Insight Focus

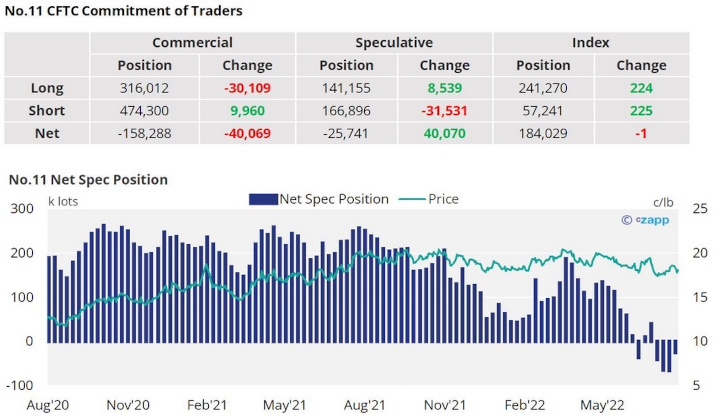

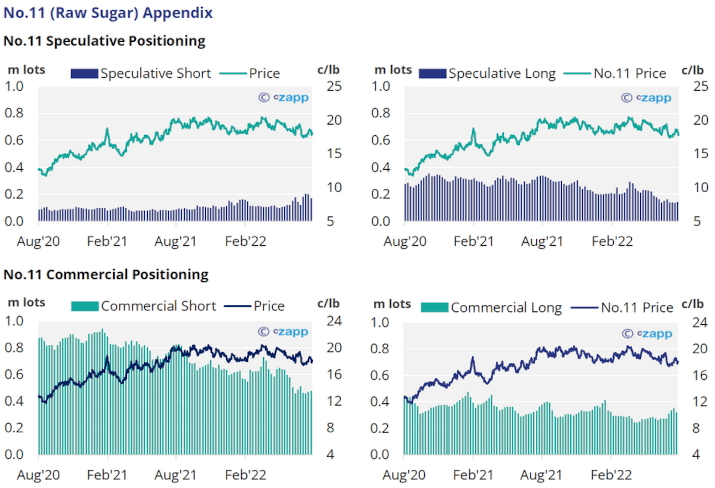

- The No.11 net spec position has swung back towards neutrality with closure of recent short positions.

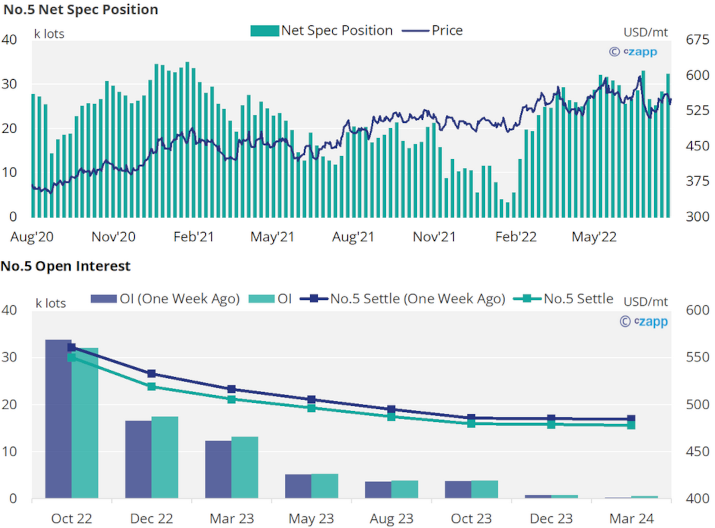

- No.5 speculators have become increasingly long in white sugar.

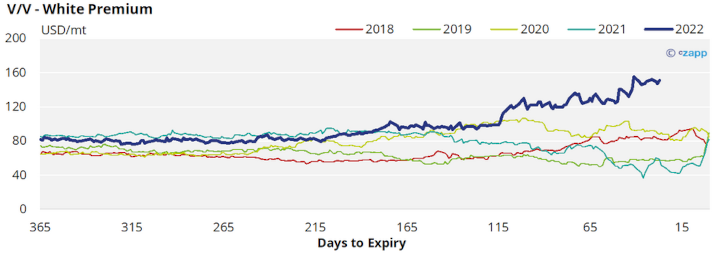

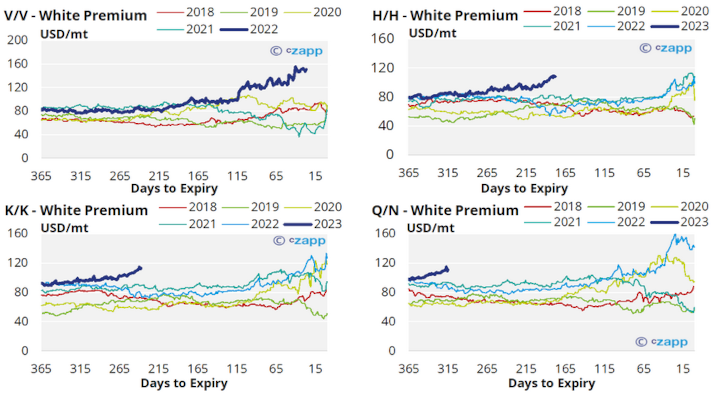

- The white premium remains strong around 150USD/mt.

New York No.11 (Raw Sugar)

- The No.11 has softened back towards 18c/lb over the last week of trading.

- As of the 16th of August, whilst prices were still climbing, raw sugar speculators cut over 30k lots of their recently built short position and added almost 9k lots of new long positions.

- This has brought the net spec position close to neutral again, further indicating the difficulty faced by speculators to hold a sustained position in the market at the moment .

- With the No.11 around 18.5c/lb by the 16th of August, the commercial long position fell by 30k lots suggesting raw sugar consumers had slowed any additional hedging with the market at that level.

- By contrast, producers increased their short position by 10k lots.

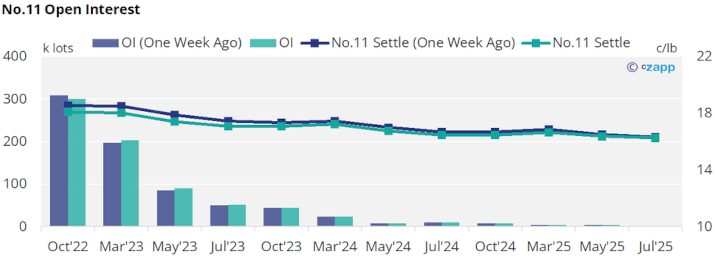

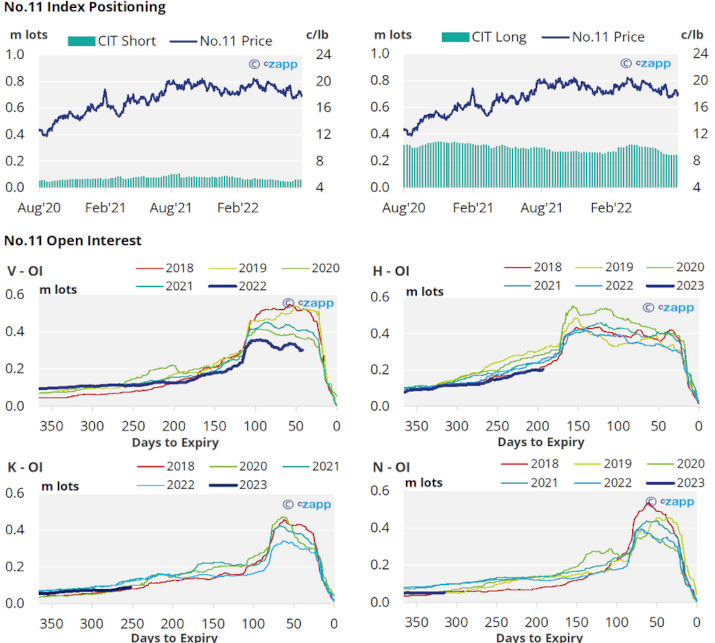

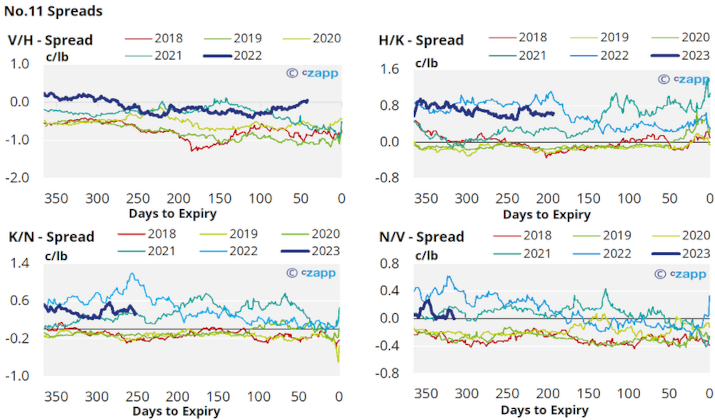

- The No.11 forward curve is flat into Mar’23, falling into backwardation to Jul’23

London No.5 (White Sugar)

- No.5 prices have weakened to 550USD/mt over the last week, mirroring movements in the No.11.

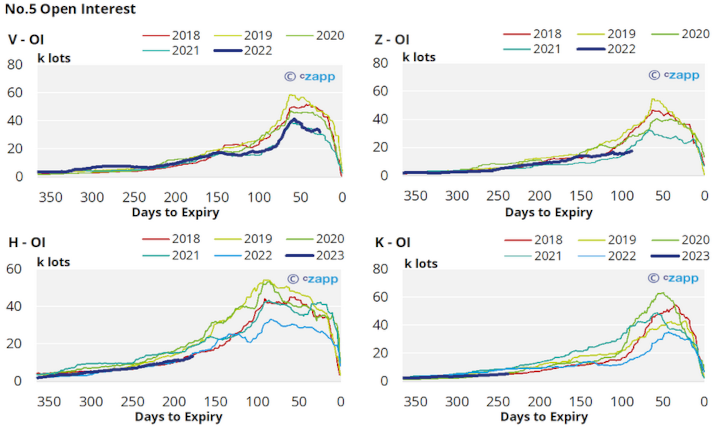

- As of the 16th of August, the net spec position has risen by a further 4k lots, bringing it close to the highest level seen yet in 2022.

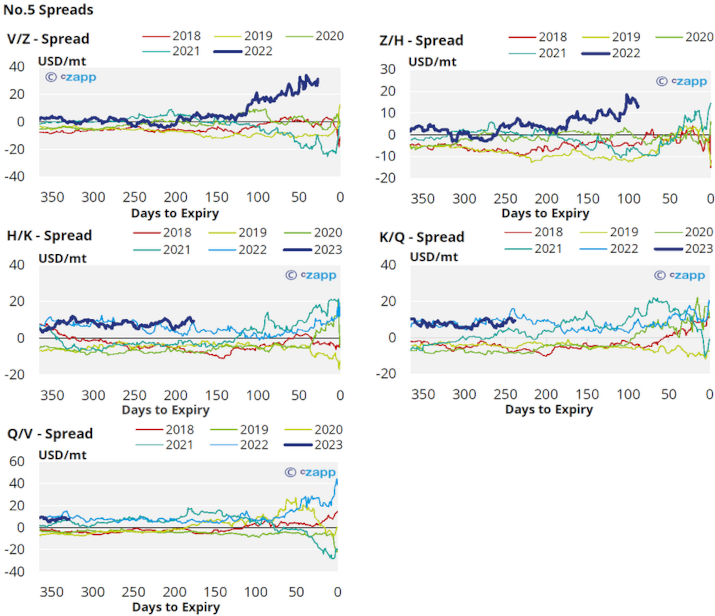

- The No.5 forward curve remains heavily backwardated into 2024, with spreads to May’23 each the widest in at least the last 5 years.

White Premium (Arbitrage)

- The sugar white premium has sustained above 150USD/mt, reflective of current tightness in the refined sugar market.

- At this level we should see re-export refiners operating profitably and maximising their throughput.

- We think discretionary refiners will need upwards of 160USD/mt to start buying extra raws cargoes for re-export.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

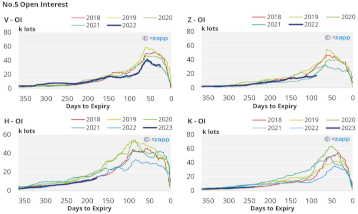

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…

Upper NE Thailand Sugar Crop Tour Manages Expectations

Ask the Analyst: New Global Corn Trade Between China and Brazil