Insight Focus

- The Mar’24 raw sugar futures will expire this week.

- Raw sugar speculators have opened a large number of short positions.

- The white premium has weakened to USD 131/tonne.

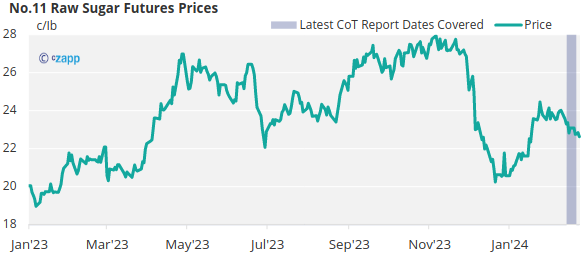

New York No.11 Raw Sugar Futures

Over the past week, the No.11 raw sugar futures took a downward turn, breaking away from the recent 23-24c/Ib range.

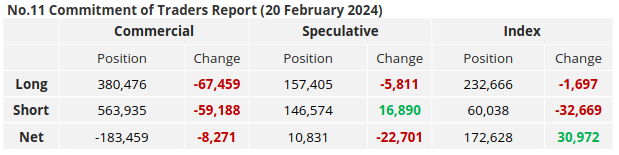

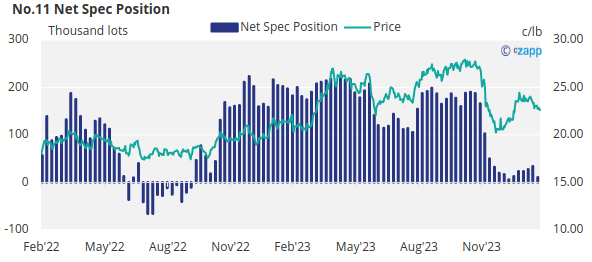

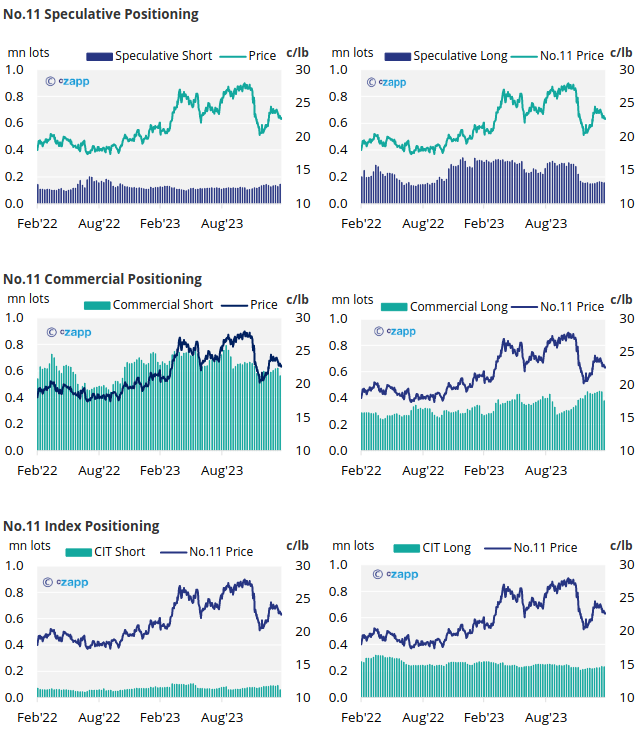

In the past week, speculators have opened 16,800 lots of short positions, the largest weekly move in over two years. This may have added to the downward pressure on price.

Not only that, but with 5.8k lots of spec long positions closed, the net spec position has dropped back to 10,800 lots. As before, speculators are largely on the sidelines of the sugar market. The spec short isn’t yet large enough to be notable. The spec long is small. The net position is effectively zero.

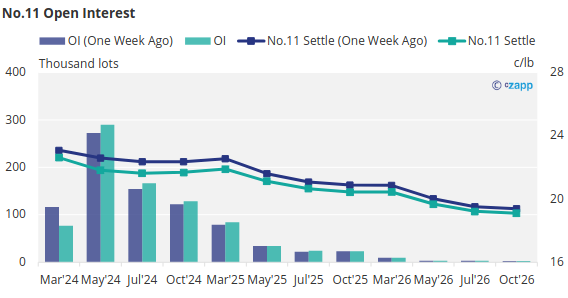

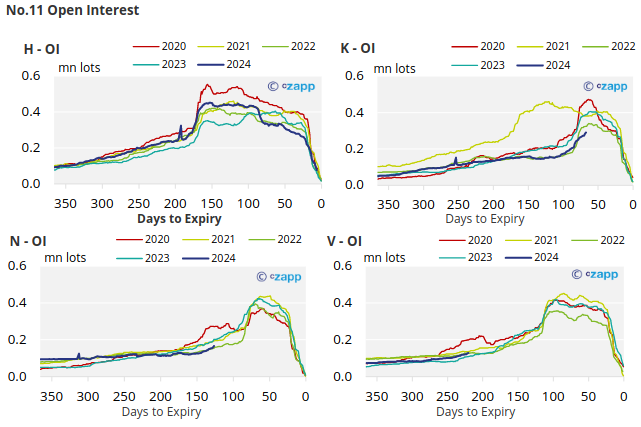

Commercial participants have closed a significant number of hedges ahead of the Mar’24 expiry. End-users remain heavily hedged for 2024; sugar producers could add to their cover given higher prices. Open interest has fallen to around 1m lots, the lowest since November 2022, when the sugar market started its most recent rally from 17-20c/lb to 22-28c/lb.

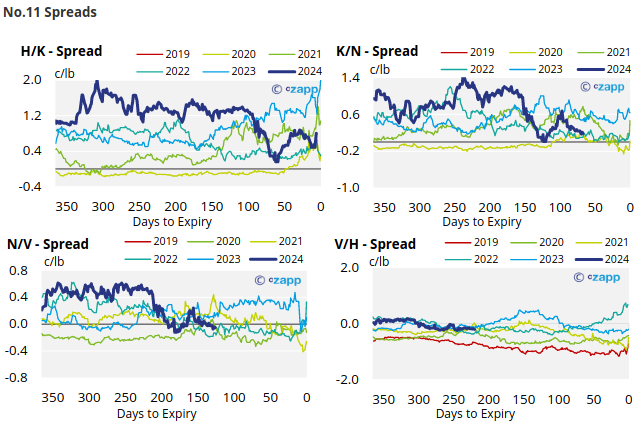

The No.11 raw sugar futures curve has levelled off, remaining mostly flat through 2024 before shifting to a slight backwardation in 2025.

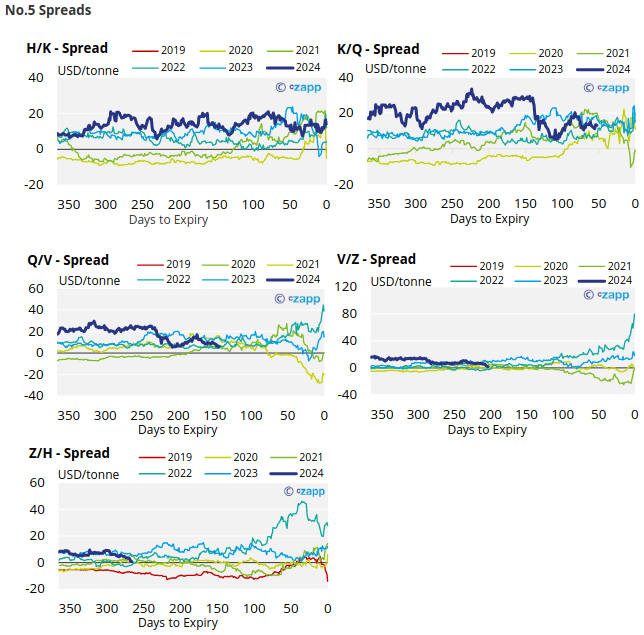

London No.5 Refined Sugar Futures

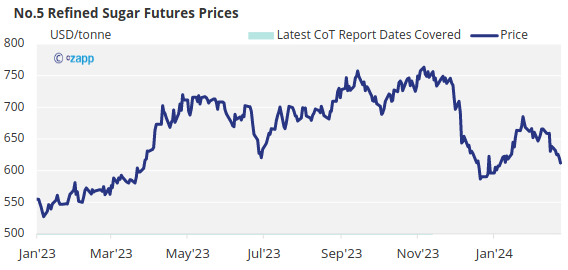

The No.5 refined sugar futures has also weakened in the past week, closing at USD 612/tonne last Friday.

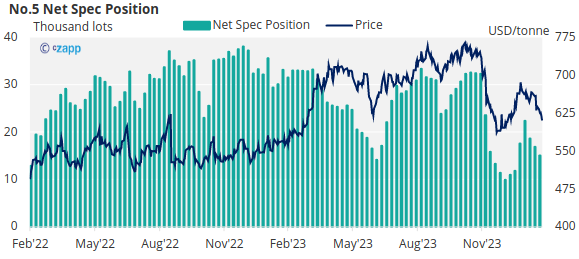

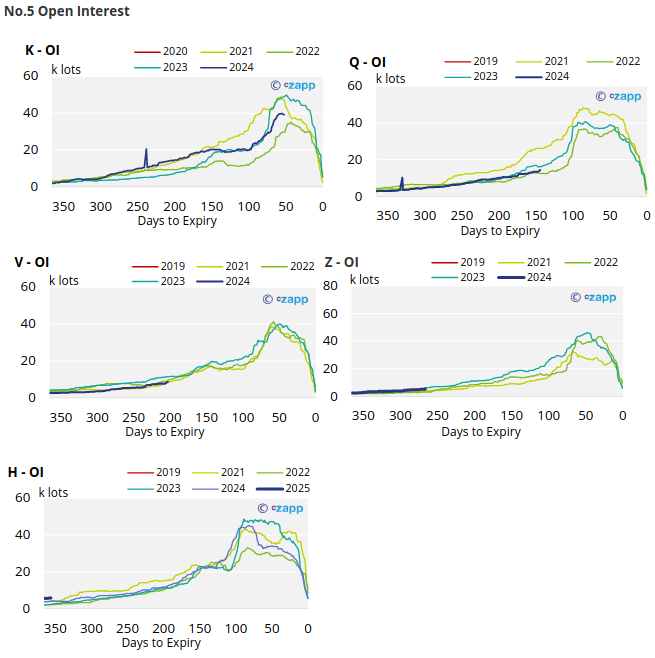

Speculators of refined sugar closed out over 1.8k lots of long positions, bringing the overall net spec position down to 15,000 lots, which is significantly lower than this time last year.

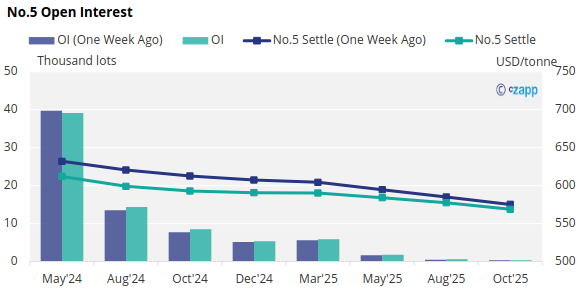

The refined sugar futures curve remains broadly flat in 2024 and the majority of 2025.

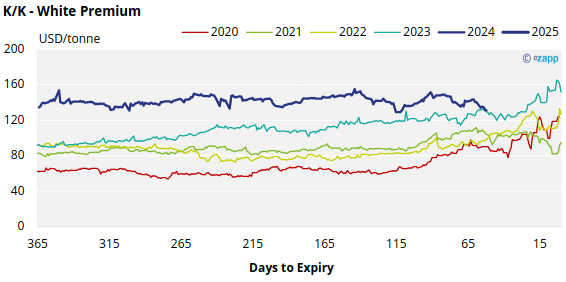

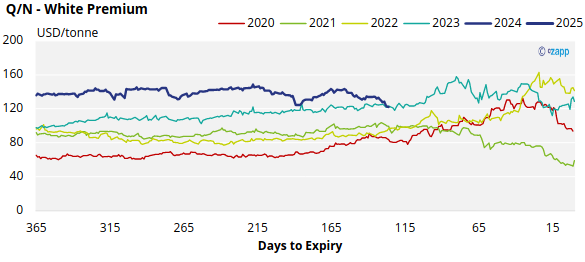

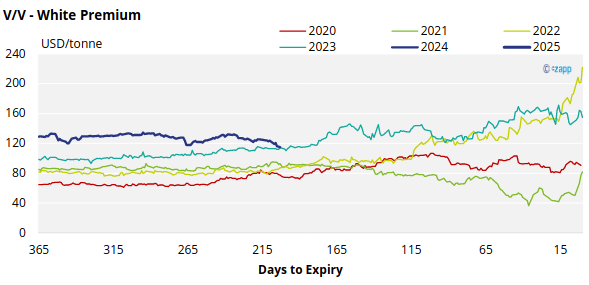

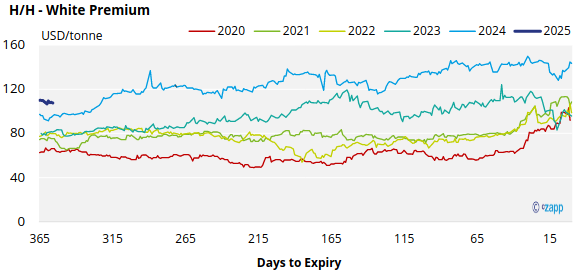

White Premium (Arbitrage)

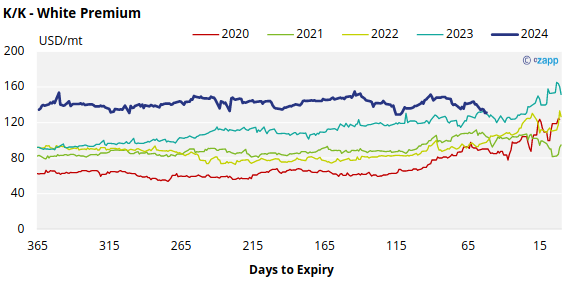

With the No.11 and No.5 making similar moves downwards, the white premium has weakened and is currently trading around USD 131/tonne.

Many re-exports refiners need around USD 105/tonne to USD 115/tonne above the No.11 to profitably produce refined sugar, therefore physical values should still be necessary to bridge this gap.

The refined sugar market is slightly undersupplied for the majority of 2024, and this is reflected in comparatively strong Q/N and V/V white premiums.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix