Insight Focus

- No.11 prices have retreated towards 19 c/lb.

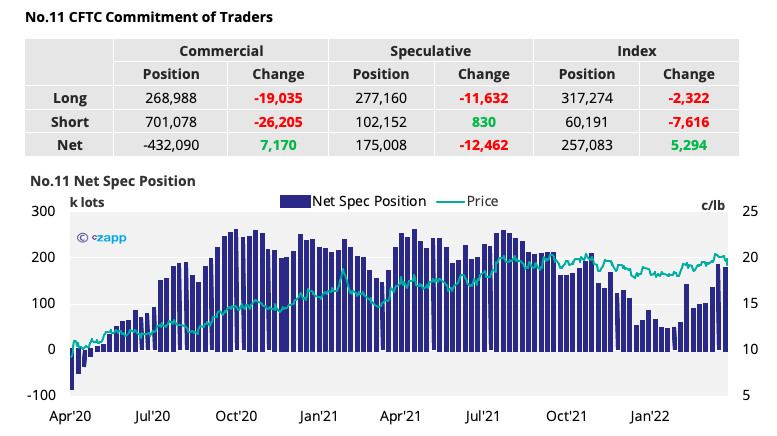

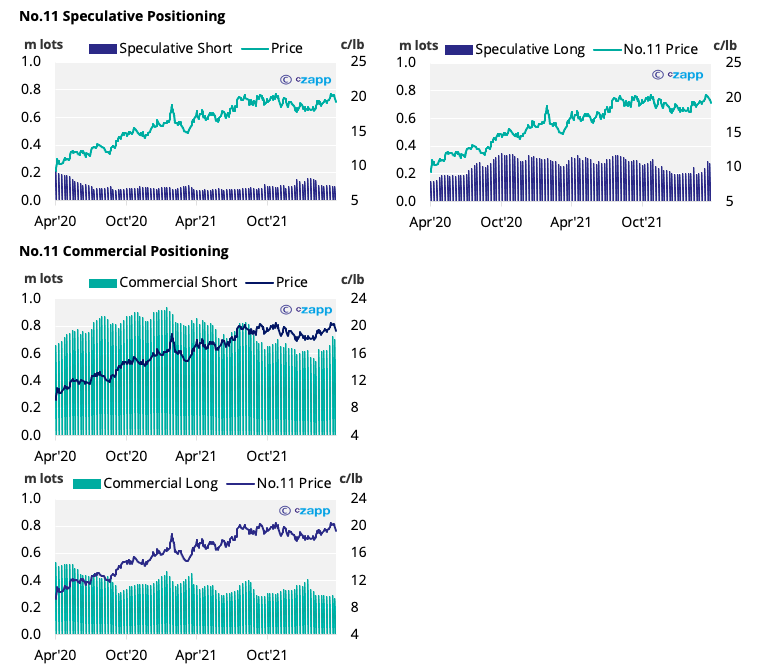

- Both raw sugar producers and consumers have trimmed their positions.

- White sugar speculators continue to add to their long position.

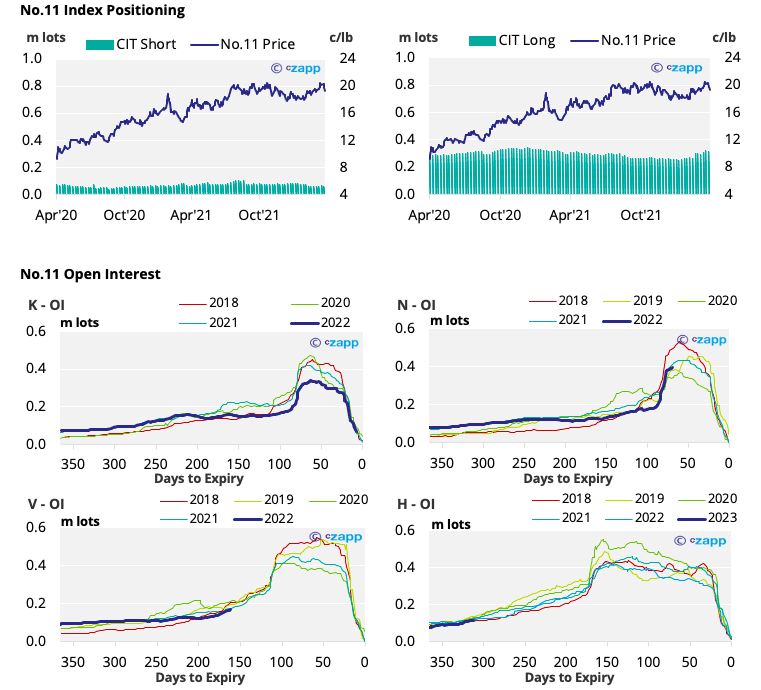

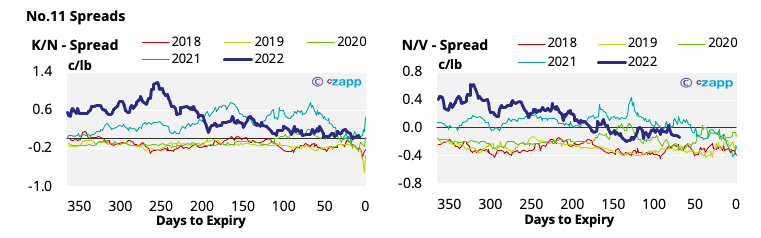

New York No.11 (Raw Sugar)

- Raw sugar prices have fallen below 20 c/lb, closing as low as 19.2 c/lb by the end of last week.

- This may put some of the newest longs (built above 19.5c) under pressure.

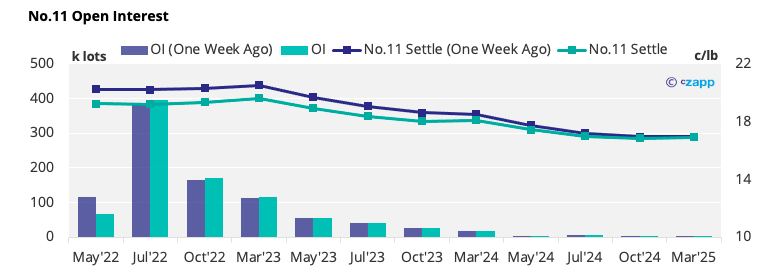

- Commercial open interest has also fallen by around 46k lots as both producers and consumers close out or roll positions ahead of the K’22 expiry.

- The No.11 forward curve is becoming gradually in contango towards H’23.

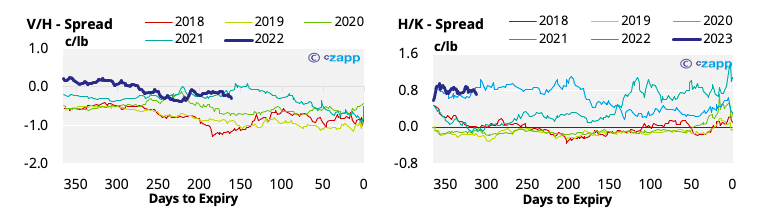

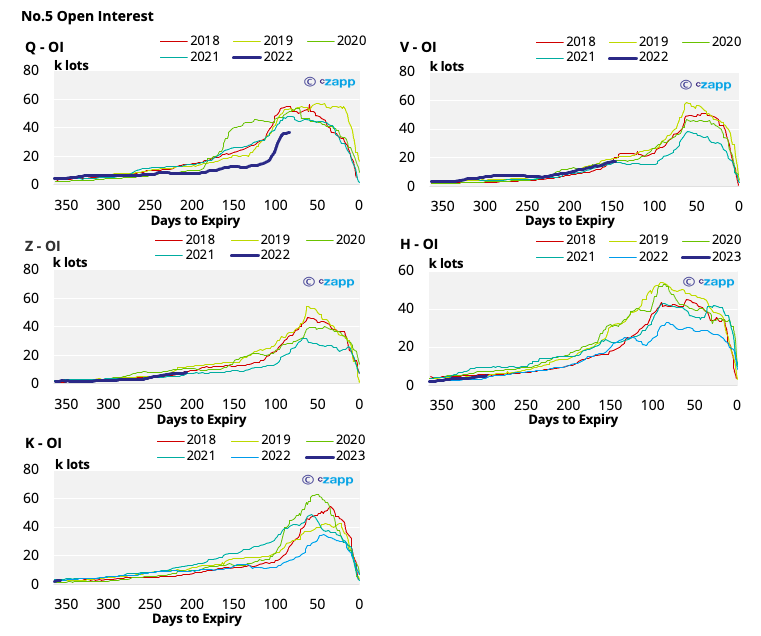

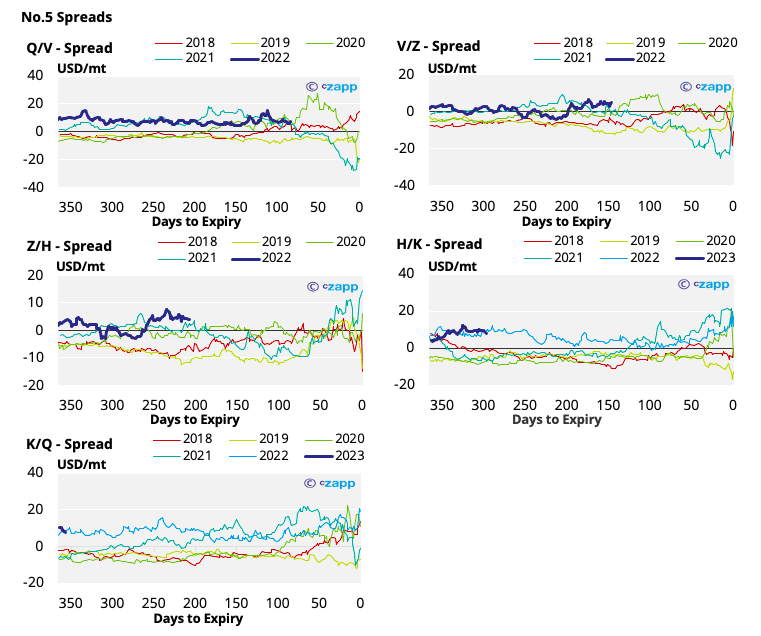

London No.5 (White Sugar)

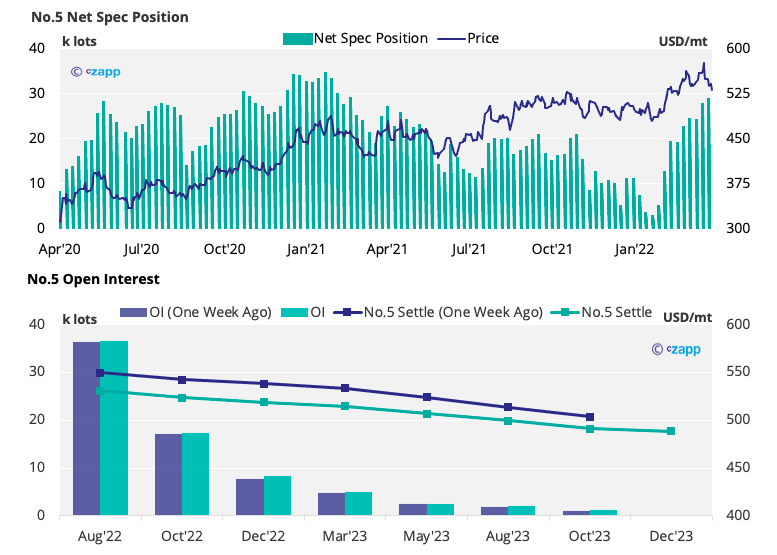

- After climbing as high as 577 USD/tonne, the No.5 retreated back below 540 USD/tonne by the close of last week (this is yet to be reflected in the CFTC data).

- As of the 19th April, the white sugar net spec position grew slightly to over 29k lots.

- White sugar prices have fallen all down the board, leaving the futures curve similarly backwardated across 2022 and 2023.

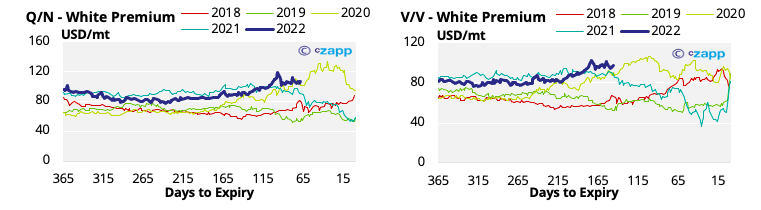

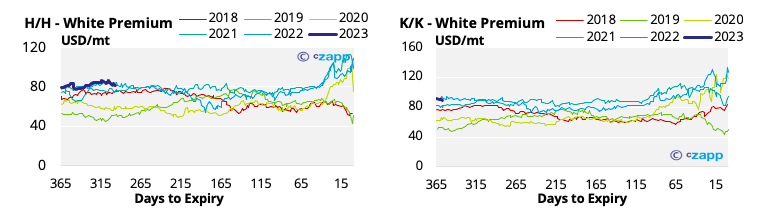

White Premium (Arbitrage)

- The white premium remains stable around 105 USD/tonne.

- We think some re-export refiners may struggle to operate profitably at this level.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…

News Review: Inflation & Economic Growth Warnings on Ukraine Crisis