Insight Focus

- The No.11 has fallen just below 19c.

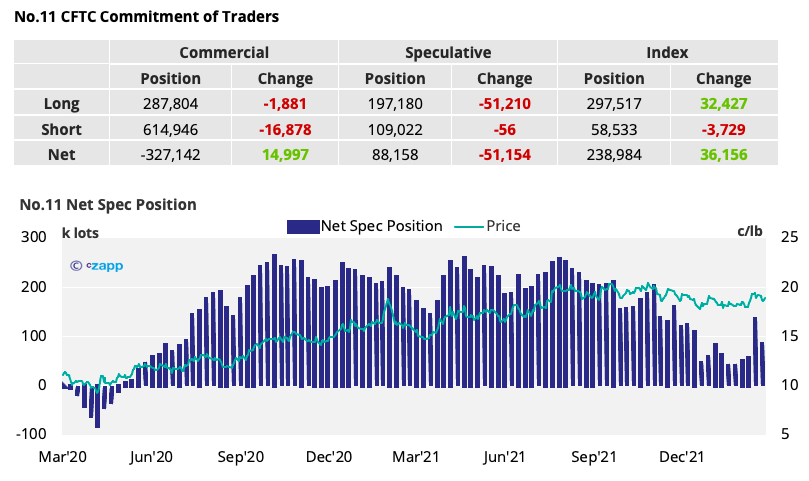

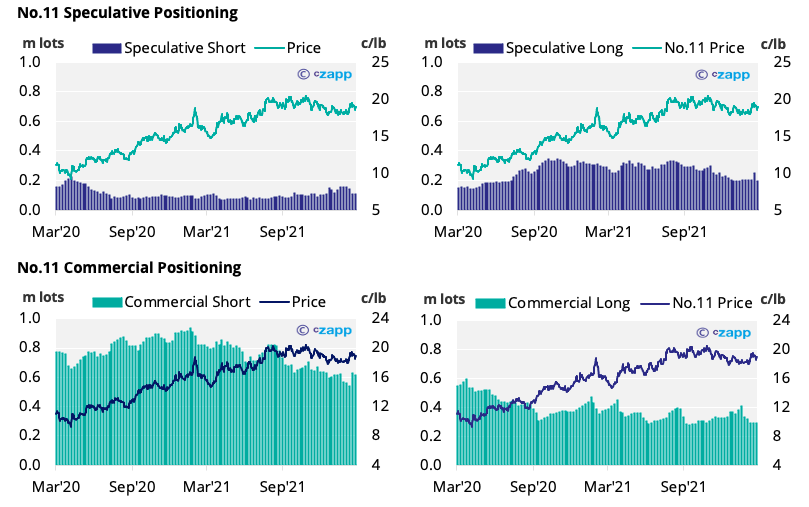

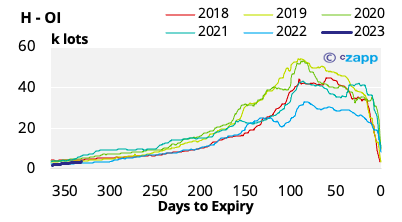

- Raw sugar speculators closed many of their long positions opened in the previous week.

- The white premium has widened further as the No.5 maintains its strength.

New York No.11 (Raw Sugar)

- After rallying in the wake of a US ban on Russian oil, the No.11 retracted back below 19c.

- As a result, the net spec position has shrunk by over 51k lots as the spec long significantly decreased.

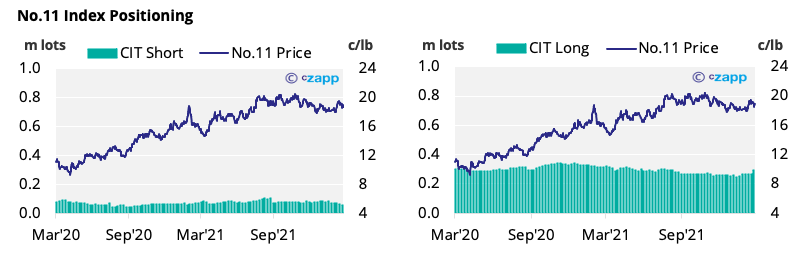

- By contrast, the net index position has increased by over 36k lots, the largest weekly move in over a year.

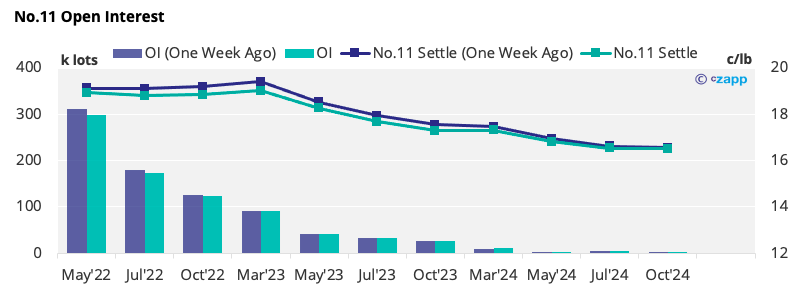

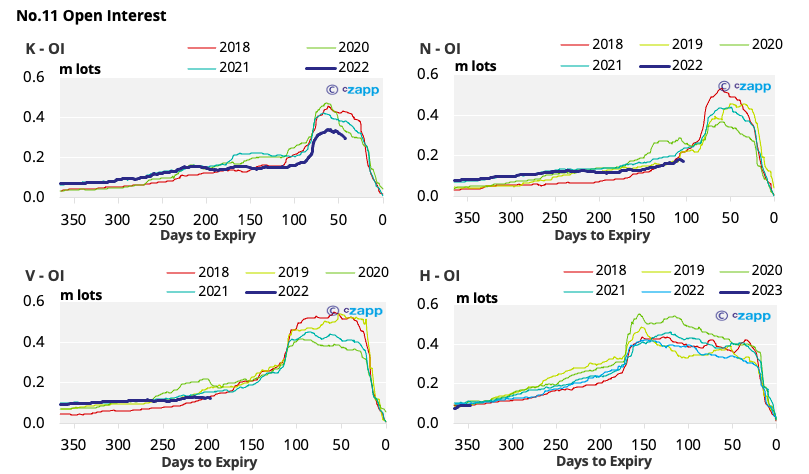

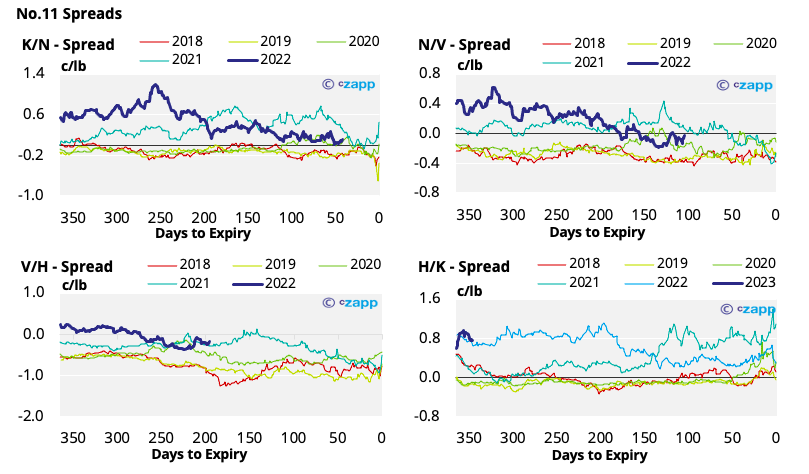

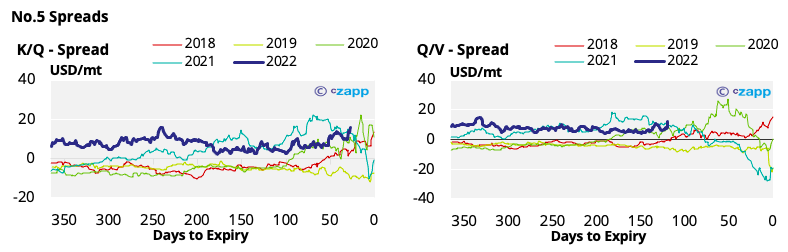

- Looking further down the board, the forward curve has flattened across 2022.

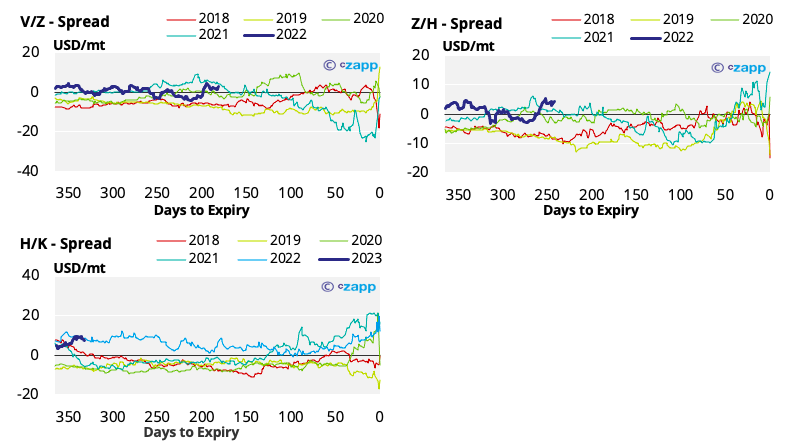

London No.5 (White Sugar)

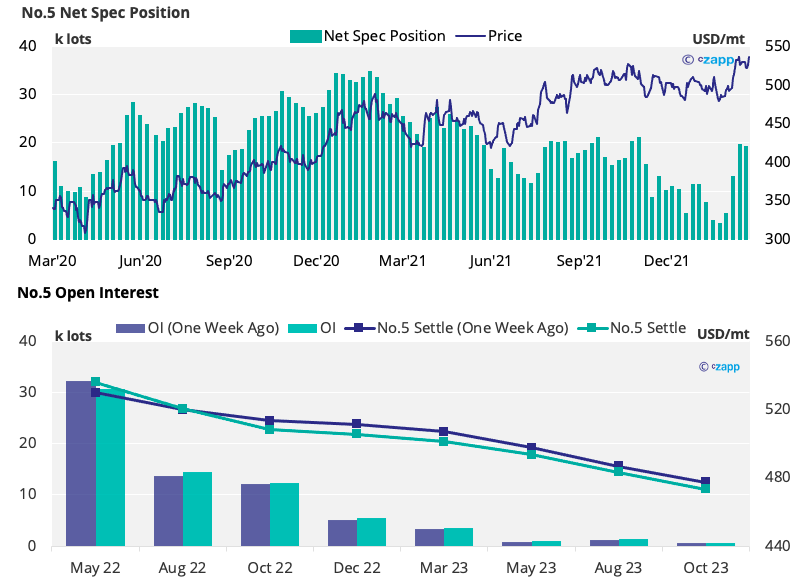

- Unlike the No.11, white sugar prices have maintained strength, hovering around 530 USD/mt.

- The net spec position has held firm, decreasing by fewer than 500 lots.

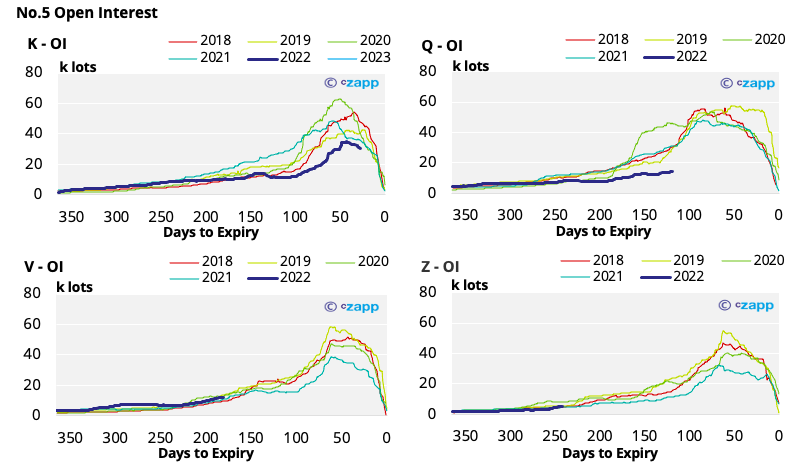

- A weakening V’22 means the white sugar futures curve looks increasingly backwardated through 2022.

- Q’22 open interest is still low by recent standards as more K’22 positions are being closed out rather than rolled into August.

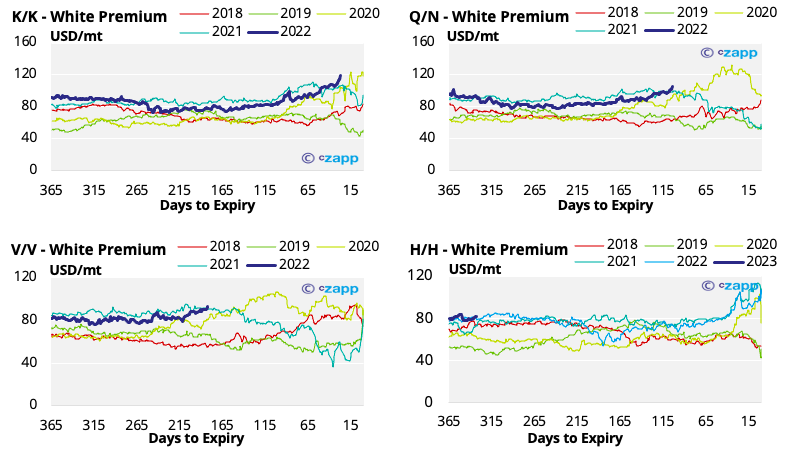

White Premium (Arbitrage)

- The white premium has grown to around 120 USD/mt with the No.11 falling back below 19c.

- This is comfortably the highest the K’22/K’22 arbitrage has been since it came on the board.

- Whilst this is positive for re-export refiners, the oil and energy price rally means their margins could be heavily squeezed through rising energy costs.

For a more detailed view of the Sugar Futures and Market Data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…