Insight Focus

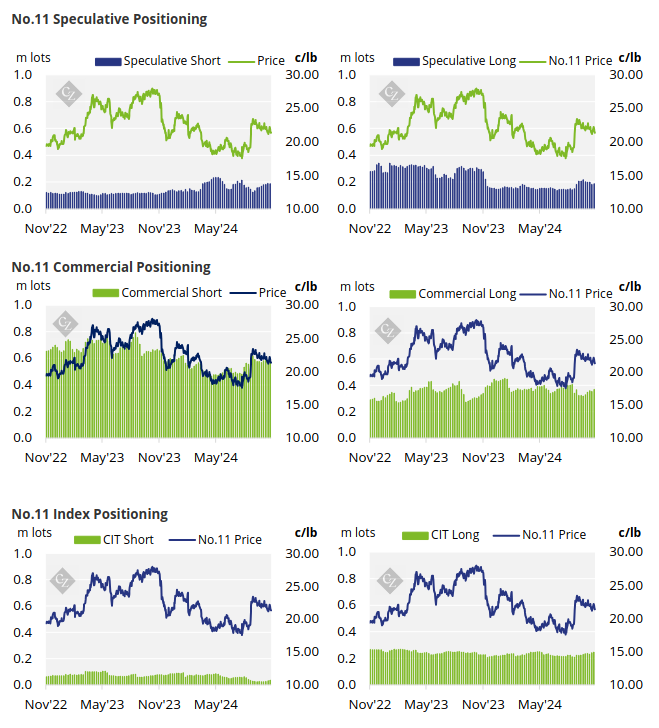

The No.11 raw sugar futures traded between 21-22.2c/lb. Both producers and end-users added to their positions over the past week. Speculators are neutral in the raw sugar market today.

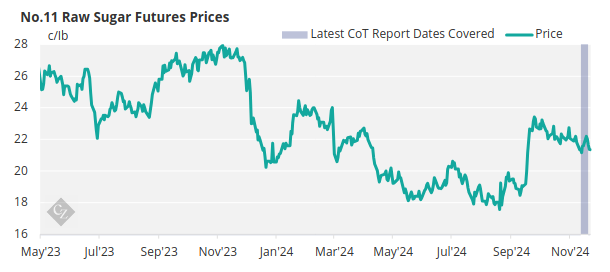

New York No.11 Raw Sugar Futures

Over the past week, the No.11 raw sugar futures traded between 21-22.2c/lb, closing at 21.4c/lb on Friday.

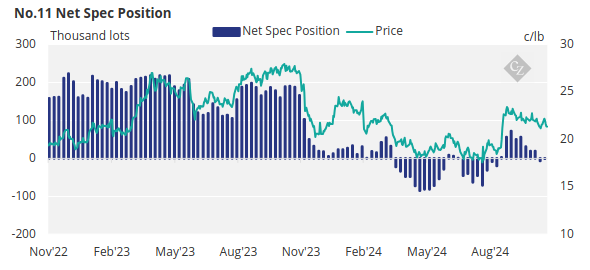

Both producers and end-users have added to their positions on the commercial side, with producers opening 22,200 lots of short position and end-users opening 14,400 lots of longs.

Speculators have opened 6,400 lots of long positions while reducing their short position by just under 600 lots of shorts.

Speculators are essentially neutral in the raw sugar market today as the net speculative positions stands at just -272 lots.

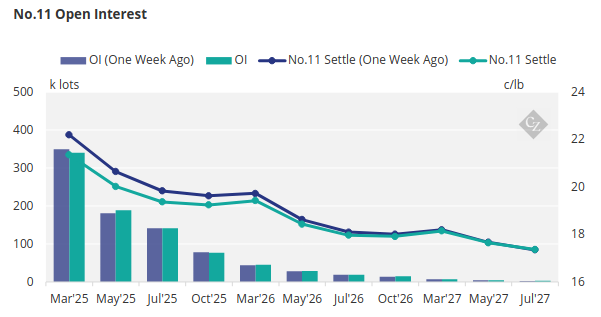

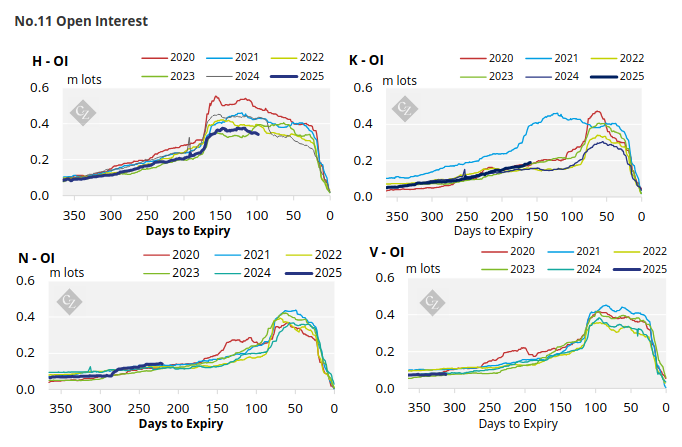

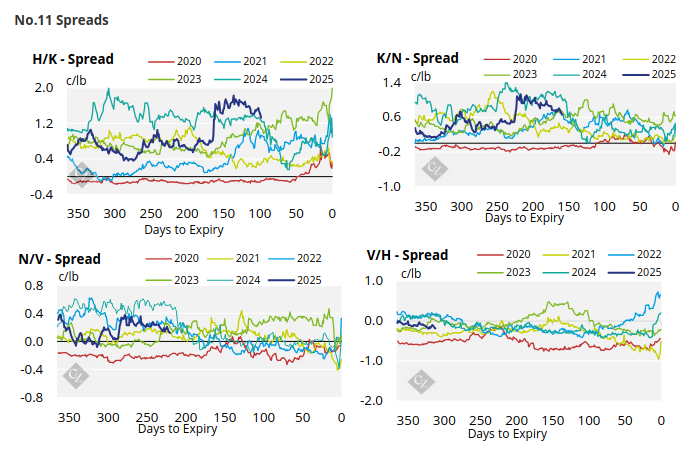

The No.11 forward curve has weakened at the front of the curve and remains in backwardation.

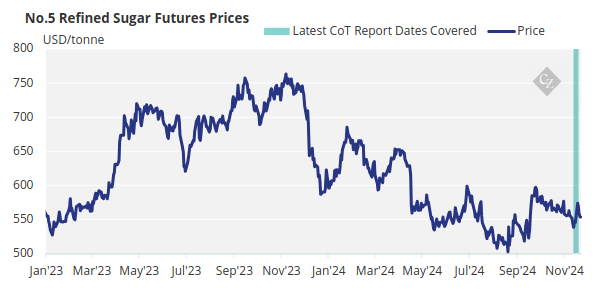

London No.5 Refined Sugar Futures

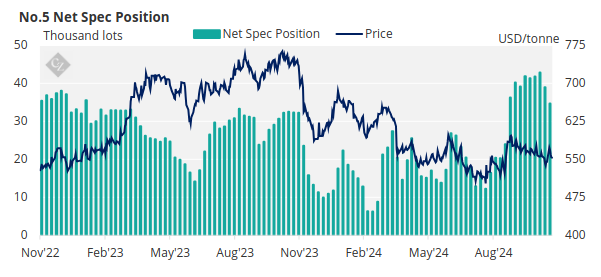

The No.5 refined sugar futures traded between USD 553-573.5/tonne, closing at USD 553.6/tonne on Friday.

Over the past week, speculators have closed out 4,300 lots of long positions, reducing the net spec position to 34,700 lots.

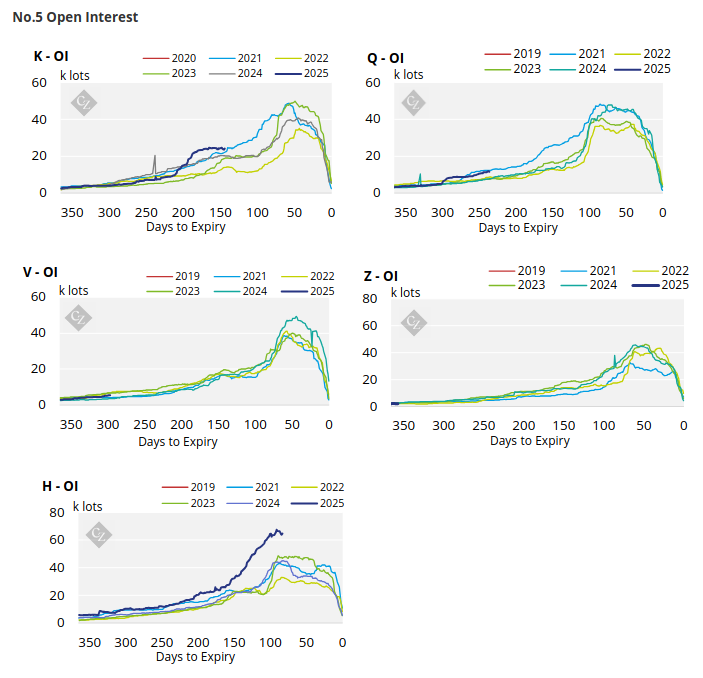

No.5 Open Interest

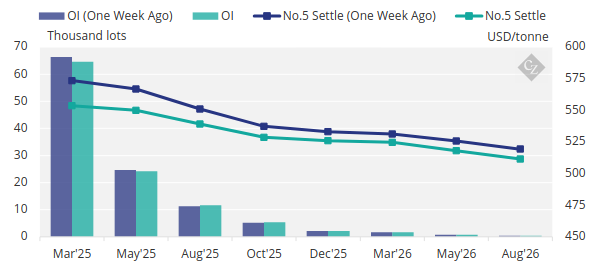

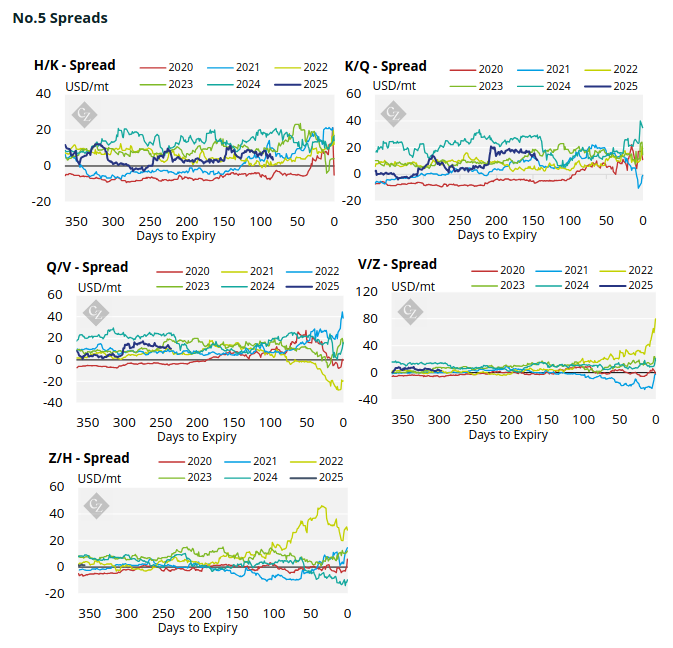

The No.5 refined sugar futures curve has weakened across the board.

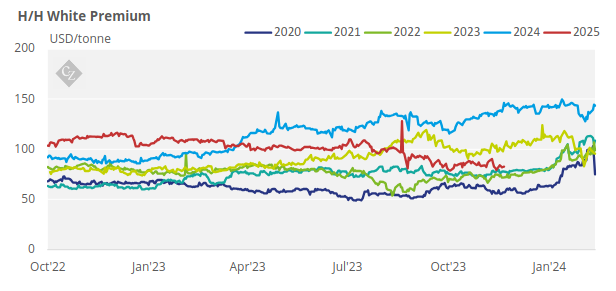

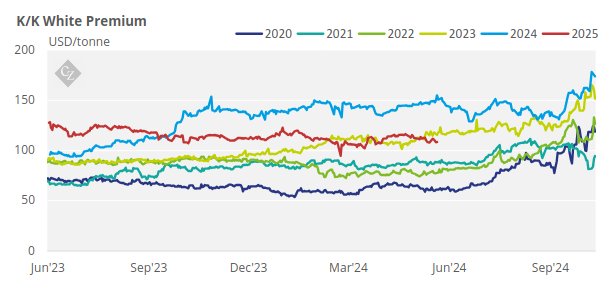

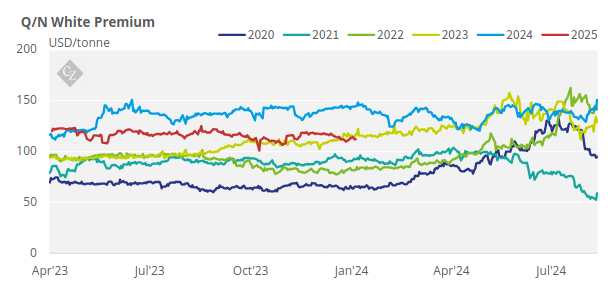

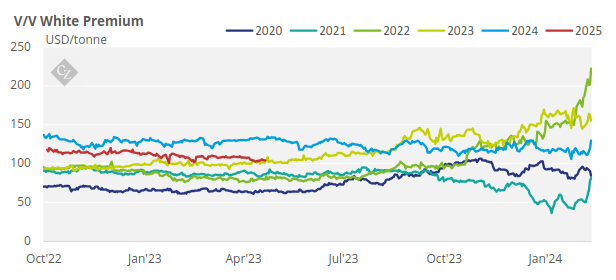

White Premium (Arbitrage)

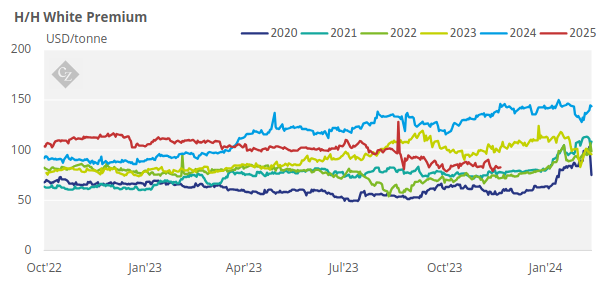

The H/H white premium traded between USD 82-84.1/tonne over the past week, closing at USD 82.7/tonne on Friday.

Many re-export refiners need around USD 105-115/tonne above the No.11 to profitably produce refined sugar. The current white premium is below this level, signalling to toll refiners to slow their operations.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix