Insight Focus

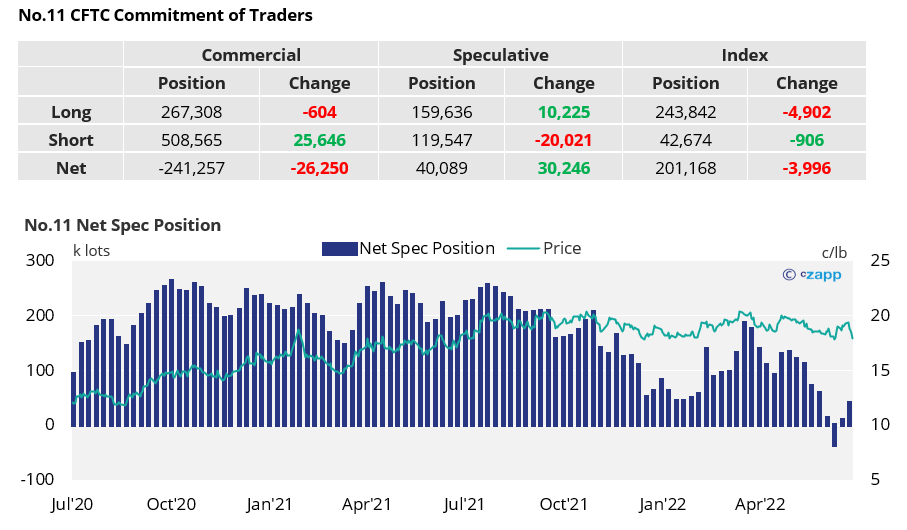

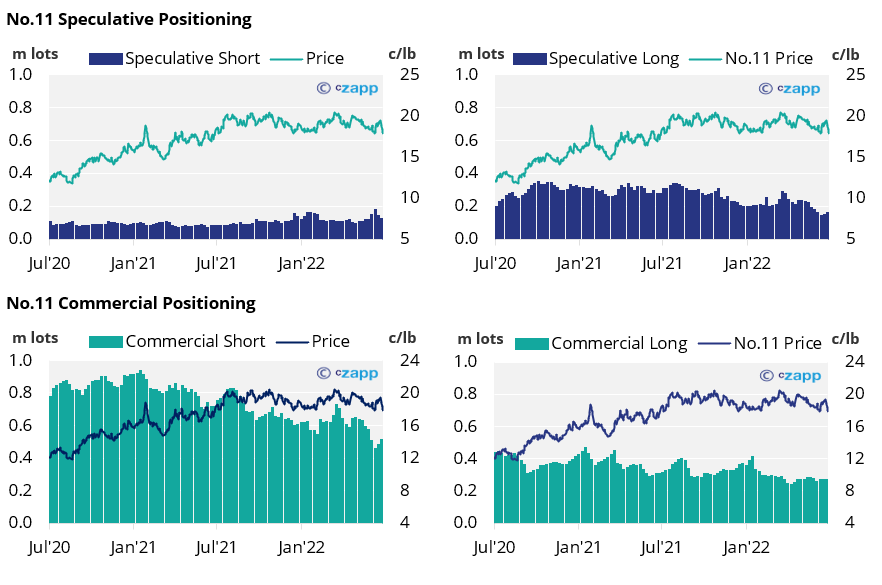

- Like last week, speculative short positions have been closed, whilst longs have been added.

- Consumers hedged more when raw sugar was above 19c/lb.

New York No.11 (Raw Sugar)

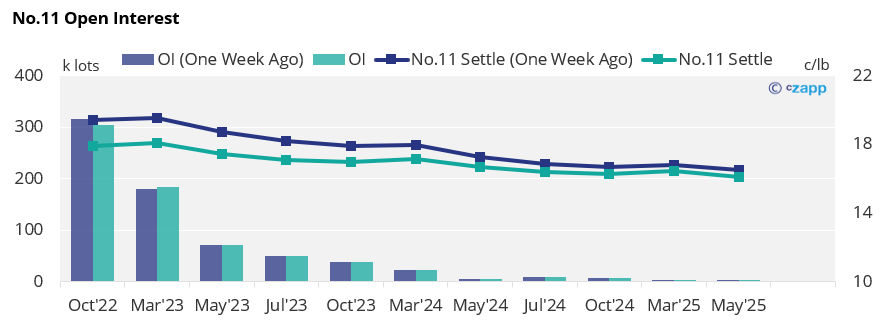

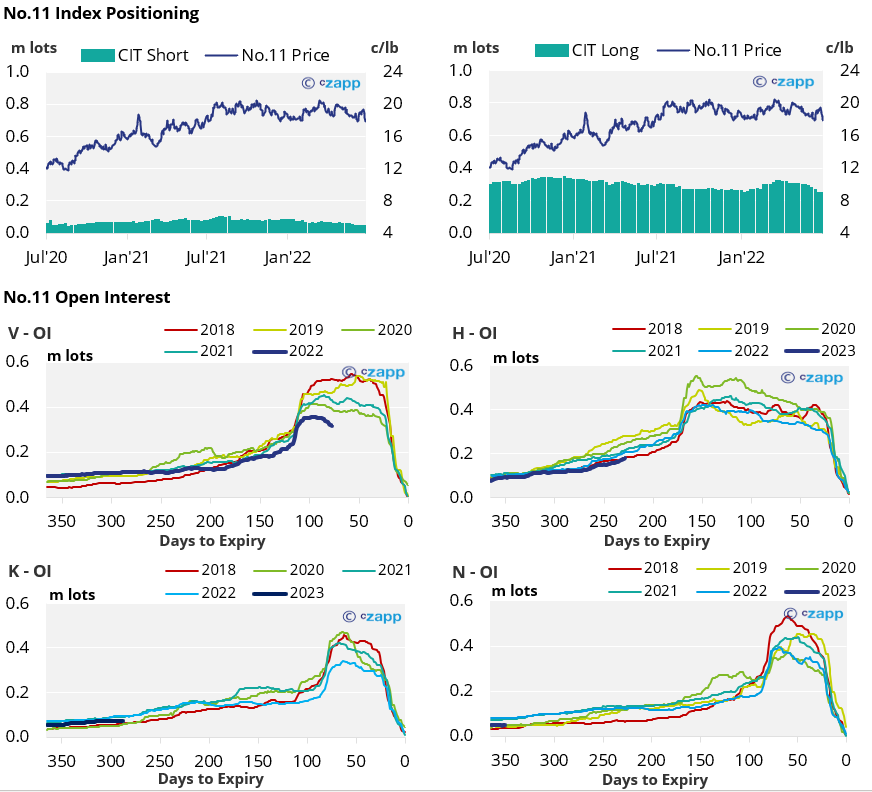

- No.11 prices have dropped below the 18c/lb after hanging around 19c/lb last week.

- Over 20k lots of short positions were closed by the 19th of July as prices traded higher.

- The net spec position is starting to grow again and is now 40k lots long.

- Raw sugar producers added almost 26k lots of hedges until the 19th of July, as prices were towards the top of sugar’s recent range.

- The whole No.11 forward curve is lower than last week but flattens slightly into 2023.

London No.5 (White Sugar)

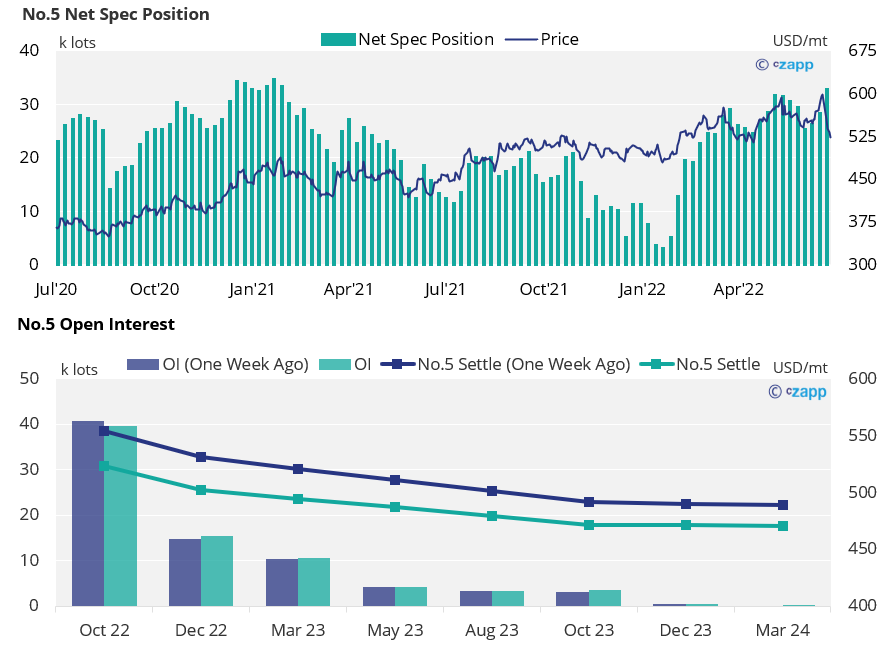

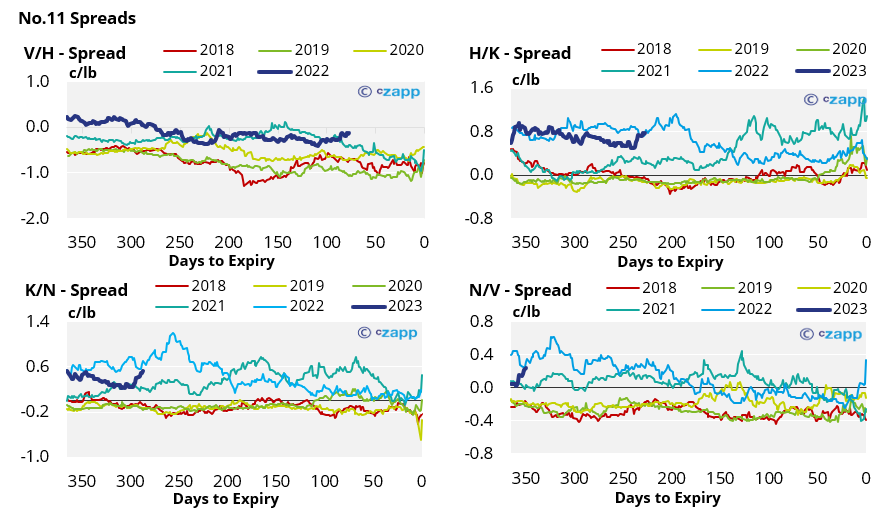

- Like the No.11, the No.5 has also fallen and now lies around 523 USD/mt.

- As of the 19th of July, the net spec position has moved 4k lots higher as white sugar speculative sentiment remains positive.

- The whole white sugar forward curve is lower than las week’s curve but flattens slightly by 2023.

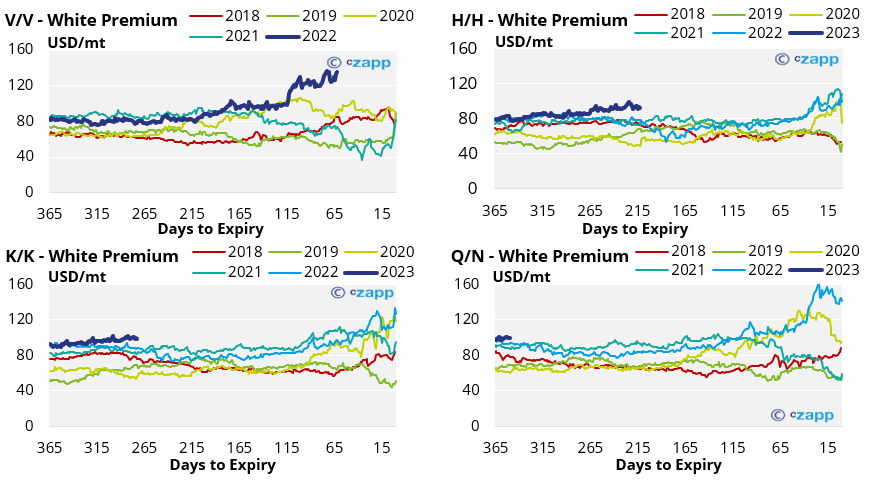

White Premium (Arbitrage)

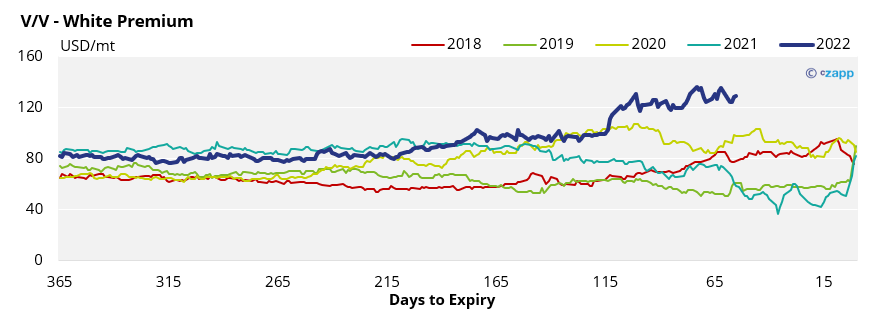

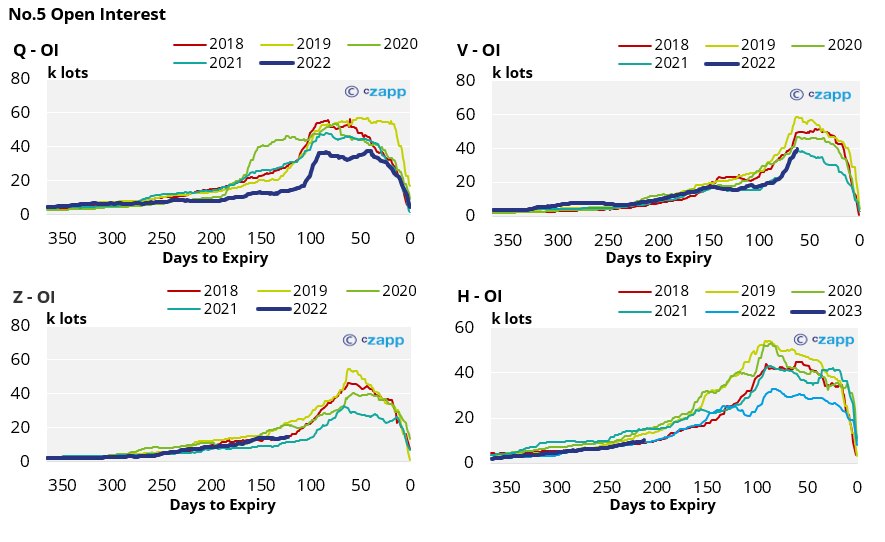

- The V’22/V’22 white premium decreased compared to last week and is now at 129USD/mt.

- Despite the decrease, the white premium remains in uptrend.

- With the white premium at this level, some re-export refiners could still struggle to operate profitably which could reduce short term refined sugar supply.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

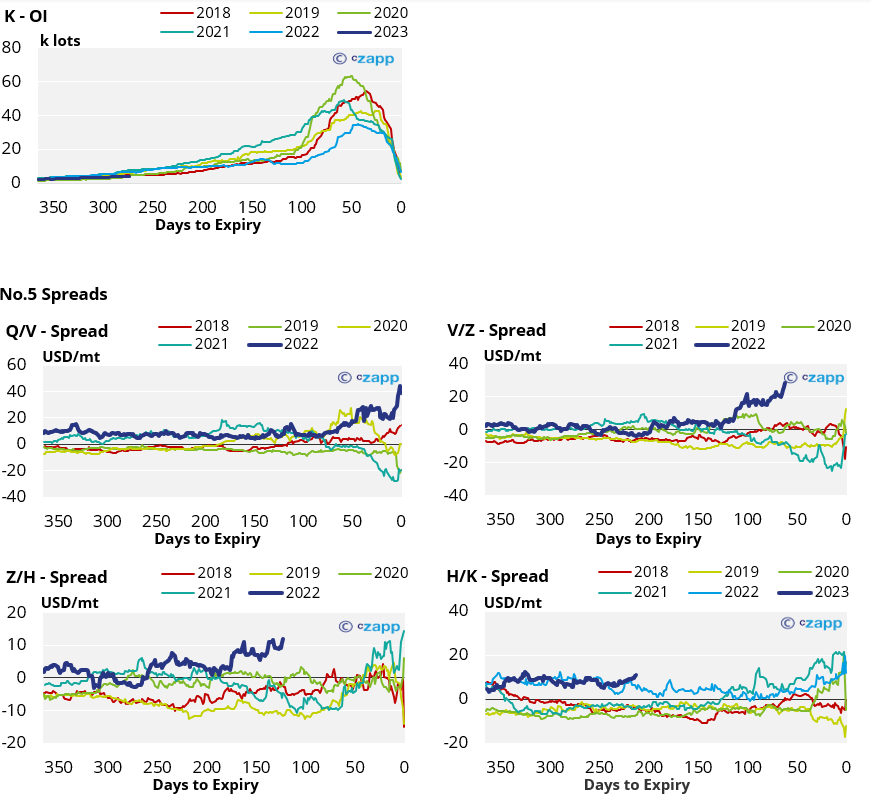

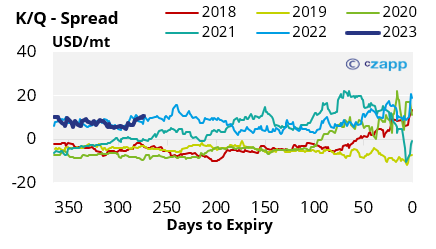

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…

European PET Market Stumbles as Producers Left Blind on Costs