchanged.

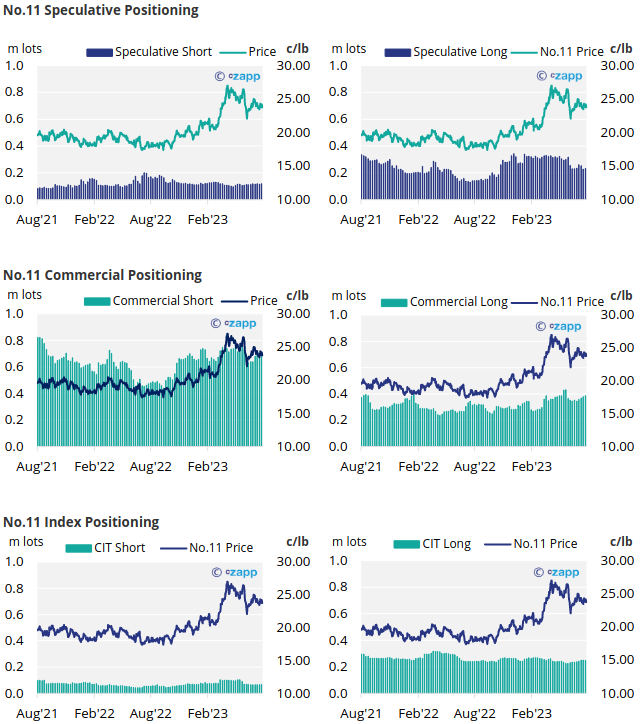

New York No.11 Raw Sugar Futures

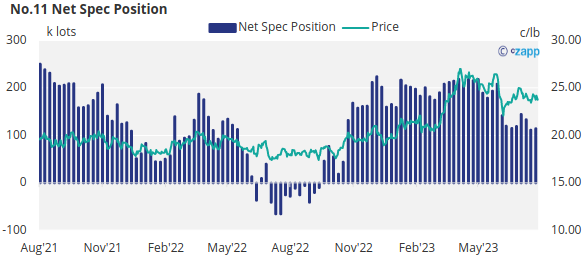

The No.11 raw sugar futures have traded sideways for the second week in a row, hesitant to break much higher or lower than 24c/Ib.

That said, the commercials have been somewhat busy in the last week, with raw sugar consumers adding 8.2k lots of new long position and producers adding approximately 6.7k lots of commercial short positions.

With the No.11 fluctuating very little in the past few weeks, consumers may have felt compelled to add new cover given that current prices are relatively favourable, especially when compared to the prices we observed earlier in the year.

Turning our attention to the speculators, they have added 4.4k lots of long positions and 1.8k lots of short positions, bringing the overall net spec position to 114k lots.

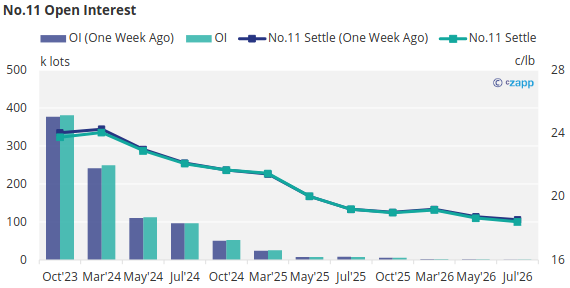

The No.11 forward curve remains inverted until Mar’26.

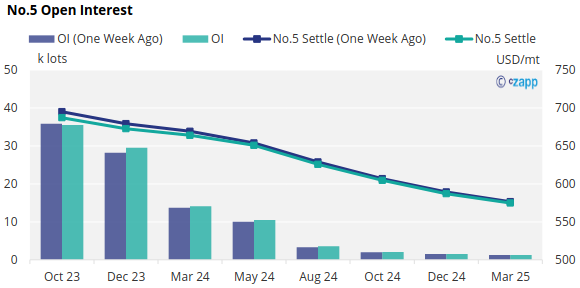

London No.5 Refined Sugar Futures

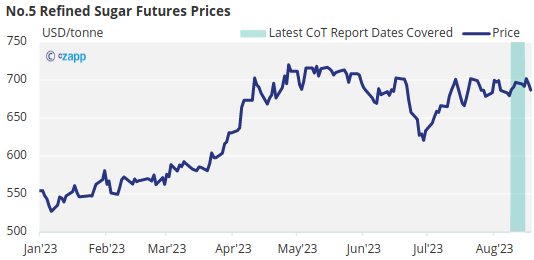

The No.5 refined sugar futures has also traded sideways over the past week, before closing at 687USD/mt on Friday.

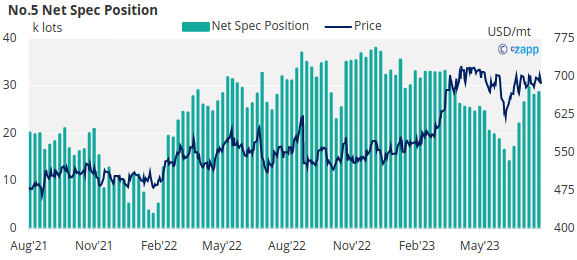

Despite this, by the 15th of August (latest CoT report), speculators extended the net spec position by 0.5k lots, bringing the overall net spec position to 28.6k lots.

The No.5 forward curve remains backwardated as far ahead as Oct’24, suggesting a slowly easing market tightness over the next few years.

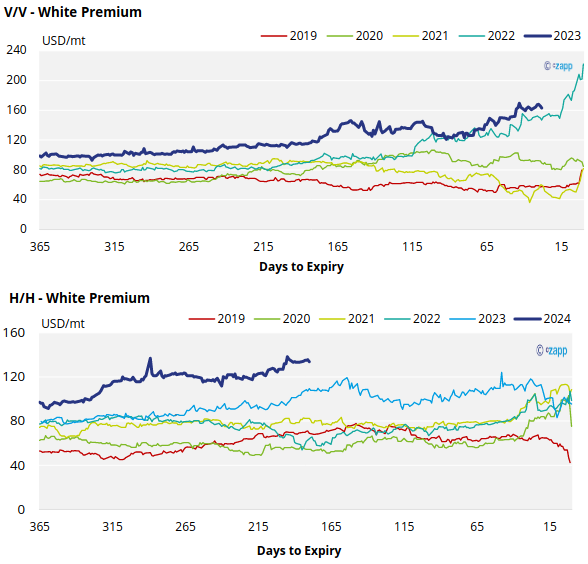

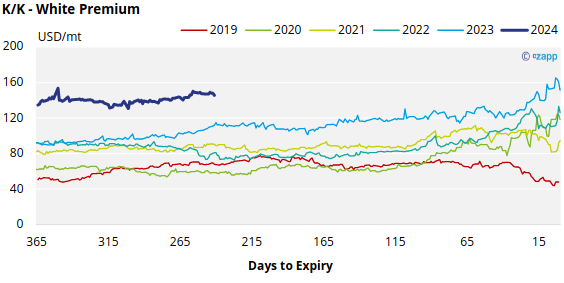

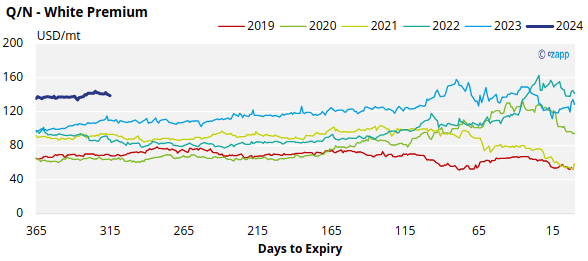

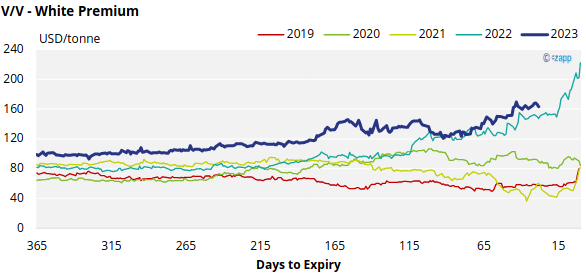

White Premium (Arbitrage)

The V/V sugar white premium has strengthened slightly over the past week, now trading at 163USD/mt.

The refined sugar market remains slightly undersupplied for the majority of 2023, and this is reflected in comparatively strong H/H and K/K white premiums which have also been rising and now approach 133USD/mt and 145USD/mt, respectively.

We think many re-export refiners require at least 85-100USD/tonne over the No.11 to operate profitably, this means the spot white premium offers comfortably enough for these refiners to be maximising their throughput.

At this level we could see higher-cost or discretionary refiners begin to consider re-exporting too, rather than just serving their domestic markets.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

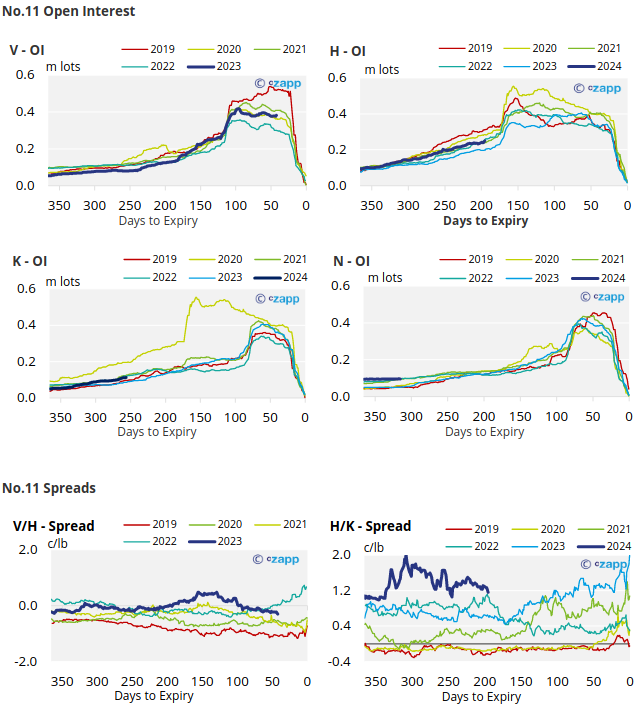

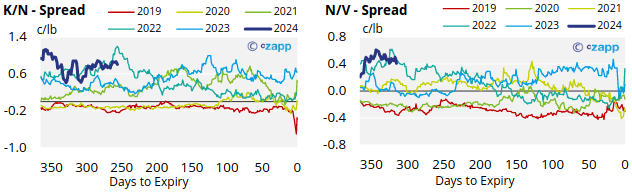

No.11 (Raw Sugar) Appendix

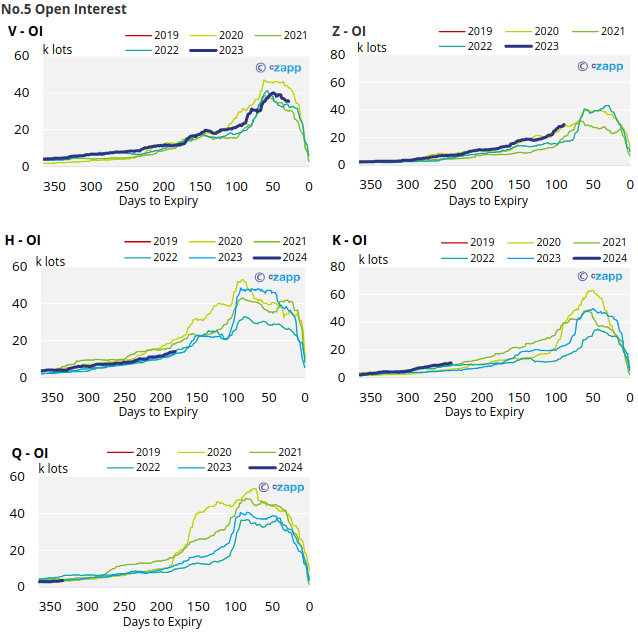

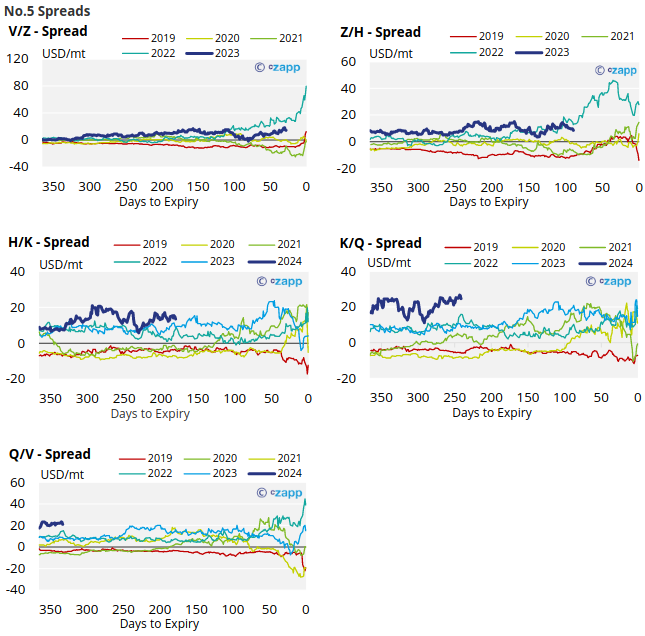

No.5 (White Sugar) Appendix

White Premium Appendix