Insight Focus

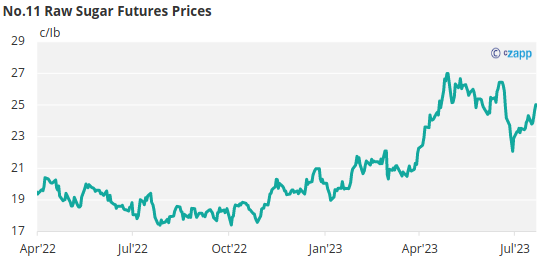

- Both the No.11 and No.5 sugar futures have strengthened for a second week in a row.

- Refined sugar speculators have increased their long positions.

- The V/V white sugar premium has weakened slightly to 145USD/mt.

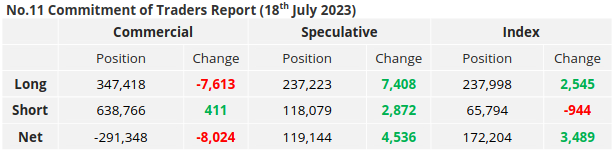

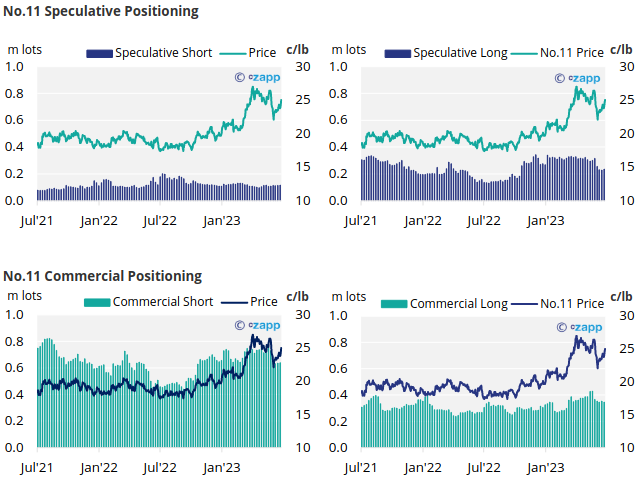

New York No.11 Raw Sugar Futures

The No.11 sugar futures has strengthened over the past week, going from 23.8c/Ib at the start of the week to 25c/Ib by Friday’s close.

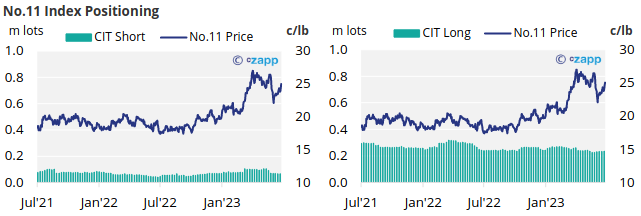

In light of this price increase, producers have added 0.4k lots of new hedges, whilst consumers on the other hand decided to close out about 7.6k lots of long positions.

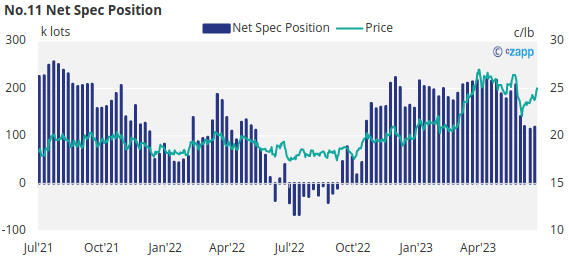

Turning our attention to the speculators, they have opened 7.4k lots of long positions as well as 2.8k lots of short positions, resulting in an increase of 4.5k lots in overall net spec positions to 119k.

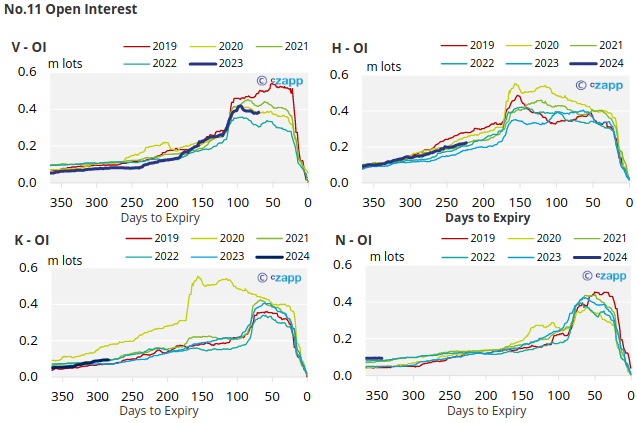

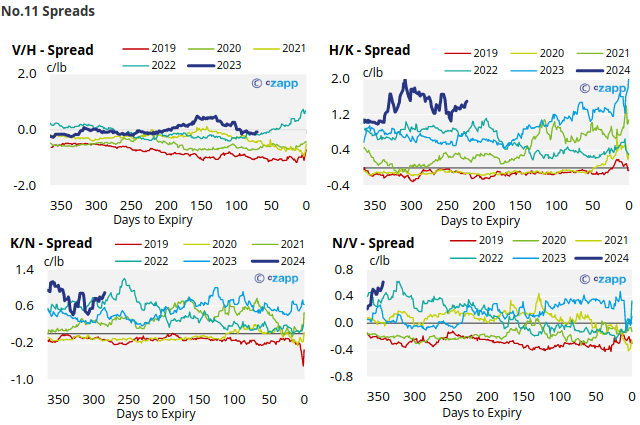

With contracts strengthening slightly across the board, over the last week, the No.11 curve remains inverted through to 2025.

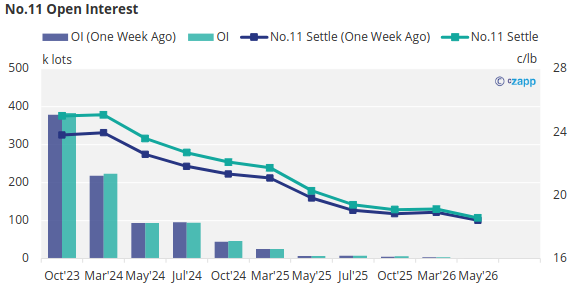

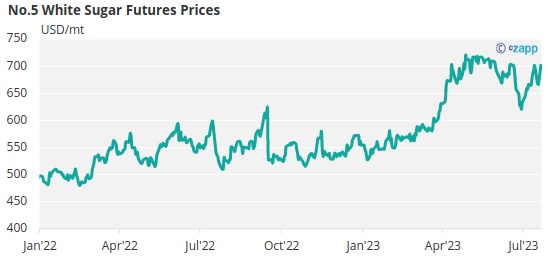

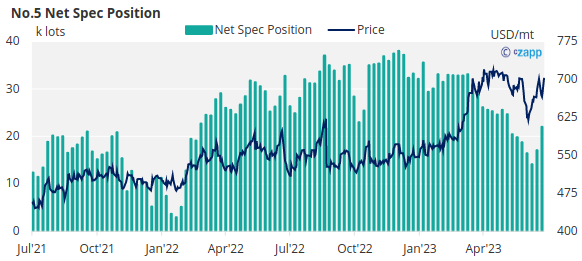

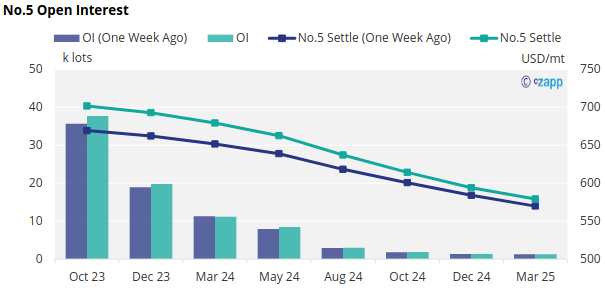

London No.5 Refined Sugar Futures

The No.5 refined sugar price has strengthened significantly over the last week, going from 666USD/mt at the start of the week to 701USD/mt by Friday’s close.

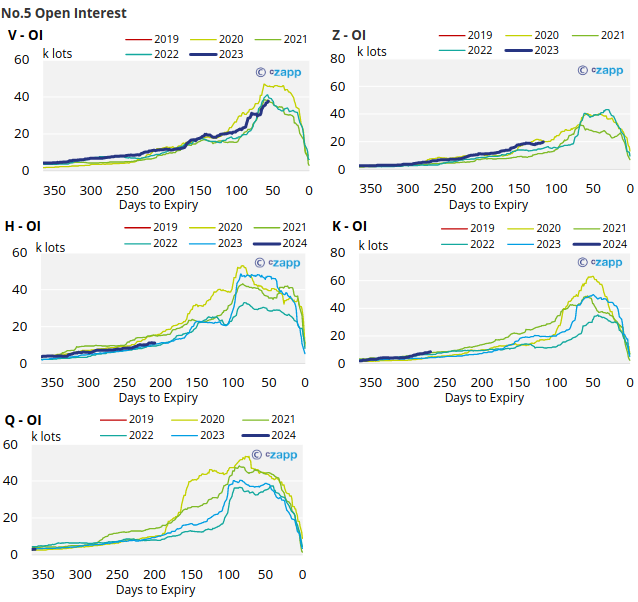

The refined sugar speculators may be driving this price increase, as they have opened just under 5k lots of long positions, helping to bring the overall net spec positions in refined sugar to 22k lots.

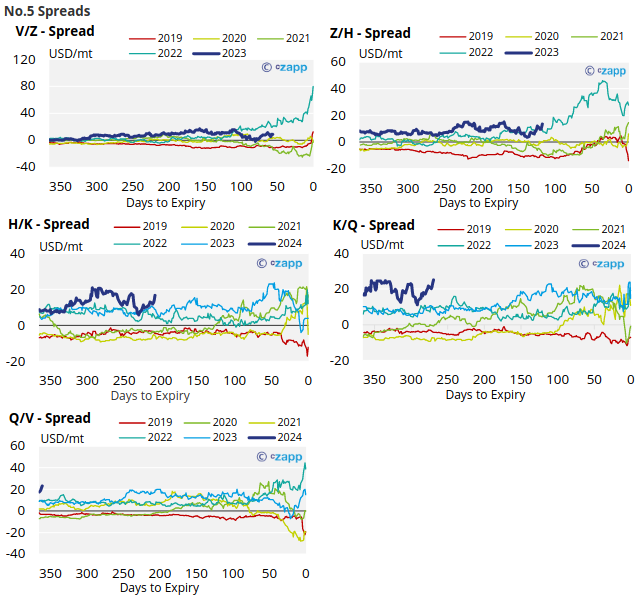

With contracts strengthening across the board, the No.5 forward curve remains inverted through to December 2024.

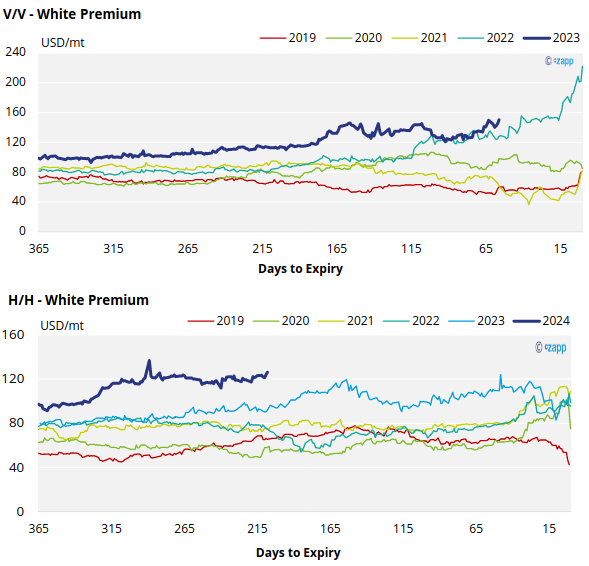

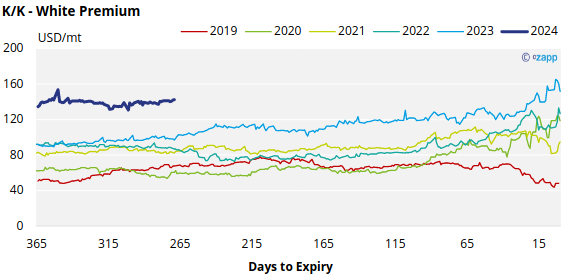

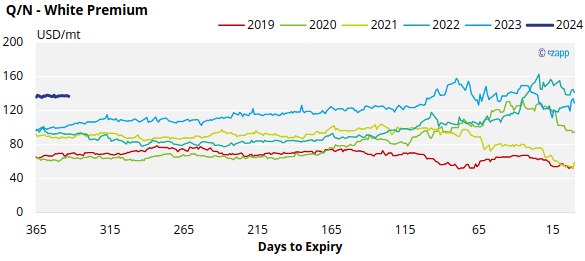

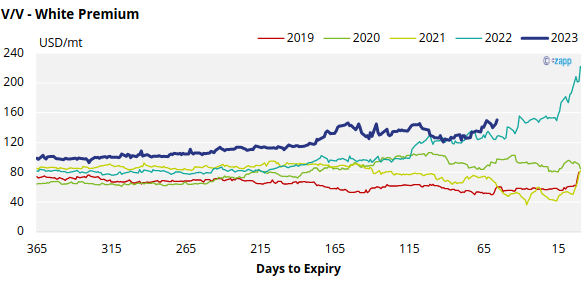

White Premium (Arbitrage)

The V/V sugar white premium has weakened slightly over the past week, reaching 145USD/mt by Friday’s close.

The refined sugar market is likely to be slightly undersupplied for the majority of 2023, and this is reflected in comparatively strong H/H and K/K white premiums, which has also weakened slightly over the past week and now approach 126USD/mt and 142 USD/mt, respectively.

Many re-exports refiners need around 105-115USD/mt above No.11 to produce refined sugar, so the current white premium is enough to encourage this.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix