Insight Focus

Both raw and refined sugar futures have strengthened in the past week. End users exit their positions ahead of the Mar’25 expiry, whilst producers take advantage of today’s prices.

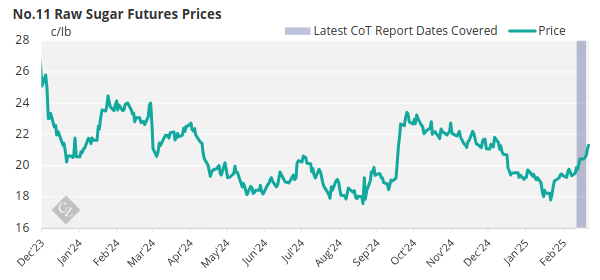

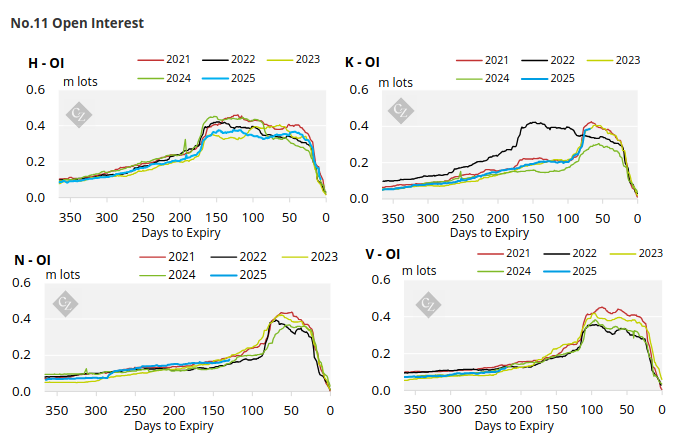

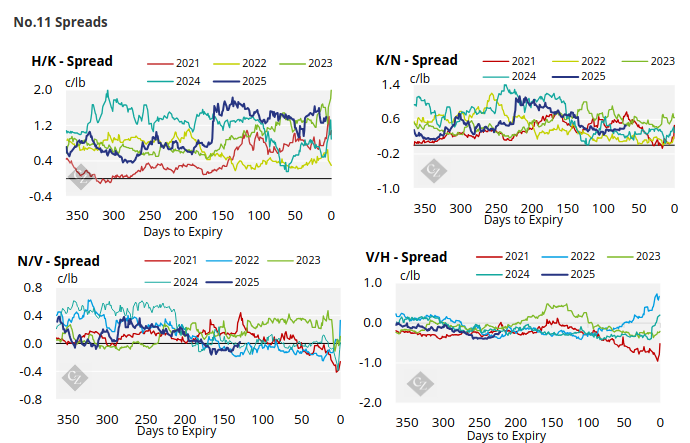

New York No.11 Raw Sugar Futures

The No. 11 raw sugar futures have been firm in the lead-up to the March 2025 expiry, currently trading at 21c/Ib.

