- No.11 prices continue to trade sideways.

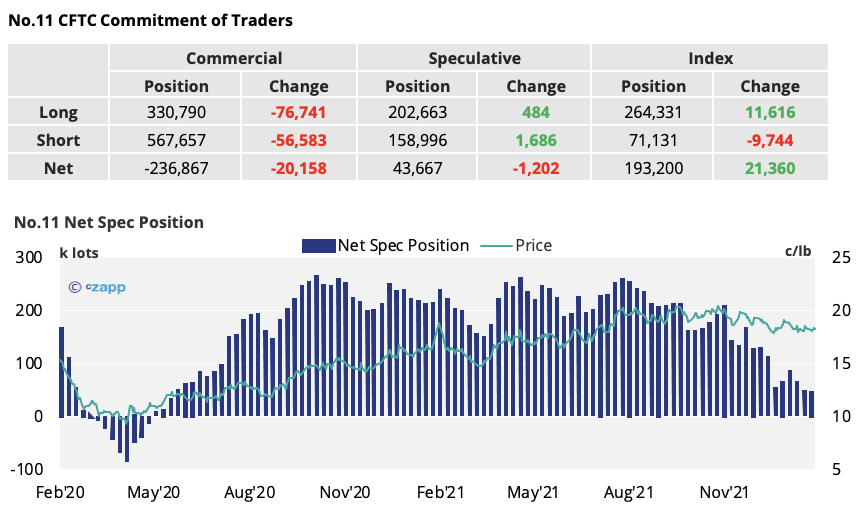

- The No.11 net spec position is unchanged from last week as spec selling slows.

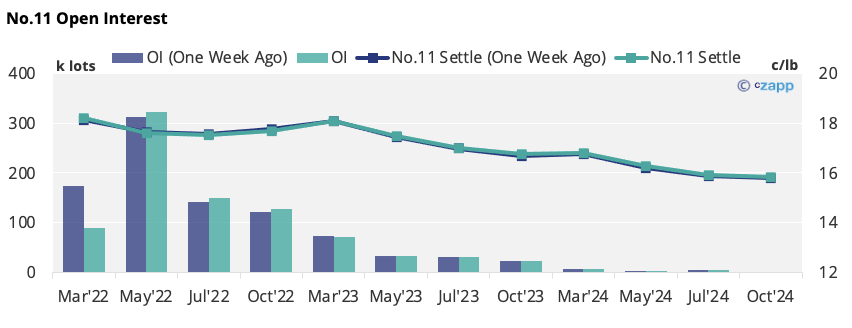

- Commercial long positions are lifting as the H’22 expiry draws closer.

New York No.11 (Raw Sugar)

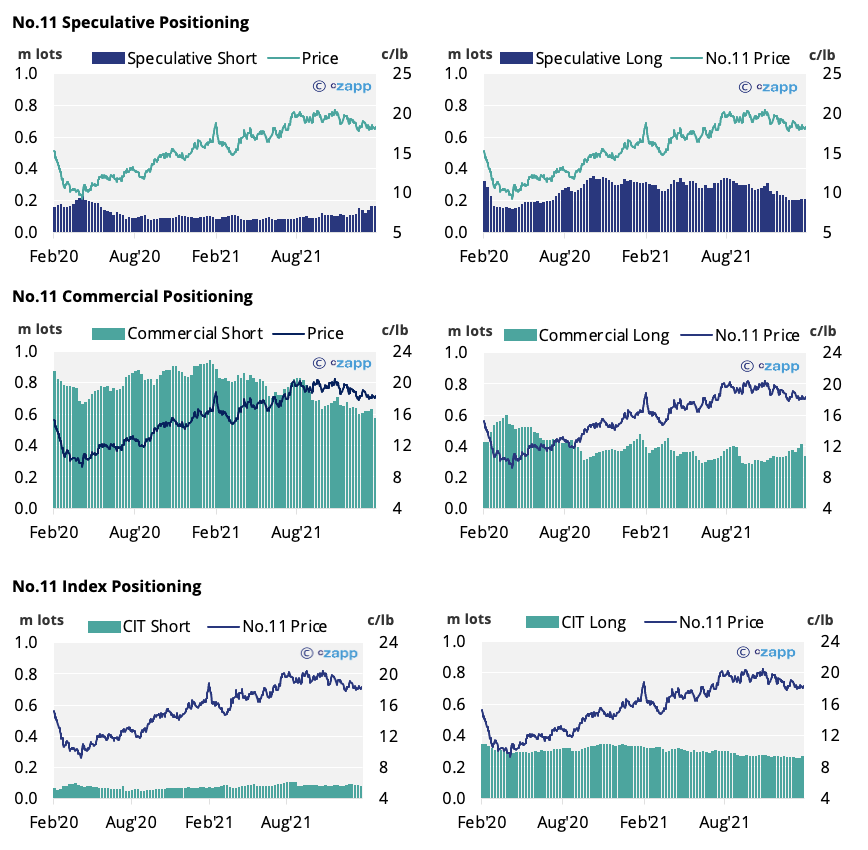

- Raw sugar prices have barely changed over the last week, trading between 18 and 18.5 c/lb.

- There’s been no meaningful change to the spec short position, which had been growing in recent weeks in following the No.11 weakening.

- This has seen the net spec position settle at around 44k lots, the lowest in roughly two years.

- With consumers adding good cover in recent weeks, the upcoming H’22 expiry now sees commercial positions close out or roll ahead of the expiry.

London No.5 (White Sugar)

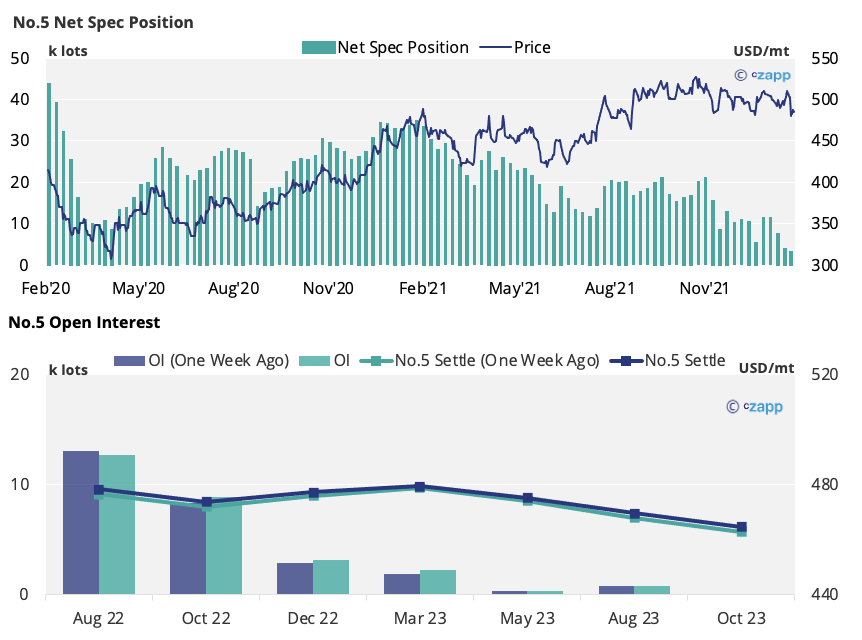

- After a fall as the H’22 contract expired last week, white sugar prices have stabilised just above 480 USD/mt.

- The open interest for the K’22 and Q’22 contracts remains below historic levels.

White Premium (Arbitrage)

- Despite the No.11 trading sideways, and a slide in the No.5 with the H’22 expiry, the white premium remains between 90-100 USD/mt

- This means with cash values or discounted raws spreads, re-export refiners can operate profitably.

- For a more detailed view of the Sugar Futures and Market Data, please refer to the data appendix below.

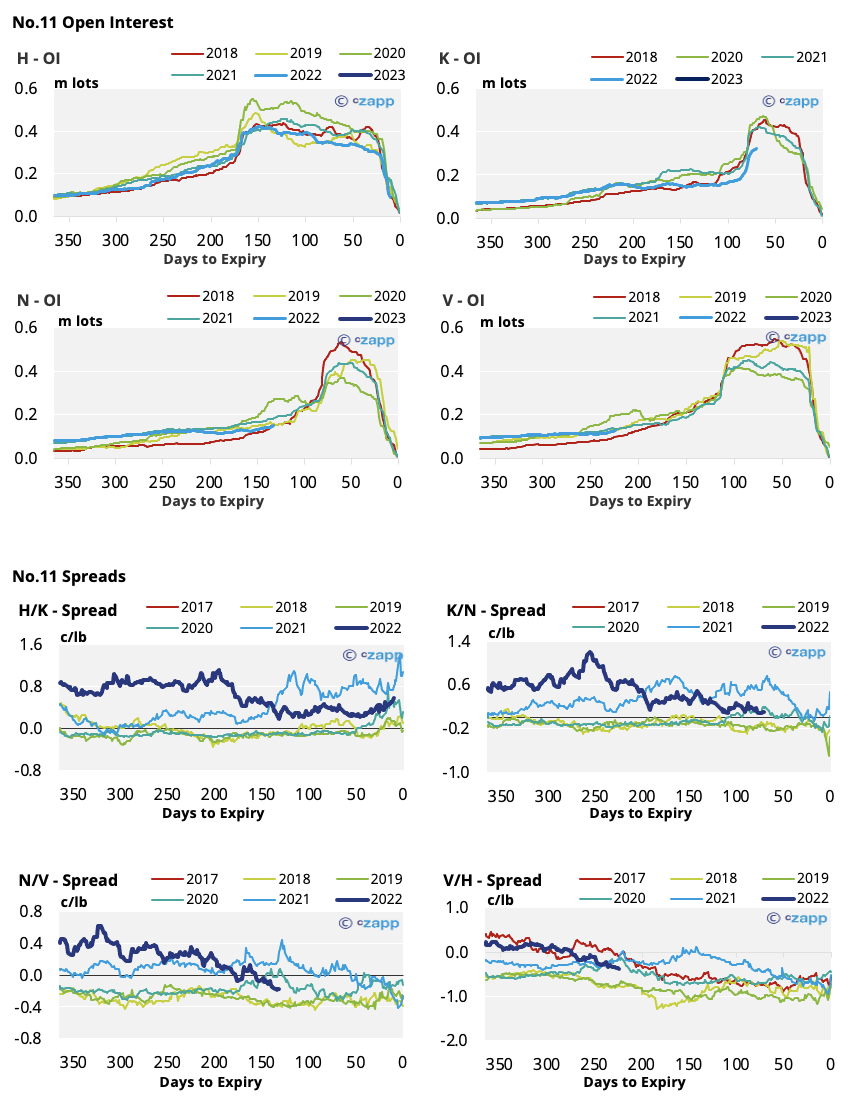

No.11 (Raw Sugar) Appendix

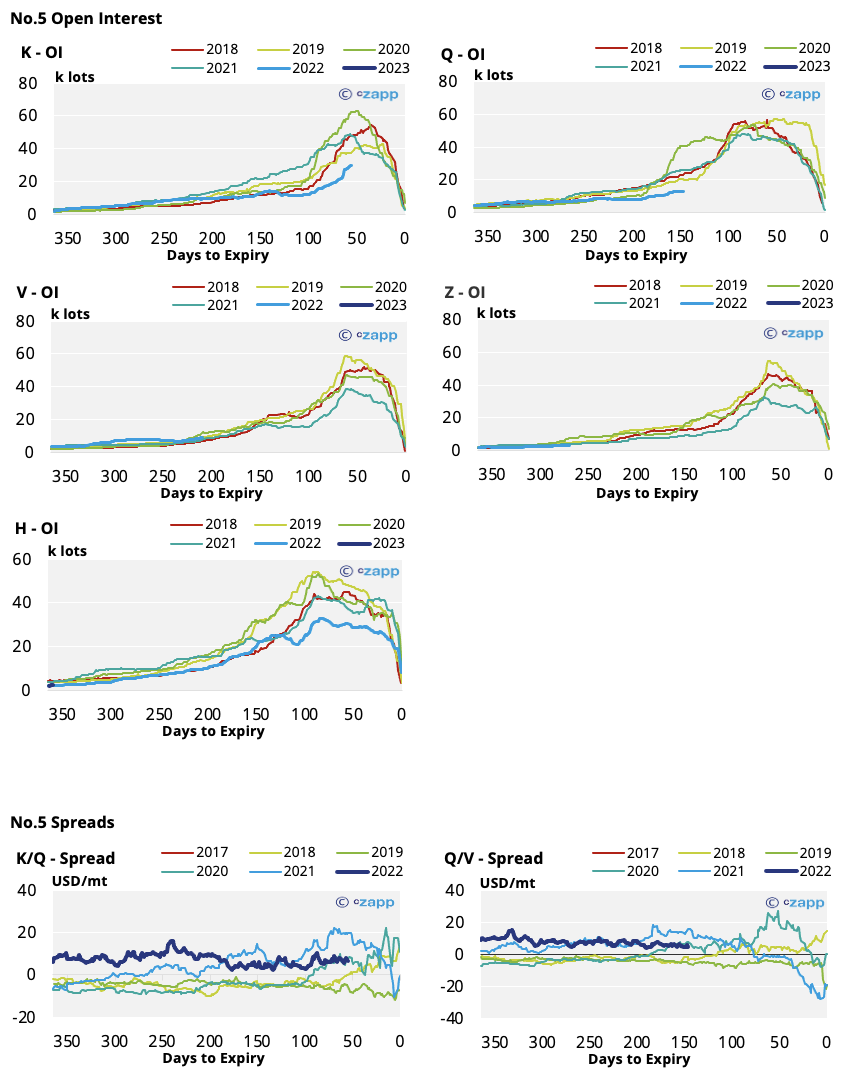

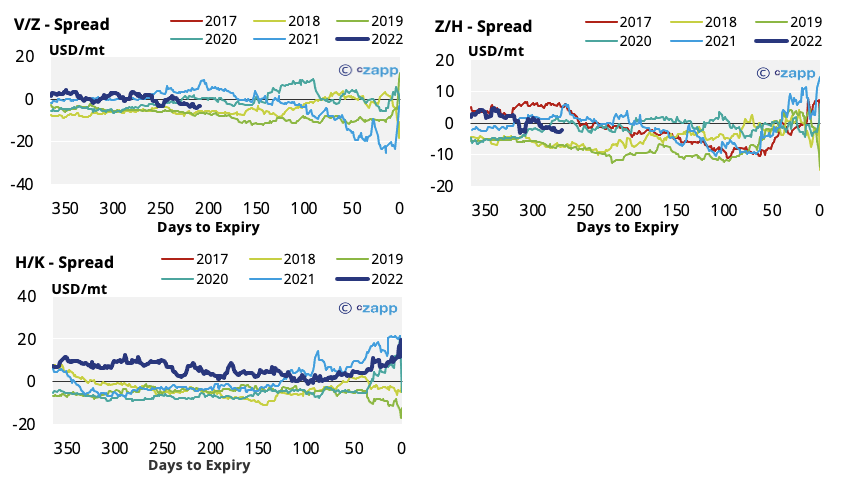

No.5 (White Sugar) Appendix

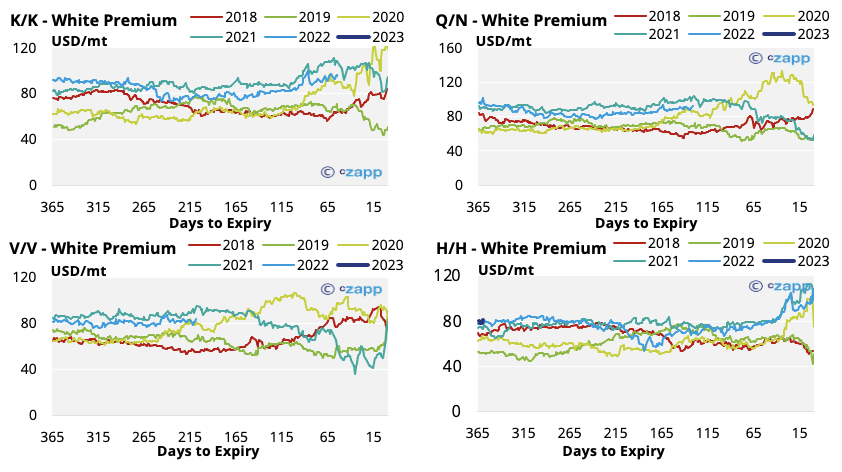

White Premium Appendix

Other Insights That May Be of Interest…

Negative Sentiment Grows as Specs Add to Short