Insight Focus

- The No.5 refined sugar futures strengthened.

- The K/K white premium has also strengthened standing at 154USD/mt.

- Wider interest in the sugar market remains weak.

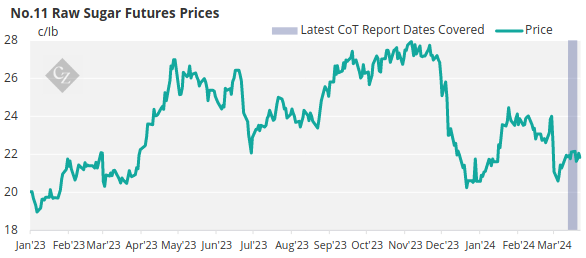

New York No.11 Raw Sugar Futures

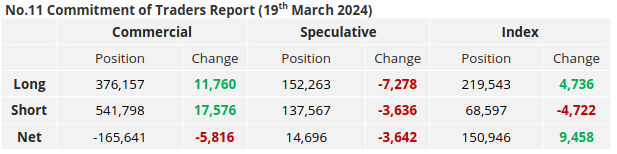

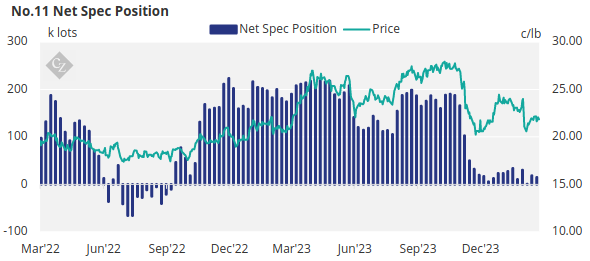

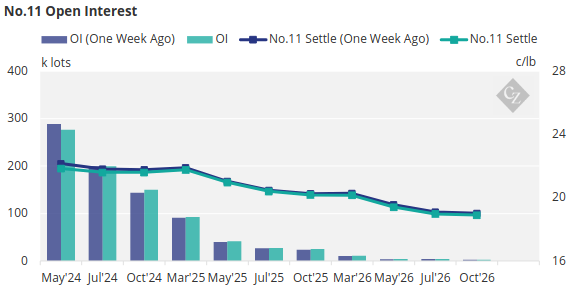

Over the last week, the No.11 raw sugar futures traded sideways at 21c/lb.

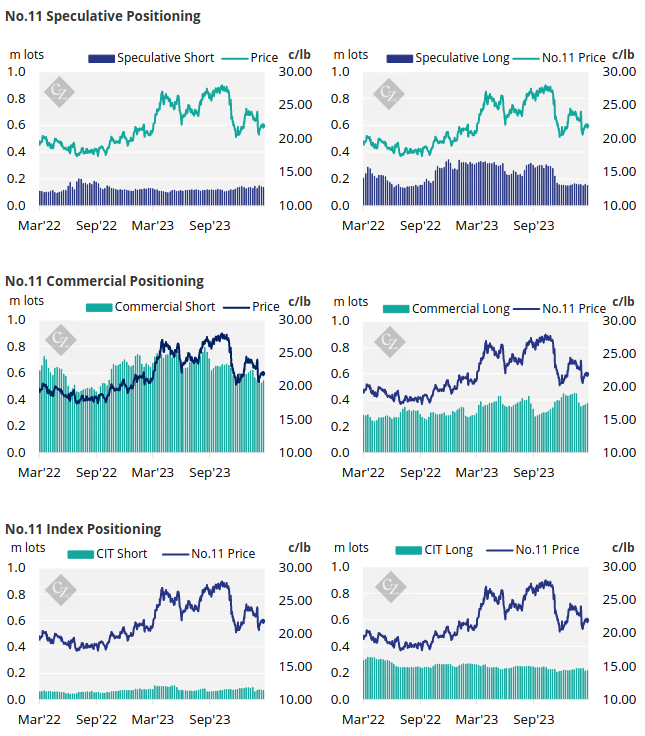

Speculators remain largely out of the sugar market. They’ve held a net neutral position since December’s price collapse and nothing has happened in the last week to change this.

Commercial participants have been active in the past week with producers opening 17.6k new hedges and end-users adding 11.8k lots of new hedges.

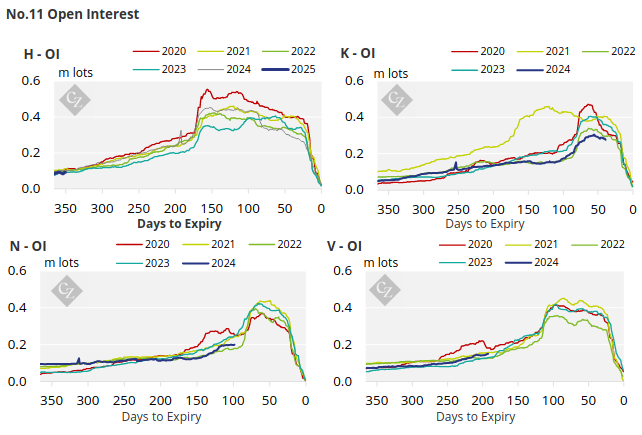

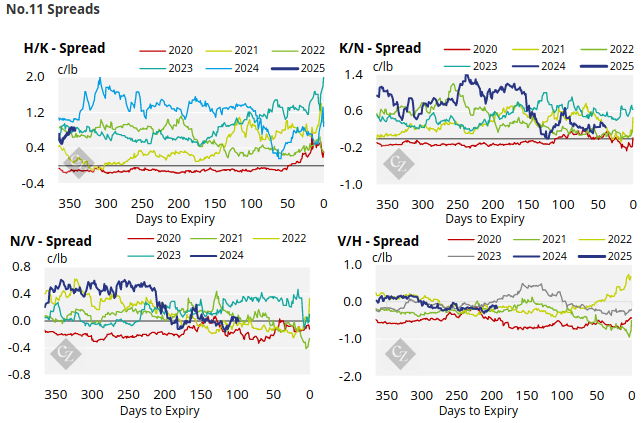

The No.11 raw sugar futures curve remains flat through 2024.

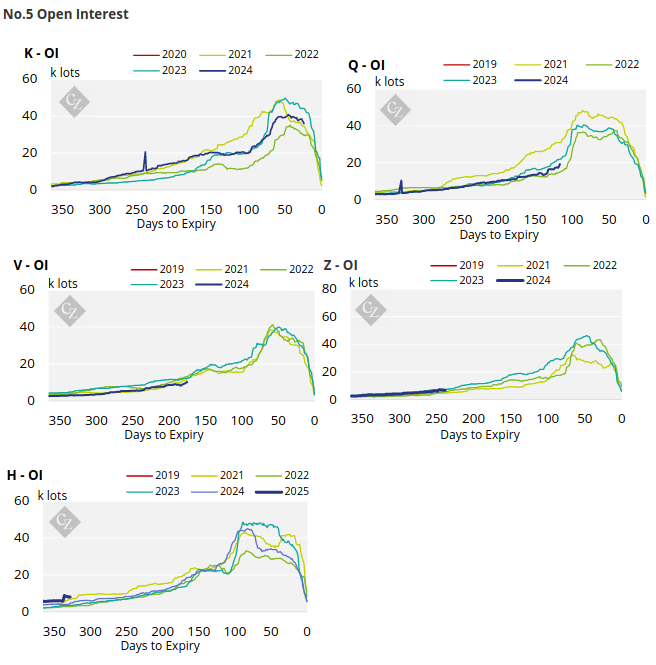

London No.5 Refined Sugar Futures

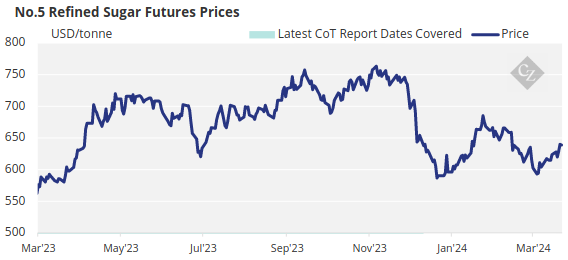

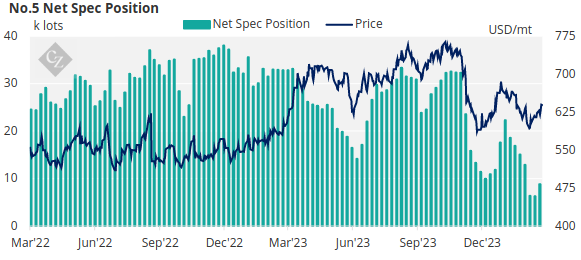

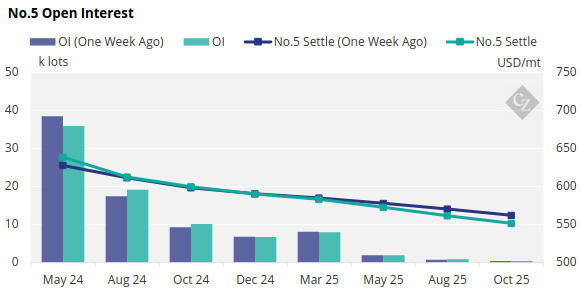

The No.5 refined sugar futures contract has strengthened in the past week, closing at 639USD/mt last Friday.

However, speculative participation in the market remains much-reduced.

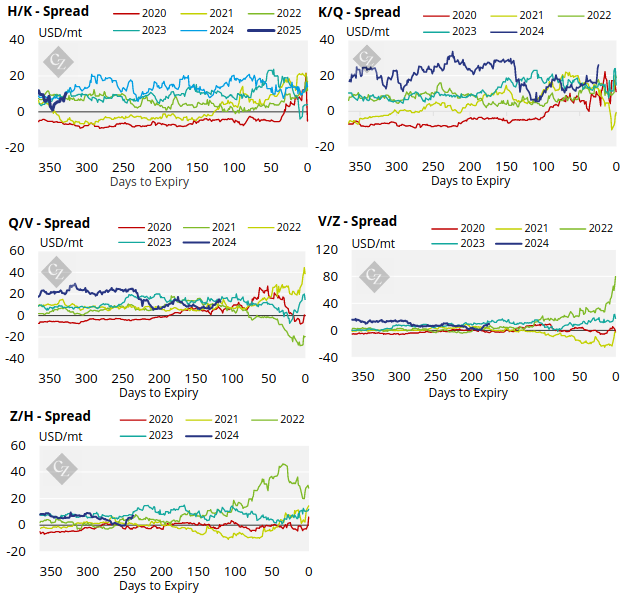

The refined sugar futures curve is still backwardated. Expect more interest in the front K/Q spread as the K’24 expiry approaches.

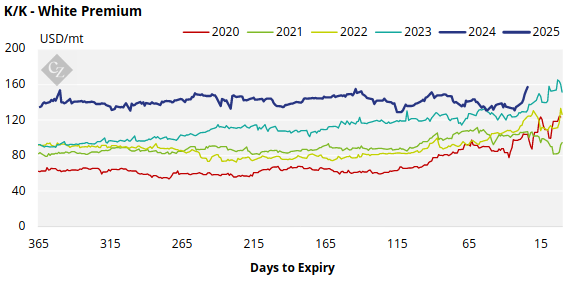

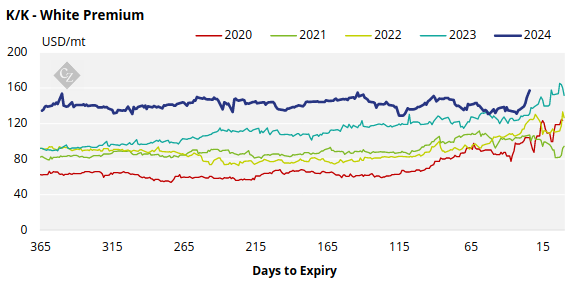

White Premium (Arbitrage)

The K/K White premium strengthened to 154USD/mt, up by around 18USD/mt.

Many re-exports refiners need around 105-115USD/mt above the No.11 to profitably produce refined sugar.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

No.5 Spreads

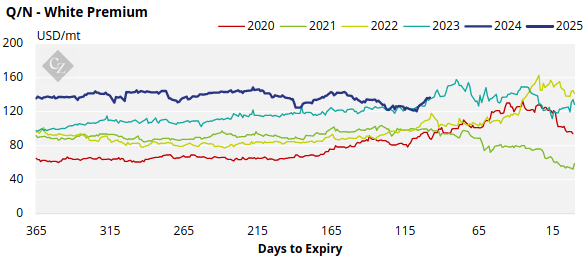

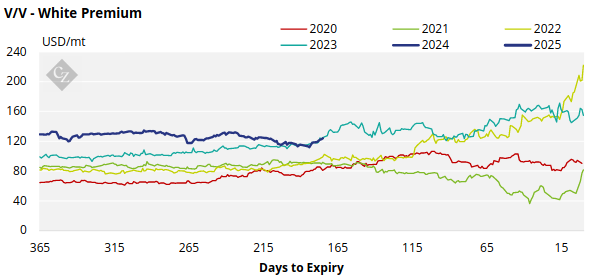

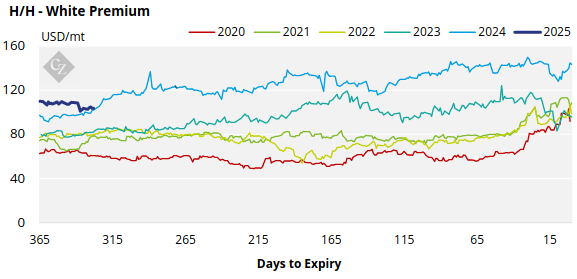

White Premium Appendix