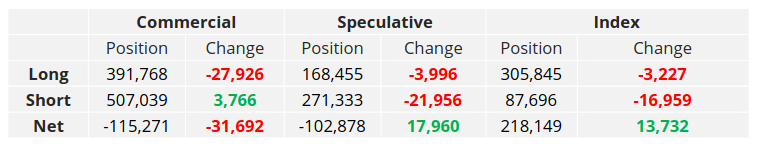

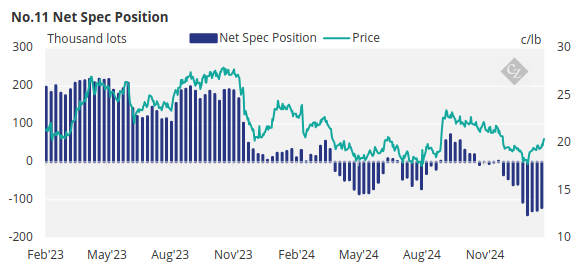

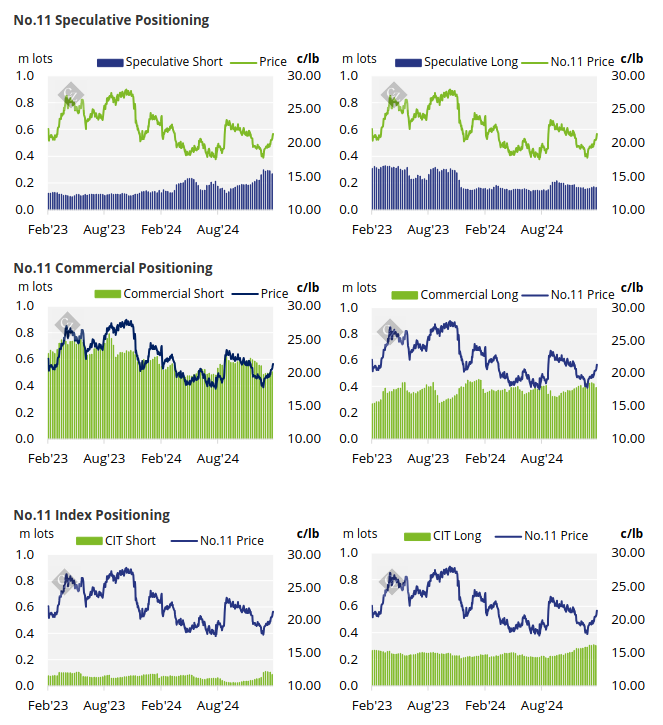

Speculators have been particularly active, closing out 27,926 lots of short positions while also liquidating 3,766 tonnes of long positions.

No.11 Commitment of Traders Report (17 February 2025)

End-users have also exited 27,926 tonnes of commercial long positions ahead of the March expiry. Meanwhile, producers have added 3,766 lots of new hedges, taking advantage of the recent price strength, as their level of cover is particular low this time of the year.

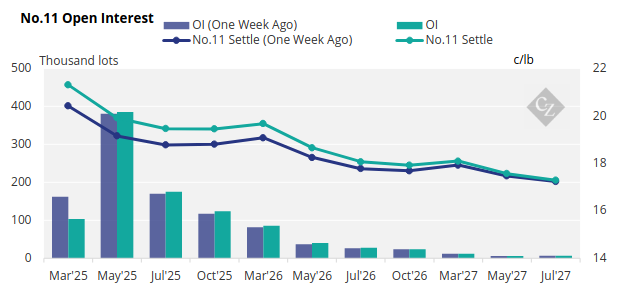

The No. 11 forward curve has strengthened across the board.

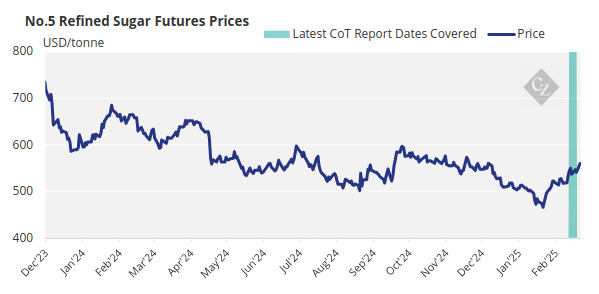

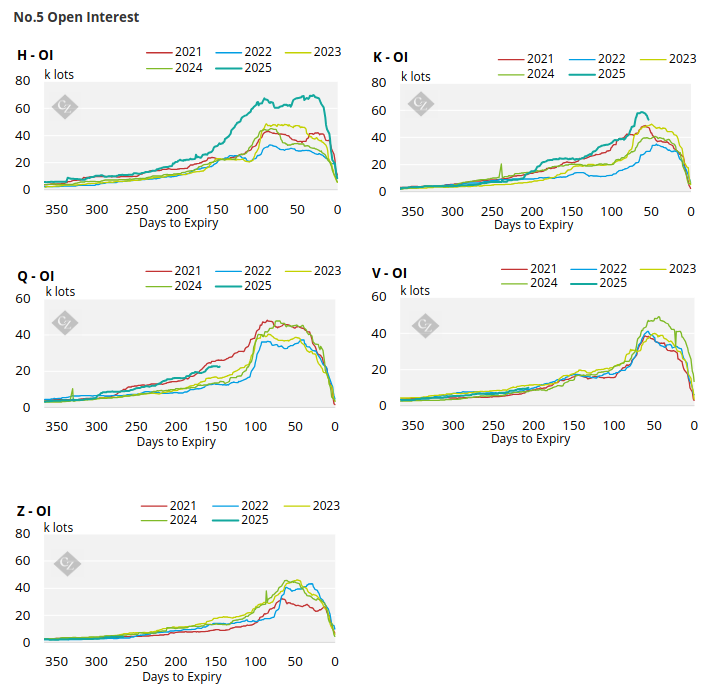

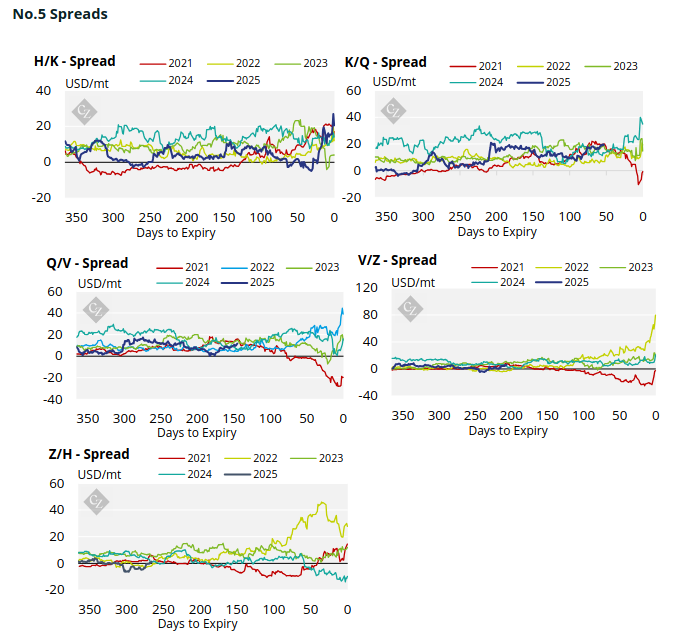

London No.5 Refined Sugar Futures

Looking at the No. 5 refined sugar futures, prices have continued to strengthen since the H’25 expiry, currently trading at USD 557/tonne.

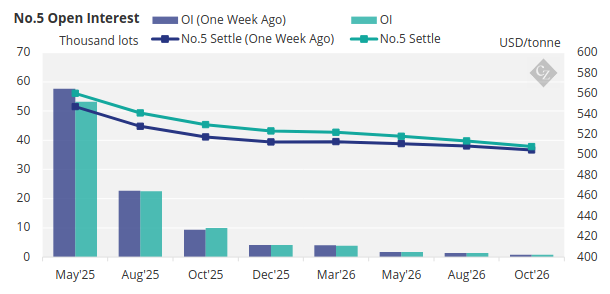

No.5 Open Interest

The No.5 refined sugar futures curve has also strengthened across the board.

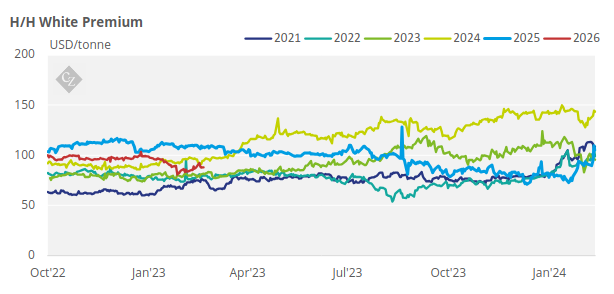

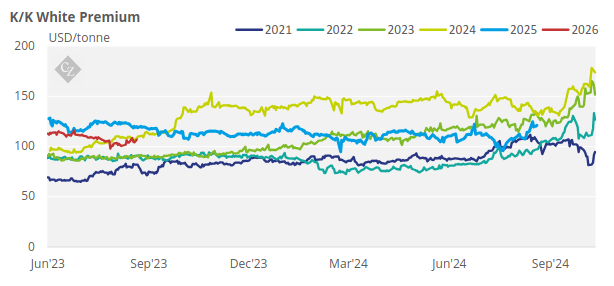

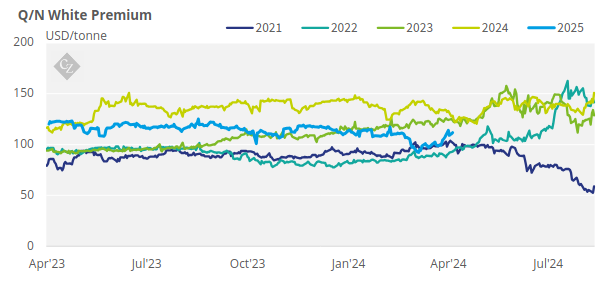

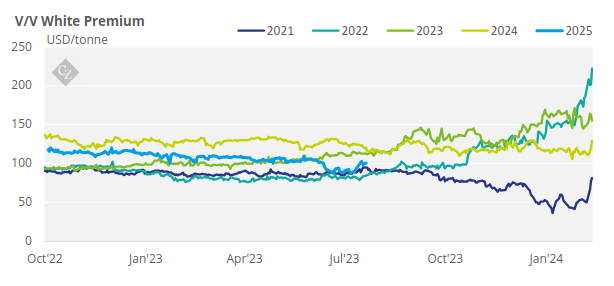

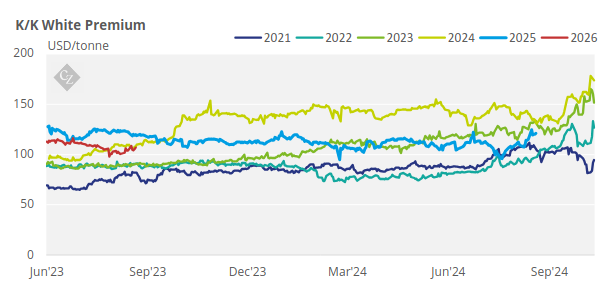

White Premium (Arbitrage)

With both No. 11 and No. 5 sugar futures moving in tandem, the K/K white premium is currently trading at USD 106/tonne.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix