Insight Focus

- Raw and refined sugar prices have been trading sideways in the last week.

- Speculators have closed more short positions, willing to hold on to long positions.

- The H/H white premium has strengthened, standing at 130USD/mt.

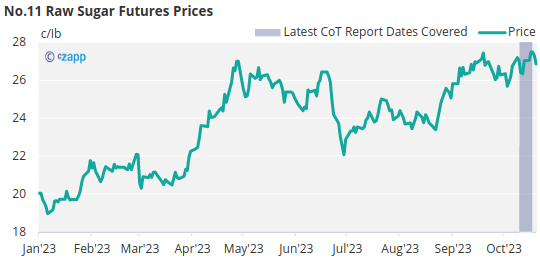

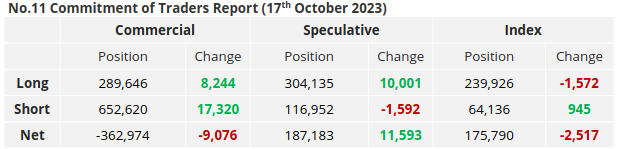

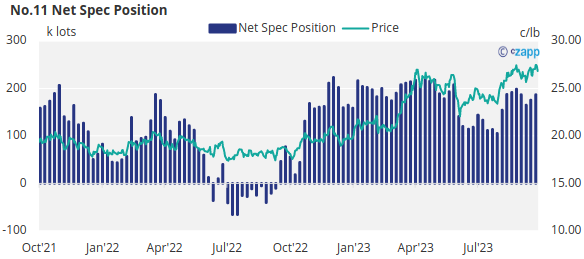

New York No.11 Raw Sugar Futures

The No.11 raw sugar futures continue to trade sideways, reluctant to break too far higher or lower than 26.5c/Ib.

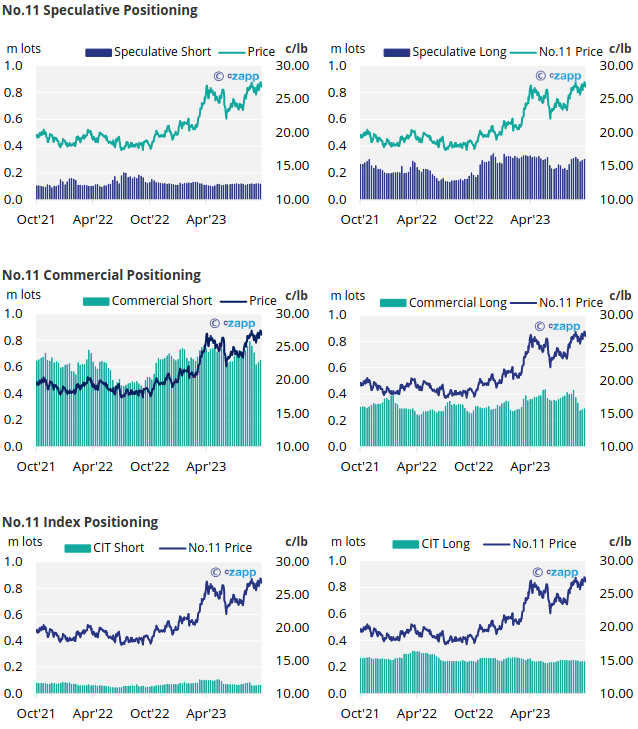

Raw sugar speculators, possibly trying to drive further upwards momentum, added 10k lots of new long positions, and closed 1.5k lots of shorts.

Raw sugar producers have also been capitalising on these decade high prices, adding over 17k lots of additional hedges, whilst consumer on the other hand have added around 8.2k lots of positions – most likely hand to mouth.

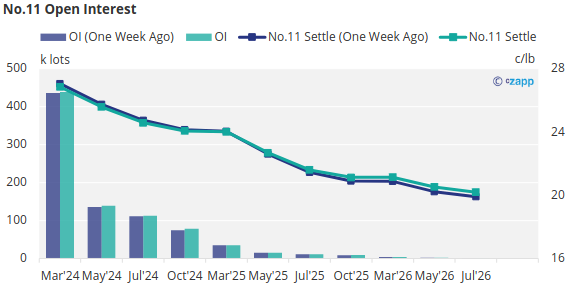

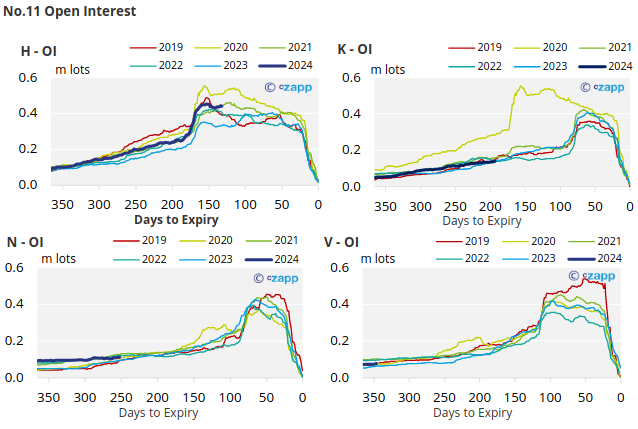

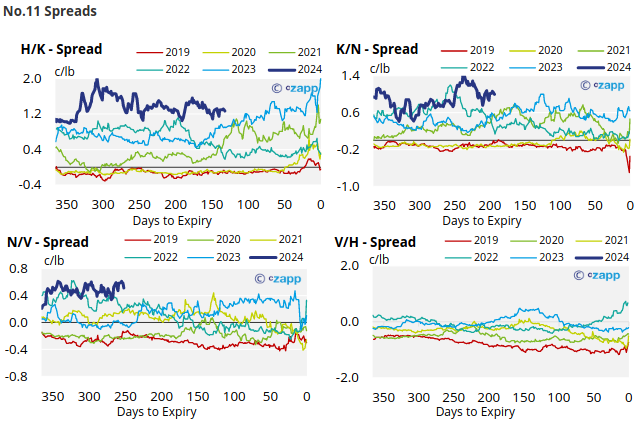

The No.11 forward curve continues to remain inverted through to Jul’26.

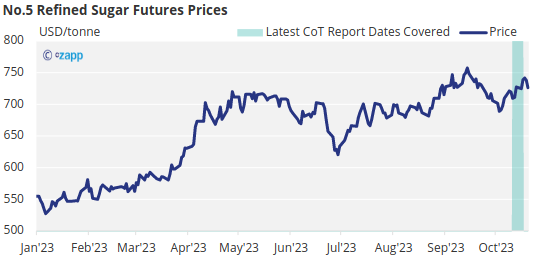

London No.5 Refined Sugar Futures

Refined sugar prices have also moved sideways over the past week, closing just above 709USD/mt last Friday.

By the latest CoT report, refined sugar speculators increased their long positions by 3k lots, bringing the overall net spec position back up to 27.7k lots.

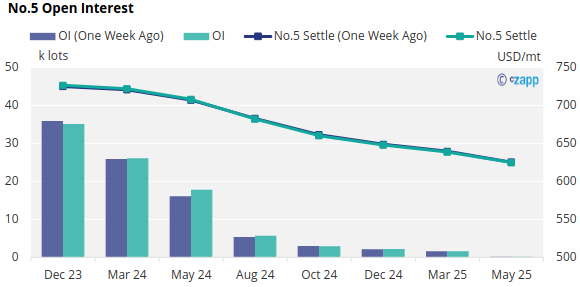

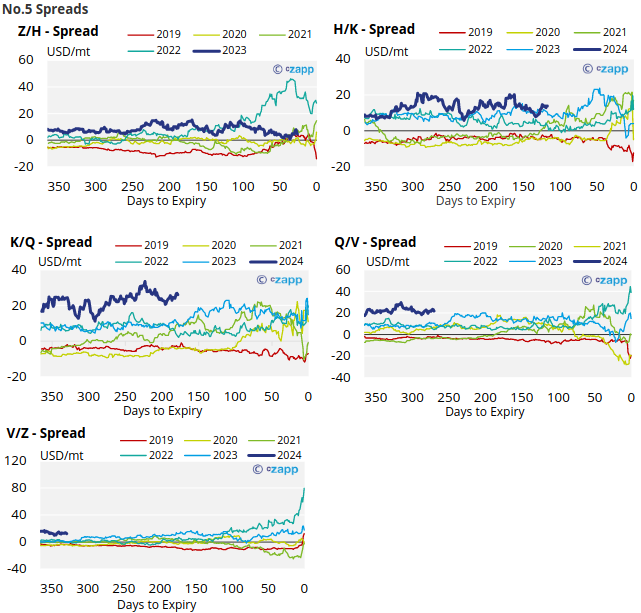

With contracts strengthening across the board, the No.5 forward curve remains inverted through to May’25.

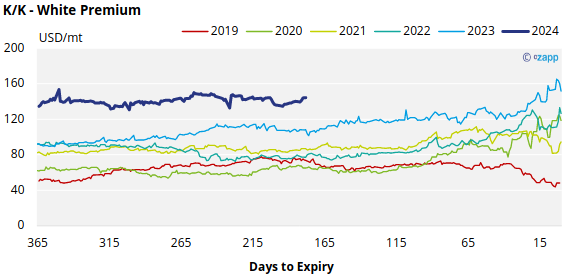

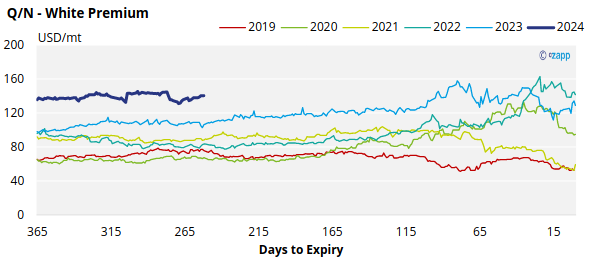

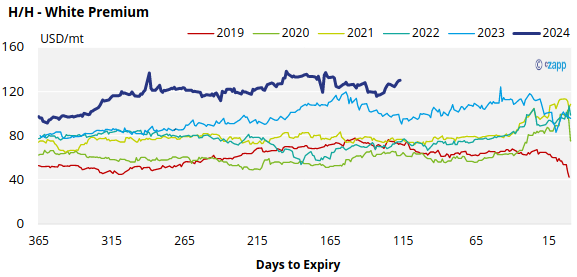

White Premium (Arbitrage)

With both raw and refined sugar prices making similar moves over the last week, the H/H sugar white premium has remained stable at around 130USD/tonne.

We anticipate that the refined sugar market will be undersupplied for the majority of 2024, as evidenced by the K/K and Q/N white premiums, which are currently trading between 140-144USD/mt.

That said, we think re-exports refiners need around 100-110USD/mt above the No.11 to profitably produce refined sugar, therefore physical values should still be necessary to bridge this gap.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix